In-Depth

1 2 3 of a Kind

A lot of factors drove the merger of three Midwest solution providers into Avtex Solutions -- but some of the reasons relate to Microsoft technology issues and the new demands of the Microsoft Partner Network.

- By Scott Bekker

- January 01, 2011

On New Year's Day 2011 three Minneapolis-area solution provider companies are formally joining to form a single mega-company that collectively will have a much larger footprint in the Microsoft channel. While general IT business factors helped drive the merger, many of the key reasons for doing the double deal that came together in late 2010 stem from the firms' roles as Microsoft partners, the combined company's executives say.

The decision by two midsize providers and a self-described "boutique" outfit to join forces may shine a light on one way that other Microsoft partners will choose to address similar opportunities and challenges, which include internal growth ambitions, pressure from Microsoft to specialize and grow, and the current emergence of especially disruptive technologies in cloud computing.

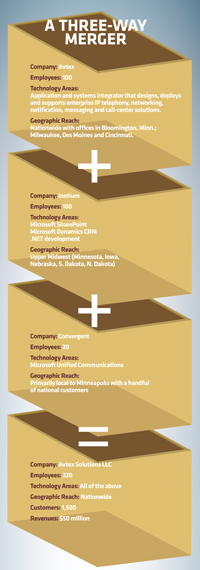

The new company is called Avtex Solutions LLC and will be headquartered in Bloomington, Minn. It results from the merger of Avtex, Inetium and Convergent. The combined company has 220 employees and about $50 million in revenues. Key practice areas for the new firm include call-center technology, Microsoft unified communications (UC), Microsoft SharePoint, Microsoft Dynamics CRM and custom .NET development. Due to its geographical heritage, the new Avtex will continue to be an outsized player in the Twin Cities area, but executives hope the national reach in call center solutions of the former Avtex will help the more regional Microsoft practices of the former Inetium (SharePoint/CRM) and Convergent (UC) expand nationwide.

Bob Denman, president of Avtex Solutions, aims to manage the combined company to doubled revenues by 2016. "Our five-year plan shows us between organic and growth through acquisition of being somewhere around $100 million. We believe that 2011 is sort of the foundation year for us, where we'll be getting fully integrated with these three companies and create the core platform to start to look for not only geographic growth that would come from the organic side, but also other acquisition opportunities that we're looking at out there," Denman says.

Avtex and Inetium shared a common owner in the Pohlad Family Companies, which acquired Avtex in March 2008 and Inetium in March 2006. Pohlad is best known for its ownership of the Minnesota Twins baseball team, but the conglomerate also encompasses banking, financial services, commercial real estate, retail, automotive and entertainment, in addition to technology. Avtex and Inetium had worked together on some customer engagements over the last few years and announced plans for a Jan. 1, 2011, merger back in September. In November, the pair announced that Convergent, which does not have Pohlad ties, would be coming aboard as well.

The former Avtex offered Microsoft UC but hadn't developed the practice much. "We felt strongly that Microsoft was going to be, and is currently, one of the main players in this space," Denman says. The Avtex and Inetium transition team looked at Convergent as a "go-to UC partner in the region," according to Denman, and also a rising star with Redmond. Although Convergent had just 20 employees, it held a coveted seat on the Microsoft Partner Advisory Council (PAC) for UC, and was being tapped by Microsoft in customer engagements around the country.

Convergent CEO Khai Tran was ambivalent about talking to the Avtex-Inetium team last fall but came away from an initial meeting impressed.

"If it was just Avtex or if it was just Inetium, I don't think we would have been interested," Tran says. "This trifecta of three companies represents something that changes the landscape, certainly here regionally, but potentially nationwide as well because of our core competencies. We are on the UC Microsoft PAC, Inetium is on the SharePoint PAC and the CRM PAC, and Avtex is the largest Interactive Intelligence [business partner] nationwide."

"Bringing that core expertise in all those technology solutions really represents something that we don't think that anyone else out there has from a channel perspective," Tran says.

National Ambitions

With its position on the Microsoft PAC, and as a launch partner with Microsoft for Lync Server 2010, Convergent was feeling the heat from Microsoft to ramp up its capabilities.

"Convergent decided that if we want to scale at the pace that Microsoft needs us to scale, we will need to provide more value to our clients -- not just from a UC [perspective], but through all of their core business-productivity stack, and also have a nationwide footprint. While we have projects and what-not ongoing nationwide, we now have a nationwide footprint, and intend to grow that footprint as well," says Tran.

Doug Splinter, CTO of Convergent, adds that going national would've been a slow, organic process for the company. "Definitely the resources of the combined organization will allow us to stretch and grow much more rapidly than we could on our own without taking on significant investment. And then if you do take on investment, what value is that investment bringing you other than money? The value of this organization is it increased the solution breadth, which was something on the CTO side that I was constrained by from an architecture standpoint."

Much like the Convergent management, Inetium President Keith Rachey is looking forward to tapping into Avtex's national scope.

"If you look at the geographic footprint that Inetium has today, it's really in the Upper Midwest," Rachey says. "Avtex has been more of a national player in that they've got presence in four other markets and Minneapolis. When we think about the unified company, we want to take our core offering to those other geographies.

"As you know, in the systems integrator world, or the channel world, it's a lot easier to do that if you've got the presence already there. That's another driver from a pure growth perspective," Rachey says.

Microsoft Program Requirements Play a Part

For Inetium, there's a Microsoft-specific angle, as well. Inetium has been a Microsoft National Systems Integrator (NSI) in the past, but dropped out of the program due to recent changes requiring companies to be a managed partner in multiple geographies to retain the elite NSI status, with its numerous business-enhancing benefits.

"With us primarily in the central region, this year we're not an NSI," Rachey says. "But now we're back on the list to be that status again. Microsoft re-evaluates every first quarter. We're expecting that by the end of March we'll be back in it."

The new Microsoft Partner Network (MPN), with its detailed and employee-intensive requirements for companies looking to meet the Gold Competency requirements, was also a factor in looking to Convergent as a merger partner, Rachey says.

"The whole [MPN] program requires that you have to have some scale to it to be competent in multiple disciplines. Our sheer size -- with the number of people on our engineering staff -- we were well positioned" to earn Microsoft competencies in Inetium's traditional practice areas, Rachey says.

"[Convergent] gave us an ability to fill in an area that we think is going to be fast-growing, and an area that complements what we do. [The MPN requirements] absolutely was part of why we bought Convergent," he says. "It got us there a lot faster."

Throughout the Microsoft channel community, partners have expressed concern about their ability to meet requirements that they certify four (or six in the case of Dynamics) employees to earn each Gold Competency from Microsoft. A common refrain among Microsoft partner executives and others is that partner-to-partner (P2P) engagements are a good alternative for Microsoft partner companies that don't have the staff to attain multiple Gold Competencies in their usual practice areas.

Tran and Splinter of Convergent, however, say they are happy to be getting Inetium's SharePoint and Dynamics CRM expertise and Avtex's call-center know-how in-house and to be out of the P2P game.

"As we continue to go down the applications route specific to UC, customers are asking us to integrate their communications foundation to their SharePoint, to their CRM, to their contact center," Tran says. "That tie-in represented the true value of a business process. Up until this point, we partnered up with other Microsoft partners who had core competencies in those technology silos. Now we have all those core capabilities in house. We can create applications that are tighter, quicker to market and address customers' business requirements out of the box."

Splinter says he often found the P2P relationships limiting. "On the UC development side, our story was historically that we'll work with whoever your SharePoint development partner was. But to be honest, it was actually an odd interaction because the SharePoint people weren't really aware or as interested or engaged on the UC side."

Thinking Big

Of course, planning a merger to prepare for the next few years isn't just about business issues or mapping out complementary skills for integration projects. The industry is moving precipitously toward cloud-based solutions and no business plan can be complete without taking the cloud into account.

[Click on image for larger view.] |

| A Three-Way Merger |

Rachey has mixed feelings about the effect on Avtex's business. "Obviously as a systems integrator, there are parts of the cloud that are intriguing but there are parts of the cloud that scare us because it's taking a part of our revenue stream away," he says.

Denman adds that Avtex is looking at the cloud as an opportunity to engage more deeply with current customers. "There will certainly be some level of confusion from a customer perspective, and we think we can help with that. We think there will be little niches that open up. As the adoption rate goes up, we'll find our footing on that. We're talking about it every day," he says.

The newfound scale of the combined company may bring one other advantage -- an opportunity to place bets on the company's own technology rather than on simply reselling and implementing big-vendor software.

"From a solution provider perspective, we've traditionally been involved in professional services," Rachey says. "One of the things that we're really going to be working on is how we develop our own intellectual property on top of the core platforms that we believe in, that are on the Microsoft stack. We've already established through this merger of these organizations an R&D team that's focused on just doing that. It's not traditional in the channel that I'm aware of, but something that we think is vitally important for our long-term success."