In-Depth

2011 Microsoft Partner Survey: Your Take on the MPN, Selling the Cloud and More

With the launch of the Microsoft Partner Network in November, Microsoft forced 400,000 partners to decide how they'll fit their businesses into the new structure. In our annual survey, readers reported how they're planning to adapt.

- By Scott Bekker

- April 12, 2011

A year ago, uncertainty reigned among Microsoft partners. Microsoft Partner Network (MPN) changes, years in the making, were about to take effect. But the outlines of Microsoft's planned changes were fuzzy and partners were waiting for details to be finalized before they took time out from their busy schedules to digest what the changes meant and how they would respond to them.

Fast forward a year, and most partners have thoroughly examined the MPN overhaul unveiled in full in July 2010 and formally rolled out in November. Partners, for the most part, have a plan for how they're going to respond and how they see themselves fitting into the new MPN structure, according to Redmond Channel Partner magazine's annual reader survey.

Despite the turmoil, Microsoft partners remain a relatively happy crew. Two-thirds of the 600-plus respondents to RCP's January survey called themselves happy or very happy as Microsoft partners (Figure 1). Statistically, that's almost unchanged from the survey last year, when 69 percent said they were happy or very happy. In another question, 57 percent of respondents this year said the MPN is better, much better or the best when compared to other vendors' partner programs.

Microsoft Partner Network

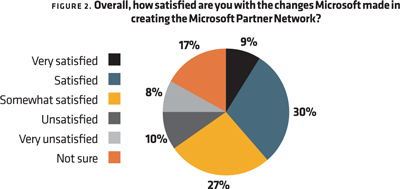

Opinion has hardened when it comes to the popularity of the changes to the MPN in the last year. The "not sure" contingent dropped way down from the RCP 2010 survey to its 2011 survey, while the groups calling themselves satisfied and unsatisfied with the changes both grew larger. In other words, every change has its winners and losers -- partners have had time to look at the new MPN and draw their conclusions about which camp their companies belong in.

Asked "Overall, how satisfied are you with the changes Microsoft made in creating the Microsoft Partner Network?" (Figure 2), 17 percent said they were not sure. That's about half the 32 percent who chose that answer in 2010. About 39 percent said they were either very satisfied or satisfied with the changes, up from 28 percent the year before. On the other end of the spectrum, 18 percent said they were unsatisfied or very unsatisfied, up from 10 percent in 2010.

|

|

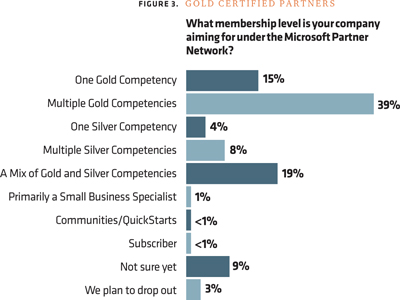

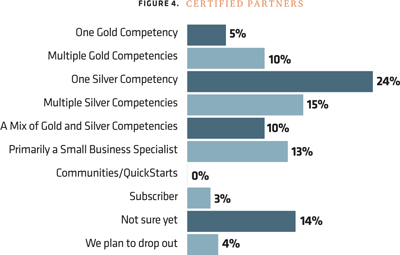

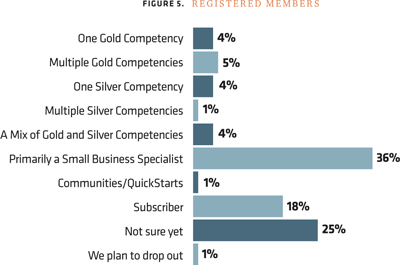

Last year, when RCP asked what membership level companies would apply for in the MPN, 58 percent didn't know. This year, only 24 percent weren't sure. The rest had pretty detailed plans. (Figures 3, 4 and 5 break out those plans, according to whether respondents were most recently Gold Certified Partners, Certified Partners or Registered Members.) Partners who belonged to the Microsoft Partner Program at the Gold Certified level are overwhelmingly planning to pursue one or more gold competencies -- 73 percent will go for one gold competency, multiple gold competencies or a mix of silver and gold competencies. About a quarter of Certified Partners plan to make the jump up to at least one gold competency. About 39 percent will make the lateral move from Certified to silver competencies, while about 13 percent will focus primarily on being Microsoft Small Business Specialists.

|

|

|

Registered Members were leaning even harder toward focusing on being Small Business Specialists, with 36 percent choosing that option. Half as many, 18 percent, planned to continue on as subscribers, basically meaning they'll pay for the Action Pack. A few Registered Members had ambitions for a gold competency (13 percent) and fewer were aiming for silver (5 percent). Predictably, those most engaged in the Microsoft partner program have the firmest plans. Only 9 percent of the Gold Certified participants aren't sure what they'll do next, compared to 14 percent of the Certified participants and 25 percent of the Registered Members.

Even though many partners are unsatisfied with the new MPN, very few partners were so disgusted that they plan to drop out. Of 612 partners who answered the question about the membership level they'll aim for under the MPN, only 10 of them reported that they planned to drop out.

There don't seem to be any simmering issues about the number of partners in the MPN, which is roughly 400,000 worldwide. Nearly 70 percent of respondents thought the number of participants is about right in the MPN, which is arguably the largest vendor partner program in IT (Figure 8).

Gold Certified Partners reported that they were pretty satisfied with the attention and assistance they get from their Microsoft partner account managers -- with 76 percent reporting that they were very satisfied or somewhat satisfied. Only 8 percent were unsatisfied or very unsatisfied, while the remaining 16 percent weren't managed partners (Figure 6). In another question for Gold Certified Partners, RCP asked how the level of Microsoft marketing funding in Microsoft FY 2011 compared to the amount in FY 2010 (Figure 7). Of those who knew or got money, more partners (13 percent) said they got less in FY 2011 than more (9 percent).

Business Climate

Not all the survey questions were about the MPN. Partners also answered questions about their growth expectations, the business climate, the IT industry in general and the cloud.

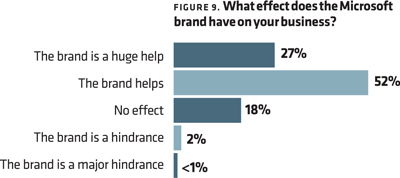

The Microsoft brand has slipped a bit since it was rated the top brand in the world by advertising industry trackers in the mid-2000s. Nonetheless, partners reported that the brand still matters in the market. To the question, "What effect does the Microsoft brand have on your business?" 27 percent said the brand was a huge help, 52 percent said it helped and 18 percent said it had no effect. Less than 3 percent found the brand a hindrance (Figure 9).

|

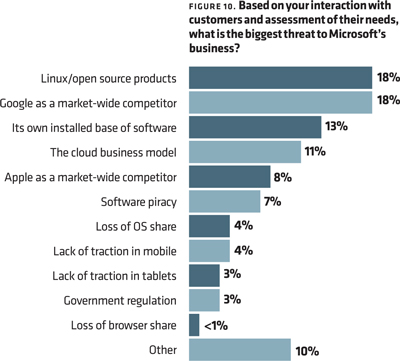

Microsoft seems beleaguered on many fronts competitively these days, but when partners were asked to name their front-line view of the biggest threats, many chose relatively traditional ones -- Linux/open source products at 18 percent, the Microsoft installed base of software as a sales inhibitor at 13 percent and software piracy at 7 percent. Newer challenges include Google as a market-wide competitor (also 18 percent), Apple as a market-wide competitor (8 percent) and the cloud business model (11 percent). Partners weren't concerned about some of the other threats. None of the following choices were identified as a key threat by more than 4 percent of respondents -- loss of OS share, lack of traction in mobile, lack of traction in tablets and loss of browser share.

|

|

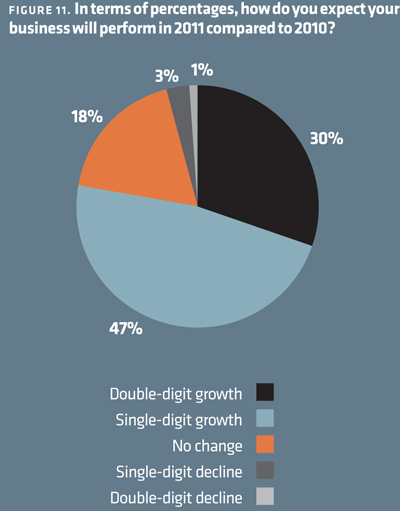

For partner companies, business was relatively slow in 2010. The biggest group, 35 percent, said business was flat on revenues, with 26 percent reporting single-digit growth, 16 percent reporting double-digit growth and 14 percent admitting declines. On the employment side in 2010, 20 percent cut staff, 26 percent added staff and 54 percent maintained 2009 staffing levels. Survey respondents had relatively modest expectations for their businesses in 2011 compared to 2010 (Figure 12). The biggest group at 47 percent predicted single-digit growth. In another question, 55 percent said their customers are saying their IT spending plans for 2011 will stay at about the same level as 2010. Still, about 40 percent of respondents expected to add staff in the first six months of 2011.

|

Cloud

Where there has been considerable excitement in the IT industry is around cloud computing, with Microsoft notably declaring itself "all in" with the cloud since the last RCP reader survey. Microsoft partners are reserving judgment on Microsoft's offerings, according to the 2011 survey. Asked how satisfied they were with Microsoft's initiatives, the biggest group, 37 percent, called themselves "neutral." However, the group of respondents saying they were satisfied or very satisfied was double the size (26 percent) of the group saying they were unsatisfied or very unsatisfied (13 percent).

The number of partners who say they're actively reselling Microsoft cloud offerings (Figure 13) was 18 percent, roughly in line with answers to similar questions over the last two surveys, suggesting a lack of momentum behind reselling the Business Productivity Online Suite, Microsoft Dynamics CRM Online and Microsoft Windows Azure-based services.

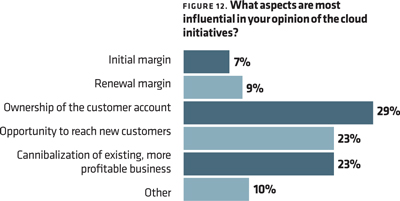

Asked "What aspects are most influential in your opinion of the cloud initiatives?" the largest single group of partners chose "ownership of the customer account" (29 percent). Other factors included "opportunity to reach new customers" at 23 percent and "cannibalization of existing, more profitable business" at nearly 23 percent.

For the apparent lack of momentum for cloud, a lot of partners plan to take up the cloud banner this year. Some 26 percent said they plan to begin reselling or expand their sales of Microsoft cloud offerings this year, while 37 percent said they may do so.

On the question of how quickly Software as a Service or cloud computing would change the structure of the channel, partners reported that it's happening now. While 11 percent said cloud has already dramatically changed the channel, 16 percent said it will impact the channel this year with the biggest group, 28 percent, saying the real impact will come in 2012.