There's a Texas-sized ransomware problem brewing on the heels of similar incidents in Florida.

The Texas Department of Information Resources (DIR) on Friday revealed that more than 20 entities, mostly smaller local governments in the state, were impacted by a ransomware attack.

"On the morning of August 16, 2019, more than 20 entities in Texas reported a ransomware attack," the Texas DIR said in an update Saturday evening that put the total number of affected agencies at 23. State government agencies were not among those affected.

The attacks seem to be coordinated. "At this time, the evidence gathered indicates the attacks came from one single threat actor. Investigations into the origin of this attack are ongoing; however, response and recovery are the priority at this time," the updated statement said.

Officials swung into action on Friday in a response that included, in addition to the DIR, the Texas Division of Emergency Management, the Texas Military Department, the Texas A&M University System's Security Operations Center/Critical Incident Response Team, the Texas Department of Public Safety, the Texas Public Utility Commission, the U.S. Department of Homeland Security, the Federal Bureau of Investigation, the Federal Emergency Management Agency, and other federal agencies.

The ransomware incidents in Texas follow a trio of incidents in Florida in Riviera Beach, Lake City and Key Biscayne. Two of those incidents involved huge ransomware payouts -- $600,000 for Riviera Beach and $460,000 for Lake City -- most of which was covered by insurance.

It is unclear whether cities are more heavily targeted for ransomware than other types of entities. On the one hand, small and local governments often have budget struggles that result in outdated IT infrastructure, and there are many documented cases of governments falling victim to attacks.

On the other hand, it's easier for a company to conceal a ransomware attack. Government agencies are more accountable to public scrutiny and less able to choose to keep an incident quiet.

Posted by Scott Bekker on August 20, 20190 comments

Microsoft is offering a big carrot to get organizations to Azure in combination with the stick of Windows Server 2008 end-of-support.

That stick that's feared across the IT landscape is that support is ending for Windows Server 2008 on Jan. 14, 2020. Specifically, Extended Support, which includes security updates, ends that day for Windows Server 2008 Service Pack 2, Windows Server 2008 R2 SP1, Hyper-V Server 2008 and Hyper-V Server 2008 R2 SP1.

It's a wide swath of the market that's still on those server operating systems. Microsoft recently estimated that 60 percent of its server installed base, or 24 million instances, remain on Windows Server 2008 and/or SQL Server 2008, which fell out of support last month.

The other part of the stick is that organizations that want to stay on Windows Server 2008 for some reason must enter into an expensive contract for Extended Security Updates (ESU) if they want any kind of security protection, and those are only available for three years.

The carrot is that Microsoft is offering another route for customers who don't want to, or are unable to, move off of Windows Server 2008 or SQL Server 2008 right away. The carrot is a sort of half-move.

What those customers can do is migrate their instances, as they are, to Azure. Customers who rehost Windows Server 2008 and 2008 R2 workloads directly to Azure will get three full years of ESU at no additional charge. That gives them the option of upgrading from Windows Server 2008 at a more leisurely pace within those virtual machines.

They'll be paying Azure hosting fees and be in the public cloud, but they don't have to pay the ESU, so their existing operations can continue largely as-is.

It's a serious move by Microsoft to make Azure very appealing to organizations that have been at the tail end of the cloud adoption curve.

While attractive, this is only one of the options for moving from Windows Server 2008 before the deadline. For more detail on options for on-premises, hybrid and cloud migrations, check out RCP's "Partner's Guide to the Windows Server 2008 Deadline" (registration required).

Posted by Scott Bekker on August 08, 20190 comments

Microsoft is investing resources in select customers in a new effort to get more on-premises data warehouses onto the Azure cloud.

Microsoft and Informatica unveiled a migration offer on Tuesday designed to lower the expense and risk of a proof-of-value project to determine the feasibility and advantages of moving a data warehouse to Azure.

The offer, for qualified customers, includes tools to reveal the contours of a data estate, free code conversion of existing schemas, a SQL Data Warehouse subscription for up to 30 days and on-site help.

Informatica's end involves its Informatica Enterprise Data Catalog and Informatica Intelligent Cloud Services for up to 30 days of a proof-of-value project. Informatica, an enterprise software company with a portfolio of data integration tools among other products, went private in a 2015 deal that attracted an investment from Microsoft.

In a blog post, John Chirapurath, general manager of Azure Data & AI for Microsoft, said the new program is designed to address the perceived risks involved in making a data warehouse move.

"For customers that have been tuning analytics appliances for years, such as Teradata and Netezza, it can seem overwhelming to start the journey towards the cloud. Customers have invested valuable time, skills, and personnel to achieve optimal performance from their analytics systems, which contain the most sensitive and valuable data for their business," Chirapurath wrote.

Posted by Scott Bekker on August 06, 20190 comments

If it seems like there's more talk about artificial intelligence (AI) than there is market momentum, that's a feature -- not a bug -- for partners, according to a senior Microsoft executive.

Julia White, the corporate vice president who leads product management for Microsoft's cloud platform, made a big splash at the Microsoft Inspire 2019 partner conference last week with a HoloLens demo involving a hologram translating her keynote into Japanese.

But in an Inspire briefing for media, White framed AI in an interesting way.

"In our executive briefing center here at Microsoft, the No. 1 requested session on Azure is AI. That's what everyone wants to talk about, every customer," White said. But then the interesting thing, if you look at actual production, real at-scale AI solutions, it's only about 4 percent. In the enterprise space. Really, it's tiny. It just tells you the interest is so high and the customers reality is still, you know, nascent."

Put another way, White is saying only one in 25 enterprise customers are currently using AI solutions, but nearly all of the rest of them are interested in AI.

In the context of partners, White contends that's a great situation to be in. "To me, that's huge partner opportunity," White said. "They need someone to come in and help them think through, what is their AI strategy? How do they use the technologies, because it's pretty complicated, and trying to navigate how they use it within the way they do it."

Posted by Scott Bekker on July 25, 20190 comments

Microsoft wrapped up its annual Microsoft Inspire partner conference last week in Las Vegas with a lot of product news, business initiatives and demos.

Here are 11 quotes from the major Corenote addresses at the show that capture key moments showing what Microsoft is up to and where the company and its partners are heading.

1. Windows Server to Azure

There's a hard deadline coming at the beginning of the next calendar year. Windows Server 2008 reaches its end of support in January 2020, and Microsoft made sure partners understood that they should be moving those customers to the Azure cloud.

According to Microsoft's internal estimates, about 60 percent of its server install base is on Windows Server 2008 and SQL Server 2008, which just passed its own support deadline earlier this month. Microsoft puts the market opportunity for those migrations at $50 billion.

2. Democratizing Digital

Democratizing digital is an emerging catchphrase for Microsoft. The quote above, which pulls together Althoff's point-by-point definition from a longer stretch, captures the key elements of the idea.

3. Listing the First-Class Citizens

Under Nadella, Microsoft has demonstrated, again and again, that Azure is the key. As long as Microsoft is getting revenues from Azure usage, it's putting less effort into all the other games Microsoft famously used to play to favor its own internal technologies over competitive technologies that also ran on its platforms.

4. SQL Database Hyperscale Demo

In a heavily promoted demo during Nadella's Corenote address, Kumar showed off Azure SQL Database Hyperscale with a massive amount of data. The demo involved feeding simulated data from a million vehicles into the relational database in the cloud to return operational insights across the entire fleet.

5. Boom Teams

"How many of you remember the explosive growth of SharePoint about a decade ago? Teams is already on a faster trajectory than that."

"How many of you remember the explosive growth of SharePoint about a decade ago? Teams is already on a faster trajectory than that."

--Gavriella Schuster

Microsoft claimed during Inspire that the Teams collaboration service has reached more than 13 million daily active users, overtaking Slack on that metric sometime in June. Microsoft is aggressively encouraging partners to emphasize Teams, which combines chat, videoconferencing, voice-over-IP calling and file-access capabilities.

6. The Persistence of Hybrid

"It used to be thought that hybrid compute was some sort of transition period until everything was 100 percent running in the cloud. Now the modern architecture's richness at the edge and leveraging the power of the cloud, and this connectedness of the two, enables us to innovate fantastic new solutions that really are at the heart of this notion of democratizing digital."

"It used to be thought that hybrid compute was some sort of transition period until everything was 100 percent running in the cloud. Now the modern architecture's richness at the edge and leveraging the power of the cloud, and this connectedness of the two, enables us to innovate fantastic new solutions that really are at the heart of this notion of democratizing digital."

--Judson Althoff

7. Microsoft Itself Becoming a Channel

"Our relationship has changed. The tables have turned, and we have become your channel."

"Our relationship has changed. The tables have turned, and we have become your channel."

--Gavriella Schuster

Microsoft is integrating its Cloud Solution Provider (CSP) partner community with its Marketplace and deepening ties to Microsoft's own field. According to Schuster, the combinations create new opportunities for partners to sell their own services through Microsoft's Marketplace, have Microsoft's internal sales force sell the services or, now, even have other partners pull partner services into their own CSP service offerings.

8. Sometimes It's Good To Say 'No'

9. Sometimes You Have To Say 'Slow'

"[Customers ask] 'How can we take advantage of IoT? How can we take advantage of the Intelligent Edge, the Intelligent Cloud, all this great new capability that's coming up?' You actually have to slow people down and say, 'For what purpose?' This idea that you're going to simply throw technology at the wall and see if something sticks without having a crisp vision and strategy outlined will certainly lead to less optimal results -- let's put it that way -- if any success at all."

"[Customers ask] 'How can we take advantage of IoT? How can we take advantage of the Intelligent Edge, the Intelligent Cloud, all this great new capability that's coming up?' You actually have to slow people down and say, 'For what purpose?' This idea that you're going to simply throw technology at the wall and see if something sticks without having a crisp vision and strategy outlined will certainly lead to less optimal results -- let's put it that way -- if any success at all."

--Judson Althoff

10. Scuttled IUR/Competency Changes

"As you may know, a couple weeks ago, we announced changes to the program competencies and internal use rights [IURs]. And the response from you, our partner ecosystem, was overwhelmingly negative. We clearly underestimated the value of those benefits and the impact that that would have on you and your businesses. ... We are going to keep the FY19 competencies and internal use rights just as they are, and you have my commitment that I will continue -- we will continue to listen, to learn, and though we may stumble, we will grow together and we will celebrate our wins together."

"As you may know, a couple weeks ago, we announced changes to the program competencies and internal use rights [IURs]. And the response from you, our partner ecosystem, was overwhelmingly negative. We clearly underestimated the value of those benefits and the impact that that would have on you and your businesses. ... We are going to keep the FY19 competencies and internal use rights just as they are, and you have my commitment that I will continue -- we will continue to listen, to learn, and though we may stumble, we will grow together and we will celebrate our wins together."

--Gavriella Schuster

This issue was settled the week before the conference, with Microsoft reversing course after first trying to explain the unpopular decision to revoke IURs, partner support hours and some other benefits. The blowback had been so large that Schuster spent the very first minutes of the conference's first Corenote address on the issue.

11. The Stress of a Weekend E-Mail from Bill Gates

"Usually, when you get a weekend mail from Bill, you kind of wait and see, 'Do I really want to open it now?' And I opened it, and I've been working with Bill for a long time, and it started by saying, 'Wow.' I've never seen those words from him, I've never heard those words, and he was really thrilled to see us make progress. Of course, he had a long list of other things we need to be working on, as

well."

"Usually, when you get a weekend mail from Bill, you kind of wait and see, 'Do I really want to open it now?' And I opened it, and I've been working with Bill for a long time, and it started by saying, 'Wow.' I've never seen those words from him, I've never heard those words, and he was really thrilled to see us make progress. Of course, he had a long list of other things we need to be working on, as

well."

--Satya Nadella

Nadella got one of the show's biggest laughs in joking about the stress he still feels after five years as CEO when hearing from Microsoft's co-founder. The e-mail referred to the Azure SQL Database Hyperscale technology demonstrated on the Inspire stage.

Posted by Scott Bekker on July 22, 20190 comments

Microsoft on Thursday reported earnings per share of $1.37 and a 12% gain in revenues to $33.72 billion for the fourth quarter.

The company's stock rose by more than 1% in after-hours trading on the results, which beat financial analysts' expectations. The earnings number was non-GAAP; the GAAP figure was higher due to a net income tax benefit of $2.6 billion for the quarter.

The most closely watched number for Wall Street this quarter was Microsoft's Azure growth metric. Microsoft reported that Azure was up by 64% compared to the year-ago period. Microsoft doesn't report Azure revenues, but the company's rate of growth has been slowing over the last few years as the company's total Azure revenues increase. For example, in the fourth quarter of 2018, Microsoft reported an Azure growth rate of 89%, and in the fourth quarter of 2017 it was 97%.

Combining Microsoft's commercial clouds by revenue did, in fact, yield a big number. "Q4 commercial cloud revenue increased 39% year-over-year to $11.0 billion, driving our strongest commercial quarter ever," Microsoft CFO Amy Hood said in a statement in Microsoft's earnings release.

For the full year, Microsoft revenues hit $125.8 billion, an increase of 14% over fiscal year 2018.

By business unit for the quarter, the Intelligent Cloud unit had the fastest growth, up 19% to $11.4 billion in revenues. That unit comprises server products and cloud services, which includes Azure, and Enterprise Services.

The Productivity and Business Processes unit grew 14% to $11 billion. That unit includes Office Commercial, Office Consumer, LinkedIn and Dynamics. Among the highlights for the unit were Office 365 Commercial revenue growth of 31%, an increase in Office 365 Consumer subscribers to 34.8 million, a 25% bump in LinkedIn revenues and a 45% gain in Dynamics 365 revenues.

The slowest-growing business unit was More Personal Computing, which reached $11.3 billion on 4% growth. Windows OEM revenue was a positive for the unit, with a 9% increase, and Surface revenues were up 14%. Gaming revenue, however, was a drag with a 10% drop.

Meanwhile, Microsoft CEO Satya Nadella took up a theme he's expressed in previous earnings calls this year -- that major customers are becoming more like partners, with roles as crucial to Microsoft as the historic OEM relationships.

Describing "deep partnerships with leading companies in every industry," Nadella said, "Every day we work alongside our customers to help them build their own digital capability -- innovating with them, creating new businesses with them, and earning their trust. This commitment to our customers' success is resulting in larger, multi-year commercial cloud agreements and growing momentum across every layer of our technology stack."

In a statement released just before Microsoft's earnings, John Dinsdale, chief analyst and research director for Synergy Research Group, called Microsoft the clear No. 2 (after Amazon Web Services) in cloud infrastructure services and a very clear market leader in the fragmented Software as a Service (SaaS) market.

For cloud infrastructure, Dinsdale noted, "[Microsoft's] revenue growth rate is way above the overall market growth rate, so it is gradually gaining market share -- 9% in 2016, 11% in 2017, 14% in 2018 and 16% in the first quarter of 2019."

Posted by Scott Bekker on July 18, 20190 comments

Microsoft is taking a big step in the direction of making Azure a friendlier platform for managed service providers (MSPs).

The theoretical appeal of Azure for MSPs has always been clear. Customers could move or create infrastructure on Microsoft's public cloud, and Microsoft partners, with far more cloud expertise than the average customer, could provision and manage that infrastructure on their behalf.

In reality, that has been difficult with native Microsoft tools. A number of third-party solutions have sprung up to help partners manage multiple customer clouds.

At the Microsoft Inspire conference for partners this week in Las Vegas, however, Microsoft is highlighting a new native toolset called Azure Lighthouse that addresses those challenges for partners in a scalable way.

"We...want to make Azure your best platform for delivering managed services to your customers. And so, we're investing in you with a new service that we call Azure Lighthouse," said Gavriella Schuster, Microsoft corporate vice president for One Commercial Partner, in her Monday Inspire keynote address. "Azure Lighthouse builds partners in by design into Azure by enabling multi-customer, multi-tenant management at scale in a secure environment with automation so that Azure becomes your best platform to deliver those managed services to your customers. And we're going to continue to invest in that service for you."

The announcement comes as Microsoft is strongly encouraging partners to lead with Azure as a replacement for aging Windows Server 2008 and SQL Server 2008 systems. SQL Server 2008 reached the end of support last week and the 2008 versions of Windows Server lose support in January.

"We estimate about 60 percent of our server install base is still on Windows Server and SQL Server 2008. That's 24 million instances. That is a $50 billion market opportunity that you should be going after right now, this year, because those customers are vulnerable and exposed," Schuster said. "You know you could easily migrate those VMs into Azure and remove that vulnerability for them."

While the migration may or may not be easy, the general availability this month of Azure Lighthouse could make management of multiple customers much more efficient for partners.

Microsoft Azure Chief Technology Officer Mark Russinovich described Azure Lighthouse in a blog post as a single control plane for service providers to view and manage Azure across all their customers. A new delegated resource concept within Lighthouse simplifies cross-tenant governance and operations, Russinovich said.

Russinovich claimed substantial scalability and automation for Lighthouse: "Partners can now manage tens of thousands of resources from thousands of distinct customers from their own Azure portal or CLI context. Because customer resources are visible to service providers as Azure resources in their own tenant, service providers can easily automate status monitoring, and applying create, update, change, delete (CRUD) changes across the resources of many customers from a single location."

Microsoft officials credited the Azure Expert MSP community and other Azure-specialist partners with helping in the development and iteration of Azure Lighthouse.

In a Microsoft video describing Azure Lighthouse, Jason Rinehart, platform architect for managed services at 10th Magnitude, said the tool, with its hooks into the marketplace, is helping his company get customers live on Azure faster. "Some of the key benefits that we're seeing are greater operational efficiency because of the single view [and] faster time to onboard because of the new automated process and because of this new marketplace," Rinehart said.

Another partner in the video, Reed Wiedower, CTO of New Signature, pointed to the role-based access control as a key feature that protects a customer's security and control while giving a partner a way to manage multiple customers and subscriptions. "By being able to apply the same policy to the same sets of resources, all at the same time, it reduces the chance of human error creeping into the equation," Wiedower said.

Other early adopters of Azure Lighthouse include DXC Technology, Nordcloud, Rackspace, Sentia, Dynatrace, Ingram Micro and Veeam.

Posted by Scott Bekker on July 16, 20190 comments

It's been a few years since Microsoft wanted to talk about how many partners it had.

In the old days, the company would regularly boast of 600,000 or even as high as 800,000 partners in broad terms. When it came to registered members of the old Microsoft Partner Program or the Microsoft Partner Network (MPN), the figures regularly landed north of 400,000 organizations.

Lately Microsoft has kept those totals close to the vest. Two years ago, I committed a little algebra on some figures Microsoft revealed to conclude that the company had about 264,000 partners. But Microsoft did not come out and claim that number.

This year, Microsoft is shouting out the figures from the rooftops.

We're told Microsoft CEO Satya Nadella's keynote speech at Microsoft Inspire on Wednesday will focus on the numbers 100 to 17 to seven. One hundred refers to the 100,000 Microsoft employees, 17 refers to 17 million partner employees worldwide, and seven for the 7 billion people in the world Microsoft hopes to reach.

In a pre-conference media briefing, Gavriella Schuster, the corporate vice president running the Microsoft One Commercial Partner organization, said, "The way I think about our partner program is that we service 300,000 organizations around the world. We're seeing about 7,000 new organizations join our network every single month."

Why the change of heart on talking numbers? I'm not sure, but it always seemed weird for the company not to highlight the huge advantage it has over competitors in the unmatched scale of its channel program.

Posted by Scott Bekker on July 15, 20190 comments

Microsoft is reversing course on a plan to revoke partners' ability to use internal use rights (IURs) to run their businesses after a substantial partner backlash.

"Given your feedback, we have made the decision to roll back all planned changes related to internal use rights and competency timelines that were announced earlier this month. This means you will experience no material changes this coming fiscal year, and you will not be subject to reduced IUR licenses or increased costs related to those licenses next July as previously announced," said Gavriella Schuster, corporate vice president of Microsoft One Commercial Partner, in a statement posted on Microsoft's partner portal on Friday.

Since the mid-1990s, Microsoft has encouraged partners to use IURs to run their business on Microsoft software, further familiarizing partners with the software and services from Microsoft that they sell or recommend to customers. The IURs were available as part of the program membership fees, and the licenses for Windows desktops, servers and other elements of the stack were often worth much more than the cost of the membership.

In recent years, IURs were extended to include cloud services, and Schuster said in interviews this week that the cost of providing the cloud services was consuming a disproportionate share of Microsoft's partner budget and necessitating cuts to other partner benefits.

The now-canceled plan would have changed the mix of IURs starting in October and retired IURs entirely on July 1, 2020. Product licenses still would have been available for business development scenarios. Those changes, plus a plan to cut off partners' on-premises support incidents, prompted a contentious Change.org petition titled "Disapprove Microsoft Partner Network Changes," which had more than 6,000 signatures as of Friday.

The decision to roll back all the planned competency changes also means that on-premises support incidents will continue to be available to competency and Action Pack partners.

In her statement, Schuster apologized for the confusion and noted that a key determining factor in rescinding the changes was partners' trust in Microsoft.

"As we move forward, we commit to providing even more advance notice and consultation with our partner community to mitigate concerns and address issues up front," Schuster wrote.

Posted by Scott Bekker on July 12, 20190 comments

Editor's Note: Due to partners' negative reaction to these changes, Microsoft on July 12 announced that it was rescinding the plan to end the internal use rights benefit. See RCP's coverage here.

Gavriella Schuster has come full circle on internal use rights (IURs).

In media briefings this week in advance of the Microsoft Inspire partner conference, Schuster, Microsoft's channel chief, addressed a major brewing controversy in the Microsoft partner community. Earlier this month, Microsoft quietly disclosed that it was ending IURs, the partner program benefit that allows partner companies to run their entire business on Microsoft software and services.

For the price of a Microsoft Action Pack Subscription, a Silver Competency fee or a Gold Competency fee, Microsoft partners have historically been able to get enough not-for-resale licenses and subscriptions to run their entire business on the Microsoft stack. The benefit supported a 10-person partner company with the Action Pack, a 25-person company with the Silver Competency and a 100-person company with the Gold Competency, saving partners thousands to tens of thousands of dollars per year or more in operating expenses. Additionally, the programs encouraged channel familiarity with advanced features and elements of the Microsoft stack that only light up when multiple premium Microsoft products are used in combination.

The reaction among Microsoft partners has been angry, swift and surprisingly broad. Like most vendors' channel communities, Microsoft partners rarely complain publicly due to the perceived need to stay in the company's good graces for perks, referrals and other discretionary benefits. Yet in this case, a highly critical Change.org petition emerged quickly and had garnered about 5,400 digital signatures as of Thursday.

The petition, titled "Disapprove Microsoft Partner Network Changes," declares, "In announcing these changes it's clear Microsoft is going to war with its Partners. [For the] Partners who have been so loyal to the Microsoft Business and to help it achieve the status of being the most valuable business in the world to be now treated like this is just not fair."

Specifically, the petition opposes three changes:

- The July 1, 2020 retirement of IUR in the Action Pack and in competencies. "Product license use rights will be updated to be used for business development scenarios such as demonstration purposes, solution/services development purposes, and internal training," Microsoft's statement says.

- An Oct. 1, 2019 change to make product licenses included with competencies specific to the competency the partner attains.

- Microsoft is shutting down the on-premises support incidents for partners in August 2019. Previously, the Action Pack included 10 incidents, a Silver Competency covered 15 incidents and a Gold Competency allowed 20 incidents. Partners with renewal dates before August will retain their incidents until their next anniversary date. Details are here.

Although Schuster has only been in her current role as corporate vice president of the Worldwide Partner Group (now called One Commercial Partner) for three years, her connection to IURs goes way back to the beginning of the benefit.

"My first job at Microsoft in 1995 was to make a global solution provider program," Schuster said this week in a pre-Inspire briefing for media. "When I, when I did that, I was like, 'OK, so what do you deliver to partners in that?' And it was, 'Well, we want them to use our products.' So we created these use rights, and we said, 'We want you to use our products.' And at that time, nobody even knew what our stuff did. So we needed them to learn how to use it. And, and delivering product use rights for software is pretty much free."

That has changed dramatically with the cloud, Schuster contends. Although cloud services like Office 365 or allowances in the Azure platform seem ephemeral, Schuster argues that the costs of delivering cloud services as IURs to partners were starting to eat into all of the other benefits of the Microsoft Partner Network (MPN).

"As we moved into cloud services, we really didn't think it through that much until recently, when the bills were getting very big," Schuster said. "We can't actually afford to run every single partner's organization all around the world anymore, because it's not free."

According to Schuster, the speed of growth in the MPN (with about 7,000 partners joining per month), the internal cost in datacenter capacity and the lack of spending discipline that the IUR program encourages are all combining to make IURs unsustainable.

"Because we have so many more partners joining the network, and our partners are getting so much more of their businesses running on cloud services, there's a real cost associated with us giving you IURs on cloud services. There's a high, high cost of sale for us. And yet, we're not making any money on it," Schuster said. "When partners aren't paying for something, they're also not as cautious as if they were paying for it. And so the example would be if you were living in a house where you didn't have to pay for utilities, you may not really pay attention to whether you're turning down the heat and turning off the lights. And the bill goes way up, and you don't really care. That was really what was happening with a lot of partners in terms of the dev test environments and the devops that they were doing in terms of scalability in their solutions. It was costing us a lot."

Schuster acknowledged that ending the IURs was a hard choice. "I had these cost overruns this last year where I had to reshuffle a bunch of things and take services away from the partners to pay for that. But I factored out that if we continue the level of growth, and our partners continue to grow like they have been, then I would basically not be able to provide the partners any other service other than IURs," she said.

Schuster downplayed the importance of IURs to the partners that she talks to regularly. "When you talk to a partner, that's not even what they talk about as being valuable. What they talk about as being valuable is [Microsoft connecting] them to customers, when we can generate business for them, when we invest in helping them build new services and practices," Schuster said. "I would rather spend the money to provide them all those other things than to help them run their business on IURs."

The 175 comments left behind so far by signatories to the Change.org petition, however, suggest that the IURs remain a headline benefit to many partners, especially smaller ones.

By removing the core of the benefit that she once helped create, Schuster is facing one of the biggest controversies in the Microsoft channel since Microsoft's decision to shut down Windows Small Business Server.

Posted by Scott Bekker on July 11, 20190 comments

Like other media and analysts, I'm not invited to Microsoft Inspire, the annual partner confab in Las Vegas. The media lockout policy started last year due to Microsoft's decision to combine the partner conference with the company's internal sales conference, Microsoft Ready. (That broke a streak of 12 Worldwide Partner Conferences and Inspires for me.)

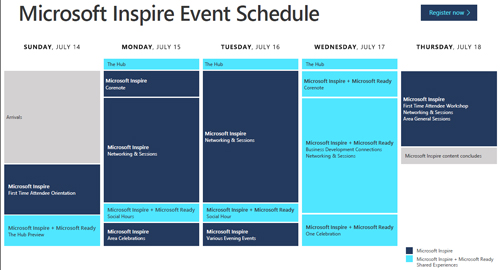

For those of you who are going, here's what to expect next Sunday through Thursday in America's gambling capital in the desert.

Corenotes

Microsoft is currently planning to hold four major addresses to the entire audience this year. These will also be live-streamed if you're not attending the show or if you want to monitor from your hotel room after a late night of networking.

Monday morning features the annual parade of Microsoft Partner of the Year award winners across the main stage. The first main Corenote comes from Judson Althoff, executive vice president of the Worldwide Commercial Business at Microsoft, on the theme of democratizing digital. Althoff is followed Monday morning by Microsoft channel chief Gavriella Schuster's annual talk about opportunities, program changes and new incentives for Microsoft partners.

The next batch of Corenotes is on Wednesday and is a joint session with the Microsoft Inspire and Microsoft Ready audiences. First, Microsoft CEO Satya Nadella provides his annual partner and business update. Then comes Microsoft President Brad Smith, who often uses his partner conference time to discuss Microsoft and technology in a larger context of global security, legal and business issues and trends.

[Click on image for larger view.]

Source: Microsoft

[Click on image for larger view.]

Source: Microsoft

Networking

The most important element of any Microsoft partner conference is connections, and there will be plenty of those available. The official word is that there will be 10,000 Microsoft partners in attendance from more than 130 countries during the week.

There are no Corenotes scheduled for Tuesday in order to allow more time for networking. Microsoft tends to be cyclical on this question, going through phases of tons of keynotes from various product groups with lots of demos in some years to fewer keynotes hitting mostly higher-level points in other years. We're in the latter phase of the cycle in 2019.

In a pre-Inspire session for media, Schuster said partners are telling her: "We come here to connect with people, we come here to connect with Microsoft, we come here to connect with each other. We do more business in this one week, then we do in probably six months." Microsoft is trying to maximize networking time this year, and she anticipates that the company will facilitate hundreds of thousands of meetings next week.

The whole show floor is configured to encourage impromptu meetings, with coffee bars and food areas and other places to sit and talk. The session count has been reduced by 20 percent to 30 percent, as well, Schuster said, in order to leave more time for partners to connect.

Demos

In that vein of lots of networking time and fewer product group Corenotes, the product demos will be few and far between. Those that do happen are supposed to have a high impact.

Microsoft spokesman Frank X. Shaw promised the media that a database demo in Nadella's Corenote will be impressive. "A wow database demo will show you how SQL runs from the edge to the cloud at an unprecedented scale. You will not see pigs flying. But there will be pigs on stage. And you'll have to tune in to see why. You'll also see an unprecedented demo the full power of Microsoft Teams plus PowerApps plus AI plus more shown through the lens of education," Shaw said.

Takeaways

What's Microsoft hoping partners will come away from Inspire with? We put that question to Schuster, and she gave us a six-point answer on partner business opportunities in Microsoft FY 2020:

- Microsoft Teams is the biggest opportunity "bar none."

- Security around Modern Workplace.

- PowerApps.

- Dynamics 365, especially migrations from on-premises, where the majority of customers remain.

- End-of-support migrations to Microsoft Azure from Windows Server 2008 and SQL Server 2008.

- Data and artificial intelligence.

Expect to hear a lot on each of those subjects next week.

Pro Tip

If you want to get some unscheduled face time with Microsoft's channel chief, hang out on the show floor. Schuster set up her official conference meeting room down there this year to avoid the usual situation where her meeting room is a 20-minute walk away. "Every time I'm in a break, I can just walk the floor and see everybody," Schuster said.

Dress for the Heat

Right now the forecast is calling for heat, heat, heat in Las Vegas. Highs of 109 degrees are expected for Saturday, Sunday and Monday, sliding down to 108 degrees Tuesday, 107 degrees on Wednesday and 106 degrees on Thursday.

Of course, the Mandalay Bay Convention Center will probably be near-freezing, so pack that sweater or sports coat.

If you see or hear anything interesting, let me know at [email protected].

Posted by Scott Bekker on July 11, 20190 comments

In a bid to win over governments and enterprises in highly regulated industries looking to move digital workflows to the cloud, Microsoft and ServiceNow on Tuesday announced an extension of their existing partnership.

Santa Clara, Calif.-based ServiceNow provides cloud-based platforms and solutions for delivering digital workflows. Its new agreement with Microsoft builds on an alliance from October that allowed Microsoft's U.S. federal government customers to deploy ServiceNow technology from the Microsoft Azure Marketplace to the Azure Government Cloud.

The main component of the expanded arrangement is that ServiceNow will use Azure as a preferred, but not exclusive, cloud platform. The Azure version will include ServiceNow's "full SaaS experience," according to the announcement. Initial availability will be in Australia and Azure Government in the United States, with additional Azure regions coming later.

ServiceNow will still provide its SaaS offering on its own private cloud. The company also announced a deal in May with Google Cloud Platform (GCP) and has integrations with Amazon Web Services (AWS).

According to the announcement, ServiceNow will benefit from Azure's broad regulatory and compliance coverage, while ServiceNow's inroads with the U.S. federal government's digital transformation efforts could bring new workloads to Azure.

Microsoft and ServiceNow will also continue to partner on development of technology integration and user experience improvements for their joint customers.

In a separate transaction announced at the same time, Microsoft will use ServiceNow's IT & Employment Experience workflow products internally.

Posted by Scott Bekker on July 09, 20190 comments