Spring is in the air in the northern hemisphere and that means Microsoft conference season is upon us.

Microsoft's Big Three tech industry-facing conferences start next week and run into mid-July. The technology giant has a lot of major products nearly ready for general availability, making the conferences even more noteworthy than usual for the Microsoft vendor ecosystem, partners, developers and customers. The big shows, in chronological order, are Microsoft Build, Microsoft Ignite and the Microsoft Worldwide Partner Conference (WPC).

Microsoft Build

http://www.buildwindows.com/

San Francisco, April 29-May 1

Microsoft's developer-focused conference has emerged over the last few years as a major source of news about the entire Microsoft platform. A more closely controlled affair than the other two, this show is almost all about Microsoft rather than sponsors or partners.

The official description promises that Build will bring new information about Windows, Azure and Office 365. Microsoft is also intent on spurring developers to take advantage of the cross form-factor elements of the forthcoming Windows 10. The company emphasizes in its Build marketing the oft-repeated-of-late figure of 1.5 billion, the number of Windows devices Microsoft claims in the world. Redmond's hope is that the free upgrade offers for Windows 10 will put most of those 1.5 billion devices on a single platform, making Windows a central development platform for tablets and smartphones rather than the also-ran it has become in the iOS/Android era.

Keynotes are scheduled for Wednesday, April 29, and Thursday, April 30. Last year, Day 1 keynotes included Microsoft senior executives Terry Myerson, Joe Belfiore, David Treadwell, Stephen Elop and Satya Nadella. Day 2 featured Scott Guthrie, Steve Guggenheimer and John Shewchuk.

(Update, 4/24: Count on that Nadella keynote. During the Microsoft Q3 results earnings call Thursday, he said, "Next week at Build, our developer conference, I'll share more about our ambitions and how our next-generation platforms will empower every person and organization.")

Microsoft Ignite

http://ignite.microsoft.com

Chicago, May 4-8

Microsoft Ignite is a new mega-conference for Microsoft, replacing the venerable TechEd conference with a new show rolling together TechEd with the programs from the Microsoft Management Summit and the Exchange, SharePoint, Lync and Project conferences.

Microsoft seems to be flying the majority of its senior technology executives to Chicago for keynotes and presentations. The main keynotes on the morning of May 4 will be delivered by Nadella. Other senior executives giving heavily promoted sessions or keynotes include Brad Anderson, corporate vice president of Enterprise Client and Mobility; Gurdeep Singh Pall, corporate vice president of Skype; Belfiore, corporate vice president of PC, Tablet and Phone; and Harry Shum, executive vice president of Technology and Research.

Among the many other Microsoft heavy-hitters with speaking slots are Dave Campbell, CTO of Cloud and Enterprise; Julia White, general manager of Office 365; Mark Russinovich, CTO of Microsoft Azure; Jeffrey Snover, distinguished engineer and lead architect for the Windows Server and System Center Division; and Perry Clark, corporate vice president of Exchange and distinguished engineer.

Ignite will be an ecosystem affair with hundreds of vendor partners on the show floor. The biggest sponsors of the event are Dell, HP and Salesforce.

Some of the technology expected to debut at Ignite includes an early look at SharePoint Server 2016, which was originally scheduled for general availability in the second half of 2015 but now is looking like a mid-2016 release. Also hotly anticipated at Ignite are clues and demos about Exchange Server 2016.

While those two potential previews have made headlines, Ignite covers a huge range of Microsoft technologies, and Microsoft is promising new information at the show on Azure, Dynamics, Intune, Lync, Office 365, Project, SQL Server, Surface, System Center, Visual Studio, Windows, Windows Server and Yammer. With Windows 10's release now looking like late July, according to a partner leak, expect a lot of detail on the new OS at Ignite.

Microsoft Worldwide Partner Conference

http://bit.ly/1Hg1TAf

Orlando, Fla., July 12-16

The final big industry-facing event on Microsoft's conference-season calendar is the Microsoft Worldwide Partner Conference (WPC). Happening just a few weeks before the rumored launch of Windows 10, expect Windows client buzz to hit a fevered pitch in Orlando.

As a gathering of partners, WPC has more of a business focus than a technology focus. So in addition to a keynote from Nadella, partners will hear about business initiatives from Microsoft COO Kevin Turner and about partner-focused initiatives from Phil Sorgen, corporate vice president of the Microsoft Worldwide Partner Group. (Read our preview of key WPC 2015 sessions here.)

While the conference is largely about fostering connections among business partners to jointly sell and implement Microsoft solutions, news about the technology and the roadmap still tend to take center stage. Microsoft has been pushing partners hardest over the last few years to represent cloud solutions based on Office 365, Dynamics CRM Online, Windows Intune and Azure. Expect technology news focused on those products to come out at WPC.

Top-tier sponsors of WPC 2015 are Dell, HP and Nintex.

Related:

Posted by Scott Bekker on April 22, 20150 comments

At a time when Yahoo was contractually able to opt out of its search partnership with Microsoft, Yahoo CEO Marissa Mayer negotiated a much more flexible arrangement for her Internet company.

Yahoo and Microsoft on Thursday announced amendments to the deal originally struck in 2009. Yahoo will now be obligated only to serve Bing ads against search results for a majority of its desktop search traffic. Previously, Yahoo needed to put Bing ads against 100 percent of its traffic.

The deal is also non-exclusive, meaning if Yahoo wants to use its Yahoo Gemini ads platform for those desktop ads, it can. Or it could sell the traffic to another provider -- say Google, should Google be interested.

The other big change in the deal is that Microsoft will be responsible for selling all Bing ads, while Yahoo will be responsible for selling any Gemini ads. Previously Yahoo's salesforce handled a lot of the Bing sales. The two companies plan to begin transitioning those sales responsibilities over the summer.

While it's not a change, the deal remains non-exclusive in mobile search, leaving Yahoo with maximum flexibility in that emerging area.

"Over the past few months, [Microsoft CEO] Satya [Nadella] and I have worked closely together to establish a revised search agreement that allows us to enhance our user experience and innovate more in our search business," Mayer said in a statement. "This renewed agreement opens up significant opportunities in our partnership that I'm very excited to explore."

One upshot is that Microsoft will have to hire some search salespeople and Yahoo will have to hire some search engineers.

For his part, Nadella emphasized the ongoing value of the partnership. "Our global partnership with Yahoo has benefited our shared customers over the past five years and I look forward to building on what we've already accomplished together," Nadella's statement said. "Our partnership with Yahoo is one example of the diverse partnerships we'll continue to cultivate in order to have the greatest impact for our customers."

For Microsoft, the Yahoo agreement comes at an interesting time. The partnership arguably helped Bing claw some search share from Google. The new Yahoo arrangement is a wild card just as Google faces antitrust scrutiny in the European Union.

Posted by Scott Bekker on April 16, 20150 comments

Meg Whitman rolled out a new logo for Hewlett Packard Enterprise on Wednesday, and her blog post revealed that she's sweating the smallest details.

By the end of its fiscal year on Oct. 31, HP is committed to splitting into two roughly equally sized independent companies -- Hewlett Packard Enterprise and HP Inc. Whitman will be CEO of Hewlett Packard Enterprise, which includes HP's servers, storage, networking, services, software, cloud and converged systems.

Dion Weisler will run the other company, called HP Inc., which includes notebooks, desktops, mobility, printing, managed print services and graphics. Whitman will be non-executive chairman of HP Inc.

Behind-the-scenes work has been going on since the planned split was announced six months ago, but this week Whitman unveiled something visible in the form of a new logo for Hewlett Packard Enterprise. It's a simple green rectangle above the company name.

"We needed a design that would express our renewed commitment to focus and simplicity," Whitman wrote, adding about the color of the green, dollar-bill-shaped rectangle, "The color we picked is no accident."

A smaller detail in the logo involves the way the letters connect.

"Maybe you noticed it, but take a look at the name 'Hewlett' in the new design. This is the first time in our history that the two t's in Hewlett connect," Whitman wrote. "That connection is symbolic of the partnership we will forge with our customers, partners, and our employees -- what we will do together to help drive your business forward."

Whitman and the HP team are thinking deeply about the little things. It's good to see partners near the symbolic center stage in that thought process.

Posted by Scott Bekker on April 16, 20150 comments

With a few months to go before the Microsoft Worldwide Partner Conference (WPC) in July, Microsoft is starting to post details on some of the hundreds of sessions that will be available to partners at the show in Orlando.

Even with only a small percentage of sessions listed in the online catalog, some key themes for Microsoft's fiscal year 2016 are becoming clear.

What follows are RCP's suggestions for major keynotes and other sessions to start building your WPC calendar around:

1. Satya Nadella Vision Keynote

By far the most talked-about keynote at any WPC is usually the CEO's session. Following in Steve Ballmer's footsteps, Satya Nadella spoke last year and will once again headline WPC this year. Nadella's two-fold mission will be to first reassure partners that they are critical to Microsoft and, second, to outline the broad trends and priorities for Microsoft for the coming year. Nadella will give one of the first keynotes of the conference on Monday, July 13.

Nadella giving his keynote address at WPC 2014. (Source: Microsoft.)

Nadella giving his keynote address at WPC 2014. (Source: Microsoft.)

2. Kevin Turner Vision Keynote

After the CEO's talk, COO Kevin Turner's annual barn-burner of a speech is usually the second-most talked about single event of WPC. With his folksy humor and competitive, can-do spirit, Turner usually delivers a dozen or more memorable one-liners.

Microsoft has famously discontinued its annual enemies list this year, the group of companies whose employees are barred from attending WPC. The list has previously included Oracle, Salesforce.com, VMware, Amazon, Google and Cisco. As Nadella presents a friendlier face of Microsoft to former rivals, the list has gone away. It will be interesting to see if Turner pulls his competitive punches.

The official theme is "Our Roadmap to Profitability." Turner usually closes out the second and final day of Vision keynotes from Microsoft executives. He is slated to talk on Wednesday morning.

3. Phil Sorgen Vision Keynote

Somewhere in those Vision keynotes on Monday or Wednesday, Microsoft's worldwide channel chief (formal title: Corporate Vice President of the Worldwide Partner Group) Phil Sorgen will get more specific for partners. Judging by previous years, he'll talk about partner momentum on cloud and will detail new programs, competencies, incentives and priorities for Microsoft's massive community of channel partners. Expect to see a short parade of other senior Microsoft executives talking about specific products that Microsoft wants partners to sell in FY '16.

4. Microsoft Partner Programs and Opportunities

Another perennially significant event is the annual update diving into specific details about the Microsoft Partner Network (MPN) for the coming years. Running this session in her second year at WPC as Microsoft's No. 2 channel executive is Gavriella Schuster, general manager of the Microsoft Worldwide Partner Group.

5. U.S. Regional General Session (and Other Regional Sessions)

The WPC truly attracts an international audience, and multiple regions have country- or region-specific keynotes. U.S. partners account for the single biggest group of attendees, making the U.S. Regional General Session one of the key events of the show. The title of the U.S. general session this year is "The Trifecta Partner Will Win the Race for Customers Wanting to Digitize Their Enterprise." In that case, the trifecta applies to Cloud Platform, Cloud Productivity and Sales Productivity.

An inside-baseball theme is that there should be a new U.S. channel chief giving the keynote. Longtime Microsoft channel executive Jenni Flinders retired from the role this month, and the U.S. keynote at WPC could be the first opportunity for partners to take the measure of her replacement.

6. "Gartner: Reading the Tea Leaves -- Top 10 Technology and Channel Trends"

This session isn't just important because it's about where Gartner sees the industry going, although that can be interesting. The reason it's significant for Microsoft partners is because it's given by Tiffani Bova, a Gartner analyst who has the ear of senior channel Microsoft executives. If you want to know how Microsoft executives are thinking about the industry and what partners should be doing, it's wise to sit in on Bova's session.

7. Evolution of Windows Licensing

The previous six sessions are all specific recommendations for sessions that will probably generate news and chatter in Orlando this summer. RCP's remaining four recommendations are less about the specific sessions than they are about the themes these sessions touch on that are already emerging as important for the coming year.

"Evolution of Windows Licensing: How SA Per User and the Enterprise Cloud Suite Modernize the EA and Position Your Business for Revenue Growth" hits one of those themes. Over the last few months and with relatively little fanfare, Microsoft rolled out some major changes to the options for licensing its software. A lot of the changes relate to cloud, and the fanfare is coming.

8. Consumption of Cloud Services

Microsoft is becoming concerned about how many (or how few) customers are actually using those Office 365 licenses that were included in their Enterprise Agreements. If Microsoft is concerned about it, its incentives will be configured to make sure partners are worried about it, too. "Moving the Needle: Boosting Customer Value by Driving Office 365 Adoption" is an early example of a WPC 2015 session that sounds that theme.

9. Windows 10

With Windows 10 on the near horizon by mid-July, partner readiness for the next operating system will be a major theme. A few sessions are already focused on it. The most intriguing one listed so far is "Stories from the Trenches (Uncensored Edition): Migrating Customers to Windows 10." The session promises both Microsoft-presented opportunity analysis and a panel discussion by early adopters, including systems integrators, ISVs and the Microsoft IT department.

10. Cloud Solution Provider

One of the biggest announcements at WPC 2014 was the introduction of the Cloud Solution Provider partner model. Details and elements of the two-tier program continued to trickle out throughout Microsoft's fiscal 2015. By WPC 2015, the program should be fully baked with some best practices starting to emerge and tweaks coming out.

One session aimed at delivering those details is "Own the End-to-End Office 365 Customer Lifecycle: the Cloud Solution Provider Partner Opportunity."

Posted by Scott Bekker on April 09, 20150 comments

A year to the day that Microsoft pulled the plug on Windows XP support, the operating system remains heavily used worldwide. How heavily used? A little back-of-the-envelope math puts the number at up to 250 million users.

Extended support ended for Windows XP on April 8, 2014. That meant no more security updates or technical support for the operating system, which at that time was already 12 years old.

The two major share tracking outfits, Net Applications and StatCounter, both report significant ongoing use of Windows XP in their latest public data covering March 2015.

According to Net Applications, Windows XP users account for nearly 17 percent of worldwide share.

Net Applications' worldwide share figures by operating system for March 2015. A year after end-of-support, only Windows 7 has more share than Windows XP.

Net Applications' worldwide share figures by operating system for March 2015. A year after end-of-support, only Windows 7 has more share than Windows XP.

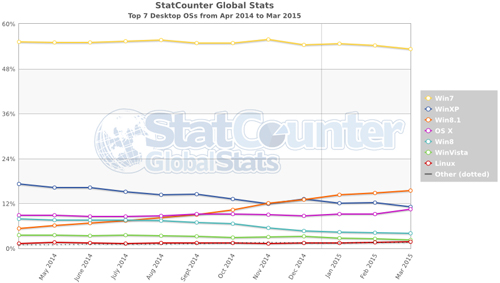

StatCounter puts Windows XP share at just over 11 percent. XP's share in the United States is lower, 6.5 percent, according to StatCounter.

[Click on image for larger view.]

StatCounter's worldwide desktop operating system data shows Windows XP trailed only Windows 8.1 and Windows 7 by the end of March 2015.

[Click on image for larger view.]

StatCounter's worldwide desktop operating system data shows Windows XP trailed only Windows 8.1 and Windows 7 by the end of March 2015.

Applying those percentages to Microsoft's frequently stated claim of 1.5 billion Windows users worldwide gives a ballpark estimate of how many Windows XP users are still out there. The range goes from 167 million using the StatCounter figure to 254 million using the Net Applications figure.

"There's actually still a lot of people running Windows XP," said Kasper Lindgaard, director of research and security at Secunia, in a recent telephone interview about Secunia's Annual Vulnerability Review.

Before the deadline, much concern was focused on how vulnerable all those Windows XP machines would be to newly discovered flaws. Since the support deadline, there's been less attention paid to the issue, other than a Microsoft decision to patch a particularly serious flaw affecting Windows XP a few weeks after the support deadline (MS14-021).

The warning that has greeted visitors to Microsoft's Windows XP end-of-support page since April 8, 2014.

The warning that has greeted visitors to Microsoft's Windows XP end-of-support page since April 8, 2014.

Nonetheless, other new vulnerabilities discovered since April 8, 2014 probably affected Windows XP, as well, Lindgaard said.

"Vulnerabilities that affect Windows 8 only or Windows 7 only probably won't affect Windows XP," Lindgaard said. "It's fair to assume that some vulnerabilities that affect older versions of the Windows client and Windows server may also affect Windows XP."

Meanwhile, as the anniversary of the Windows XP support cutoff passes, other deadlines approach. On July 14 of this year, support ends for Windows Server 2003. On the same day, Microsoft plans to end anti-malware signature updates for Windows XP on Microsoft Security Essentials. A little further out, support ends for SQL Server 2005 on April 12, 2016.

Posted by Scott Bekker on April 08, 20150 comments

In an unusual move, Microsoft is bundling a third-party tool into the Internal Use Rights (IUR) software and services packages for select Microsoft partners.

The new tool being offered as part of the Microsoft Partner Network (MPN) IUR is the SkyKick Migration Suite for Microsoft Office 365, which helps partners simplify, automate and speed up the sales, provisioning, migration and management of Microsoft's cloud productivity suite.

IUR, Microsoft's term for not-for-resale licenses, are included in the Microsoft Action Pack (MAPS) and for Silver Competency and Gold Competency partners. MAPS partners generally get enough licenses from Microsoft to run a 10-person partner organization, with Silver-level IUR accommodating a 25-person partner company and Gold-level IUR outfitting a 100-person partner company.

The Office 365 IUR SkyKick Migration Offer was announced Wednesday and runs through the end of Microsoft's fiscal year on June 30. The SkyKick IUR covers a migration of up to 500 seats, regardless of whether the partner has MAPS, a Silver Competency or a Gold Competency.

"The feeling is that partners get the opportunity to leverage it and use it," said Evan Richman, co-CEO of Seattle-based SkyKick. "It's good for them, and if they're using it, it's good for their productivity and it's good for their organization's ability to pass it along to customers in a more robust way."

SkyKick and Microsoft decided to offer the SkyKick IUR at 500 seats regardless of a partner's MPN level for simplicity's sake. For example, Richman said, "If they're a Gold Competency partner with 100 licenses, and they were a 250-seat organization, they could move all 250 seats."

In that case, while the SkyKick licenses would be covered, the partner would still need to pay for 150 extra Office 365 licenses from Microsoft for the seats that go beyond their 100-IUR benefit.

In an e-mail interview, a Microsoft spokesperson declined to say if this is the first time third-party software, services or tools have been included as part of Microsoft IUR.

"The SkyKick Migration offer for our partners is a way to enable a partner to easily unlock the benefits of Office 365. Providing partners access to SkyKick's Migration offer for up to 500 seats is another example of how we're taking new approaches to really engage with and support partners who are helping to lead the transformation to the cloud. This offer is an investment in our partner ecosystem to help them receive the most value from their partnership with Microsoft," the spokesperson said.

Asked if Microsoft intended for partners to use the SkyKick IUR to get familiar with the SkyKick tool and use the regular paid version on behalf of customers in migrations, the spokesperson suggested that the initial goal is simply to get partners themselves onto Office 365.

"As Gavriella [Schuster, general manager of Microsoft's Worldwide Partner Group] wrote in a blog a few weeks ago, we know that when partners use their IUR [benefits] for Office 365 in their own businesses they are three times more successful at selling the product to customers. But we also know that many partners are focused on helping their customers move to the cloud right now," the spokesperson said.

"After all, IDC predicts the public cloud market will grow to over $127 billion by 2018. We have many partners who can make migrating to the cloud much easier for customers, and whether a customer uses SkyKick, the Office Fast Track program, or works with another partner, we are confident that now is the time to bet on Microsoft's cloud offerings and want to expose our partners to the many ways they can assist our customers accelerate their own access to Office 365. Providing access to the SkyKick Migration tool is a great example of how partners can get the most value out of their Microsoft cloud IUR benefits," the spokesperson said.

Posted by Scott Bekker on March 25, 20150 comments

When it comes to customers' spending plans for managed services, backup figures big.

As part of a large hosting survey conducted by 451 Research LLC and commissioned by Microsoft, researchers asked 1,736 respondents to indicate on which managed services they intended to spend heavily over the next two years.

As long as there have been managed services and managed services providers (MSPs), backup and disaster recovery have been the main upsell opportunity. The survey reinforces that truism.

Sixty-eight percent of respondents picked backup and recovery, and 54 percent said disaster recovery/site recovery. Those were the top two responses from the cloud and hosting service provider customers of all sizes from 10 countries in the survey, "Beyond Infrastructure: Cloud 2.0 Signifies New Opportunities for Cloud Service Providers."

[Click on image for larger view.] Managed Services: Spending Over Next Two years (Source: 451 Research.)

[Click on image for larger view.] Managed Services: Spending Over Next Two years (Source: 451 Research.)

Another backup-related category, archiving, came in sixth with 44 percent expecting to spend money on that managed service.

Other categories with high levels of interest included mobile services (47 percent), premium 24x7 support services (45 percent) and end-to-end application management, including monitoring and configuration (42 percent).

For more coverage of the survey, see Microsoft Backs Survey to Define the Elusive Cloud Buyer.

Posted by Scott Bekker on March 23, 20150 comments

After steadily eating away at Cisco's leadership position in enterprise unified communications (UC) collaboration in 2012 and 2013, Microsoft seemed poised to grab the market leader role and hold onto it. Indeed, Microsoft claimed a sliver of a lead in the enterprise UC market in the first quarter of 2014.

Since then, though, Cisco has proven itself a hard target for Redmond in UC, according to data from Synergy Research Group.

Cisco narrowly reclaimed market leadership in the second quarter of 2014, widened the lead slightly in the third quarter and, according to data released by Synergy this week, expanded that lead further in Q4.

[Click on image for larger view.]

[Click on image for larger view.]

Synergy defines enterprise UC as a $30 billion market that includes enterprise voice, UC applications, telepresence, e-mail software, enterprise content management, enterprise social networks and a range of hosted/cloud communications and applications.

In Q4, Synergy said that the UC collaboration market hit $8.5 billion, an all-time high but one that represents just a 2 percent increase year on year. That low single-digit growth masks a dynamic market with new technologies riding a very different growth path than legacy technologies.

As a major player on both old UC and new UC, Cisco's latest gains in share come from the legacy side.

"While revenues from enterprise IT telephony are clearly continuing to decline, Cisco saw a very nice year-end bump in its telephony revenues, which helped it to distance itself from Microsoft," said Jeremy Duke, Synergy's founder and chief analyst, in a statement.

Microsoft, which this week unveiled its next generation of enterprise UC products under the Skype for Business brand, has a strong strategic position in the fastest-growing part of the market, leading Synergy's Duke to project an ongoing battle between the two leaders: "The real bright spot for Microsoft is that it has clear leadership in hosted/cloud solutions which are also the highest growth part of the market. Cisco dominates in premise-based solutions but the general trend is for hosted/cloud revenues to catch up with and surpass premise-based revenues."

By share, Synergy ranks the top five contenders as Cisco (16 percent), Microsoft (14 percent), Avaya (7 percent), IBM (4 percent) and Polycom (3 percent).

Posted by Scott Bekker on March 19, 20150 comments

A common piece of conventional wisdom on cloud is that it changes who buys technology.

In a detailed and wide-ranging new survey commissioned by Microsoft, 451 Research LLC attempts to provide some data to support a definition of that amorphous and elusive concept -- the new cloud buyer.

The report, "Beyond Infrastructure: Cloud 2.0 Signifies New Opportunities for Cloud Service Providers," is a survey of 1,736 cloud and hosting customers conducted in 10 countries between December and March.

Addressing the new buyer, the survey pointed to decisions being made at a much higher level than the traditional IT manager, confirming -- in this case, at least -- what analysts and technology executives have been telling partners for the last few years: To succeed, the sales pitch has to get more business-focused and less technical.

The traditional IT buyer, the IT infrastructure manager, is still important. The survey finds the IT infrastructure manager is identified by 38 percent of respondents as the primary decision-maker (see Figure 1). However, that only ranks third on the list. In second place is the CEO, identified by 44 percent of respondents as the primary decision-maker. That's a huge percentage, and a CEO requires a completely different selling style than traditional IT infrastructure managers. The top person for evaluating hosting and cloud services, with 52 percent of respondents, is the CIO or CTO -- a role that bridges the concerns of the other two.

[Click on image for larger view.]

Figure 1: Stakeholder decision-making authority. (Source: 451 Research.)

[Click on image for larger view.]

Figure 1: Stakeholder decision-making authority. (Source: 451 Research.)

The survey also shines a light on a significant new player in the IT buying world -- the marketing department. Marketing is emerging as an aggressive and heavy consumer of cloud services, and this is a department where business considerations heavily outweigh any technical concerns.

When asked about an organization's highest expectation for moving to hosted services or cloud computing, marketing respondents' answers were all about business. The highest expectation was "help grow our business" at 27 percent, with "better business service" at 15 percent and "add capabilities we cannot build internally" at 13 percent (see Figure 2).

[Click on image for larger view.]

Figure 2: Highest expectation moving to cloud by department. (Source: 451 Research.)

[Click on image for larger view.]

Figure 2: Highest expectation moving to cloud by department. (Source: 451 Research.)

Marketing is the department most likely to launch new cloud applications with capabilities that the company didn't have -- 26 percent of the time. Marketing also has the most aggressive plans among the departments surveyed (other departments were IT operations and application development) to put applications in the cloud. In 35 percent of cases, marketing expected to have more than 75 percent of its applications or resources in the cloud in the next two years (see Figure 3).

[Click on image for larger view.] Figure 3: Future percent of applications in cloud by department. (Source: 451 Research.)

[Click on image for larger view.] Figure 3: Future percent of applications in cloud by department. (Source: 451 Research.)

While a marketing manager is seldom the primary decision-maker, marketing department projects are the most likely ones for the CEO to weigh in on. The CEO is the one making decisions on IT purchasing decisions for marketing in more than half of organizations, according to the survey.

The general trend for cloud IT decisions to move up the corporate ladder brings new concerns to the fore, according to Michelle Bailey, senior vice president at 451 Research.

"As new decision-makers emerge, so too does the criteria for selecting cloud service providers. Trust, uptime, security, performance and technical expertise are today's differentiators for a business-ready cloud," Bailey said in a statement. "Cloud 2.0 is really about value, redefining cloud computing from a technical specification to a business-ready environment. Enterprises are looking for a trusted end-to-end solution, and ultimately this will involve multiple partners."

Aziz Benmalek, general manager for the hosting service provider business at Microsoft, highlighted other findings of the survey -- the maturity level of customers, with 75 percent saying they were beyond the cloud discovery phase, and a healthy interest in combined private and public cloud environments. Benmalek contends those trends spell new opportunities for Microsoft's community of hosting service providers, which grew by 5,000 partners in the last year.

"This presents a significant opportunity for our service provider partners to provide value-added services to their customers," Benmalek said in a statement. "By offering these expanded services, cloud service providers will be able to drive additional consumption, increase revenue and serve as trusted advisors."

More than half of the customers surveyed were in the United States. The percentage of respondents from each of the other nine countries ranged from 9 percent to 2 percent and were, in descending order, Germany, the United Kingdom, India, Brazil, Australia, Japan, Singapore, Turkey and the Netherlands. Of respondents who provided company size information, about 40 percent had between 100 and 999 employees, with roughly 20 percent each in the bands of less than 100 employees, 1,000 to 4,999 employees, and more than 5,000 employees.

Posted by Scott Bekker on March 18, 20150 comments

Ingram Micro on Monday unveiled an expanded set of automations and services around Office 365 that the distributor believes will kickstart strong growth for Microsoft's Cloud Solution Provider (CSP) partner business model.

Microsoft announced the CSP program last July and began rolling the program out in the fall. The idea behind CSP is to allow partners to package Office 365 and other cloud products and control the billing and customer relationship. Unlike Microsoft's advisor model, Microsoft does not bill the partner's customer directly. Unlike the Open licensing partner model, the partner is not responsible for buying a year's worth of licenses but instead can pay on a monthly basis in the same way that they will be billing their customers.

CSP consists of two models: 1-tier is for a few strategic partners who will deal directly with Microsoft, while 2-tier is the breadth program in which Microsoft will sell to distributors, called Master Cloud Service Providers, who then resell to partners who resell subscriptions to customers.

Ingram joined the CSP program as a distributor last year, but this week at its annual Cloud Summit in Phoenix, Ariz., announced significant automations, channel services and add-on programs for its partners.

"We actually announced in the fall of 2014 that we had been authorized to sell CSP, and we went to market as everybody else did with some manual intervention in the background," said Renee Bergeron, vice president of cloud computing at Ingram Micro, in an interview. "We are the first two-tier partner that has actually automated the entire process."

That automation takes the form of the new inclusion of Office 365 in the Ingram Cloud Marketplace, where Ingram's partners can come to order cloud products. The other major new automation component is tight integration with SkyKick -- the channel-focused toolset created by former Microsofties to simplify, automate and speed up the selling, provisioning, migration, management and setup of Office 365.

"In general, the feeling is CSP really is going to be a powerful new model, especially the way Ingram is using it to really drive adoption," said Evan Richman, co-CEO of SkyKick.

SkyKick, which has been selling its toolset to partners since 2013, can take a regular username and password (administrative credentials aren't necessary) from a customer and automatically discover the server, all the e-mail addresses and other critical details of the existing infrastructure. From there, SkyKick presents the partner with a list of e-mail addresses and a simple selection process to pick which Office 365 SKU addresses each need.

Integration with Ingram Micro's back end will mean precise pricing customized for the selling partner will appear on the partner's screen. Once SKUs are selected, SkyKick provides tools for customizing and scheduling migrations and managing the project.

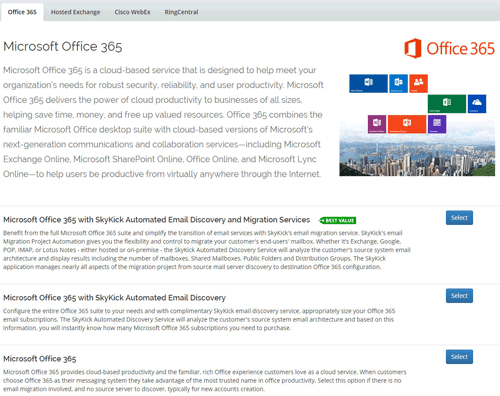

In the Ingram Micro cloud marketplace, partners who select Office 365 will get three ordering options for Office 365. They can select Office 365 with the full SkyKick Automated Email Discovery and Migration Services; they can pick Office 365 with SkyKick's automated e-mail discovery for free; or they can choose Office 365 by itself, mostly for new accounts without legacy e-mail accounts or servers to migrate (see screenshot).

[Click on image for larger view.] Selecting Office 365 in Ingram Micro's Cloud Marketplace brings up three order options, two of which are powered by SkyKick automation tools. (Image Source: SkyKick.)

[Click on image for larger view.] Selecting Office 365 in Ingram Micro's Cloud Marketplace brings up three order options, two of which are powered by SkyKick automation tools. (Image Source: SkyKick.)

Ingram is also bringing many other elements to the cloud marketplace that its partners will be able to sell to enhance Office 365. "Now with the automation, we can enable them to do a lot more than just sell the mailbox. For example, on the marketplace, they can bundle that mailbox with their own help desk, or they can bundle it with security," Bergeron said. "We have 10 vendor partners, and together they represent 55 different services."

Other offerings in the marketplace include security from McAfee and Trend Micro, backup from Acronis, an Ingram Micro Service Desk that can be white-labeled, as well as products from Cirius, Nomadesk and RingCentral.

Posted by Scott Bekker on March 09, 20150 comments

How much would Microsoft's overseas profits add up to if the company paid U.S. taxes on them the way Uncle Sam prefers? A lot, according to an infographic in the March 9-15 issue of Bloomberg Businessweek.

In the graphic (see below or page 35 of the print issue, which just landed in the snow outside my house), Bloomberg compiled securities filings and U.S. Office of Management and Budget information and assumed the 35 percent tax rate that companies owe when they repatriate profits after getting credit for taxes paid abroad.

[Click on image for larger view.]

[Click on image for larger view.]

Bloomberg says Microsoft booked $92.9 billion in profits in Ireland, Puerto Rico and Singapore. The magazine declares that amounts to $29.6 billion in lost U.S. taxes. According to the graphic, that's enough to cover the entire budget of the Department of Justice and a quarter of the Department of Commerce.

Microsoft tops the Bloomberg Businessweek list, but two other tech giants are close behind. Apple has $69.7 billion stashed and would owe $23.3 billion if it brought it all home -- enough to pay for all but $500 million of the Department of Agriculture's discretionary budget. Oracle has $39.3 billion stashed overseas -- equal to about $12.2 billion in taxes, enough to cover the Department of the Treasury.

In all, corporations are parking more than $2 trillion in profits offshore, the magazine said. For perspective, the proposed U.S. budget for 2015 is about $3.9 trillion. That's one year of U.S. federal government spending, and the offshore corporate accounts have been amassed over many years.

It's a nice touch by the magazine to subtly note that Microsoft's tax avoidance choices are equal to defunding the department that gave them so much trouble in the 1990s.

Posted by Scott Bekker on March 06, 20150 comments

In an effort to increase channel uptake of its strategic mobility and security cloud offering, the Enterprise Mobility Suite, Microsoft is making EMS available for free to partners and providing a new way for partners to sell it.

"EMS is available in Open Licensing on March 1, 2015," wrote Gavriella Schuster, general manager of the Microsoft Worldwide Partner Group, in a blog post Thursday. "Like many of the other cloud-based services that recently become available in Open such as Office 365, Azure or Dynamics CRM Online, the flexibility and potential cost savings of the Open Licensing model makes it possible for distributors and resellers to sell additional cloud services to small and medium-sized enterprises."

Microsoft has two main models for the majority of partners to sell its cloud services. In the original model, partners get themselves registered on a deal between Microsoft and the customer and receive Partner of Record fees, also known as advisor fees. That option had been available for partners with EMS already.

In another model, partners buy the license on behalf of the customer, and then resell it, ideally in a bundle with other Microsoft, third-party and their own services. One method for facilitating those types of sales is with Open Licensing. In Microsoft's Open model, the customer places an order with a partner, the partner in turn makes an order from a distributor -- such as Tech Data, Ingram Micro or Synnex -- and the distributor ultimately passes the order on to Microsoft. The invoice goes back through the chain in the other direction, allowing the customer-facing partner to present a single bill to the customer, offering customer convenience and partner control over margin. The approach also is supposed to protect partners from having their customers poached by either the distributor or Microsoft.

Microsoft introduced that Open model for cloud services with Office 365 in February 2013 and later added other products to the model -- Intune and Power BI in April 2014, Azure in August 2014 and CRM Online earlier this month.

EMS is also being dropped into the package of not-for-resale offerings that partners get from Microsoft to encourage internal familiarity, customer demos and testing. "Starting in early March, Microsoft Action Pack subscribers, along with Silver and Gold competency partners, will get access to EMS and Azure AD Basic as part of their Internal Use Rights (IURs) benefits," Schuster wrote.

A response to the megatrends of consumerization of IT and bring your own devices (BYOD), EMS consists of Azure AD Premium for hybrid identity and access management, Intune for mobile device and application management, and Azure Rights Management for information protection.

To encourage usage of the products together, Microsoft cut the price to buy the suite by almost half compared to what it would cost to purchase the three products separately. According to a December 2014 customer datasheet, the suite costs $7.50 per user per month with an annual commitment. Individually, the products would cost $14 -- $6 for Azure AD Premium, $2 for Azure Rights Management and $6 for Microsoft Intune, according to the datasheet.

Matt Scherocman, president of Interlink Cloud Advisors in Cincinnati, has several customers on trials of EMS and sees the product as a huge opportunity for the channel.

"I think partners should want to drive this as a solution. No. 1, it's services. No. 2, it's about helping the customer with all the ways they protect their data, which is huge," Scherocman said, adding that the single sign-on that EMS enables through Azure AD Premium allows users to connect to several thousand cloud apps in a way that's managed by the AD administrator. "The other thing I like about EMS as a partner is that it's an area that Microsoft is investing in."

Posted by Scott Bekker on February 26, 20150 comments