News

Microsoft Beats Analyst Expectations in Q3 Despite Sliding PC Market

- By Kurt Mackie

- April 23, 2015

Microsoft on Thursday reported its financial results for the third quarter of its fiscal year 2015.

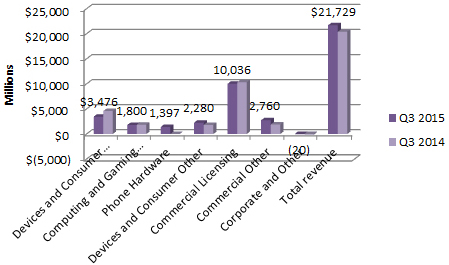

Overall revenue for the quarter was $21.7 billion, up 6% compared with last year's Q3 earnings. Earnings per share was $0.61, down 10% vs. last year's Q3 result. Financial analysts had expected a revenue result of $21.1 billion and $0.51 earnings per share.

Microsoft's July restructuring and layoff costs, along with the costs of integrating Nokia's Devices and Services business, had a "$0.01 per share negative impact" for this quarter, according to Microsoft's announcement. A strong U.S. dollar versus other currencies also affected Microsoft's earnings, the company indicated.

Microsoft's fiscal Q3 period ended on March 31, 2015, which corresponds to the Q1 calendar year. That was a bad time for PC shipments. For instance, IDC reported a year-on-year decrease of 6.7% for worldwide PC shipments in the Q1 2015 calendar year.

Devices and Consumer Segment

Microsoft's Q3 earnings results reflected the PC downturn. Windows OEM Pro revenue dipped 19%, while Windows OEM non-Pro revenue dropped 26%. Microsoft cited an overall 22% decline for its Windows OEM revenues for the quarter.

Despite those financial hits, Microsoft's announcement claimed that its Devices and Consumer business segment, which includes other products besides devices, grew revenue 8% for the quarter. However, when the numbers are graphed, the Devices and Consumer business segment was a loss for this quarter, in a year-over-year comparison (see chart).

Microsoft's fiscal Q3 2015 revenues by segment. Source: Microsoft investor relations site.

Microsoft's fiscal Q3 2015 revenues by segment. Source: Microsoft investor relations site.

Also included in the Devices and Consumer segment are Office 365 Consumer subscribers, which were up 35% at 12.4 million subscribers, Microsoft indicated. Surface device revenue, also part of this business segment, was $713 million, up 44%, with Surface Pro 3 sales being the driving force, Microsoft contended.

For the first time this quarter, Microsoft is reporting its Windows Phone hardware sales. Revenue for those devices was $1.4 billion. Microsoft indicated that 8.6 million Lumia devices were sold in the quarter, which represents an 18% increase over last year's Q3 result, according to a Microsoft earnings slide. Microsoft is mostly selling non-Lumia phones, though, with 24 million sold in Q3.

Microsoft reported a decline in Windows Phone revenue of 16% for the quarter. The cause was mostly because of a "higher mix of low royalty devices," according to an earnings slide.

Other Devices and Consumer results include search ad revenue up 21% and Xbox Live use up 30%.

Commercial Segments

Microsoft's announcement stated that its Commercial business segments delivered a 5% increase in revenue for the quarter. There are two Commercial segments, so that number appears to be an overall calculation. According to an earnings slide, Commercial Licensing revenue was down 3%, while Commercial Other revenue was up 45%, so it's a bit confusing.

Commercial segment highlights included 106% commercial cloud revenue growth and a 10% growth in server revenues, according an earnings slide. Surprisingly, though, Windows volume licensing was down 2%. It seems that the PC refresh cycle has cooled after Windows XP upgrades.

Microsoft Office products also are included the Commercial business segments. Office showed a 2% revenue decline, according to Microsoft's announcement. The decline was partly attributed by Microsoft to organizations moving to Office 365 subscriptions over "boxed" software. A lower PC refresh rate also squeezed Office sales.

More info on Microsoft's Q3 earnings can be found Microsoft's investor relations site here.

About the Author

Kurt Mackie is senior news producer for 1105 Media's Converge360 group.