Microsoft Backs Survey To Define the Elusive Cloud Buyer

A common piece of conventional wisdom on cloud is that it changes who buys technology.

In a detailed and wide-ranging new survey commissioned by Microsoft, 451 Research LLC attempts to provide some data to support a definition of that amorphous and elusive concept -- the new cloud buyer.

The report, "Beyond Infrastructure: Cloud 2.0 Signifies New Opportunities for Cloud Service Providers," is a survey of 1,736 cloud and hosting customers conducted in 10 countries between December and March.

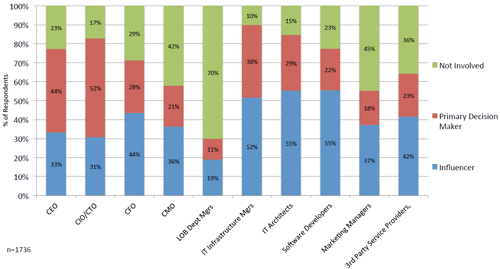

Addressing the new buyer, the survey pointed to decisions being made at a much higher level than the traditional IT manager, confirming -- in this case, at least -- what analysts and technology executives have been telling partners for the last few years: To succeed, the sales pitch has to get more business-focused and less technical.

The traditional IT buyer, the IT infrastructure manager, is still important. The survey finds the IT infrastructure manager is identified by 38 percent of respondents as the primary decision-maker (see Figure 1). However, that only ranks third on the list. In second place is the CEO, identified by 44 percent of respondents as the primary decision-maker. That's a huge percentage, and a CEO requires a completely different selling style than traditional IT infrastructure managers. The top person for evaluating hosting and cloud services, with 52 percent of respondents, is the CIO or CTO -- a role that bridges the concerns of the other two.

[Click on image for larger view.]

Figure 1: Stakeholder decision-making authority. (Source: 451 Research.)

[Click on image for larger view.]

Figure 1: Stakeholder decision-making authority. (Source: 451 Research.)

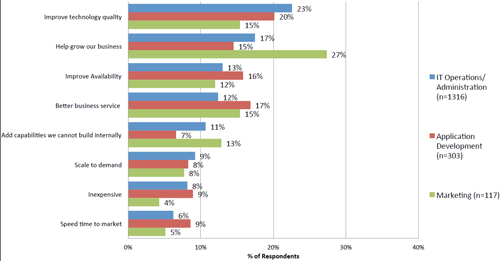

The survey also shines a light on a significant new player in the IT buying world -- the marketing department. Marketing is emerging as an aggressive and heavy consumer of cloud services, and this is a department where business considerations heavily outweigh any technical concerns.

When asked about an organization's highest expectation for moving to hosted services or cloud computing, marketing respondents' answers were all about business. The highest expectation was "help grow our business" at 27 percent, with "better business service" at 15 percent and "add capabilities we cannot build internally" at 13 percent (see Figure 2).

[Click on image for larger view.]

Figure 2: Highest expectation moving to cloud by department. (Source: 451 Research.)

[Click on image for larger view.]

Figure 2: Highest expectation moving to cloud by department. (Source: 451 Research.)

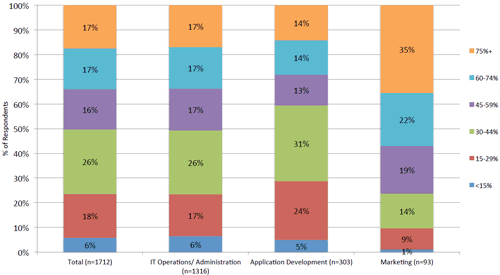

Marketing is the department most likely to launch new cloud applications with capabilities that the company didn't have -- 26 percent of the time. Marketing also has the most aggressive plans among the departments surveyed (other departments were IT operations and application development) to put applications in the cloud. In 35 percent of cases, marketing expected to have more than 75 percent of its applications or resources in the cloud in the next two years (see Figure 3).

[Click on image for larger view.] Figure 3: Future percent of applications in cloud by department. (Source: 451 Research.)

[Click on image for larger view.] Figure 3: Future percent of applications in cloud by department. (Source: 451 Research.)

While a marketing manager is seldom the primary decision-maker, marketing department projects are the most likely ones for the CEO to weigh in on. The CEO is the one making decisions on IT purchasing decisions for marketing in more than half of organizations, according to the survey.

The general trend for cloud IT decisions to move up the corporate ladder brings new concerns to the fore, according to Michelle Bailey, senior vice president at 451 Research.

"As new decision-makers emerge, so too does the criteria for selecting cloud service providers. Trust, uptime, security, performance and technical expertise are today's differentiators for a business-ready cloud," Bailey said in a statement. "Cloud 2.0 is really about value, redefining cloud computing from a technical specification to a business-ready environment. Enterprises are looking for a trusted end-to-end solution, and ultimately this will involve multiple partners."

Aziz Benmalek, general manager for the hosting service provider business at Microsoft, highlighted other findings of the survey -- the maturity level of customers, with 75 percent saying they were beyond the cloud discovery phase, and a healthy interest in combined private and public cloud environments. Benmalek contends those trends spell new opportunities for Microsoft's community of hosting service providers, which grew by 5,000 partners in the last year.

"This presents a significant opportunity for our service provider partners to provide value-added services to their customers," Benmalek said in a statement. "By offering these expanded services, cloud service providers will be able to drive additional consumption, increase revenue and serve as trusted advisors."

More than half of the customers surveyed were in the United States. The percentage of respondents from each of the other nine countries ranged from 9 percent to 2 percent and were, in descending order, Germany, the United Kingdom, India, Brazil, Australia, Japan, Singapore, Turkey and the Netherlands. Of respondents who provided company size information, about 40 percent had between 100 and 999 employees, with roughly 20 percent each in the bands of less than 100 employees, 1,000 to 4,999 employees, and more than 5,000 employees.

Posted by Scott Bekker on March 18, 2015