Cisco Proves a Hard Target for Microsoft in Enterprise UC

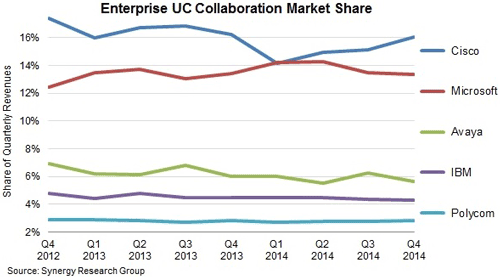

After steadily eating away at Cisco's leadership position in enterprise unified communications (UC) collaboration in 2012 and 2013, Microsoft seemed poised to grab the market leader role and hold onto it. Indeed, Microsoft claimed a sliver of a lead in the enterprise UC market in the first quarter of 2014.

Since then, though, Cisco has proven itself a hard target for Redmond in UC, according to data from Synergy Research Group.

Cisco narrowly reclaimed market leadership in the second quarter of 2014, widened the lead slightly in the third quarter and, according to data released by Synergy this week, expanded that lead further in Q4.

[Click on image for larger view.]

[Click on image for larger view.]

Synergy defines enterprise UC as a $30 billion market that includes enterprise voice, UC applications, telepresence, e-mail software, enterprise content management, enterprise social networks and a range of hosted/cloud communications and applications.

In Q4, Synergy said that the UC collaboration market hit $8.5 billion, an all-time high but one that represents just a 2 percent increase year on year. That low single-digit growth masks a dynamic market with new technologies riding a very different growth path than legacy technologies.

As a major player on both old UC and new UC, Cisco's latest gains in share come from the legacy side.

"While revenues from enterprise IT telephony are clearly continuing to decline, Cisco saw a very nice year-end bump in its telephony revenues, which helped it to distance itself from Microsoft," said Jeremy Duke, Synergy's founder and chief analyst, in a statement.

Microsoft, which this week unveiled its next generation of enterprise UC products under the Skype for Business brand, has a strong strategic position in the fastest-growing part of the market, leading Synergy's Duke to project an ongoing battle between the two leaders: "The real bright spot for Microsoft is that it has clear leadership in hosted/cloud solutions which are also the highest growth part of the market. Cisco dominates in premise-based solutions but the general trend is for hosted/cloud revenues to catch up with and surpass premise-based revenues."

By share, Synergy ranks the top five contenders as Cisco (16 percent), Microsoft (14 percent), Avaya (7 percent), IBM (4 percent) and Polycom (3 percent).

Posted by Scott Bekker on March 19, 2015