News

Windows Phone 7: Will Microsoft's Mobile Plans Pan Out?

Windows Phone 7 manages to lose share for the Windows Mobile platform in the three months that span the launch. Can Microsoft show enough momentum for partners to commit to the platform?

- By Scott Bekker

- April 07, 2011

Microsoft put a lot of its chips on the table with Windows Phone 7 in the critical smartphone market.

The software giant may be sweating in response to the first market share numbers for devices based on the mobile OS in the three months that cover the Windows Phone 7 launch.

The comScore Inc. numbers came out last month for the October 2010 through January 2011 period. During that period, Microsoft's share dropped 1.7 points from 9.7 percent to 8 percent. Windows Phone 7 launched in Europe and the Asia/Pacific region on Oct. 21 and in the United States and Canada on Nov. 8.

Microsoft is probably most worried about Google Inc. because, unlike Apple Inc. or Research In Motion (RIM), Google shares Microsoft's strategy of providing a mobile OS around which multiple OEMs build phones. Google had a fantastic three months, leapfrogging both RIM and Apple in the three-month period to claim the top spot. By comScore's numbers, Google gained 7.7 points of share to claim 31.2 percent of the market.

|

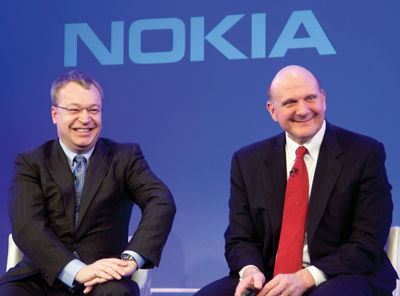

| Microsoft's Steve Ballmer and Nokia's Stephen Elop make a deal that demonstrates Microsoft's long game on Windows Phone 7. |

The March scores from comScore continue a trend of market share loss for Microsoft. Microsoft has now lost 6 points of share from the 14 percent it held in April 2010.

Microsoft claims to be playing long ball. "We introduced a new platform with Windows Phone 7, and when you do that it takes time to educate partners and consumers on what you're delivering, and drive awareness and interest in your new offering. We're comfortable with where we are, and we're here for the long run; Windows Phone 7 is just the beginning," Achim Berg, Microsoft corporate vice president, Mobile Communications Business and Marketing Group, said in a statement in December.

The biggest evidence of Microsoft's long game is a deal with Nokia, which is led by former senior Microsoft executive Stephen Elop. The Finland-based device manufacturer plans to transition primarily to push Windows-based phones and attempt to keep the 200 million users of the Symbian smartphone platform with Nokia, but on Windows-based devices. Rumors that the deal would involve $1 billion in payments from Microsoft to Nokia only underscore Microsoft's commitment to Windows Phone 7.

In another sign of Microsoft's long game, the company changed long-standing human resources policies to allow Microsoft employees to effectively moonlight as Windows Phone 7 app developers. Microsoft will share any revenue on those apps in a 70/30 employee/Microsoft split.

Those employees and the rest of Microsoft's development community will need to get busy if Microsoft is to catch up to Apple and Google in the number of apps available in smartphone app stores. A chart compiled by the Business Insider blog in March put the app count at 350,000 for the Apple iPhone, 250,000 for the Google Android, 20,000 for the RIM BlackBerry and 9,000 for Windows Phone 7.

For Microsoft to get traction, the company has some convincing to do, even within the ranks of its own partners. In our RCP Reader Survey, one Microsoft Certified Partner from a custom software development firm in Washington state, wrote in, "We don't see much incentive to port our existing Android phone apps to Windows Phone 7. Too bad, because we are major Microsoft fans."

Other Microsoft partners are worried. In the RCP survey, partners rated Windows Phone in the middle of a pack of about 25 major products in terms of importance to their businesses, ahead of all of the Microsoft cloud offerings but behind the core infrastructure servers, Windows and Office.

"If Microsoft doesn't capture a significant percentage of the end-user mobile community, the advantage of Microsoft-centric solutions loses mindshare and business customers who want the advantages that full cross-platform Microsoft solutions could bring," a Registered Member in Minnesota wrote in his RCP survey response.

About the Author

Scott Bekker is editor in chief of Redmond Channel Partner magazine.