It's a Wide-Open SaaS-y World in the Public Cloud, For Now

The public cloud is a predominantly Software-as-a-Service (SaaS) market, with the Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) elements gaining steadily in SaaS' rear view.

Oh, and that SaaS market is still wide-open, even as the IaaS/PaaS sector becomes more consolidated by the year.

Those are the main takeaways of IDC's useful snapshot of public cloud revenues, released Tuesday. The numbers come in a 2019 after-action report showing combined public cloud revenues of $233.4 billion, SaaS revenues of $148.5 billion, IaaS revenues of $49 billion and PaaS revenues of $35.9 billion. Significantly, all of this data predates the effects of the global pandemic.

Specifically, SaaS makes up nearly two-thirds of the public cloud market (64 percent). The sector's growth is still half that of IaaS and PaaS, making it a long slog for those two to catch up. SaaS had 2019 year-over-year growth of 20 percent, while IaaS and PaaS were both near 39 percent. Meanwhile, SaaS application growth has been slowing slightly in recent years, although the current crisis could reverse that trend.

IDC has started looking broadly at the public cloud market as two main buckets, rather than three. There's SaaS on the one side and IaaS and PaaS together on the other side. The market research company explains the grouping as reflecting the way end customers consume the services when deploying applications on the public cloud.

When it comes to market consolidation, those two buckets tell very different stories.

[Click on image for larger view.] Source: IDC

[Click on image for larger view.] Source: IDC

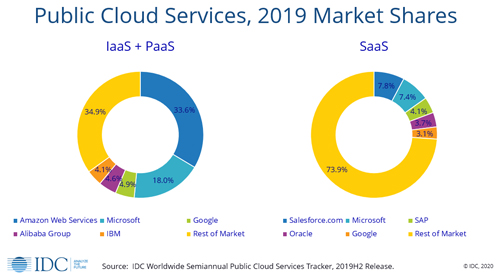

While SaaS is more mature from a revenue and growth perspective, the market is completely disorganized, owing partly to the nearly infinite variety of applications involved. Market leader Salesforce.com commands only 7.8 percent of total revenues. Microsoft, with its many SaaS offerings headlined by Office 365 and Dynamics 365, is second with 7.4 percent. After a top five rounded out by SAP, Oracle and Google, the "rest of market category" accounted for a whopping 74 percent of revenues in 2019.

On the IaaS + PaaS side, it's a highly consolidated market, with Amazon in the lead at 34 percent, Microsoft next at 18 percentand Google, Alibaba Group and IBM all in a tight market share range between 4 percent and 5 percent. The entire rest of the market in 2019 took 35 percent of the revenue, IDC said.

Still, IDC, which spends much of its time characterizing market sectors, viewed the rest of the IaaS/PaaS market as healthy. AWS and Microsoft have more than half of global revenues, but the firm sees a vibrant market of companies with what it describes as targeted use case-specific PaaS offerings.

IDC cautioned that next year's snapshot of the 2020 public cloud may show very different results from the trends suggested by the 2019 numbers, especially because of an acceleration in enterprises' shift to the cloud.

Posted by Scott Bekker on August 18, 2020