Ten Takeaways from Microsoft's Nokia Acquisition

The plan to acquire close smartphone partner Nokia's devices and service business for $7.2 billion reveals a lot about Microsoft.

1. Devices & Services Just Got Real

Microsoft's "Devices & Services" strategy is Steve Ballmer's baby. The idea is to grow beyond Microsoft's roots as a software company and use those software skills to support two new branches -- devices like convertibles and smartphones, and services, or in other words, cloud. Ballmer introduced the phrase in October 2012 and seemed to put the finishing touches on it with his "One Microsoft" reorganization with him at the center in July.

Just when it seemed he'd cemented Microsoft's direction, however, came the surprise announcement that he would retire within 12 months, and lots and lots of hints that retirement wasn't his choice. The Microsoft Board of Directors issued a statement confirming that Devices & Services would still be the company's strategic direction, but Ballmer's apparent ouster made that seem highly questionable.

Now Microsoft is "all in," as the company once said of cloud. Devices went from a notion and aspiration, backed mainly by a Microsoft Surface convertible/tablet that recently suffered a $900 million inventory-related writedown, to a $7.2 billion purchase of Nokia's product lines with 32,000 new employees. Unless investors or regulators derail the deal, the "device" part of Microsoft being a "Devices & Services" company is now inarguable.

2. Securing Microsoft's Flank on Windows Phone

When it comes to Windows Phone, there is only one partner that really matters to Microsoft -- Nokia. HTC may have produced the first flagship Windows Phone 8 device, and Samsung sells a few. But Nokia accounts for more than 80 percent of Windows Phone sales. If Nokia were to stop selling Windows Phones for any reason, it would be the death knell for Microsoft's smartphone platform.

The pressure on Nokia CEO Stephen Elop to reverse course on his decision a few years ago to focus on Windows Phone has been intense and non-stop. He's held steady, but Microsoft has always faced the possibility that Nokia would 1) go bankrupt, 2) oust Elop and change direction or 3) keep Elop but end the exclusive future focus on Windows Phone.

There was a lot of happy talk by Ballmer and Terry Myerson, executive vice president of Microsoft's Operating System Engineering Group, in the investor call Tuesday morning about the efficiencies and messaging improvements that would be gained by combining the companies' mobile efforts under one umbrella. Ballmer's best point there was a good joke about the unwieldy name of the companies' latest joint effort: "We can probably do better than the 'Nokia Lumia Windows Phone 1020.' Just take that as a proxy for a range of improvements we can make."

Nonetheless, it's hard to imagine two companies working together more closely than what Microsoft and Nokia have done. Knowing the reputation that Microsoft divisions have for working together (remember that cartoon organizational chart with each division pointing guns at other divisions?), the Nokia team's best collaboration days with their Microsoft peers may be behind them.

Asked by an analyst, however, Ballmer briefly acknowledged that Microsoft was securing its key delivery partner by buying its business. Other observers have suggested that the financing included in the deal is a clue that Microsoft was forced to act now in order to save Nokia from bankruptcy.

Whether or not Microsoft's hand was forced by bankruptcy or by a threat to expand to Android when the companies' joint agreement comes up next year, this move will secure a handset maker for Windows Phone. Nokia was always committed, but whether the company, or its management, would survive was a constant question.

3. The Dynamics with ValueAct Are Weird

Late on the Friday before the U.S. Labor Day weekend, Microsoft posted a little-noticed news release about a cooperation agreement with ValueAct Capital. That's the San Francisco-based investment firm run by Mason Morfit, an activist investor who has taken a $2 billion position in Microsoft stock. What Morfit wants, other than a higher Microsoft stock price or a bigger dividend, is a closely held secret. But rumors have Morfit agitating for a recommitment to Microsoft's software fundamentals and less emphasis on devices, like the Xbox or presumably the Surface and Nokia phones.

The timing is very interesting. There's more to the Aug. 30 date than an effort to sneak in some news before Labor Day. According to an Aug. 22 report in the Puget Sound Business Journal, that was the deadline for ValueAct to notify Microsoft if it would engage in a proxy fight. So Microsoft locked up a cooperation agreement with ValueAct that prevents the investor from speaking out publicly against Microsoft, confirms it won't try to gain a 4.9 percent share of the company or launch a proxy fight, gives it the ability to consult with Microsoft, and offers Morfit a spot on the board after the 2013 shareholders meeting (a huge concession). That done, Microsoft a few short days later announces the Nokia deal, which there's a good chance ValueAct would have opposed.

Nomura Securities analyst and longtime Microsoft watcher Rick Sherlund asked the most pointed question during the investor call about the Nokia deal: Was ValueAct consulted? Ballmer passed the question to Microsoft's chief counsel Brad Smith, who said, "You would not expect the company to disclose material, non-public information to an entity that doesn't have an appropriate non-disclosure agreement, so the answer is no."

So the intriguing possibility is that Microsoft maneuvered ValueAct out of a proxy fight, then immediately closed a deal that cements Ballmer's "Devices & Services" strategy (see No. 1). Maybe Microsoft's old pugilistic, legalistic ways aren't completely over.

4. Elop Seems To Have the Inside Track for Microsoft CEO

Of the internal candidates to be the next CEO of Microsoft, Satya Nadella seemed to have the best portfolio. No one inside the company had serious devices experience outside the Xbox unit. With devices off the table, Nadella offered leadership for either direction. If Microsoft returned to the fundamentals, he had the server and tools business experience, a business that has continued to grow despite struggles elsewhere at Microsoft. For a Microsoft going the "Devices & Services" route, Nadella's also been heavily involved in cloud.

But the sudden return of Stephen Elop at the head of 32,000 new Microsoft employees makes a strong case for the man in Finland. Elop ran the Office business before he left Microsoft to take over Nokia, so he spent quality time at the very top of Microsoft. And now he has deep experience that is unique to Microsoft in the intricacies of all the Nokia device businesses that will be coming to Microsoft.

Nokia CEO Stephen Elop (left) with Microsoft CEO Steve Ballmer.

Nokia CEO Stephen Elop (left) with Microsoft CEO Steve Ballmer.

One other point -- Elop is Microsoft's biggest fan outside of Redmond. The guy actually bet the company that he ran on Microsoft technology rather than Android, and he wasn't drawing a Microsoft paycheck at the time.

By no means is the choice down to two people, but the complexities of integrating a huge hardware company and his proven belief in Microsoft give Elop the inside track.

5. This Is a Huge Bet

As Jeff Schwartz reported, this is one of the biggest deals Microsoft has ever done:

"The deal is Microsoft's second largest -- its 2011 acquisition of Skype is its biggest at $8.5 billion -- and puts an even larger bet on its expansion into hardware. The company's third-largest acquisition was that of aQuantive for $6 billion, which Microsoft wrote off last year."

The number of employees coming over from Nokia makes it even more consequential.

6. Julie Larson-Green's Roller Coaster Ride

Among executives assigned major roles in Ballmer's reorg, Julie Larson-Green got one of the biggest career bumps. Larson-Green was on a level with Satya Nadella, Terry Myerson and Qi Lu as the executive vice president of an engineering group under the reorg. She runs the Devices and Studios Engineering Group. In his internal memo announcing the Nokia deal, Ballmer explained that Elop would be coming over as executive vice president of devices and Larson-Green would be on his team. That's several months away, and if Elop ends up as CEO, she could have another opportunity.

Here's the text of Ballmer's e-mail regarding roles for Elop and Larson-Green once the acquisition closes:

"1. Stephen Elop will be coming back to Microsoft, and he will lead an expanded Devices team, which includes all of our current Devices and Studios work and most of the teams coming over from Nokia, reporting to me.

"2. Julie Larson-Green will continue to run the Devices and Studios team, and will be focused on the big launches this fall including Xbox One and our Surface enhancements. Julie will be joining Stephen's team once the acquisition closes, and will work with him to shape the new organization."

7. A 50-Million Phone Hurdle

Microsoft clearly established the lowest bar that these combined businesses must clear for the collaboration to be a success. In a slide deck accompanying the investor call, Microsoft states, "Operating income breakeven when Smart Device units exceed ~ 50M." That's not a huge figure compared to Android and iPhone volumes, but 50 million units is a big increase over Windows Phone's current run rate. Executives on the call repeatedly mentioned that there were 7.4 million smart Windows Phones in the last quarter. That's an annual run rate of about 30 million phones.

8. A 15 Percent Share Assumption

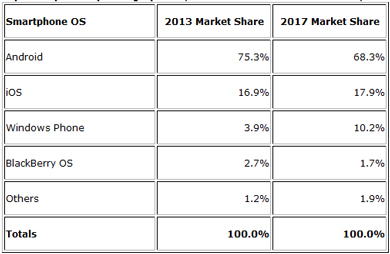

Another slide covering the revenue opportunity revealed something of the two companies' expectation as far as market share goes. The slide was based on achieving 15 percent market share in 2018. That's a lower assumption than the two companies persuaded analysts they'd be able to achieve when they first launched their partnership. At the time, IDC and Gartner both pegged Windows Phone's 2014 share at about 20 percent based on Nokia's smartphone market share at the time. In the interim, Nokia legacy platforms lost share extremely quickly and Windows Phone didn't gain it that quickly. IDC numbers released Wednesday are more conservative. IDC estimates Windows Phone share at just under 4 percent for all of 2013 and project a 10 percent share in 2017.

Top Smartphone Operating Systems, Forecast Market Share and CAGR, 2013–2017 (Source: IDC).

Top Smartphone Operating Systems, Forecast Market Share and CAGR, 2013–2017 (Source: IDC).

9. Other Handset Partners

Doing a huge deal with one handset partner tends to alienate your other partners. However, with Windows Phone, this alienation has been happening for a while. Samsung is having huge success with Android and has paid only marginal attention to the Microsoft platform, although Samsung did release a phone for Windows Phone 8. HTC, also, is far more focused on the Android opportunity than the Windows Phone opportunity.

When one partner (Nokia) accounts for 80 percent of the volume, there's not that much difference between having one partner and having a few. During the investor call, Ballmer said other handset manufacturers were greeting the Microsoft-Nokia news with enthusiasm and getting more interested in Windows Phone, and said that he expected other partners to account for more than the current 20 percent of the total shipment volumes in the future. He didn't offer a rationale for that counterintuitive interpretation.

10. At Least Microsoft Didn't Buy BlackBerry

If Microsoft was destined to buy a struggling handset company, at least it didn't buy BlackBerry. Whatever limited success the Microsoft-Nokia partnership has had compared to the Android and iOS platforms, they've done better together than BlackBerry has. There had been ample calls for Microsoft to buy BlackBerry. That would have married a struggling strategy (Microsoft-Nokia) to a flailing one.

The annals of business success are filled with tales of companies steadily pushing at a flywheel in one direction. If Microsoft's mobile efforts are to succeed, continuing to push in the same direction and trying to build momentum seems the most likely route. The Microsoft-Nokia strategy has a chance to one day break out. Buying Blackberry would have been a guarantee of 18 to 24 months of chaos followed by a new, and unlikely-to-succeed, strategy.

Related:

Posted by Scott Bekker on September 04, 2013