News

IDC: Windows Phone Will Be Fastest-Growing OS in Slowing Market

- By Gladys Rama

- February 26, 2014

Among the top three smartphone operating systems, Microsoft's Windows Phone will have the fastest-growing market share over the next four years, according to IDC's latest projections.

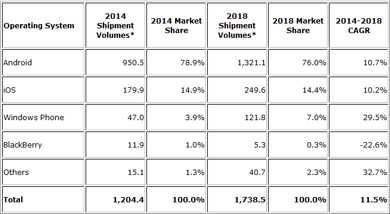

Windows Phone's worldwide market share is expected to grow from 3.9 percent in 2014 to 7 percent in 2018, IDC said in a report published Wednesday. Shipments of Windows Phone devices will almost triple in that time to 121.8 million.

Windows Phone will still remain a distant third behind perennial market leaders Google Android and Apple iOS, however. IDC projects those two platforms will make up 76 percent and 14.4 percent of the worldwide smartphone market, respectively, by 2018 (see table).

[Click on image for larger view.]

Worldwide smartphone forecast by OS, shipments and market share, 2014-2018 (units in millions). Source: IDC.

[Click on image for larger view.]

Worldwide smartphone forecast by OS, shipments and market share, 2014-2018 (units in millions). Source: IDC.

IDC attributes Windows Phone's growth partly to the raft of new hardware partners Microsoft recently signed up. Microsoft on Monday announced that it was adding nine new Windows Phone original equipment manufacturers (OEMs) to its original stable of four. The OEMs now include major global players like Samsung and Nokia (which Microsoft is set to acquire this quarter), as well as more locally known manufacturers like New Delhi-based Gionee and Shanghai-based Longcheer.

IDC notes this added geographic diversity among Windows Phone's OEMs will help its prospects in emerging markets, which are becoming increasingly important as smartphone saturation has led to slower growth in mature markets.

"Most of these new vendors come from emerging markets and could help bring the Windows Phone experience to customers there," IDC said.

IDC's report does not mention the impact of the Nokia's recently launched line of "forked" Android phones called Nokia X. The Nokia X devices, aimed at entry-level buyers, run several Windows services out of the box and resemble the Windows Phone-based Lumia phones in aesthetics. Nokia described the line as being designed to give users in emerging markets an "on-ramp to Lumia and Microsoft services."

As Forrester analyst Bryan Wang noted in a blog Monday, the Nokia X line would give Microsoft one avenue to bring to market the kind of low-cost devices that Windows Phone can't support because of its hardware requirements.

"Nokia's move dramatically expands the reach of Microsoft's digital platform to reach a wider audience with the Microsoft account than it can reach with Lumia alone -- a very smart move," Wang wrote.

However, others note that even if the Nokia X line performs well in emerging markets, that may not necessarily mean a win for Windows Phone.

"The new Nokia X range will most likely bring good sales results in several emerging markets, where the Nokia brand still has strong appeal. This may represent a positive for Microsoft in the short-term, as it may give the possibility of closing the acquisition of a stronger Nokia, enjoying good sales momentum in the low-end market," wrote Nortia Research's Paolo Gorgo. "Over the long-term, however, we doubt that Nokia's forked Android move will lay the groundwork for customers to upgrade to the Lumia range, in spite of the effort from the company to create a similar look to the Windows Phone platform. It's all about the ecosystem, and that's the weak area restricting Windows Phone popularity."

Cheaper Devices for Emerging Markets

Overall, the picture for the worldwide smartphone market over the next four years will be marked by slowing growth in mature markets and rising demand for lower-cost devices, according to IDC. The slowdown will begin in 2014, which -- despite a 19.3 percent year-over-year growth in shipments -- will be "the year smartphone growth drops more significantly than ever before," the research firm said.

Stagnating demand in mature markets will cause device manufacturers and OS developers to compete on price, particularly in markets where there is still significant opportunity for growth. IDC projects the average smartphone cost to drop to $260 by 2018, compared to $308 in 2014.

Device prices for each of the top three smartphone OSes are expected to decline over the next four years (see graphic), but IDC expects Windows Phone prices to have biggest decline -- down from $265 in 2014 to $195 by 2018.

"In order to reach the untapped demand within emerging markets, carriers and OEMs will need to work together to bring prices down," according to IDC Research Manager Ramon Llamas.