Acronis will unify its products into a single line on March 31 and roll out significant changes to its partner program throughout 2021, the company told partners Tuesday.

Founder Serguei Beloussov described the design goal of the licensing changes as "one policy, one user interface, one license from one vendor." Acronis is aiming to roll up security, e-mail security, file sync and share, management, notarization, backup and disaster recovery under the Acronis Cyber Protect license.

During a virtual 2021 Acronis #CyberFit Partner Kickoff event Tuesday, Beloussov made several commitments for the year ahead, including roadmap transparency and increased investment in support, partner management and joint events/marketing funding.

He also promised to extend the Acronis Cyber Cloud platform beyond its original MSP focus. "Sometime in 2021, we will make sure that all of our partners can use it," he said.

Under the new licensing plan, all baseline capabilities will be provided under the Acronis Cyber Protect Cloud license. Some elements of the license, such as backup, file sync and share, disaster recovery and notary will be delivered in a pay-as-you-go format under the license. Other components of the baseline product are free cyber protection packs -- security, management, data loss prevention and e-mail security, which will launch in the second half of the year. Additional functionality will be delivered through upgrade add-ons known as Advanced Protection Packs. All of the Advanced Packs can be licensed on a per-GB or per-workload licensing model.

"You basically will be able to use Advanced Packs as Lego blocks...for every particular customer," said Yury Averkiev, vice president of product management for apps and services at Acronis.

The initial set of five Advanced Protection Packs that will be available on March 31 will include Advanced Security, Advanced Management, Advanced Backup, Advanced Disaster Recovery and Advanced Files. Packs on the roadmap for later in the year, Averkiev said, include Advanced Email Security, Advanced Data Loss Prevention and Advanced Security.

As examples of the types of features included in the base license versus the Advanced Packs:

- Security features in the base license include a #CyberFit Score, weak password check, vulnerability assessment, active protection, exploit prevention, anti-virus and anti-malware protection, and device control. The Advanced Security Pack includes local signature-based detection to the AV and anti-malware protection, URL filtering, forensic backup, backup scanning for malware-safe recovery, a corporate allowlist and smart protection plans.

- Baseline backup features are file backup, image backup, application backup, network shares backup, backup to cloud storage and backup to local storage. The Advanced Backup Pack adds support for Microsoft SQL Server and Microsoft Exchange clusters, Oracle DB, SAP HANA, Acronis' data protection map feature and continuous data protection.

Channel Chief Alex Ruslyakov walked partners through the specific changes to the partner program and demonstrated a new partner portal, which he said the company is planning to launch next month.

One major introduction is an Acronis #CyberFit Score that helps determine a partner's level in the Acronis platform. The score operates on a scale of 0 to 33 with up to three points available in each of 11 categories. Registered partners need no points, Authorized Partners need eight points, Gold Partners need 15 points and Platinum partners need 22 points. Meanwhile, a recurring revenue bar for service providers has been newly eliminated at the Gold level, although all Platinum partners must still clear a revenue hurdle.

Other immediate changes to the program for resellers and service providers include an updated referral program, new quarterly performance rebates, increased market development funds, marketing account managers for Platinum partners and enhanced technical support.

Changes planned for later in the year include marketing automation tools, training program enhancements, an on-demand demo lab, leads-sharing for service providers, a partner community forum and the ability to vote to influence the product roadmap.

Posted by Scott Bekker on February 02, 20210 comments

Microsoft experienced a lengthy technical glitch during CEO Satya Nadella's comments to financial analysts in the quarterly investor call on Tuesday.

A seven-minute, 40-second stretch of dead air started for at least some users watching the session on Microsoft Teams a little over three minutes into the call. Partway into the outage, Microsoft posted a message from its production studios reading, "We are experiencing technical difficulties. Please standby."

[Click on image for larger view.] A message posted during a nearly eight-minute audio outage during the Microsoft second quarter earnings call.

[Click on image for larger view.] A message posted during a nearly eight-minute audio outage during the Microsoft second quarter earnings call.

Ironically, as audio came back on around the 11:17 mark, Nadella was highlighting the Teams platform: "...Team's calling globally to 42,000 employees in just four weeks." According to a transcript that Microsoft rushed out faster than usual due to the downtime, Nadella had been talking about Lumen, formerly CenturyLink, undertaking a global rollout of Teams.

The outage came during more widespread Internet problems. Outages across the East Coast on Tuesday morning affected Verizon, Google, Zoom, YouTube, Slack and Amazon Web Services, according to media reports. It was not immediately clear what caused the problem for Microsoft Tuesday evening.

The glitch marred an otherwise very positive quarterly call on an earnings report that saw Microsoft's stock price get a lift in after-hours trading.

Microsoft reported revenues of $43.1 billion and earnings per share of $2.03, for the three-month period ending Dec. 31, 2020. Compared to the year-ago period, that represented a 17% increase in revenues, and both revenues and earnings beat analyst expectations.

"It was a record quarter, driven by our commercial cloud, which surpassed $16 billion in revenue, up 34 percent year over year," Nadella said. "What we are witnessing is the dawn of a second wave of digital transformation sweeping every company and every industry."

Highlights among business-oriented products included a 50% quarter-over-quarter increase in Azure revenues, a 21% increase in Office 365 commercial revenues, 39% growth in Dynamics 365 revenue and a 1% gain in Windows OEM revenues -- a figure that doesn't sound impressive except the comparison was against the frenzy a year ago to replace Windows 7 before the support deadline.

Posted by Scott Bekker on January 26, 20210 comments

Microsoft this week announced Tyler Bryson as the replacement for the departing David Willis to run the company's U.S. channel operations.

Bryson is officially corporate vice president of the U.S. One Commercial Partner organization.

"As I step into this new role, I look forward to deepening the relationships in our ecosystem and helping us all grow together," Bryson said in an introductory blog post.

In a nearly 20-year career with Microsoft, Bryson has led sales, marketing and services teams in the United States, India and Latin America. His most recent role was as vice president of the Microsoft U.S. Small, Medium & Corporate Segments. Bryson said he worked closely with Willis in that role on initiatives related to digital transformation.

According to Bryson's LinkedIn profile, he graduated from Brigham Young University in 1992 with a degree in accounting and went to the Wharton School for an MBA in finance in the late 2000s. He also spent six years at QuickStart Technologies in sales and marketing roles.

To U.S. partners, Microsoft's U.S. channel chief is arguably the second-most visible role at Microsoft after the worldwide channel chief job held by Gavriella Schuster. Due to Microsoft's organizational structure, Schuster and Bryson report into different departments and have more of a dotted-line relationship than at many other companies where country-level channel chiefs report to the global channel leader.

Bryson updated his LinkedIn profile with a description of his role and responsibilities:

My team is responsible for Microsoft's US Partner business including strategy, management, and overall partner ecosystem health. The team works with US partners to develop strong practices aligned to Microsoft's workload and industry priorities and delivers these solutions to customers to help them maximize business benefits from their investment in Microsoft technology. My organization is comprised of Partner Management, Channel Sales, Go-To-Market (GTM), and partner-facing Technical Specialists and Architects.

Willis, a fixture of the partner community for much of his 28 years at Microsoft, announced in early December that he would be leaving Microsoft after assisting with the transition to his replacement. While he didn't specifically say he was retiring, Willis said he was looking forward to family time, leisure activity, travel and volunteering.

Posted by Scott Bekker on January 21, 20210 comments

The PC market was on fire in the fourth quarter.

In its quarterly tracking of worldwide PC shipments, IDC reported preliminary numbers of 26.1 percent year-over-year growth to 91.6 million units.

And the fire could have been hotter.

"Every segment of the supply chain was stretched to its limits as production once again lagged behind demand during the quarter," said IDC analyst Jitesh Ubrani in a statement Monday. "Not only were PC makers and ODMs dealing with component and production capacity shortages, but logistics remained an issue as vendors were forced to resort to air freight, upping costs at the expense of reducing delivery times."

Citing pandemic-related demand factors such as work-from-home, remote learning, gaming and monitors, IDC predicted the boom in PC sales has a ways to go.

For the full year, market growth was 13.1 percent. The research house said the last time PC growth was that strong was 2010, when the market grew by 13.7 percent.

Lenovo led all vendors in worldwide PC shipments for Q4, followed by HP Inc., Dell Technologies, Apple and Acer Group.

Posted by Scott Bekker on January 11, 20210 comments

In the holding pattern that is early 2021, Microsoft's priority guidance to partners for the new year is for more of the same.

Microsoft channel chief Gavriella Schuster detailed her view of partner priorities and opportunities this week in a blog post that largely echoed earlier guidance from Microsoft Inspire, the annual July partner conference that helps kick off Microsoft's fiscal year.

As the ongoing coronavirus pandemic leads to renewed lockdown calls around the world, sets new daily death records in the United States and brings an uncertain vaccine rollout schedule, organizations and the partners who serve them find themselves in a similar technology circumstance to most of 2020. To wit, an uncertain business environment, ambiguity about when or if all employees can go back to the office, and limitations on IT spending driven by all that uncertainty.

Schuster, nonetheless, strikes a hopeful note about the challenges. "While some of these factors will unavoidably carry over to 2021, I am confident things are headed in the right direction, and I see a bright future on the horizon for our partner ecosystem," Schuster wrote.

In her post as head of the Microsoft One Commercial Partner organization, Schuster identified four key priority areas that Microsoft hopes its partners will focus on and succeed in during the coming year.

Remote work, unsurprisingly, leads the list. "While the initial exodus to remote work occurred early last year, organizations of all sizes are still evolving in response," Schuster wrote. Her post called for additional adoption of Microsoft Teams and other Microsoft 365 components.

Schuster also pointed to new opportunities in business continuity, noting the infrastructural changes organizations have had to make in the last year that haven't all been followed by revised and reinforced backup and recovery plans.

Like almost every year, security earns a place on the opportunity list. "The mass shift to remote work has made this even more critical for every organization worldwide," she said.

Finally, cloud migrations are another key opportunity area, Schuster said. She highlighted the way Microsoft has been simplifying the migration process for customers to turn to cloud adoption.

The post gives lip service to the term "digital transformation," the major theme of the last few years from Microsoft to its partners. However, what's called "digital transformation" now is dialed back substantially from the heady definitions of 2019 and earlier, when it referred to unlocking massive business potential by reinventing processes through innovative new applications and application modernization. The term now seems to refer more to the survival-oriented operations of supporting remote workers, reducing datacenter expenses and rejiggering business continuity/disaster recovery coverage.

That said, many of these more limited projects can be a stepping stone toward more ambitious projects in the future. When the pandemic recedes, organizations with more robust cloud infrastructures may be more ready to invest in and execute truly transformative projects than they had been before the crisis.

With luck, it's "digital transformation lite" in 2021, involving the types of priorities Microsoft is recommending, followed by "digital transformation heavy" in 2022.

Posted by Scott Bekker on January 07, 20210 comments

Microsoft U.S. Channel Chief David Willis announced Friday that he would be leaving Microsoft in January after 28 years at the company.

He didn't use the word "retire" in a blog post on the official U.S. Partner Blog, and some of his phrasing left open the possibility that he might emerge as an executive somewhere in the future. However, Willis suggested that his focus in the near future would be on family time, leisure activity, travel and volunteering.

"Personally, I've always lived life with a 'work hard, play hard' mentality, and I'll be shifting my balance from less work to more play, as I spend much more of my time on passions that include snowboarding, playing hockey, my guitars, spending more quality time with family & friends, and eventually some fun travel experiences once COVID-19 eases up. I'm also looking forward to participating in more volunteer opportunities and giving back to the community. I thank Microsoft for making it possible for me to be in this position," Willis wrote.

Willis said that it wasn't an easy decision to leave Microsoft, and that he was proud to have spent most of his career there.

Willis joined Microsoft in Canada in 1992 and held a number of marketing and sales roles in his first decade with the company, according to his LinkedIn profile.

He's been a fixture of the partner community since becoming the vice president for Small and Midmarket Solutions & Partners (SMS&P) in Canada in 2003. Later he held the positions of VP of U.S. East Region for SMS&P and VP of U.S. Dynamics.

In 2013, Willis became Microsoft's U.S. Channel Chief, when the full title of the role was corporate vice president of U.S. SMS&P. In the major reorganization of 2017, when the partner organization became One Commercial Partner (OCP), Willis essentially maintained the same function as CVP of U.S. OCP.

A successor has not been named. Willis plans to stay through January to assist with the transition.

Posted by Scott Bekker on December 04, 20200 comments

Sirius Computer Solutions snapped up Boca Raton, Fla.-based solution provider Champion Solutions Group and Champion's cloud practice, MessageOps, which was one of the pioneering toolsets for Office 365.

With the acquisition, Sirius expands its national IT solutions integration business into the southeastern United States and strengthens its Microsoft cloud capabilities in both Microsoft/Office 365 and Microsoft Azure.

Sirius is a privately held company with 2,600 employees based in San Antonio, Texas. Terms were not disclosed for the deal, which closed on Monday and was announced Tuesday.

Joe Mertens, president and CEO of Sirius, described the MessageOps unit with its intellectual property around the Microsoft cloud as a competitive advantage for Sirius, which also has cloud partnerships with Amazon Web Services (AWS), Google Cloud, IBM and VMware.

"Joining forces with Champion provides an opportunity for Sirius to gain valuable intellectual property assets and expertise related to Microsoft Azure cloud services and Microsoft 365 productivity and collaboration tools, which will add value for our clients," Mertens said in a statement.

MessageOps solutions handle functions within Microsoft 365 environments such as monitoring, managing, reporting, synchronizing passwords and migrating data across environments. Originally a private company that was later acquired by Champion, MessageOps was among the first ISVs automating migrations and other tasks related to the Office 365 predecessor, Microsoft Business Productivity Online Suite (BPOS).

Mertens added that Sirius plans to offer expanded services and solutions to Champion's client base in Florida and the southeastern United States. Champion has also been part of Microsoft's National Systems Integrator (NSI) program and was a Tier-1 Cloud Solution Provider (CSP) for Microsoft.

Sirius planned to immediately integrate Champion's employees into the Sirius organization, which includes a Cloud Center of Excellence (CCoE) model that brings together cloud solutions practices with consulting and services that include migration, data analytics, security and compliance.

Champion President and CEO Chris Pyle called Sirius a great fit for Champion's employees and clients, and added that he was excited about new investments in MessageOps and Inscape.

"We will also have the ability to invest more resources into the ongoing development of our IP, enabling us to deliver leading-edge cloud monitoring, management and security tools," Pyle said.

Posted by Scott Bekker on December 02, 20200 comments

Microsoft released its first quarter earnings on Tuesday afternoon, reporting revenues of $37.2 billion and earnings of $1.82 per share. The company beat analyst expectations on the back of strong cloud growth.

However, the centerpiece of the Satya Nadella-led earnings call on Tuesday evening was the Microsoft Teams collaboration platform, which keeps surging to new highs due to COVID-19-related remote work.

Microsoft Teams now has 115 million daily active users (DAU), Nadella told analysts during the call. That's a 475 percent increase over the 20 million DAU that Microsoft reported for Teams in November 2019, before a huge portion of the global workforce started logging in from home offices rather than their companies' office space. It's also a 53 percent jump over the last number Microsoft released -- 75 million DAU in April.

Unlike some metrics that Microsoft reports consistently, the Teams DAU figure is revealed sporadically and only when the company has a milestone that fits a positive growth story. For example, Microsoft reported DAU in March of 44 million, and then a month later released the 75 million DAU figure for April to show the 70 percent growth of users in about a month of global work-from-home decisions. Since then, growth has slowed and the company went quiet for six months.

"We are seeing increased usage intensity as people communicate, collaborate and co-author content across work, life and learning," Nadella said before tossing out a few more momentum metrics:

- Referencing Teams as a part of the larger Microsoft 365 suite, Microsoft reported that Microsoft 365 users generated more than 30 billion collaboration minutes in a single day in the quarter.

- Nearly 270,000 educational institutions are using Teams.

- A large deal with PepsiCo will include a rollout of Microsoft 365 and Teams to 270,000 employees worldwide.

During a question portion of the call with analysts, Nadella answered an inquiry about the Teams opportunity by describing how he views Teams. "Teams is very exciting to us because, unlike anything else that we have done at the application layer, it's literally like a shell. It has a platform effect because meetings, chat, collaboration, as well as business process applications, integrate into Teams so that scaffolding richness makes it a very robust platform," Nadella said.

Nadella also highlighted for analysts the pace at which Microsoft is adding new features to Teams. He claimed more than 100 new capabilities in the last six months, and specifically called out breakout rooms, meeting recaps, shift scheduling and events with up to 20,000 participants.

During a separate question about artificial intelligence, he called out how heavily Teams is drawing upon Microsoft's AI research and development. "Every Teams session is full of AI because of the transcription services, the speech recognition services and so on that it incorporates," Nadella said.

Other positives in the quarter for Microsoft were Azure growth of 48 percent and 20 percent growth of the larger Intelligence Cloud segment generally, which includes Azure. Negatives included a 5 percent drop in licensing revenues from Windows OEMs and a 10 percent drop in search advertising business compared to the year-ago quarter. Contributing to the Windows decline is a comparable against a quarter that benefited from the end of support for Windows 7, but it also comes in a quarter that Canalys, Gartner and IDC all reported as a boom time for PCs.

Microsoft stock rose by about 1 percent in after-hours trading on the earnings news but moved 2 percent lower after Microsoft shared second-quarter guidance that was more conservative than analysts expected.

Posted by Scott Bekker on October 28, 20200 comments

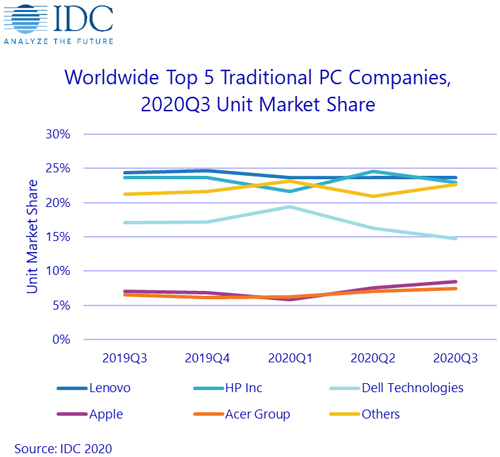

The PC market boomed in the third quarter, with pandemic-related buying producing growth rates at levels not seen for a decade.

Market researchers from IDC, Gartner and Canalys all released their growth estimates this week. The three firms told similar stories -- heavy purchasing on the consumer side, robust activity around Chromebooks and education, and very strong growth in the United States.

For the third quarter, the growth reports were 12.7 percent from Canalys, 14.6 percent from IDC and 9 percent from Gartner. (Gartner's headline number was lower, 3.6 percent, but that figure didn't include Chromebooks.)

[Click on image for larger view.] Source: Canalys

[Click on image for larger view.] Source: Canalys

In fact, the numbers could have been better if it weren't for component shortages, according to Jitesh Ubrani, research manager for IDC's Mobile Device Trackers.

"Consumer demand and institutional demand approached record levels in some cases. Gaming, Chromebooks, and in some cases cellular-enabled notebooks were all bright spots during the quarter. Had the market not been hampered by component shortages, notebook shipments would have soared even higher during the third quarter as market appetite was yet unsatiated," Ubrani said in a statement.

Gartner research director Mikako Kitagawa suggests that it's time to start thinking about the consumer PC market differently, and in a way that could point to strong future growth: "The market is no longer being measured in the number of PCs per household; rather, the dynamics have shifted to account for one PC per person."

The business PC market was a different, not as strong, story in the third quarter, illustrated by Dell's performance. Among major PC vendors, Dell was the only one to decline, seeing shipments fall by a little less than 1 percent for the quarter, according to IDC's numbers. By comparison, Lenovo and HP were both up about 11 percent, Apple was up 39 percent and Acer was up 29 percent.

[Click on image for larger view.] Source: IDC

[Click on image for larger view.] Source: IDC

Gartner's news release on the numbers noted that Dell broke a streak of 17 consecutive quarters of year-over-year growth. "Dell's decline is one indicator of cautious spending by business buyers as a reaction to the current weak economies in most developed nations," the market research firm said in its statement.

Canalys Research Director Rushabh Doshi picked up on a nuance of the remote work reality that complicates the separation of the business and consumer PC markets.

"As the line between work and home lives is increasingly blurred, it becomes important to position devices towards a wide array of use cases, with a focus on mobility, connectivity, battery life, and display and audio quality," Doshi said in a statement. "Differentiation in product portfolios to capture key segments such as education and mainstream gaming will also provide pockets of growth. And beyond the PC itself, there will be an increased need for collaboration accessories, new services, subscription packages and a strong focus on endpoint security. These trends will most benefit vendors who provide holistic solutions that enable their customers to make structural changes to their operations."

In the near term, Doshi said the consumer-driven holiday season should make for a strong Q4 for PCs. But the Canalys analyst was bullish for the longer term, as well.

"The lasting effects of this pandemic on the way people work, learn and collaborate will create significant opportunities for PC vendors in the coming years," Doshi said.

Posted by Scott Bekker on October 14, 20200 comments

Microsoft declared about two dozen products ready for general availability (GA) -- and thus production deployment -- this week during the Microsoft Ignite conference. The products ranged from elements of the high-profile Project Cortex to Azure SQL for edge deployments to major and minor components of Microsoft's three clouds.

A virtual event this year, Ignite kicked off on Tuesday morning with a keynote from CEO Satya Nadella and was scheduled to run through Thursday. Microsoft typically treats Ignite as a major launchpad for IT pro- and IT management-focused products and services across its enterprise portfolio with some developer, education and government tools and products thrown into the mix.

Delivering 'Content Management Superpowers' with SharePoint Syntex

One of the highest-profile announcements involved Project Cortex, a set of new services in Microsoft 365 involving the use of artificial intelligence. While Microsoft had said at Build in May that Project Cortex would be generally available in early summer, the project has been expanded with a first element now promised for purchase for Microsoft 365 commercial customers on Oct. 1. That Project Cortex-based product is called SharePoint Syntex.

What SharePoint Syntex is supposed to do is use AI to "automate the capture, ingestion and categorization of content to accelerate processes, improve compliance, and facilitate knowledge discovery and reuse," according to Microsoft documentation. Colorfully, the documentation describes SharePoint Syntex as giving SharePoint "content management superpowers."

Bringing SQL to IoT

Microsoft is pushing the SQL data engine to the edge with general availability of Azure SQL Edge. Designed for Internet of Things (IoT) gateways and edge devices, Azure SQL Edge is built on the same code base as Microsoft SQL Server and runs in a container of less than 500MB.

A Cloud for Health Care

Certain industries have specific regulatory requirements or privacy concerns that make the general-purpose public cloud a harder sell. With an eye to serving the specific needs of vertical industries, Microsoft plans to roll out several industry-specific clouds, and the company is starting with health care.

The Microsoft Cloud for Healthcare has been in public preview since May, but Microsoft now is promising a firm date for general availability within the month -- Oct. 20. At a high level, the cloud is architected to comply with regulatory frameworks like GDPR, HIPAA and HITRUST and includes capabilities from Microsoft Azure, Microsoft 365, Microsoft Dynamics 365 and the Microsoft Power Platform, as well as partner solutions.

Upgrading the Compliance Manager

Recognizing the complexity and volume of compliance considerations that IT organizations of all kinds must deal with, Microsoft is making generally available immediately a new Compliance Manager for Microsoft 365 customers.

The new Compliance Manager is a superset of its existing Compliance Manager and the Compliance Score. Microsoft's design goal for Compliance Manager is to turn complex regulatory requirements into specific controls and help organizations measure their progress through scores.

Putting Windows and Linux Servers Under Azure Arc

Customers managing Azure services use Azure Resource Manager. For those who like the model and want to use similar tools and capabilities to manage more of their infrastructure, there's Azure Arc, which extends the model to other clouds, Kubernetes clusters and on-premises servers.

As of Ignite, Microsoft made Azure Arc-enabled servers generally available for Windows and Linux servers. From a single control plane, customers can now manage their servers with Azure Policy and use Azure Security Center, Azure Monitor or Update Management on them.

Dynamics 365 Project Operations Goes Live

Microsoft spun off a new solution out of Dynamics 365, this time for services businesses. Now generally available is Dynamics 365 Project Operations. The solution is designed to integrate sales, project management and accounting teams and cover parts of the process from quotes to invoices to business intelligence.

Microsoft Teams Activity

All the remote work going on in the world has Microsoft Teams as a critical product for Microsoft in the near-term and potentially in the long-term, as well. Microsoft has a few big initiatives going on here. One of them is a new category of all-in-one dedicated Teams devices. In Microsoft videos, the devices are small desktop devices with screens that work as a complement to a PC and allow a user to do things like launch a meeting and see other participants on the device while controlling a screen share for the meeting from the PC.

While not quite ready as of Ignite, Microsoft now says to expect general availability for the devices in the "coming weeks." Initial hardware partners include Lenovo and Yealink. For the record, Microsoft is also working with AudioCodes, Poly and Yealink on less expensive Teams phones for common areas and has some Teams-related USB peripherals in the works.

Also for Teams, Microsoft announced that live captions with speaker attribution is now generally available. Also, the Teams displays will include Cortana voice assistance. The functionality is generally available but depends on delivery of the devices. Meanwhile, Cortana's Amazon peer Alexa also had GA news at Ignite: The Alexa channel is now generally available within the Azure Bot Service.

What's Your Productivity Score?

The novel coronavirus pandemic has also initiated a push by organizations to figure out how to track and improve worker productivity from remote locations. Microsoft is taking a crack at it with the Microsoft Productivity Score, which is partly about those questions and partly about monitoring how much employees and organizations are taking advantage of capabilities in Microsoft 365. While, again, not generally available immediately, Microsoft committed at Ignite to an end-of-October GA for Productivity Score. The score is broken into Employee Experience and Technology Experience.

Other GA Services and Products

Highlights of the other generally available services and products in Microsoft's Ignite announcements included:

- Additional features for Azure Cognitive Search called Private Endpoints and Managed Identities.

- An Anomaly Detector in Azure Cognitive Services, Metric Advisor.

- A new Designer capability for Azure Machine Learning featuring drag-and-drop modules for things such as data prep, model training and evaluation.

- New Azure Migrate features for datacenter-to-cloud migrations.

- A next generation version of Azure VMware Solution (AVS) in US East, US West, West Europe and Australia.

- Two new Azure Stack Edge appliances, including one designed to be carried in a backpack.

- Azure Virtual Machines featuring Intel Cascade Lake processors.

- Azure Disk Storage updates, including Azure Private Link integration and support for 512E on Azure Ultra Disks.

- ServiceNow integration with Azure AD.

- Microsoft Edge DevTools extension for Visual Studio Code.

- An Azure Policy add-on for Azure Kubernetes Service (AKS).

Posted by Scott Bekker on September 22, 20200 comments

Microsoft on Tuesday launched an advanced specialization for Windows Virtual Desktop (WVD), giving partners access to a new badge that highlights expertise in the newly essential area of supporting remote workers.

Advanced specializations layer on top of competencies within the Microsoft Partner Network (MPN) as a way for partners to demonstrate Microsoft-sanctioned certification of their specialized skills.

Competencies are a baseline element of the MPN and Microsoft partners have used them for decades as a way to show expertise. There are currently about 19 competencies in the MPN.

Advanced specializations are newer and can only be attained after a partner already has a prerequisite competency. Microsoft currently lists 11 of the specializations, including Microsoft Windows Virtual Desktop.

To attain the new Microsoft Windows Virtual Desktop advanced specialization, a partner must first have a gold competency in Cloud Platform. The partner must also clear a revenue bar, document that five individuals have earned specific certifications and pass a third-party audit, which costs $2,000.

"Our newest advanced specialization will showcase your experience with implementing Windows Virtual Desktop, including deploying, optimizing, and securing virtual desktop infrastructure on Azure. This will ensure you’re prepared to meet the needs of your customers as they continue to evolve their remote work approach," said Dan Truax, general manager of Partner Digital Experiences and Programs in Microsoft One Commercial Partner, in a blog post announcing the advanced specialization.

Earlier this year, Microsoft released some Microsoft Teams-related advanced specializations, also related to the shift to remote work caused by the COVID-19 pandemic.

WVD is Microsoft's virtual desktop infrastructure service for remote access to Windows 7 or Windows 10 desktops and applications. The virtual desktops are hosted in Microsoft datacenters.

Posted by Scott Bekker on September 15, 20200 comments

Quest Software this week added to its already full quiver of Microsoft modernization tools with the acquisition of Binary Tree.

While Quest already had capabilities for migrating to Office 365 within its broad existing toolset, Binary Tree brings sophisticated tooling for second-generation cloud migrations -- handling the complex requirements of enterprise cloud-to-cloud migrations necessitated by M&A and other concerns in a maturing market.

Quest, based in Aliso Viejo, Calif., positioned the acquisition as combining two companies with strengths in on-premises, hybrid and cloud migrations.

"I see tremendous opportunity by uniting two market leaders, each with strong capabilities that -- when brought together -- will offer best-in-breed solutions for customers modernizing their Microsoft environment. With the integration of our technologies and vast experience with their Power365 Active Directory and Power365 Tenant-to-Tenant solutions we are able to deliver more value faster to our customers and partners which is increasingly important as the market and business continues to evolve," said Patrick Nichols, who took over as CEO of Quest in April, in a statement about the deal.

While Binary Tree has focused lately on Office 365-to-Office 365 migrations and Active Directory migration work, it's been around since 1993 and has long experience and continuing business in Lotus Domino/Notes and other legacy migrations.

Quest, meanwhile, boasts dozens of products and its major brands include KACE, Foglight, Metalogix and One Identity. The company's products cover data protection, database management, identity and access management, Microsoft platform management, performance monitoring and unified endpoint management.

In the statement announcing the deal, Quest committed to continue selling and supporting Kendall Park, N.J.-based Binary Tree's products "as the company works through the integration."

Partners of both companies can expect to see upsell opportunities where the two organizations' products are complementary, with an initial emphasis on Quest Change Auditor and Quest on Demand.

Posted by Scott Bekker on September 03, 20200 comments