Bushel, a SaaS-based mobile device management (MDM) solution for Apple devices, on Wednesday launched an affiliate program that represents the first stage of a channel push.

Bushel grew out of Minneapolis-based JAMF Software LLC, maker of an on-premises Apple device management platform. While Bushel's primary market is Apple ecosystem partners, Bushel Product Manager Charles Edge told RCP that the product makes sense for Microsoft partners and managed service providers (MSPs) looking to manage the Apple devices that crop up around the edges of their customers' networks.

"It's very similar to what Microsoft has done releasing Intune for Windows," Edge said of Microsoft's SaaS solution for system management. "What we're after is policy-based management for small business. We're taking out complexity and the things you need lots of experience to do."

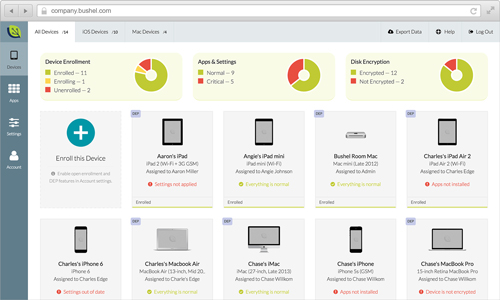

Bushel can be used to manage Macs, iPads, iPhones and iPods. Capabilities of the product include device inventory, app distribution, e-mail configuration, Wi-Fi setting distribution and device protection.

[Click on image for larger view.]

The Bushel interface.

[Click on image for larger view.]

The Bushel interface.

Under the small business-focused pricing model, the first three devices managed by Bushel are free, with supplemental devices costing $2 per month. The affiliate program, which Edge likens to consumer affiliate programs, involves a partner providing a specific sign-up link for customers that returns a percentage of the monthly payment to the partner.

Partners are able to manage devices on behalf of customers only with the customer's individual login, Edge said. So, for example, managing five customers would require five separate logins.

Other elements will be coming to the channel program. "Within a couple weeks we'll have marketing materials, PDFs and leave-behinds, customizable assets so the partners can put their brand on it, and YouTube channels with videos on how to set things up and manage them," Edge said.

Bushel is in a fast-growth stage, climbing from about 500 customers at the formal launch in mid-January to 3,300 organizations now. Anticipating similar uptake with partners, Edge said the company will wait for feedback from the channel on what resources and features to add.

One item that's on the radar but not formally on a roadmap is potential integration with Intune and other management platforms for single-pane-of-glass management. "We're looking at ways to partner with and do integrations with other platforms," he said. "But at the four-month mark, we're still gaining lots and lots of marketshare on the Apple side."

Posted by Scott Bekker on May 27, 20150 comments

Here at Redmond Channel Partner, we aim to provide an independent magazine and Web site (RCPmag.com) that serve the needs of the Microsoft partner community. As part of our editorial mission, we regularly check up with our readers on how well Microsoft is meeting your needs. Hence, this "RCP Microsoft Partner Satisfaction Survey."

The information you provide will only be used in aggregate and any verbatim quotes we use in articles based on these results will not include your name or company affiliation. None of your personally identifiable data will be shared with Microsoft or any other vendors.

What's the point? Let's face it -- when you give feedback directly to Microsoft through official channels, you've often got to flatter it because you're simultaneously lobbying for resources that it controls. This survey is your chance to help get real, unvarnished feedback to Microsoft that will help it get you products that better meet your customers' needs and get you the programmatic resources that you need to grow your business.

Take the survey here. It's only 10 questions and will only take a few minutes. As an additional thank you for participating, we'll include your name in drawings for three Amazon.com gift cards worth $50 each. So sound off!

Posted by Scott Bekker on May 27, 20150 comments

In an era in which Microsoft is preaching intellectual property development to its partner choir, the technology giant has named Cireson to the Microsoft National Solution Provider (NSP) program.

San Diego-based Cireson bills itself as a company that enhances Microsoft Azure and Microsoft System Center with its own service and asset management offerings, including the recently unveiled Cireson Platform.

As for the NSP designation, it applies to a group of about 30 partners in the United States that get an extra layer of partner management from Microsoft. The program evolved from the older National Systems Integrator (NSI) designation, which typically covered systems integrators who spanned multiple U.S. regions and had either broad expertise or high-end specialty expertise.

Other NSPs include such well-known Microsoft partners as Perficient Inc., Tallan Inc., SADA Systems, Project Leadership Associates and Nimbo.

Posted by Scott Bekker on May 20, 20150 comments

The venerable IT services and solutions provider Computer Sciences Corp. (CSC) is splitting in two.

The Falls Church, Va.-based company, which was founded in 1959, is walling off its U.S. public sector business from the rest of its operations in a move approved by its board of directors and unveiled this week. CSC is a major Microsoft partner, listing Microsoft among its 15 global technology alliances.

The main business will be called CSC-Global Commercial, with customers drawn from Fortune 1,000 companies and non-U.S. government clients. That side of the business accounts for $8.1 billion in fiscal year 2015 revenue, more than 1,000 customers, 51,000 employees and 34 delivery centers globally, CSC said.

The other business will be called CSC-U.S. Public Sector and will serve U.S. federal, state and defense agencies. With $4.1 billion in FY 15 revenues, the public sector business employs 14,000 people, CSC said.

In a statement, CSC CEO Mike Lawrie noted diverging "growth profiles and cash flow dynamics" for the two sides of the business. "Our analysis shows significant benefits of going with a pure-play strategy. We expect this change to enable both businesses to enhance innovation and improve delivery, in ways that are consistent with the rate and pace of the markets they serve," Lawrie said.

The separation is expected to be completed by the end of October. At that point, CSC shareholders will own shares of both companies. CSC announced plans to pay a special cash dividend to shareholders of $10.50 per share when the separation is closed.

Posted by Scott Bekker on May 20, 20150 comments

For years, Microsoft has used the phrase "better together" as shorthand for all the benefits and special features you get if you run an exclusively Microsoft stack.

At a Microsoft Build Tour event on Monday in New York, one of the customers in a testimonial video used the same phrase. But here's the thing: He was talking about the benefits inside his organization of new interoperability between Microsoft and Salesforce.com. The products that were better together were parts of the Microsoft stack and Salesforce.com's cloud CRM -- not, say, Windows Server, SharePoint and SQL Server with Office.

Even if it was originally an unwitting comment by the customer, the fact that an inversion of a standing Microsoft catchphrase made it into a heavily edited Microsoft promotional video is telling. More telling, the rest of the video included developers talking about how much more open Microsoft is now and, literally, how it's no longer thought of as the "Death Star."

Having sat through Microsoft's presentations for nearly 17 years, it struck me again and again on Monday how many times Microsoft made reference to interoperating with the non-Microsoft world. Yes, the company has said things like that over the years, but the references now are more mature, more matter of fact. In the past, Microsoft presenters might make reference to a necessary competitor, but they'd often do so with a wink or a snide comment. The subtext was often, "Clearly it would be better if you used a completely Microsoft stack, but if you're foolish enough to use this inferior product, we'll deign to work with it."

Nothing felt snide or superior on Monday.

"What we've done over the last two years is really transform the platform," Neil Hutson, a Microsoft technology evangelist speaking on the Build Tour, said of Office in one typical comment. He was talking about how Office is now running on Android and iOS, and he went on to describe all the non-Microsoft languages you can use to develop for Office now. Then he invited developers to take things further. Describing Office Graph, Hutson said, "We have completely opened up the back end."

Other references were to the Windows Universal Application bridges for Android and iOS, frequent references to GitHub and recurring references to Salesforce.com. There was an Apple Mac on stage. One demo showed an Android phone emulator in Visual Studio. Microsoft regularly plugged the new Visual Studio Code, a development environment for Mac and Linux. One of the evangelists used the word "Google" as a synonym for search.

The themes carry over from the main Build show in late April when Azure CTO Mark Russinovich appeared on stage wearing a Docker T-shirt and giving a talk on interoperability between Microsoft and Docker's container technologies.

Clearly, Microsoft still prefers customers to go all-in with Microsoft. "Native is better," Kevin Gallo, partner director for developer ecosystem and platform, said of Windows Universal Apps in a keynote on Monday as he explained the Android and iOS bridges.

But the feel on this Build Tour is that Microsoft is clearly recalibrating its approach to the market. The new Microsoft seems to be opening up to match the speed of open source, mobile and cloud competitors. Microsoft is no longer pretending to itself or to its customers that it can do everything well for everybody -- or that everyone should, or will, wait while it tries.

Posted by Scott Bekker on May 18, 20150 comments

It's been a wild ride for new Carbonite President and CEO Mohamad Ali. Named to the post on Dec. 4, Ali took charge of a cloud and hybrid backup and recovery solutions company that had received a buyout offer from J2 Global Inc. just two days earlier.

In the crucible of the back-and-forth between J2 and Carbonite, which quickly devolved from a friendly offer into a hostile bid, Ali and the Carbonite board of directors appear to have reaffirmed a vision for Carbonite's future that's different from what many investors see. As it happens, that vision is focused on SMB and is completely reliant on a channel strategy, as opposed to riding out the consumer legacy of the brand.

Ali is well-prepared for such high-profile stress. His last position was chief strategy officer at Hewlett-Packard, where he reported directly to CEO Meg Whitman on the company's restructuring. RCP caught up with Ali in a recent telephone interview to talk about his vision for Carbonite and his view of the channel.

"The investment community is still valuing the company as a lower growth consumer business," Ali said. "One of the things I saw in Carbonite was a really amazing SMB business that was buried in this consumer business."

By annual run rate, Ali argues that Carbonite's consumer business brings in $90 million at a 2 percent growth rate. The SMB business, by contrast, is a $50 million business with 42 percent growth in bookings in the last quarter.

"If you look at the hot cloud companies out there, not too many of them have revenues of $50 million and are growing at over 40 percent," Ali said. He wouldn't speculate on when the SMB business might outpace consumer, but he offered a sort of verbal wink: "You can do the math and figure out where you're going to have the crossover."

"One of the things I saw in Carbonite was a really amazing SMB business that was buried in this consumer business."

"One of the things I saw in Carbonite was a really amazing SMB business that was buried in this consumer business."

Mohamad Ali, President and CEO, Carbonite

That confidence in the future of the SMB side helps explain why Carbonite turned down a $415 million offer from J2, which had also tried unsuccessfully to acquire Carbonite in 2012. In a Carbonite statement on Jan. 9 titled, "Carbonite's Board of Directors Unanimously Rejects Unsolicited Tender Offer from J2 Global," the company said it believed the 27.6 percent premium that J2's $15-per-share offer represented over the unaffected market price on Dec. 2 "substantially undervalues the company." The statement also expressed the board's support for Ali and his channel strategy.

"The new President and Chief Executive Officer has strategies with respect to improved operating and margin performance, scalability of the business and other areas of operational and strategic focus, including expanding the market for the Company's products through broader distribution capabilities, as well as enhanced features and functionality in the product portfolio," the statement read.

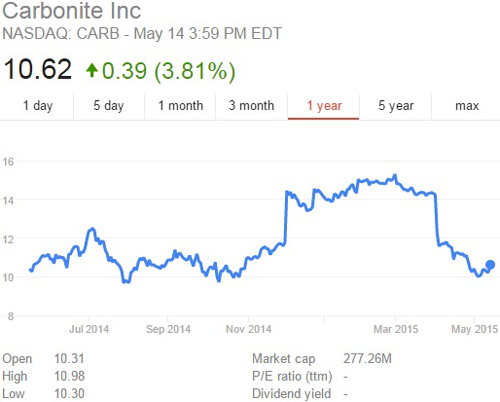

In the short term, at least, the stance has been costly. A look at a stock chart covering the December-to-mid-April period looks like steep cliffs on either side of a plateau. One cliff, heading upward, reflected J2's offer when the NASDAQ-traded CARB jumped from an $11.76 close on Dec. 2 to a $14.44 close on Dec. 3. The plateau for most of the December-through-March period fluctuated with the twists and turns in the buyout drama, peaking at a $15.30-per-share close on March 2. The other cliff, heading down, reflected J2's change in strategy to approaching Carbonite about buying only its endpoint business and withdrawing the candidates it had planned to offer for election to Carbonite's board. That cliff goes from a $14.23 close on April 1 down to an $11.59 close on April 6.

Carbonite Inc.'s performance on the NASDAQ since December resembles a mesa, with sharp walls marking the introduction and withdrawal of a $15-per-share buyout offer from J2 Global Inc. (Image source: Google Finance.)

Carbonite Inc.'s performance on the NASDAQ since December resembles a mesa, with sharp walls marking the introduction and withdrawal of a $15-per-share buyout offer from J2 Global Inc. (Image source: Google Finance.)

The stock value continued to fall to a nadir of $10.03 earlier this month. The announcement Thursday of a $20 million stock buyback program through 2018 by Carbonite briefly brought the price up 7 percent in midday trading before settling down to a little less than a 4 percent gain ($10.62) by close of trading.

Against that tumultuous backdrop, Carbonite has continued to invest in an SMB- and channel-focused future. Its partner recruitment efforts are "on fire," Ali said. "We had 5,400 resellers when I got here. Today we're up to 6,000. Where I'm heavily focused is with the seven big distributors and direct market resellers. From HP, I know some of these executives and CEOs personally. They love what we've done with the 6,000 VARs and are huge believers."

Carbonite also spent a reported $20 million in mid-December to acquire MailStore, a vendor of e-mail archiving solutions for SMBs. "In addition to offering email archiving to businesses worldwide with MailStore's existing solutions, Carbonite will integrate MailStore's robust full-text search and indexing capabilities into our product portfolio to help our business customers better manage, understand and leverage their data," Ali said in a statement at the time. Aside from the obvious SMB appeal of the product, MailStore also already had a Service Provider Edition for channel partners. Incidentally, the MailStore acquisition was a point of contention in a Dec. 23 letter to Carbonite from J2, which contended that the acquisition reduced Carbonite's value by $0.50 per share.

As part of its channel push, Carbonite also commissioned research from IDC showing, among other things, how much small businesses were willing to spend on backup and recovery. The study found SMBs are willing to pay $2,800 a year on average to protect their data, an amount less than some of Carbonite's competition but well in the range of the company's three-server, $799 solution, Ali said.

"That study is underscoring the approach we're taking, which is super-simple products. And since we came from the consumer world, we're able to create these super-simple products [that are also] price disruptive," Ali said. "CSB [Carbonite Server Backup] is six steps to install, compared to 20 to 30 for other products. That product is what's driving 40 percent growth. There's a huge whitespace opportunity in SMB."

Most recently, Carbonite went on a senior executive hiring spree announced May 6 that Ali characterized as channel-oriented. As Ali explains the hires, Chief Marketing Officer Nina McIntyre has experience marketing to the channel; Paddy Sreenivasan, vice president of server engineering, will stitch the products together with the ecosystem; Irwin Weiss, vice president of IT, will work on integrating Carbonite's internal systems with the channel; and Christopher Wey, vice president of corporate development, will bring his long channel and M&A experience to Carbonite.

A month ago, Carbonite declared it was shutting down a process to explore a potential sale of the company -- a process that was originally spun up in response to the J2 offer. In working to fend off a takeover and steadily investing in channel efforts, the company's board and executives seem to be putting real money behind the message that Carbonite's best potential lies in developing the channel and chasing the SMB opportunity.

Posted by Scott Bekker on May 14, 20150 comments

Taking its public cloud infrastructure buildout beneath the sea, Microsoft this week unveiled investments in three trans-oceanic cable projects to improve the connections among its international datacenters.

"As we expand our cloud services and global infrastructure, we need a strong subsea strategy to ensure our customers experience high availability access to their data," David Crowley, managing director of network enablement for Microsoft, blogged earlier this week. "Over the past nine months, Microsoft has been significantly investing in subsea and terrestrial dark fiber capacity by engaging in fiber partnerships that span multiple oceans and continents. And today, our connections across the Atlantic and Pacific just got stronger."

At first blush, satellite connections for intercontinental communication might seem more in line with the concept of cloud. Both clouds and low earth orbit are "up" from here on the ground. But in the real world of hardware, wiring and electricity where the "cloud" actually exists, it's undersea cables that do the work of moving data between continents. Some estimates put the amount of intercontinental data moving through subsea cables at 99 percent. When it comes to international data, the "cloud" in a lot of those marketing diagrams might be more accurately represented by a fish tank.

Microsoft's global cloud efforts have always depended on such cabling, but now Microsoft is investing in fiber partnerships that will guarantee it higher priority and the latest bandwidth capability by helping to add three cables to the 230-plus cables already criss-crossing the ocean floor. "These cables will help deliver data at higher speeds, with higher capacity and lower latency for our customers across the globe," Crowley said.

[Click on image for larger view.] A map of planned and active submarine cable systems. (Source: TeleGeography/Submarine Cable Map.)

[Click on image for larger view.] A map of planned and active submarine cable systems. (Source: TeleGeography/Submarine Cable Map.)

Microsoft's specific moves involve two transatlantic cables and one transpacific cable:

- Hibernia Networks sent out three ships this week to start laying a transatlantic cable for its Hibernia Express project, which will connect Halifax, Canada, with Ballinspittle near Cork, Ireland, and pass on to Brean, which is near Bristol in the U.K. Hibernia Networks says the cable, which is supposed to begin service in September of this year, will be the first new transatlantic cable in 12 years. "Hibernia Networks is proud to have been selected by Microsoft to provide a key piece to their existing backbone network on our transatlantic cable system," said Hibernia's CEO Bjarni Thorvardarson in a statement.

- Aqua Comms Ltd. also announced that Microsoft would be its first "foundation customer" on the America Europe Connect (AEConnect) subsea cable system. That cable, being built by TE SubCom, which is involved in all three of the Microsoft-related projects, is supposed to go into service in December 2015 and stretch from Shirley, N.Y., to Killala, Ireland. Asked in an e-mail interview why Microsoft was supporting two new transatlantic cables, Crowley said, "We optimized for two cables to ensure physical diversity, availability and uptime for customers."

- Microsoft is one of a number of players in the new transpacific cable announced this week. TE SubCom began construction on the New Cross Pacific (NCP) Cable Network, which will run from Hillsboro, Ore., to the Chinese mainland in three places at Chongming, Nanhui and Lingang. It will also connect to Busan, South Korea; Toucheng, Taiwan; and Maruyama, Japan. Other members of the NCP consortium include Chunghwa Telecom Co. Ltd., China Mobile, China Telecom, China Unicom, KT Corp. and SoftBank Mobile Corp. The 13,000-kilometer network is planned for service launch in late 2017.

[Click on image for larger view.] A map of Microsoft's planned subsea cables to connect its Hillsboro, Ore., landing station to areas in the Asia-Pacific region. (Source: Chunghwa Telecom.)

[Click on image for larger view.] A map of Microsoft's planned subsea cables to connect its Hillsboro, Ore., landing station to areas in the Asia-Pacific region. (Source: Chunghwa Telecom.)

Investing in undersea cable is not completely new for Microsoft. Last September, Microsoft and Seaborn Networks agreed to work together on a U.S.-Brazil subsea cable, which is called Seabras-1 and is planned to go live in 2016. The difference is in the scale of the announcements this week -- there were three at once and they covered a much broader geographical area. While Crowley declined to say how much Microsoft is investing or what percentage of the available bandwidth its participation is securing, such projects typically cost hundreds of millions of dollars.

Whatever the specific amount, it's a significant addition to the billions Microsoft has already poured into that global cloud buildout. Dollar by dollar, Microsoft continues to press its financial and scale advantages to ensure that it remains in a very small class of megavendors for public cloud services.

Posted by Scott Bekker on May 13, 20150 comments

After 20 years in the tech industry spotlight, John Chambers will ease into the shadows this summer.

Chambers will trade in his current titles of Cisco chairman and CEO for the role of executive chairman on July 26. His replacement as CEO is Chuck Robbins, a 17-year veteran at Cisco who is currently senior vice president of worldwide operations.

Chambers joined Cisco as head of sales in 1991 when Cisco was a 7-year-old company. Under his leadership, Cisco has grown from $1.2 billion to $48 billion a year in revenues and seen more than a 3,000 percent increase in non-GAAP earnings per share, according to the company.

"We've selected a very strong leader at a time when Cisco is in a very strong position," Chambers said of Robbins, going on in a statement to describe the next CEO's strengths as an insider. "Chuck knows every Cisco segment, technology area and geography and will move the company forward with the speed required to capitalize on the opportunities in front of us. He is a champion of the Cisco culture and has an incredible ability to inspire, energize and connect with employees, partners, customers and global leaders."

In the official announcement, Cisco emphasized Robbins' channel credentials. It noted that in his current role he leads the global sales and partner team that drives $47 billion in business for the company. In that role, Cisco credited Robbins with helping "lead and execute" the build-out of the partner program that is "now worth more than $40B in revenue to the company each year." Robbins was also a sponsor for the Sourcefire and Meraki acquisitions.

Robbins was elected to the Cisco Board of Directors effective May 1. For Chambers, the title change will probably mean fewer public speaking engagements as the voice of Cisco, which, because of Cisco's influence, doubled as a voice of the tech industry overall.

Chambers' new role will involve advising and supporting Robbins and engaging with business and government customers.

Posted by Scott Bekker on May 04, 20150 comments

There are few better ways to guarantee a system will be breached, compromised and exploited than failing to keep up with vendors' patches. Yet millions of public-facing systems run unpatched.

In an effort to document which previously reported security vulnerabilities are most popular with attackers, government public computer security awareness agencies from five countries on Wednesday released a Top 30 list of targeted high-risk vulnerabilities.

"This Alert provides information on the 30 most commonly exploited vulnerabilities used in these attacks, along with prevention and mitigation recommendations," read an alert from the U.S. Department of Homeland Security's National Cybersecurity and Communications Integration Center and the U.S. Computer Emergency Readiness Team.

An analysis by the Canadian Cyber Incident Response Centre provides the foundation for the list, which was jointly developed by government computer security organizations in Australia, Canada, New Zealand, the United Kingdom and the United States.

The vulnerabilities are not listed by severity. Instead, they are grouped by the vendor or project whose software is affected. Microsoft accounts for 16 of the vulnerabilities, Adobe for 11, Oracle for 2 and OpenSSL for 1.

What's both interesting and depressing about the list is how old some of the vulnerabilities are. For example, in the Microsoft list, some of the 30 most commonly exploited vulnerabilities date to 2009 and 2008, as well as an Internet Explorer malware issue, which first emerged almost nine years ago.

On Microsoft platforms, the attackers' favorite flaws come from the following bulletins:

- MS08-042

- MS09-067

- MS09-072

- MS10-018

- MS10-087

- MS11-021

- MS12-027

- MS12-060

- MS13-008

- MS13-022

- MS13-038

- MS14-012

- MS14-017

- MS14-021

- MS14-060

The malware issue with Internet Explorer is CVE-2006-3227.

The U.S. version of the Top 30 bulletin is available here.

Posted by Scott Bekker on April 29, 20150 comments

Put Microsoft's latest quarterly earnings on a business dashboard of some of the company's traditional key performance indicators, and the screen would light up red.

- Windows OEM revenues down 22 percent!

- Office commercial products and services revenues down 2 percent!

- Earnings per share (EPS) off 10 percent!

So why did Microsoft CEO Satya Nadella sound so sanguine in the earnings call Thursday? "Overall, I'm pleased with our business performance," Nadella said, according to a Seeking Alpha transcript.

Could it be that the words "I'm pleased" mean something different to Nadella than they do the rest of us? After all, later in the call he said, "I'm pleased with our renewed partnership with Yahoo!" That would be the deal that was widely regarded as Yahoo CEO Marissa Mayer getting everything she wanted, including a new back-out clause, in a renegotiation.

For their part, investors seemed actually ecstatic with Microsoft's results. Microsoft shares were up a whopping 10 percent to close at $47.87 on Friday.

From the context of the rest of his remarks, it's pretty clear that Nadella was also actually optimistic. Microsoft did manage to scratch out a 6 percent year-over-year revenue increase, despite struggling in some of its historically core businesses. And the EPS figure, while lower than the year-ago period, beat analyst estimates.

Nadella legitimately pointed to three headwinds in this last quarter: the negative impact on Microsoft of the strong dollar, a bruising IT purchasing environment in Microsoft's second-biggest market of Japan, and a tough comparable because of Windows XP. The January-March period of 2014 was the absolute peak of the Windows XP end-of-life migration. Windows client purchases fell from those highs back to more normal levels in the most recently completed quarter. Normal would also be the new normal of a contracting PC industry.

One traditional metric, server software sales, was a bright spot. Microsoft CFO Amy Hood said server products and services revenues were up 12 percent, and revenues for premium offerings of SQL Server, System Center and Windows Server were up 25 percent.

It was cloud and devices that Nadella directed investors' attention to. "Our momentum in cloud is a highlight," he said. He fired off data points, including a $6.3 billion annualized run rate for Microsoft's commercial cloud, a seventh consecutive quarter of triple-digit commercial cloud revenue growth, 50 million Office 365 monthly active users, 5 million organizations in Azure Active Directory, three-x growth year-over-year in storage transactions in Azure, and a doubling of enterprise paid seats for Dynamics CRM Online year-over-year.

On the device side, Microsoft made some serious money in the quarter on Surface to the tune of $713 million, and that's ahead of the Surface 3 availability. Nadella pointed to the 64 percent usage of OneNote by Surface Pro 3 users as evidence of the potential for Microsoft's better-together story and hinted that the new Windows 10 upgrade strategy will provide opportunities to continue monetizing customers for years after the initial system purchase.

Windows Phone results were mixed. Still not making any real headway against Android devices and iPhones, Microsoft at least seems to be getting some of the Nokia acquisitional hiccups under control. Lumia sales volumes hit 8.6 million units for the quarter, and Hood reported that Microsoft has reduced the operating expense base in the phone business from an annualized rate of $4.5 billion at acquisition to less than $2.5 billion.

As a recurring theme during the call, Nadella encouraged investors not to think of Microsoft's transition as a one-to-one shift from the old revenue sources of on-prem Windows, Office and server software to the new revenue sources of cloud services and, to a lesser extent, devices.

He argued that, yes, Microsoft is getting the direct dollars -- the Office 365 subscription where there used to be a boxed suite of Office applications, the Azure infrastructure where there used to be a server closet. But he made the case that Microsoft is positioned for a lot of net-new workloads, such as Power BI, Delve, e-discovery and mobility management.

"We definitely are seeing one-for-one migration, but the opportunity in every one of our offerings from Office 365 to Dynamics to Azure has a non-zero-sum component to it," he said.

It's a message that, for now, Wall Street seems to be buying.

Posted by Scott Bekker on April 24, 20150 comments

New Signature, the Washington, D.C.-based Microsoft national solutions provider and 2014 Microsoft U.S. Partner of the Year, unveiled a $35 million initial investment from venture capital firm Columbia Capital on Thursday.

The relatively rare VC investment in a pure-play solution provider is intended to drive accelerated capacity, geographic growth and acquisitions at New Signature, a 100-percent Microsoft-focused systems integration company with a high-profile cloud practice and a focus in the business segment that Microsoft calls SMS&P.

Columbia Capital, based in Alexandria, Va., manages about $2.5 billion in assets, according to the company's Web site, and companies in its portfolio similar to New Signature include Cloud Sherpas and 2nd Watch.

Along with the investment come a new CEO, Jeff Tench, and a new chairman, Neil Hobbs. Co-founders Christopher Hertz and David Geevaratne will stay on, Hertz as president and Geevaratne as Chief Sales Officer.

"We are excited to be entering the next stage of our development alongside Jeff and Neil and a respected capital partner," Hertz said in a statement. "Jeff's experience building successful services organizations enables our firm to take the reputation and credibility we have established to new heights."

Tench's resume includes roles as CEO at Teliris and president of the Business Markets Group at Level 3 Communications. He reiterated New Signature's commitment to Microsoft solutions. "New Signature has full-stack Microsoft expertise which enables us to evangelize Microsoft cloud services and ultimately accelerate the purchase and consumption of these services. With a clear focus on delivering actionable roadmaps to business and technical decision makers, we will chart the course for solution optimization and modernization through cloud technologies such as Azure, Office 365 and Dynamics CRM Online," Tench said in a statement.

Patrick Hendy, a partner at Columbia Capital, meanwhile, positioned the investment and plans for New Signature as a vote of confidence in Microsoft's current direction.

"Under Satya Nadella's leadership, Microsoft has transformed into a pivotal technology provider that is focused on empowering companies across every vertical to achieve value rapidly by reinventing productivity and business processes," Hendy said in a statement. "Microsoft is clearly positioned to be a market leader in this transformation and we believe that New Signature will be a key player in helping customers successfully navigate this transformation."

Posted by Scott Bekker on April 24, 20150 comments

SharePoint-based workflow specialist Nintex this week revealed significant advances in its solutions for Office 365.

Nintex rolled out a number of usability and mobility functions to its Office 365-based workflow products and announced a partnership with Sharegate for migrating on-premise Nintex workflows between SharePoint versions and into the Office 365 cloud.

A one-time systems integrator, Nintex turned a specialty in SharePoint workflows into a product that allows users, developers and IT to collaborate on creating and updating business processes. The channel-centric company has more than 1,100 partners worldwide, including more than 400 in the United States.

This week, Nintex added several capabilities to its Office 365-focused product set of Nintex Workflow for Office 365, Nintex Forms for Office 365 and Nintex Mobile.

"We're rolling out some key enhancements for things related to approvals, content field data collection on our mobile forms, as well as some other areas," said Josh Waldo, vice president of channel programs and strategies at Nintex and a former senior partner executive at Microsoft, in a telephone interview.

The most appealingly titled of the enhancements is "Lazy Approval," which allows natural language e-mail responses such as "yes/no" from any device to be added to a business process. Lazy Approval does not require the user to log in to move a process along, making it easy for stakeholders on the go to stay involved in processes without becoming a bottleneck.

Other new features available to Nintex workflow designers are barcode scanning, image annotation and a single button tool that allows an end user to add geolocation information to a form. Also new are the ability to view multiple outcomes for tasks to make it easier to create workflows based on complex business logic and cascading lookups, which can do things like create dependencies between fields, such as country and state.

Nintex, with its U.S. headquarters in Bellevue, Wash., is also partnering with Montreal-based Sharegate for migrating customer workflows to the Office 365 cloud in a way that maintains metadata, business logic and security settings.

For Nintex, with the bulk of its customers using on-premise-based solutions, Sharegate's expertise and the ability of its tools to maintain connections between on-premises and cloud solutions in hybrid scenarios were key, Waldo said.

"We've got a number of customers that have thousands and thousands of workflows that are sitting on-premises, and they're looking to migrate a number of those to Office 365 and manage those touch points," Waldo said.

The companies will be demoing their joint solutions next month at the Microsoft Ignite conference in Chicago. Nintex will also be demonstrating its new capabilities to partners at the Microsoft Worldwide Partner Conference (WPC) in July in Orlando, Fla., where Nintex is one of the show's top three sponsors.

Posted by Scott Bekker on April 23, 20150 comments