Carbonite's Wild Ride

It's been a wild ride for new Carbonite President and CEO Mohamad Ali. Named to the post on Dec. 4, Ali took charge of a cloud and hybrid backup and recovery solutions company that had received a buyout offer from J2 Global Inc. just two days earlier.

In the crucible of the back-and-forth between J2 and Carbonite, which quickly devolved from a friendly offer into a hostile bid, Ali and the Carbonite board of directors appear to have reaffirmed a vision for Carbonite's future that's different from what many investors see. As it happens, that vision is focused on SMB and is completely reliant on a channel strategy, as opposed to riding out the consumer legacy of the brand.

Ali is well-prepared for such high-profile stress. His last position was chief strategy officer at Hewlett-Packard, where he reported directly to CEO Meg Whitman on the company's restructuring. RCP caught up with Ali in a recent telephone interview to talk about his vision for Carbonite and his view of the channel.

"The investment community is still valuing the company as a lower growth consumer business," Ali said. "One of the things I saw in Carbonite was a really amazing SMB business that was buried in this consumer business."

By annual run rate, Ali argues that Carbonite's consumer business brings in $90 million at a 2 percent growth rate. The SMB business, by contrast, is a $50 million business with 42 percent growth in bookings in the last quarter.

"If you look at the hot cloud companies out there, not too many of them have revenues of $50 million and are growing at over 40 percent," Ali said. He wouldn't speculate on when the SMB business might outpace consumer, but he offered a sort of verbal wink: "You can do the math and figure out where you're going to have the crossover."

"One of the things I saw in Carbonite was a really amazing SMB business that was buried in this consumer business."

"One of the things I saw in Carbonite was a really amazing SMB business that was buried in this consumer business."

Mohamad Ali, President and CEO, Carbonite

That confidence in the future of the SMB side helps explain why Carbonite turned down a $415 million offer from J2, which had also tried unsuccessfully to acquire Carbonite in 2012. In a Carbonite statement on Jan. 9 titled, "Carbonite's Board of Directors Unanimously Rejects Unsolicited Tender Offer from J2 Global," the company said it believed the 27.6 percent premium that J2's $15-per-share offer represented over the unaffected market price on Dec. 2 "substantially undervalues the company." The statement also expressed the board's support for Ali and his channel strategy.

"The new President and Chief Executive Officer has strategies with respect to improved operating and margin performance, scalability of the business and other areas of operational and strategic focus, including expanding the market for the Company's products through broader distribution capabilities, as well as enhanced features and functionality in the product portfolio," the statement read.

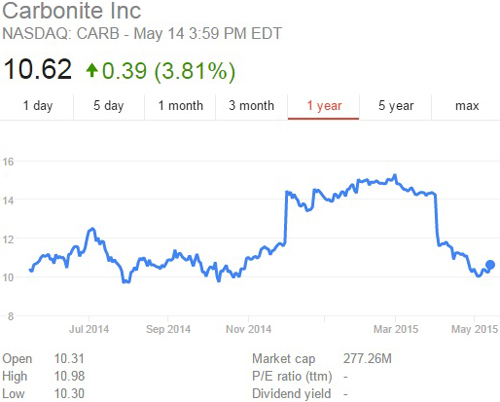

In the short term, at least, the stance has been costly. A look at a stock chart covering the December-to-mid-April period looks like steep cliffs on either side of a plateau. One cliff, heading upward, reflected J2's offer when the NASDAQ-traded CARB jumped from an $11.76 close on Dec. 2 to a $14.44 close on Dec. 3. The plateau for most of the December-through-March period fluctuated with the twists and turns in the buyout drama, peaking at a $15.30-per-share close on March 2. The other cliff, heading down, reflected J2's change in strategy to approaching Carbonite about buying only its endpoint business and withdrawing the candidates it had planned to offer for election to Carbonite's board. That cliff goes from a $14.23 close on April 1 down to an $11.59 close on April 6.

Carbonite Inc.'s performance on the NASDAQ since December resembles a mesa, with sharp walls marking the introduction and withdrawal of a $15-per-share buyout offer from J2 Global Inc. (Image source: Google Finance.)

Carbonite Inc.'s performance on the NASDAQ since December resembles a mesa, with sharp walls marking the introduction and withdrawal of a $15-per-share buyout offer from J2 Global Inc. (Image source: Google Finance.)

The stock value continued to fall to a nadir of $10.03 earlier this month. The announcement Thursday of a $20 million stock buyback program through 2018 by Carbonite briefly brought the price up 7 percent in midday trading before settling down to a little less than a 4 percent gain ($10.62) by close of trading.

Against that tumultuous backdrop, Carbonite has continued to invest in an SMB- and channel-focused future. Its partner recruitment efforts are "on fire," Ali said. "We had 5,400 resellers when I got here. Today we're up to 6,000. Where I'm heavily focused is with the seven big distributors and direct market resellers. From HP, I know some of these executives and CEOs personally. They love what we've done with the 6,000 VARs and are huge believers."

Carbonite also spent a reported $20 million in mid-December to acquire MailStore, a vendor of e-mail archiving solutions for SMBs. "In addition to offering email archiving to businesses worldwide with MailStore's existing solutions, Carbonite will integrate MailStore's robust full-text search and indexing capabilities into our product portfolio to help our business customers better manage, understand and leverage their data," Ali said in a statement at the time. Aside from the obvious SMB appeal of the product, MailStore also already had a Service Provider Edition for channel partners. Incidentally, the MailStore acquisition was a point of contention in a Dec. 23 letter to Carbonite from J2, which contended that the acquisition reduced Carbonite's value by $0.50 per share.

As part of its channel push, Carbonite also commissioned research from IDC showing, among other things, how much small businesses were willing to spend on backup and recovery. The study found SMBs are willing to pay $2,800 a year on average to protect their data, an amount less than some of Carbonite's competition but well in the range of the company's three-server, $799 solution, Ali said.

"That study is underscoring the approach we're taking, which is super-simple products. And since we came from the consumer world, we're able to create these super-simple products [that are also] price disruptive," Ali said. "CSB [Carbonite Server Backup] is six steps to install, compared to 20 to 30 for other products. That product is what's driving 40 percent growth. There's a huge whitespace opportunity in SMB."

Most recently, Carbonite went on a senior executive hiring spree announced May 6 that Ali characterized as channel-oriented. As Ali explains the hires, Chief Marketing Officer Nina McIntyre has experience marketing to the channel; Paddy Sreenivasan, vice president of server engineering, will stitch the products together with the ecosystem; Irwin Weiss, vice president of IT, will work on integrating Carbonite's internal systems with the channel; and Christopher Wey, vice president of corporate development, will bring his long channel and M&A experience to Carbonite.

A month ago, Carbonite declared it was shutting down a process to explore a potential sale of the company -- a process that was originally spun up in response to the J2 offer. In working to fend off a takeover and steadily investing in channel efforts, the company's board and executives seem to be putting real money behind the message that Carbonite's best potential lies in developing the channel and chasing the SMB opportunity.

Posted by Scott Bekker on May 14, 2015