How secure are those mobile apps that users bring into company networks via their own devices? Not very, according to researchers at Gartner. Nor is the situation likely to improve soon.

As part of the Gartner Security and Risk Management Summit this week in Dubai, Gartner principal research analyst Dionisio Zumerle flagged mobile apps as an emerging route for attackers to get into enterprise networks and steal corporate data.

"Enterprises that embrace mobile computing and bring your own device (BYOD) strategies are vulnerable to security breaches unless they adopt methods and technologies for mobile application security testing and risk assurance," Zumerle said in a statement. "Most enterprises are inexperienced in mobile application security. Even when application security testing is undertaken, it is often done casually by developers who are mostly concerned with the functionality of applications, not their security."

Gartner contends that through 2015, more than three out of four mobile applications will fail basic security tests, and encourages enterprises to get aggressive about testing apps that access corporate data and about exploring technologies that help contain the activity of apps on mobile devices, such as wrapping and hardening.

"Today, more than 90 percent of enterprises use third-party commercial applications for their mobile BYOD strategies, and this is where current major application security testing efforts should be applied," Zumerle said. "App stores are filled with applications that mostly prove their advertised usefulness. Nevertheless, enterprises and individuals should not use them without paying attention to their security. They should download and use only those applications that have successfully passed security tests conducted by specialized application security testing vendors."

Gartner called out static application security testing and dynamic application security testing as two categories of vendors working to improve the capabilities of their toolsets for mobile app testing. Another promising area, according to Gartner, is behavioral analysis, which monitors running apps to detect risky behavior, such as accessing users' contact lists or locations. It's equally important, the research firm warns, to test or certify security on the servers the apps access, whether internal to an enterprise or those that provide back ends for third-party apps.

The attacks on mobile endpoints are still relatively immature and Gartner anticipates that three-quarters of mobile security breaches through 2017 will result from misconfigurations rather than deeply technical attacks.

Nonetheless, the attackers are rushing at tablets and smartphones. "Already there are three attacks to mobile devices for every attack to a desktop," according to Gartner.

Posted by Scott Bekker on September 17, 20140 comments

Microsoft just spent $2.5 billion on Mojang, the little Swedish company that created the wildly popular, blocky-graphic video game Minecraft.

This is an enormous amount of money by any standard. For a little context, this ranks as the fourth-largest dollar amount for an investment in Microsoft's history. It trails only what Microsoft paid for Skype ($8.5 billion), Nokia's phone business ($7.2 billion) and aQuantive ($6.3 billion).

Even with rough estimates for inflation, the Mojang acquisition still appears to hold onto that fourth-place rank. Microsoft is putting more value on Mojang than it did on Visio Corp., Navision, Great Plains, Fast Search & Transfer or Yammer, to name a few strategic acquisitions in the company's past.

In explaining what it's getting for all that money, Microsoft called Minecraft one of the most popular video games in history and noted the 100 million downloads on PC alone since 2009, the 2 billion hours played on Xbox 360 in the past two years and the game's status as the top paid app for iOS and Android in the United States.

"Gaming is a top activity spanning devices, from PCs and consoles to tablets and mobile, with billions of hours spent each year," said Microsoft CEO Satya Nadella said in a statement. "Minecraft is more than a great game franchise -- it is an open world platform, driven by a vibrant community we care deeply about, and rich with new opportunities for that community and for Microsoft."

It's interesting that Nadella's first big investment as CEO comes not in his wheelhouse of enterprise software and services but instead in the area of gaming. The move does seem to confirm that Nadella's Microsoft will remain committed to consumer gaming, despite all the calls from outside Microsoft for him to sell off the Xbox business.

Posted by Scott Bekker on September 15, 20140 comments

A new program offering free Office 365 migrations performed remotely by Microsoft employees for customers with more than 150 seats went live this week. Partner reaction so far has ranged generally from extreme concern to wary acceptance.

Microsoft formally announced two new programs to customers in a blog post on Wednesday -- the Office 365 FastTrack Onboarding Center and the Office 365 Adoption Offer. Both programs officially launched Sept. 1.

Office 365 FastTrack Onboarding Center is a free benefit to new Office 365 customers buying 150 seats or more. It supports provisioning and configuration of Office 365 workloads, including Exchange, SharePoint, Lync, Office 365 Pro Plus and Yammer. According to the blog, one key feature involves "direct remote assistance provided by an Office 365 onboarding expert who will assist with critical onboarding activities working with customers and partners."

The Office 365 Adoption Offer also applies to customers with at least 150 seats but has a limited run, ending March 31, 2015. The offer is primarily a partner subsidy that the customer can pay to an Office 365 Cloud Deployment Partner or a Cloud Productivity Competency Partner, a category that doesn't launch until Sept. 29. The subsidy is for adoption-related work that goes beyond the relatively simple onboarding work offered by FastTrack.

In a blog post to partners Aug. 21, Gavriella Schuster, Microsoft's general manager of Worldwide Partner Programs, said the subsidy is $15 per seat up to 1,000 seats and $5 per seat above 1,000 seats to a $60,000 limit.

A key element of the adoption offer is an e-mail migration offer, billed as "delivered remotely by Microsoft." The migration of relatively straightforward e-mail configurations from supported platforms (Exchange Server 2003 or above, Lotus Domino 7.0.3 or above, Google Gmail or IMAP accessible environments) is provided by Microsoft. Reportedly, Microsoft is hiring between 400 and 800 people worldwide to staff the onboarding center. The migration offer gives customers with relatively simple environments a way to avoid partner engagement altogether.

In her post, Schuster appeared to reiterate a commitment made earlier in the summer about partner commitment, but her phrasing, although underlined in the blog post, was actually less strong. In a Microsoft Worldwide Partner Conference keynote in July, John Case, corporate vice president of the Microsoft Office Division, said, "Our intent is for every single new customer that comes into Office 365, for example, or Dynamics or Azure, to make sure that there is a partner attached to every single one of those new customers. And we'll help provide that."

Schuster's post read, "Every customer onboarding via FastTrack interested in working with a partner will be connected to a qualified Microsoft partner as part of the process."

She also laid out three reasons why the combined FastTrack and the Office 365 Adoption Offer was a big opportunity for partners:

1. FastTrack will help get our mutual customers onboarded to Office 365 more quickly which will increase sales velocity, customer satisfaction and open the door for partners to provide more high-value services.

2. Any customer onboarded via FastTrack not already working with a partner will be offered the opportunity to be connected to a qualified partner to assist with onboarding and adoption of Office 365. When a partner is already present in the account, the Onboarding Assistance team will work with that partner.

3. The Office 365 Adoption Offer provides an option for customers to receive funding to be used with qualified partners to help offset the cost of onboarding, migration and adoption.

Partners responding on Schuster's blog seemed to disagree strongly with the opportunity argument.

"We have deployments we have been working on for 6 to 12 months and for larger customers. It looks like all the investments made will get flushed with this program. Why should we spend that kind of time talking with customers and watch MS pull the most profitable part away from us? Bad decision to proceed with this program, Microsoft," wrote a commenter identifying himself as JDB.

"This has been abysmally messaged and handled," said the commenter MSPartner. "There is far more to a migration than Microsoft appreciates and customers need to understand exactly what's required to have a smooth transition to the cloud, not have Microsoft both oversimplify and undervalue the process, as well as make obscure promises to perform a half-*** migration."

Ric Opal, a longtime Microsoft partner with the Chicago area company Peters & Associates, said he understands that Microsoft is eager to do something to ensure that customers who buy Office 365 licenses actually deploy them.

"I get it. I respect it. To me, the jury is out. I want to see it operationally moving," he said in a telephone interview.

Opal's concerns include what Microsoft will do when the pipeline of e-mail migrations backs up beyond what its operational funnel can handle, how effectively Microsoft will connect customers to partners and numerous other details.

Nonetheless, he's not sitting back and waiting to see what happens. "That's the gap opportunity. Everybody should get in early and exploit the opportunities in the program," Opal said.

Pete Zarras, president of Cloud Strategies, a born-in-the-cloud partner based in New Jersey, was initially concerned about the changes when he first heard the vague outlines of the programs at WPC, but has grown more comfortable, especially as details of related incentives through Microsoft's new Partner Investment Engine (PIE) have emerged.

"We struggled through some of the communication challenges, but we do see there is opportunity for our clients, and we feel in the short- to-medium term it is very good for us," he said in an interview. "We believe that we will be able to evolve as Microsoft evolves."

Another born-in-the-cloud partner, Interlink Cloud Advisors in Cincinnati, is also sprinting to help customers take advantage of the simultaneous PIE incentives. But Interlink President Matt Scherocman said the pace of change in the Microsoft Partner Network is a challenge to keep up with. For example, the first round of PIE incentives were just announced and expire at the end of the year.

"I'm very excited about the deployment offer because it helps Microsoft recognize more workloads than just e-mail, and it helps Microsoft recognize the partner's role in the sales cycle. But I think it needs to have a longer time horizon than ending at the end of the year," he said.

For more, check out the feature story in the September issue of Redmond Channel Partner, which puts the new programs in the larger context of Microsoft's partner plans around cloud.

Posted by Scott Bekker on September 04, 20140 comments

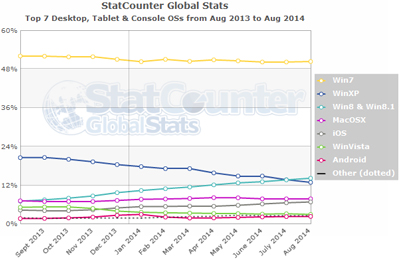

Windows 8 finally overtook Windows XP in global Internet usage in August, more than four months after Microsoft stopped supporting the aging operating system, according to Web site analytics company StatCounter.

In figures released Tuesday, StatCounter Global Stats put the combined worldwide share for Windows 8 and Windows 8.1 at 14 percent, compared with 12.9 percent for Windows XP (see Figure 1). Microsoft put a stop to paid support for Windows XP on April 8.

The most popular operating system by far remains Windows 7, with 50.3 percent share.

[Click on image for larger view.] Figure 1.

[Click on image for larger view.] Figure 1.

Windows XP's share of Internet browsing is getting low in western countries. According to StatCounter, XP's share in all of Europe is 10.6 percent, in the United States is 8.9 percent, and in the United Kingdom is 5.2 percent.

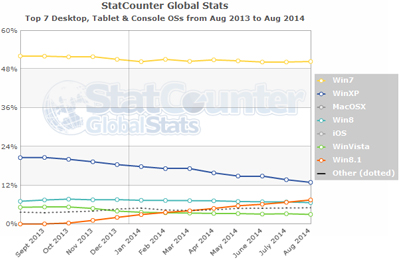

StatCounter also noted that Windows 8.1 has finally passed Windows 8 in global share, as well. Windows 8.1 now stands at 7.5 percent, while Windows 8 is at 6.6 percent (see Figure 2).

"Following a mixed reaction to Windows 8, perhaps because of its radical new look, Windows 8.1 appears to be winning over users," Aodhan Cullen, CEO of StatCounter, said in a statement.

[Click on image for larger view.]

Figure 2.

[Click on image for larger view.]

Figure 2.

Posted by Scott Bekker on September 02, 20140 comments

It looks like boardroom politics just got simplified for Microsoft CEO Satya Nadella.

As we noted back in April, the Microsoft boardroom had the potential to become a very disharmonious place. For a long time, Bill Gates was revered in tech circles for exercising near total control over the Microsoft board. A key element of the most recent era of the Microsoft board was Gates and former CEO Steve Ballmer seeing eye to eye on most things, and presenting a unified front of the two largest shareholders.

With a boardroom blow-up between Ballmer and everyone else over the Nokia acquisition reportedly leading to Ballmer's sudden decision to step down as CEO, the old rules were out the window. Then with Gates stepping aside as chairman, new chairman and industry heavyweight John Thompson onboard, and activist investor Mason Morfit in the mix as Microsoft faces a very uncertain future, things had the potential to get volatile.

Another potential destabilizing element, and a big one, was the continuing presence of Ballmer on the board. Now the largest shareholder due to Gates' orderly selloff, Ballmer also had his legacy to protect, including the controversial "Devices and Services" strategy that made room for the Nokia acquisition.

Microsoft CEO Satya Nadella (left) with former CEO Steve Ballmer at a company event announcing Nadella's appointment in February.

Microsoft CEO Satya Nadella (left) with former CEO Steve Ballmer at a company event announcing Nadella's appointment in February.

That's why some observers made a lot of Ballmer's use of the phrase "devices and services" in his board resignation letter this week.

"I have confidence in our approach of mobile-first, cloud-first, and in our primary innovation emphasis on platforms and productivity and the building of capability in devices and services as core business drivers," Ballmer wrote.

A close read of Nadella's massive strategy memo in July, though, reveals that he's very much building on and evolving Ballmer's devices and services strategy, not throwing it out. None of Ballmer's billions in investments, including in Nokia, are being written off yet in Nadella's strategy.

Even if Nadella is roughly on the same page as Ballmer for now, if circumstances change, he could have more latitude. For example, if Windows Phone's abysmal market share continues to worsen, he's going to have more room to spin off Nokia in a few years without anyone on the board feeling personally invested in it.

Microsoft's boardroom still has the components necessary for a corporate train wreck of epic proportions. But with Ballmer removing himself to the basketball court, there's one less actor on the board to cause potential headaches for Nadella.

Posted by Scott Bekker on August 21, 20140 comments

The Microsoft Worldwide Partner Group's new No. 2 may be new to WPG and to most Microsoft partners, but it's not Gavriella Schuster's first time building programs for the Microsoft channel.

Microsoft global channel chief Phil Sorgen named Schuster in May to the newly created role of general manager of Worldwide Partner Programs. The job combines the titles held by two formerly high-ranking and long-serving Microsoft partner executives -- Julie Bennani, general manager of the Microsoft Partner Network, and Karl Noakes, senior director of Worldwide Partner Marketing and Communications. After a brief transition period, both Bennani and Noakes left Microsoft, according to their LinkedIn profiles.

"If you looked at the organization previously, I had one person on my leadership team who did design, strategy and design and program development [Bennani] and then I had another person who did marketing, comms and brand," Sorgen said in an interview at the Microsoft Worldwide Partner Conference (WPC) last month. "My view, and the change I made, was to bring that together. I wanted single ownership from strategy and design program to comms, marketing and brand for the program. That's the net of what we did."

Asked what it was about Schuster that made her the pick for the job, Sorgen cited her broad experience in various areas of Microsoft over a 19-year career.

"She's a seasoned Microsoft veteran whose done a lot of things at Microsoft, from product group to subsidiary marketing to subsidiary sales to partner group to licensing and programs. So when you look at diversity of background across the areas that are important at Microsoft, she has a pretty deep set of experiences," he said.

Some of that experience includes stints in the Server and Cloud business, the Windows Client Commercial business, enterprise services, licensing sales and marketing and training.

For many partners, Schuster's polished, main-stage keynote at WPC to announce the forthcoming cloud competencies was their first introduction to her.

"Partners have already given me a ton of feedback. They took me very literally. I've got LinkedIn e-mails and lots of cards and people telling me, 'I live in MPN, I can tell you all the things you need to do.'"

"Partners have already given me a ton of feedback. They took me very literally. I've got LinkedIn e-mails and lots of cards and people telling me, 'I live in MPN, I can tell you all the things you need to do.'"

Gavriella Schuster, General Manager, Worldwide Partner Programs, Microsoft

In an interview at WPC, Schuster explained that joining the Partner Group is a return of sorts to her Microsoft roots. She was hired in 1995 by former senior Microsoft executive Rick Devenuti to create global standards for the Solution Provider programs being run by Microsoft's dozens of subsidiaries.

"The only thing that was worldwide about it was the name," Schuster joked as she recalled the role. "Everybody called them Solution Provider. We had 39 marketing managers around the world who all had a spreadsheet of their partners. What was happening was that we had global partners like Dell or HP who were saying, 'Look, Microsoft, I don't want to go to 39 marketing managers around the world to say "make me a partner." Do something!' And so they hired me in to figure out what that means."

Over several months, Schuster interviewed country and regional marketing managers, asking how they qualified partners, what they offered those partners as benefits and what they did to enable partners.

"I had these whole spreadsheets of all these countries, and then I sat down and said, 'OK, if I was going to do something globally, what would I do that could be consistent and then what do I say is still for you to do locally?'" The process led to early versions of things that would later become staples of the Microsoft Partner Program and later the Microsoft Partner Network (MPN).

"That's how we started with certifications in the first place," Schuster said. "We don't know customers, so locally you're responsible for doing customer references, so you have to call and make sure and then you just tell us."

"Then we said, 'What do we have to offer,' and everyone was doing different things for partners. What do we have to offer partners that could be consistent? And then we said, 'Well, we can offer them support and products, that's what we do.' That's how we came up with IURs [internal use rights] and support. That was just the beginning of the program. A lot of that took on a life of its own. I did it for about two years in the beginning and then I moved on," she said.

Since starting the new job in WPG, she's been getting her arms around the role and reaching out to partners on the phone and with in-person meetings to keep her ideas for the MPN and marketing grounded in partner realities.

"Partners have already given me a ton of feedback. They took me very literally. I've got LinkedIn e-mails and lots of cards and people telling me, 'I live in MPN, I can tell you all the things you need to do,'" she said.

One of her first big tasks is ironing out final details on the new cloud competencies that she described for partners at WPC -- Small and Midmarket Cloud Solutions, Cloud Platform and Cloud Productivity. She'll need to shepherd those competencies to their debut on Sept. 29. Then she'll be working on hammering out details for a fourth cloud competency covering CRM Online, which is scheduled to come online sometime during Microsoft's current fiscal year.

Another overarching goal for Schuster is what she calls rationalizing the benefits and requirements of the MPN. "We have really had a lot of benefits and requirements that have been set very much at the product level. What I want to do is I want to start to rationalize that. In and of itself, every product manager that comes to talk to you about it -- it sounds simple. But when you have 10 or 15 or 30 products that all have something slightly different, it's not simple at all," Schuster said. "Part of what I'm going to be working on over the next year is to really take a look at what we are trying to achieve and whether we can we come to some standardization. Is there one way of looking at this? Are there three?"

Her experience in the licensing group will be a model, she said. It used to be that similar products were licensed in completely different ways. "We basically said look, really there's seven models of the way that we license and every product has to fall in one of these seven. We're not making little exceptions here and little exceptions there because at the end of the day they start to conflict with each other," Schuster said. "I think that that's the kind of rationalization that my team is going to go through in that journey over the next 12 months is to say, OK, I understand how some of this might have occurred, but we have to simplify it to come back to something rational."

In any event, Schuster joins the partner group at an interesting time -- when many of the old ways that Microsoft and its partners did business together are up for renegotiation.

"It's great to be able to come full circle and take a look at it now, and say, 'Now what do you do? What's the next iteration with the cloud?'"

Posted by Scott Bekker on August 20, 20140 comments

Partners who depend on Microsoft field representatives to help close sales or to access Microsoft resources and benefits can often help themselves by knowing the Microsoft employees' incentives.

As explained in two recent Both Sides columns, "What Gaps Does Microsoft Want Partners To Fill?" and "How To Motivate Microsoft To Close Your Opportunities," the Microsoft field tends to be motivated by what's commonly known as the scorecard. More specifically, Microsoft refers to two specific targets -- Revenue-Based Incentives (RBI) and Commitment-Based Incentives (CBI).

The RBI is fairly straightforward: It's how much money the rep is supposed to bring in for the year. But the CBI changes year by year depending on Microsoft's priorities and initiatives. The CBI is a way for Microsoft to make sure low-revenue products that are strategically important are getting the proper attention, and that reps aren't simply making their sales quotas on products that are easier to sell but less important to the company's future.

Asked about the scorecard during a conversation with RCP at the Microsoft Worldwide Partner Conference last month, Microsoft's top global channel executive, Phil Sorgen, said, "It's an important operating mechanism for us that measures the kind of things that are very strategic and important to our business. We could achieve our revenue targets [without them]. If you just look at P&L and that was the only operating mechanism that you used, you might miss some important indicators that you're making it on the things that are important but not 100 percent aligned to the R&D and your future. It allows us to ensure that not only are we meeting our P&L responsibilities to our shareholders, but that we're also doing it in a balanced way aligned to some of the future solutions, the leading-in-the-market solutions, that are important to our future."

While the Microsoft reps' compensation doesn't help a partner in itself, knowing how compensation works in a given year helps savvy partners command those reps' attention when a potential deal or initiative falls within a rep's wheelhouse.

We asked Sorgen at a high level what those metrics are for Microsoft's fiscal 2015, which started July 1.

"It will be no surprise to you that it's things like Office 365, CRM Online, Azure consumption, things like [the Enterprise Mobility Suite] that you saw [in the keynotes]. I can keep going, but they're all things around mobile-first, cloud-first and directional," Sorgen said.

Not all of the people in the field, obviously, have the same scorecard metrics, so it's always in a partner's best interest to ask.

"With our partners, we're pretty open about what our scorecard targets are," Sorgen said. "We share that pretty openly."

Posted by Scott Bekker on August 18, 20140 comments

Microsoft this week removed training from the requirements of gold and silver competencies for partners focused on certain Dynamics products.

The move is a major reversal for Microsoft's Dynamics organization, which spent the last few years ratcheting up training and other requirements in a way that strained the resources of smaller Dynamics partner organizations.

Effective immediately, Microsoft is eliminating the technical, pre-sales and sales certification/exam requirements for partners focused on the Microsoft Dynamics GP, NAV, SL, RMS and C5 products. Training requirements remain in effect for Dynamics AX and Dynamics CRM partners. Other requirements for gold and silver, such as minimum license revenues, customer retention metrics, customer references and participation in Microsoft's customer satisfaction survey, remain in place for all Dynamics partners.

"Since the Dynamics SMB partners have been on a performance path for the competency for years, and since we are asking these same partners to invest in additional training and certifications for Office 365 and Azure as they continue to move their business into the cloud, we made the decision to shift resources previously spent on creation of exams and assessments instead toward the creation of more training and readiness content, as partners have told us they require a broader variety of training to optimize and grow their businesses and shift to the cloud," said Jeff Edwards, director of worldwide ERP partner strategy at Microsoft, in an e-mail to RCP.

"By making the change now, we're able to give partners flexibility to use their readiness time and money on investments in key areas -- this could be Office 365 training, training on a new vertical product created by one of our ISVs, or non-technical, sales, marketing and business transformation training that has been created by Microsoft," Edwards said.

The move comes as Microsoft also prepares to launch its first-ever cloud competencies on Sept 29 -- Small and Midmarket Cloud Solutions, Cloud Productivity and Cloud Platform. Those competencies are similar in that there will be no training requirement for partners to reach the silver competency level. However, the cloud competencies are built from pre-existing Microsoft Partner Network (MPN) cloud programs that were light on training requirements to start with.

The message conveyed with the introduction of the cloud competencies at the Microsoft Worldwide Partner Conference in July was that Microsoft wanted partners to invest in business model changes and sales readiness for the cloud, and didn't want to tie partners up with burdensome technical hurdles.

The Dynamics ERP and CRM competencies, on the other hand, always carried heavier training requirements than the rest of the MPN competency structure. For example, while most gold competencies required a partner to field four unique Microsoft Certified Professionals (MCPs), the gold competencies in Dynamics required six MCPs.

Edwards said much of the Dynamics NAV, GP and SL readiness content has already been moved online in what he called "bite-sized components" such as the "How Do I...?" series of videos. Those videos have received more than 100,000 views already, he said.

"The amount of money and resources dedicated to training and readiness for these product lines is at its highest level in years. We're confident partners will continue to utilize these offerings to ensure their resources remain competent on the latest ERP technologies," Edwards said.

Steve Endow, a Microsoft MVP and owner of Precipio Services, posted word of the change to his blog at Dynamics GP Land on Wednesday after receiving an announcement from Microsoft about it.

"I have mixed feelings about this change. A few years ago, Microsoft made such a big push for requiring Dynamics GP certification, and requiring all partners to have several certified consultants on staff. That produced dramatic changes in the partner channel that affected a lot of people. Eventually things settled down and the exams and certifications became routine," Endow wrote.

"This announcement appears to be a 180-degree shift from that prior strategy, and completely abandons exams and certifications. While this may open the market back up to smaller partners, I now wonder if consulting quality may decrease as a result. But this assumes that the exams and certifications mattered and actually improved consulting quality -- I don't know how we could measure or assess that," he wrote.

An open question is whether a Dynamics CRM Online cloud competency planned for later in Microsoft's 2015 fiscal year would share the same low bar of training of the other cloud competencies. The Dynamics announcement this week doesn't shed much light on that question. Some Dynamics training requirements are now reduced and MPN planners are leaning toward light training with the other cloud competencies, but the on-premise Dynamics CRM competency's training requirements have not been reduced.

Posted by Scott Bekker on August 14, 20140 comments

Four months after rebranding itself as an "IT management cloud company," Kaseya acquired a security company that will provide the foundation for a new identity management as a service (IDaaS) offering.

Kaseya on Tuesday announced the acquisition of Scorpion Software, a Chilliwack, British Columbia company that sells password solutions for two-factor authentication, single sign-on and password management.

"They have been very, very successful in selling to the same customers that Kaseya sells to -- managed service providers and midmarket IT," said Yogesh Gupta, Kaseya president and CEO, in a telephone interview. Scorpion has about 500 MSPs on its customer list, many of whom overlap with Kaseya MSPs.

"They are the most attractive solution for MSPs when it comes to identity and access management," Gupta said of Scorpion. Kaseya and several other remote monitoring and management tool vendors use Scorpion's APIs to integrate with that company's AuthAnvil-branded password solutions. Major PSA vendors ConnectWise and Autotask have also integrated with AuthAnvil.

Gupta vowed to continue to support open APIs. "We are very committed to continuing to support products from folks who are perceived as competitors of Kaseya. From our perspective, a customer is a customer," he said.

Kaseya plans to integrate AuthAnvil capabilities into its core product, Virtual System Administrator, in the next six to nine months, much as it integrated its three 2013 acquisitions -- Office 365 Command, Rover Apps and Zyrion.

However, Gupta has his eye on another market for the Scorpion products -- IDaaS, which analysts at Gartner have pointed to as a potentially hot area within the security sector.

"Even in this day and age, user IDs and passwords are the worst challenge when it comes to security. Being able to have an identity and access management solution that leverages two-factor authentication makes it extremely easy to get to everything that people want to do," Gupta said.

Spearheading the effort for Kaseya will be Dana Epp, who founded Scorpion in 2003. Epp becomes principal architect for identity access management at Kaseya. Epp said AuthAnvil will become a cornerstone of what Kaseya will call the "Universal Directory."

Epp will focus initially on extending the Kaseya Universal Directory to help users manage their disparate log-ons to common cloud applications. Another area of effort will involve unifying the log-on experience to include more seamless access to devices.

"Today you have your identity as a user. But you probably have a phone and a tablet and a laptop. If I know this is your cellphone, and I know that you have already proven to have access to it, why do you have to provide another password on the phone? We'll be building that into the next-gen platform as we extend the application stack. AuthAnvil will be the cornerstone," said Epp, who is also a Microsoft MVP for enterprise security.

Terms of the deal weren't disclosed, and Gupta declined to say how many employees Scorpion Software has. "The entire team is coming over," Gupta said. "It's a relatively small team, but they've been growing very rapidly. The company revenues are doubling year over year."

Posted by Scott Bekker on August 12, 20140 comments

The addition of the first three cloud competencies to the Microsoft Partner Network (MPN) on Sept. 29 will come with a twist.

"When a customer achieves the gold competency level, we will provide them with account management. We've never made that commitment before," Gavriella Schuster, general manager of worldwide partner marketing and programs at Microsoft, said in an interview with RCP.

Microsoft has been pushing for years to get partners to offer cloud to customers, but the company has wrestled with how to integrate cloud into the MPN's structure of nearly 20-odd competencies. An extra-competency structure, called Cloud Essentials and Cloud Accelerate, is being wound down. Last year, the company also introduced, then canceled, a plan to create cloud tracks within relevant competencies.

The new plan is to create three competencies for cloud: Small and Midmarket Cloud Solutions, Cloud Productivity and Cloud Platform. A fourth competency built around Microsoft Dynamics CRM Online is planned for later in Microsoft's fiscal year.

Promising either a Partner Account Manager (PAM) or a telePAM for partners who reach gold in a cloud competency is new for Microsoft. Normally, Microsoft reserves the right to choose only certain gold partners for management.

Posted by Scott Bekker on July 25, 20140 comments

For the second year, Redmond Channel Partner magazine has teamed with Revenue Rocket Consulting Group to award IT services companies with unique business strategies that are resulting in sustained growth.

Today we're pleased to announce the three winners of our second annual award: Concurrency Inc., a multi-competency Microsoft infrastructure solution provider based in Milwaukee, Wis.; HMB Inc., a business technology services firm in Columbus, Ohio; and PowerObjects, a Microsoft Dynamics CRM specialist based in Minneapolis, Minn.

The award recognizes the companies for their innovative business strategies that resulted in sustained growth over a three-year period, from 2011 through 2013.

The award sought applications from U.S.-based IT services firms with annual revenues between $5 and $75 million.

Stay tuned for the October issue of RCP when we'll profile the winners and tell their inspiring growth stories.

Posted by Scott Bekker on July 11, 20140 comments

We'll be watching Satya Nadella closely next week in his first Microsoft Worldwide Partner Conference (WPC) keynote as CEO of the company, but he surely previewed some of his themes in the major employee memo released to the public Thursday.

In addition to redefining Microsoft's mission statement and telegraphing upcoming organizational and engineering changes, Nadella also made a few comments about where partners fit in the new Microsoft in the 3,000-plus-word memo.

Here are four partner-related quotes from the Nadella memo (emphasis mine):

1) Dual Users and a Platform Mindset

"Microsoft will push into all corners of the globe to empower every individual as a dual user -- starting with the soon to be 3 billion people with Internet-connected devices. And we will do so with a platform mindset. Developers and partners will thrive by creatively extending Microsoft experiences for every individual and business on the planet."

Dual user is a major priority for Nadella. His memo repeatedly uses the phrase, which means people who expect to use their devices and an array of cloud services for both work or school and play or personal. (I hope someone is sending his memo to the Microsoft licensing team. Case in point: You can't legally use Office apps on the Surface RT for business.) Nadella's quote suggests that he believes partner buy-in to this dual user concept is critical for its success.

That platform mindset is an allusion to Microsoft's new core vision, which Nadella stated earlier in the memo: "Microsoft is the productivity and platform company for the mobile-first and cloud-first world." Platform, of course, is a good word to partner ears.

2) Customize and Extend

"Our cloud OS will also run all of Microsoft's digital work and life experiences, and we will continue to grow our datacenter footprint globally. Every Microsoft digital work and life experience will also provide third-party extensibility and enable a rich developer ecosystem around our cloud OS. This will enable customers and partners to further customize and extend our solutions, achieving even more value."

If you look closely, the first quote mentions extending, too. It's a theme. Nadella hasn't spent a lot of time in his tenure so far talking about implementers, resellers or licensing partners. This former engineer's attention seems reserved for those partners who can make Microsoft products do more than work, even if it sometimes takes substantial skill to get Microsoft products working effectively in a customer environment.

3) Stimulate Demand and Make the Market

"Our first-party devices will light up digital work and life. Surface Pro 3 is a great example -- it is the world's best productivity tablet. In addition, we will build first-party hardware to stimulate more demand for the entire Windows ecosystem. That means at times we'll develop new categories like we did with Surface. It also means we will responsibly make the market for Windows Phone, which is our goal with the Nokia devices and services acquisition."

This dog whistle goes out to the OEM community, one of Microsoft's longest-standing partner categories. The Surface launch, along with the tepid market response to Windows 8 and overall declines in PC sales, caused tension to come out into the open between Microsoft and some major OEMs. Nadella, who cut the word "devices" out of the new company mission statement, is further clarifying here for OEMs that products like Surface are really about stimulating demand for everyone's PCs. The sentiment is similar for smartphone manufacturers.

4) New Partnerships

"New partnerships will be formed."

This statement comes in a paragraph of similarly phrased, blunt statements intended to knock any complacency out of Microsoft employees. In some ways, it's an acknowledgment of things that have already happened. The decision under Nadella's watch to move ahead with the Office on iPad is effectively a partnership with Apple. Then there's the recent deal with longtime flame war foe Salesforce.com. It serves as an additional heads-up to partners selling non-market-leading Microsoft products that Nadella's Microsoft might not be as willing to sacrifice strategic platform revenues and positioning for tactical product advantages.

Stay tuned for RCP's Twitter (@scottbekker), blog and in-depth coverage of WPC all next week, including Nadella's keynote Monday morning.

Related:

Posted by Scott Bekker on July 10, 20140 comments