Teams, Azure Absorb Coronavirus Hit to Microsoft Earnings

Before Microsoft reported its quarterly earnings on Wednesday, analysts weren't sure how COVID-19 would affect different parts of its diverse portfolio of businesses.

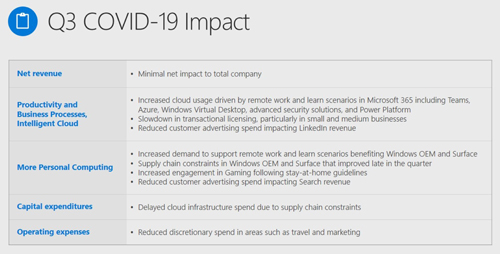

But as CFO Amy Hood told investors during the Wednesday afternoon earnings call, there was a minimal net impact to the total company. A slide presented during the call broke down the impact of the coronavirus at length for Microsoft's third quarter, which ended March 31:

[Click on image for larger view.] Source: Microsoft

[Click on image for larger view.] Source: Microsoft

In one of the toughest financial quarters in decades, Microsoft managed once again to beat analyst expectations and post double-digit increases on revenue and earnings. Revenues were $35 billion, an increase of 15% and diluted earnings per share hit $1.40, a 23% jump. Company shares were up by 5% in after-hours trading.

CEO Satya Nadella put the results into the context of the times. "As COVID-19 impacts every aspect of our work and life, we have seen two years' worth of digital transformation in two months," Nadella said during the earnings call in a reference to customers' scramble to set up remote teamwork, sales and customer service, while setting up cloud infrastructure and security for their altered environments.

"Our durable business model, diversified portfolio and differentiated technology stack position us well for what's ahead," Nadella predicted.

One of the biggest COVID-19 positives for Microsoft was a huge jump in usage of the Teams collaboration platform. Microsoft had already teased strong Teams usage in late March, when it announced that daily active users had jumped to 44 million from 20 million in November. On Wednesday, Nadella announced that Teams daily active users had exploded to 75 million.

Other big jumps in cloud usage occurred with Azure, Windows Virtual Desktop, advanced security solutions and Power Platform. Azure revenues increased 59% year-over-year for the quarter, while the broad Commercial Cloud category was up 39%.

A slight surprise was increased demand to support remote work for Windows OEM and the Surface line of hardware, which was helped when China-related supply chain constraints eased late in the quarter. Microsoft also noted increased engagement in its gaming business, due to stay-at-home guidelines.

Drops occurred in transactional licensing, especially for the small and medium-sized business segment, which has been particularly hard-hit by the coronavirus-related downturn. Similarly, Microsoft saw declines in advertising spending both for search and for the career-related LinkedIn social media network.

Posted by Scott Bekker on April 29, 2020