The channel will play a more central role for Symantec Corp. under a program rolling out next year.

Symantec telegraphed some of the changes on Wednesday at its Symantec Partner Engage event in Scottsdale, Ariz.

In a pre-briefing, Garrett Jones, a Symantec veteran who became vice president for global channel operations this spring, said the changes stemmed from Symantec 4.0, the new strategy under CEO Steve Bennett, who is the company's fourth CEO (thus 4.0). The strategy developed out of Bennett's review of the company after taking over as CEO in 2012.

Symantec is the sum of a lot of acquisitions with hundreds of products in dozens of areas. Previous channel efforts pushed partners to represent as many of the company's products as possible.

"Before to climb tiers, you would have sell very broadly across our portfolio," Jones said. "We had 20 programs, even more than 20. Now we've consolidated those down to one overarching framework."

Symantec is also recognizing that partners don't want to operate in multiple Symantec programs; they want to operate in one Symantec program. Moreover, if they're successful as security partners, for example, Symantec doesn't want its incentives to force them to go into adjacent areas, such as backup, to access program benefits like higher margins.

"Our [old] programs were designed more as a one-size-fits-all. It wasn't designed so that partners can go deep in one area and be successful and be rewarded for it. Before, [it was] sell everything in a peanut-butter approach," Jones said.

Symantec isn't ready to go public with specifics of the new channel program yet. Jones said the company has taken its roughly 150-point solutions and is moving toward a roadmap for partners with 10 integrated offerings.

"What we're hoping to do is really clarify the Symantec portfolio," Jones said. While details will be available later, examples of integrated offering areas would include things like user productivity, information security, information management and data-loss prevention, he said.

Meanwhile, Symantec is already tinkering with its indirect-direct sales mix and started implementing some changes in July. Among the changes, Symantec is:

- reducing the number of named accounts that Symantec sells to directly,

- expanding the number of accounts in the 100-percent-channel-led commercial space,

- investing in the inside sales organization to better support the channel,

- clarifying the rules of engagement for Symantec's sales teams and

- adjusting compensation internally to incentivize Symantec sellers to engage with partners.

Jones said Bennett's review found that Symantec's best bet is to rely more on channel partners.

"We [have] clear evidence that our sales and marketing costs were out of line with where we wanted to be and we weren't really getting return on investment," Jones said. "We need to effectively embrace channel and give them opportunity. We need to let them lead."

Posted by Scott Bekker on November 13, 20130 comments

One partner's view from the trenches is that mergers and acquisitions are a powerful driver for midmarket customers to move to the Microsoft cloud.

Matt Scherocman is president of Interlink Cloud Advisors Inc. in Cincinnati. A longtime Microsoft channel player, Scherocman and some business partners spun up an Office 365-focused consultancy a couple of years ago. He blogs occasionally, and this week provided some interesting insights about M&A.

Scherocman called M&A "the #1 driver of the cloud."

Some of the reasons his clients cite include capacity limitations in both environments preventing either party from consolidating all users, the ability to quickly create collaboration through SharePoint or Lync, the opportunity to break or renegotiate existing contracts, and covering IT costs in the integration budget.

See Scherocman's blog for a lot more detail.

Posted by Scott Bekker on November 04, 20130 comments

Big U.S. tech companies are setting their rivalries aside to unite against a common problem -- the ongoing damage revelations about the U.S. National Security Agency are doing to their reputation for keeping customers' cloud data private and secure.

On Thursday, AOL, Apple, Facebook, Google, Microsoft and Yahoo co-signed a letter to the sponsors of the USA Freedom Act calling for greater government transparency about legal demands for the companies' customer and user information and greater accountability for government surveillance.

Dozens of lawmakers sponsored the USA Freedom Act, which was written by Sen. Patrick Leahy, D-VT, chairman of the Senate Judiciary Committee and original Patriot Act author Rep. James Sensenbrenner, R-WI. The bill, with 16 Senate co-sponsors and more than 70 House of Representatives co-sponsors, was introduced on Tuesday.

The legislation is aimed at limiting the phone record collection program and other government surveillance programs unveiled by former NSA contractor Edward Snowden over the last five months.

The tech companies, which were all signatories of an open letter to the Obama administration in July, as well, wrote to "applaud the sponsors of the USA Freedom Act for making an important contribution."

They urged the sponsors to ensure the legislation include several key provisions.

"Allowing companies to be transparent about the number and nature of requests will help the public better understand the facts about the governments' authority to compel technology companies to disclose user data and how technology companies respond to the targeted legal demands we receive," the letter stated.

While the letter called transparency a critical first step, it went on: "Our companies believe that government surveillance practices should also be reformed to include substantial enhancements to privacy protections and appropriate oversight and accountability mechanisms for those programs."

The Leahy-Sensenbrenner bill is expected to encounter heavy resistance from the White House and from members of the House and Senate Intelligence committees.

A copy of the letter posted by IDG News Service is available on Scribd.

Related:

Posted by Scott Bekker on November 04, 20130 comments

It was starting to look like the world was getting serious about migrating away from Windows XP in time for the operating system's April 8, 2014 support deadline.

The end-of-life date for Windows XP has been a major focus for Microsoft, with annual reminders to partners at the Worldwide Partner Conference for each of the last three years and tools like countdown clock gadgets.

It's especially significant because users who don't migrate will be vulnerable to zero-day exploits and other security holes that Microsoft no longer ever plans to patch for XP. Their systems will be vulnerable, endangering their own data and networks, and their computers will also serve as launching pads from which attackers can mount attacks against the rest of the Web.

Hitting on that theme Oct. 29 at the RSA Conference in Amsterdam, Microsoft claimed that Windows XP systems are already six times more likely to be successfully hacked than Windows 7 or Windows 8 machines. Once support ends, attackers will wait for Microsoft's Patch Tuesday bulletins and treat them like a shopping list of new ways to attack Windows XP, according to one security expert.

Windows XP, which Microsoft sold between October 2001 and January 2009, still commanded 50 percent of PC usage share 10 years after its launch in 2011, according to NetMarketShare monthly statistics from Net Applications.

Windows 7 finally surpassed Windows XP in usage in August 2012, when both operating systems hovered around 42 percent of overall PC usage, as measured by Net Applications, which relies on thousands of partners worldwide running its software to capture platform information about systems visiting their sites.

From there, Windows XP kept its grip, losing less than a point of share per month, and in some months even gaining a little share, all the way through July of this year.

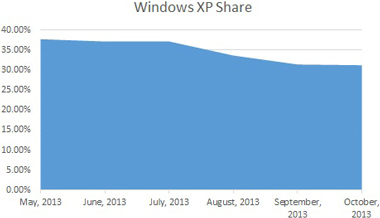

But in August and September, Windows XP shed share very quickly by Net Applications' measure. XP clunked from 37.19 percent in July down to 33.66 percent in August, then down to 31.42 percent in September.

After dropping precipitously in August and September, Windows XP's share of the worldwide usage market stabilized in October. (Data source: NetMarketShare by Net Applications.)

After dropping precipitously in August and September, Windows XP's share of the worldwide usage market stabilized in October. (Data source: NetMarketShare by Net Applications.)

In the updated figures for all of October posted by Net Applications Nov. 1, however, the momentum stalled. Windows XP's share now stands at 31.24 percent of all desktop operating systems in use worldwide -- virtually unchanged from the month before.

With 159 days until extended support ends for Windows XP, we'll see if this is a pause or the outlines of the hard kernel of users who won't be upgrading at all.

Posted by Scott Bekker on November 01, 20130 comments

In advance of its 10th anniversary as a company in December, StorageCraft Technology Corp. is bolstering its international presence.

Draper, Utah-based StorageCraft is opening a new international headquarters in Cork, Ireland. The disaster recovery, system migration and data protection vendor that is a mainstay in the managed services provider market is currently hiring for IT support, marketing and human resources positions for the Cork office.

Mike Kunz, vice president of sales, noted in a statement that StorageCraft has had a presence in Europe since 2006.

"With the establishment of the international headquarters in Ireland and the addition of key personnel, StorageCraft will provide an increased level of marketing, technical and sales support to its global network of resellers and master distributors in order to continue its high rate of growth throughout the world," Kunz said.

The company has been busy the last few weeks. Oct. 24 marked the release of StorageCraft ShadowProtect IT Edition PRO, which combined the IT Edition -- for hot server backups, migrations to new hardware and migrations from physical systems to virtual platforms -- with ShadowProtect Granular Recovery for Exchange. A week before that, StorageCraft and Advanced Backup Solutions unveiled a partnership that includes ShadowProtect software in ABS' backup and disaster recovery appliances and in its offsite disaster recovery infrastructure.

Posted by Scott Bekker on November 01, 20130 comments

Now that Microsoft is buying Nokia's phone business, the Finnish company's financial results are less important to the Microsoft ecosystem. Nokia was Microsoft's most strategic partner in CEO Steve Ballmer's long game to become a player in smartphones. One major reason to pay attention to Nokia's financials was to determine if the company would survive its former CEO Stephen Elop's plan to transition to the Windows Phone platform.

The other major reason to pay attention was to see how many Lumias, the flagship brand for Windows Phone, Nokia had sold in the preceding three months. With Nokia Lumia devices accounting for 80 percent or more of Windows Phone shipments in recent quarters, Lumia sales were a good indicator of the Windows Phone platform's overall health.

Until Microsoft integrates the Nokia devices business into its own company sometime in the first calendar quarter of 2014, the Nokia financial results will continue to be the key place to find out how Windows Phone is doing. In fact, given Microsoft's usual practices, that integration could be the end of regular reporting of Lumia unit sales. For example, Microsoft declined to tell the market last week how many Surface units were sold in its most recently completed quarter. We'll probably have to rely on IDC or Gartner estimates of Windows Phone unit sales rather than quarterly company reports from Microsoft.

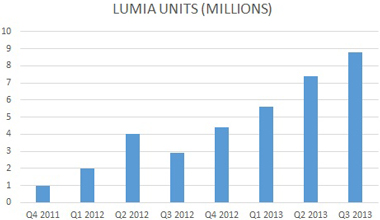

Let's take a look at the data, though, while we still have it. Nokia's financial results on Tuesday were very promising for Microsoft's phone platform. Nokia reported that it had sold 8.8 million Lumia units in the July-September period. That's nearly a 19 percent improvement sequentially over the previous quarter and about triple the number of devices Nokia sold in the year-ago quarter.

Figure 1.

Figure 1.

A look at Nokia's Lumia sales since the company first started shipping the Windows Phone-based devices in the fourth quarter of 2011 shows a nearly steady march upward in units, with the exception of a dip in the third quarter of 2012 (Figure 1). It's a pretty chart, the kind executives like to show to investors.

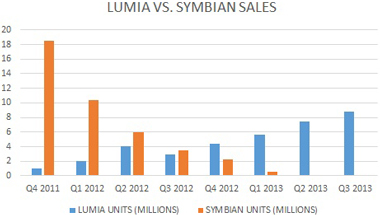

Another chart illustrates why Nokia was eager to jettison the devices business. Elop, the former Microsoft executive who is returning to Microsoft with the sale of Nokia assets, originally projected that Nokia would sell 150 million additional Symbian smartphones as it managed the transition of its customers to Windows Phone and Lumia. Symbian had been the powerhouse of the smartphone industry in the pre-iPhone era. The 150 million Symbian projection proved hopelessly optimistic. In reality, Nokia managed to sell about 41 million more Symbian devices in the Lumia era, which stretched from the fourth quarter of 2011 until the company effectively stopped offering Symbian devices in the first quarter of 2013 (Figure 2).

Figure 2.

Figure 2.

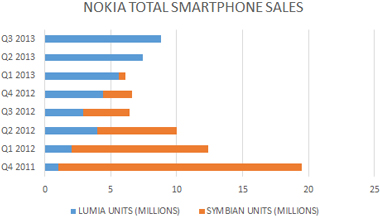

Another chart illustrates what a gigantic hole that rapid dropoff in Symbian sales left in Nokia's business. At a time when the overall smartphone market was vaulting to ever higher shipment totals quarter after quarter, Nokia was watching its absolute number of smartphone unit shipments drop. See the third quarter of 2012 and the first quarter of 2013 for the worst parts (Figure 3).

Figure 3.

Figure 3.

But the blue part -- Microsoft -- of the blue and orange bars kept accounting for more and more of the sales quarter-by-quarter, and that is the only part of the business that has ever mattered to Redmond.

Where it gets interesting is that with this quarter's results, Nokia's Lumia sales are starting to become a significant number in the market. Sure, the IDC smartphone estimates also released on Tuesday show a market dominated by Samsung at 81 million units, followed by Apple at a distant second with 33 million units.

The next tier, though, is Huawei, Lenovo and LG. All three are in the 12 million unit range. Nokia is coming up on that group fast. Another quarter of 20 percent growth would put Lumia at about 10.5 million units -- and fourth quarters are traditionally strong so Windows Phone's performance could conceivably be even better than that.

None of this is to say that the ball of Windows Phone progress couldn't get fumbled in the Nokia-to-Microsoft handoff. The trajectory, though, suggests that Microsoft will just keep on coming and has a credible chance of becoming not just the third-place smartphone platform but the third-place global smartphone maker, as well, in the next few quarters.

Related:

Posted by Scott Bekker on October 30, 20130 comments

Microsoft's earnings report last week brought a sharp bounce in the stock price. Here are five notes for the Microsoft channel from Microsoft's earnings release, press release, investor call and 10Q statement:

- Surprisingly strong overall performance. After last quarter's poor performance, this quarterly earnings statement was a loud cry from Microsoft that rumors of its demise are greatly exaggerated. The company beat analysts' expectations with revenues of $18.53 billion, net income of $5.24 billion and earnings per share of $0.62. The results even caught Microsoft off guard. "Total revenue was up 7%, to $18.6 billion, and came in about $700 million better than our expectations," said Chris Suh, general manager of investor relations, on the investor call.

Meanwhile, the new reporting structure that divides Microsoft up into different reporting units seems, for now, less opaque than it at first appeared. Several financial analysts on the investor call thanked Microsoft for providing more detail.

- The "Devices" in the Devices and Services strategy are hurting margins. No surprise here, but selling computers like the Surface rather than just the software for computers cuts into your profit margins. We got detail on this in the 10Q. Devices and Consumer hardware cost of revenue increased by 101 percent, dropping the gross margins for the sector by 54 percent. This increase in cost of revenue was "primarily due to $645 million higher Surface cost of revenue." (This segment also includes Xbox.) The cost came both from higher volumes of Surface sales during the quarter, along with inventory buildups of the Surface 2 and Surface Pro 2 devices, which launched after the quarter ended.

Across the company, cost of revenue increased 23 percent, and Microsoft's 10Q again said the increase was "primarily due to Surface product costs." There's a reason investors have been lukewarm about Microsoft's shift toward devices.

- As a product, Surface is doing better. In the previous quarter, there was little but bad news about Surface. Microsoft announced a $900 million charge related to excess inventory of the Surface RT devices. This time, CFO Amy Hood said, "We more than doubled the number of units sold over the prior quarter. In terms of mix, Surface RT did better than expected."

Altogether, units and revenues were both up. "D&C Hardware revenue increased $401 million or 37%, due primarily to Surface revenue of $400 million," Microsoft's 10Q stated. While the channel went unmentioned and Microsoft referred vaguely to improved execution, the quarter does coincide with the extension of Surface sales to authorized distributors, rather than just through Microsoft's physical and online stores.

- Client Windows remains a disaster, business Windows is stabilizing. The numbers from IDC and Gartner for the comparable period have been stark -- a freefall for the PC market. Microsoft's results reflect that on the consumer side, but the company's core Windows client franchise did OK on the business side. Here's Suh summarizing the situation:

"Our Windows OEM business performed better than expected, declining 7% versus our expectation of a mid-teens decline. ... We believe we are seeing a stabilization in business PCs, which grew again this quarter and drove Pro revenue growth of 6%. We also saw better-than-expected performance in the consumer part of our business. Non-Pro revenue declined 22%, but was several points better than expected."

- The state of servers is strong. For the bulk of Microsoft's solution provider partners whose bread-and-butter business is built atop Microsoft servers, those products continue to perform. Tidbits from the investor call involving servers included:

- Server product revenue grew 12% overall.

- SQL Server revenue grew in double digits; SQL Server Premium revenue increased over 30%.

- SharePoint and Exchange saw double-digit growth.

- Lync revenues increased nearly 30%.

Posted by Scott Bekker on October 28, 20130 comments

Time was, a Microsoft operating system update would be the major IT event of that month, and every computer- and peripheral-maker would drop everything to be sure to have drivers and software ready for go-day.

So it speaks to Microsoft's loss of market power, at least on the client side, that much of the industry seems to yawn when Microsoft does something as major as update its flagship OS, in this case from Windows 8 to Windows 8.1.

I encountered a separate wrinkle that points up our increasingly, geographically multi-polar world. The United States is no longer the undisputed king of tech. This has been obvious for a while, but I'm about to share my first actual experience of it.

It used to be that when Microsoft would ship something, the rest of the industry would be ready with English-first drivers, and they'd be carefully checking Microsoft's multi-language roadmap to align their non-English software and drivers with Microsoft's schedules.

Not so with Windows 8.1. I'd been using a Lenovo Ideapad Yoga 13 with the Windows 8.1 preview for months, so I thought nothing of upgrading when Windows 8.1 became available in the Windows Store last week.

Much to my chagrin, once the upgrade was complete, the audio stopped working and I had trouble staying connected to my wireless network, among other problems.

An online hunt for new Windows 8.1 drivers led me to a Lenovo support forum, where I learned from a forum participant that the Beijing-based Lenovo did have a Chinese driver available already, but didn't have an English one yet. (This was last week -- new drivers are available now.)

Comfortable with the Lenovo domain in the URL, the pointer from an official support forum and the rudimentary Google Chrome translation of the Chinese-language support page, I went for it. It was a slightly white-knuckle affair when the pop-up windows of the installation wizard presented me with mostly question marks where text ought to go, but it worked well enough. A reboot later, and audio and consistent wireless access were back.

Spare me the lectures about not doing my homework before upgrading and the potential security problems I could have opened myself up to by downloading in another language. I know I'm guilty of ranging far afield of safe-computing best practices. (Although I will say that Microsoft's loss of mindshare has also led to much, much less non-official documentation of non-obvious potential pitfalls. That's a subject for another day.)

This was my first experience of seeing non-English drivers available for Windows before English drivers. What's your take? Is this symptomatic of an inevitable erosion of influence by U.S. tech companies? Or am I reading too much into an isolated incident? Leave a comment below or e-mail me at [email protected].

Posted by Scott Bekker on October 24, 20130 comments

Kaseya fully embraced Microsoft Office 365 on Thursday.

The Lausanne, Switzerland-based systems management and MSP tools vendor bought the technology of the high-profile Office 365 tool 365 Command for an undisclosed amount. The 365 Command technology was owned by Champion Solutions Group, based in Boca Raton, Fla., a company that is a Microsoft National Systems Integrator and an early cloud adopter.

Much of the 365 Command technology came from Champion Solutions Group's acquisition of Charlotte, N.C.-based MessageOps in November 2012, and MessageOps founder Chad Mosman continued to help drive feature development of the product through 2013.

It was not immediately clear if any employees were part of the deal, which fell on the same day as Microsoft's quarterly earnings report, in which Microsoft boasted of continuing momentum for the Office 365 cloud productivity suite.

The 365 Command toolset consists of migration tools for moving on-premise Exchange mailboxes to Office 365, as well as tools for managing users, devices and permissions, among other functions. Several 365 Command capabilities are geared for MSPs, including the ability to manage multiple Office 365 clients through a single log-on.

"Office 365 is exploding in popularity. With this growth, mid-market organizations and MSPs are scrambling for a better and more efficient way to manage these applications," said Yogesh Gupta, president and CEO of Kaseya, in a statement. "This acquisition gives Kaseya yet another powerful tool in its arsenal to help our customers dramatically simplify management of their IT environments, and to make managing today's modern infrastructure and applications seamless for organizations."

Posted by Scott Bekker on October 24, 20130 comments

Jon Roskill is out of Microsoft, his employer for nearly 20 years, less than a month after stepping down from the high-profile role of channel chief.

Microsoft replaced Roskill with Phil Sorgen as corporate vice president for the Microsoft Worldwide Partner Group in a move announced Aug. 29. In a blog post announcing the change, Roskill had said he hoped to "return to my roots of product development and take all the great insights I gained from my time with our partners and use them to create even more partner opportunity."

However, an e-mail from RCP to Roskill's Microsoft address on Friday returned a note that Roskill left Microsoft Sept. 20. He did not respond to an e-mail to the personal address in the automatic reply, although Microsoft executives at that level are usually bound by a legal agreement not to discuss the terms of their departures for a set period of time.

In a statement provided by e-mail, a Microsoft spokesperson confirmed Roskill's departure: "Jon Roskill has left Microsoft, and we wish him well in his future endeavors."

Roskill's experience in Microsoft was a combination of operational work from his partner role and previously as corporate vice president/U.S. Business and Marketing Officer, and product/technical work. Previous roles on that side included a stint as a general manager in the Server & Developer Tools Division.

Roskill hasn't updated his LinkedIn profile yet.

According to a source familiar with the situation, Roskill's planned move to a technical role was blocked by a more senior executive. "In essence, the reason Jon left was corporate politics, nothing to do with corporate decision-making," the source said.

Posted by Scott Bekker on October 21, 20130 comments

Tech Data Corp. on Wednesday launched a new program to help its solution providers expand their Microsoft practices.

The distributor's new initiative is called Microsoft Beyond!, and it includes a rewards program, education, marketing kits and incentives.

"Microsoft has complete solutions, and there's a growing need to take those solutions into market and enable based on a solution, not just on a point product," said Stacy Nethercoat, vice president of Product Marketing, Software and Cloud Services at Tech Data, in a telephone interview.

While Tech Data has always had specialized Microsoft programs running for its partners, Nethercoat said the new effort will be more comprehensive and consistent.

"With Beyond, what's different about it is it's comprehensive across four different Microsoft workloads -- productivity, datacenter, business intelligence and cloud. In the past, we might have attacked productivity for a quarter or two, then we might have moved on to datacenter," she said. "We thought a more meaningful approach would be to pull these all together in a long-term program."

By grouping Microsoft's key SMB products into the four areas, Tech Data and Microsoft executives also hope to encourage partners who start in one area to branch out into the others.

"Our goal is to enable our partners to sell the full stack of Microsoft. Bringing Beyond together the way that we have, virtually any partner can take advantage of it," Nethercoat said.

The Beyond! name stems from the program's prize tiers, which are "Build," "Breakthrough" and "Beyond!" A top prize is a seven-day stay at Club Med, according to a Tech Data flier on the program.

The point system puts the highest value on Office 365 Small Business Premium, which is good for 5 points for every $1 sold. Office 365 Open is worth 3 points/$1, while Open Business/Open Value Commercial sales are worth 1 point per dollar.

Posted by Scott Bekker on October 16, 20130 comments

The parent company of Redmond Channel Partner magazine, 1105 Media LLC, also puts on the Visual Studio Live! event series all around the United States. I've been lucky enough to attend a few of the events, and I'm always struck by how much of the content is relevant to partners. Yet the audience is usually dominated by corporate IT developers.

In advance of the year-end blowout show, called Live! 360, I put that question about partner content and a few others to Andrew Brust, a longtime Microsoft partner himself and also one of the conference chairs.

Scott Bekker: Most of the attendees at VS Live! events are corporate IT developers. But a lot of the content seems like it would be pretty informative for developers working at Microsoft partner companies, as well. What are some of the things that a Microsoft partner could take away from VS Live next month?

Andrew Brust: I would say that partner companies, especially if they're systems integrators [SIs], need our content just as urgently as the corporate developers do, if not more so. Corporate IT shops tend to adopt new technologies at a conservative pace (as well they should), but SIs and other partners, who may need to provide guidance on the newer technologies and products, need to be up-to-speed very quickly. Live 360! is great for that. Whether it's the new Visual Studio 2012, the upcoming VS 2013, the new SQL Server 2012, the soon-to-come SQL 2014 or significant changes in SharePoint 2013, there's lots of new stuff to learn and more coming down the pike. We help tame that beast.

Scott: Are there any new capabilities of, or emerging best practices for, Visual Studio that are creating new business opportunities that Microsoft partners should be aware of?

Andrew: As Office 365 matures and reaches greater market penetration, it's creating new opportunities for partners. Getting customers on SharePoint is now far simpler and much less capital-spending-intensive than it once was, for example. Add to that the new app development model that works across Office desktop applications, Office Web Applications and SharePoint (both online and on-premises), and suddenly partner solutions can have much better reach. This impacts both SI partners and ISVs [independent software vendors], and goes a long way toward supporting the legitimacy of CSVs [cloud services vendors] as a new partner category.

Scott: For Microsoft partners, what are the top trends right now with Visual Studio that you've tried to illuminate through sessions at this show?

Andrew: The biggest trend is the orientation of both Visual Studio and .NET apps to the cloud and to HTML 5/JavaScript technologies. Whether it's JavaScript editing inside VS, or use of JavaScript frameworks like jQuery, the experience around deploying to Windows Azure or working with cloud-based ALM [application lifecycle management] tools like Team Foundation Service and its Git integration, this is an industry-wide pivot, and we're helping our attendees acclimate to the Microsoft flavor if it.

Live! 360 consists of four co-located events running from Nov. 18 to 22 in Orlando, Fla.: Modern Apps Live! SharePoint Live! SQL Server Live! and Visual Studio Live! Attendees can register for one of the events and attend sessions in the other three as part of the base registration price. More information is available here.

Posted by Scott Bekker on October 08, 20130 comments