News

Microsoft's First Post-Reorg Earnings Report Is Mostly Positive

- By Kurt Mackie

- October 24, 2013

Microsoft on Thursday reported $18.5 billion in revenue for its fiscal first quarter, a 16% year-over-year increase.

In fact, much of Microsoft's Q1 2014 financial report was mostly up compared with last year. The total gross margin was $13.4 billion, compared with $11.8 billion last year. Net income was $5.2 billion, up from $4.4 billion last year. Diluted earnings per share was $0.62, up from $0.53 last year and beating expectations by $0.08.

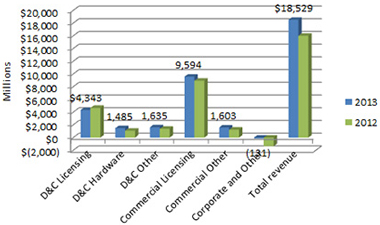

The Q1 report reflected Microsoft's new reporting structure that was explained in September. Instead of reporting the results from its five traditional divisions, Microsoft now has five reporting segments grouped under "Devices and Consumer" (D&C) and "Commercial" categories, plus it added a "Corporate and Other" category (see chart).

Microsoft Q1 2014 revenue earnings across segments.

Microsoft Q1 2014 revenue earnings across segments.

The D&C category includes licensing for Windows and Windows Phone, plus hardware and subscriptions to Office 365, among other items. The Commercial category includes licensing for some online services plus licensing for Microsoft's servers and other technologies (examples include Windows Server, SQL Server, Visual Studio, System Center, Windows Embedded, Microsoft Office, Exchange, SharePoint, Lync, Skype and Microsoft Dynamics excluding Dynamics CRM Online).

The D&C licensing segment that includes Windows and Windows Phone licensing, notably returned less revenue in Q1 ($4.3 billion) than it did last year ($4.7 billion). However, Microsoft explained that the Q1 results reflected "the deferral of $113 million of revenue primarily related to Windows 8.1 pre-sales."

Overall, Microsoft claimed that D&C revenue grew 4% year-over-year to $7.5 billion this quarter, even with a 7% decrease in Windows OEM revenue. The company claimed that its Commercial revenue grew 10% to $11.2 billion.

D&C highlights for the quarter included Surface revenue of $400 million and search ad growth of 47%, according to Microsoft's earnings report. Commercial highlights included double-digit revenue growth for SQL Server, Lync, Exchange and SharePoint, plus 103% cloud revenue growth, according to Microsoft.

Related:

About the Author

Kurt Mackie is senior news producer for 1105 Media's Converge360 group.