News

AWS Withstands Cloud Surge by Rivals Microsoft, Google

- By Gladys Rama

- November 01, 2017

Despite recording significant increases in their latest earnings reports, neither Microsoft Azure nor Google Cloud Platform (GCP) managed to put a significant dent in Amazon's lead in the cloud infrastructure services market.

That's the upshot of two recent reports by Canalys and Synergy Research Group. Both firms published data on the current state of the cloud market last week, capping off a period of back-to-back quarterly earnings releases from some of the world's top cloud service providers, including Amazon Web Services (AWS), Microsoft and GCP.

All told, the global cloud market grew by about 40 percent year over year in the third quarter, raking in a total of $12 billion (by Synergy's accounting) or $14 billion (by Canalys').

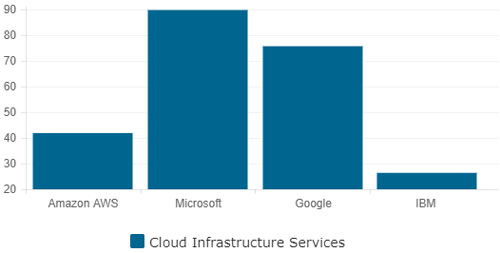

Both Azure and GCP posted dramatic year-over-year gains in their earnings reports. Google parent company Alphabet doesn't break out GCP earnings as a separate line item, but Canalys pegs GCP's year-over-year growth at 76 percent. Meanwhile, Microsoft reported that its Azure business nearly doubled year over year, growing by 90 percent in the latest financial period.

Year-over-year growth (%) of the top cloud infrastructure services providers in Q3 of 2017. (Source: Canalys)

Year-over-year growth (%) of the top cloud infrastructure services providers in Q3 of 2017. (Source: Canalys)

Compared to its biggest rivals, market leader AWS grew at a much more sedate pace at 42 percent, tying its own record for its smallest year-over-year increase in 10 quarters.

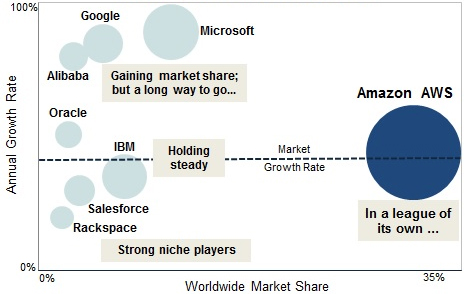

Nevertheless, AWS remains the top cloud provider by a wide margin with a worldwide market share that's pushing 40 percent -- more than its five closest competitors combined, according to Synergy's data.

"While we forecast 40% growth in the total market for 2017, there's still something a little shocking about seeing a business unit the size of AWS consistently growing its revenues by over 40%," said John Dinsdale, Synergy research director and chief analyst, in a prepared statement.

Competitive positioning of the top cloud infrastructure services providers in Q3 of 2017. (Source: Synergy)

Competitive positioning of the top cloud infrastructure services providers in Q3 of 2017. (Source: Synergy)

As stubborn as AWS' lead is, it's a safe bet that Microsoft will continue to be its most serious rival in the quarters to come. "AWS will continue to benefit from its first-mover advantage, broadest cloud services portfolio and strong awareness among developers," said Canalys research analyst Daniel Liu. "But Microsoft's substantial growth, driven by its huge enterprise installed base, compatibility with its Office portfolio and enhanced hybrid cloud solutions, means it will remain AWS' closest competitor."

With the cloud infrastructure services market being largely a two-horse race between AWS and Azure -- and others like Google and Alibaba jockeying for a distant third-place slot -- Dinsdale suggested that the window of opportunity for other providers to play upstart is steadily narrowing.

"It is becoming increasingly difficult for cloud providers outside of the leading pack to make an impression on the market share rankings," he said.