Distribution giant Ingram Micro shook up the channel space this week with the announcement that it was being acquired by a Chinese investment company and folded into the conglomerate HNA Group, based in Hainan.

What does the deal mean for Ingram's channel customers and vendor partners?

First, the numbers: The deal announced Wednesday by Tianjin Tianhai Investment Co. Ltd. values Ingram Micro at $6 billion, which is a 39 percent premium over the average closing share price of Ingram Micro for the last 30 trading days. HNA Group is Tianjin Tianhai's largest shareholder.

Things are unlikely to change for Ingram customers and partners in the near term, other than potential customer churn and employee turnover related to uncertainty. While the boards have approved the deal, it is not expected to close until the second half of 2016, and it faces some substantial regulatory hurdles before that happens.

Executives of the companies went out of their way to vow that things wouldn't change for Ingram Micro's customers and vendor partners after the deal closes, either.

"Ingram Micro is expected to remain headquartered in Irvine, California, and Ingram Micro's executive management team will remain in place, with Alain Monié continuing to lead as CEO. All Ingram Micro lines of business and all regional and country operations are expected to continue unaffected," the companies said in a statement.

Monié said being part of HNA Group would allow Ingram to accelerate strategic investment. "Additionally, Ingram Micro will now be part of a larger organization that has complementary logistics capabilities and a strong presence in China that can further support the growth and profitability objectives of our vendor and customer partners," he said.

There are good structural reasons to believe that Ingram Micro may continue as it is in the near future, as well. If the deal is approved, Ingram would be the biggest single component of HNA Group, which also holds aviation, tourism and logistics enterprises. Tianjin-HNA are also looking to Ingram to help broaden the acquiring group's global reach. "After the transaction, Ingram Micro would...facilitate the internationalization process of the group," said Adam Tan, vice chairman of the board of directors and CEO of HNA Group, in the statement. "With the help of Ingram Micro, HNA Group would have access to business opportunities in emerging markets, which have higher growth rates and better profitability."

Add to that the Chinese economic slowdown, which means the growth appeal in China is less for Ingram now than it might have been a year or two ago.

At first blush, it looks like the deal does more for HNA than for Ingram, meaning it seems unlikely that HNA will tinker with Ingram extensively in the next few years.

Posted by Scott Bekker on February 18, 20160 comments

Against a backdrop of general warnings about the global economy in the financial sector, IDC is ringing new alarm bells about IT spending for 2016.

In a news release Wednesday, IDC revised its 2016 forecast and projected that worldwide IT spending would post a "major slowdown" in 2016, thanks mostly to economic weakness in emerging markets and smartphone saturation. Overall, IDC expects global IT spending for hardware, software and services to reach $2.3 trillion this calendar year. That's about a 2 percent increase, which is about a third of the roughly 5-6 percent growth in IT spending every year since recovery from the financial crisis.

For IT companies doing business in the United States, though, 2016 could be OK. IDC is looking for stable spending, with an increase of about 4 percent. Breaking that figure down into its component parts, IDC is calling for a decline in the PC market, slower growth for servers and storage, and strong investments in big data, cloud, mobile and social.

Lest the U.S. tech industry get too comfortable, IDC warns that weakness in China and other fragile emerging markets could spark global problems. "The downside risks have now increased across all geographies, and the likelihood of a more widespread slowdown in IT spending is now higher than three months ago," said IDC analyst Stephen Minton.

A new feature of financial earnings calls for U.S.-based multinationals has been the caveat "constant currency." The strong U.S. dollar has led to revenue declines or slower growth even as products grow by other measures internationally for companies like Microsoft. That currency volatility seems set to continue for the duration of the calendar year, IDC says.

One bright spot in the IDC forecast for the rest of 2016: channel companies that have made the transition to acting as service providers. "IT buyers continue to prioritize software investments like data analytics and enterprise mobility, and have increasingly leveraged the service provider model in order to increase the effectiveness of their IT budgets," Minton said. "Underlying buyer sentiment is strong."

Posted by Scott Bekker on February 17, 20160 comments

Kaseya on Tuesday launched the Kaseya Business Management Solution (BMS), which it billed as a generation beyond the current professional services automation (PSA) tools offered by ConnectWise, Autotask and Tigerpaw.

As part of the launch, Kaseya also unveiled a competitive upgrade promotion of one year of free licenses for all ConnectWise, Autotask and Tigerpaw customers. Kaseya is one of the original vendors to managed services providers (MSPs) and comes from the remote monitoring and management (RMM) side of the market. RMM providers typically partner with PSA vendors to offer integrated solutions to MSPs.

Kaseya CEO Fred Voccola contends the all-inclusive price of $25 per seat per month for Kaseya BMS is a third of what the PSA vendors currently charge. "We're saying the value of a PSA is not what ConnectWise or Autotask say it is," Voccola said in a telephone interview. "Spending money on an internally facing PSA system is not as good as hiring another sales rep or technician."

"PSA-plus-RMM is so first-generation. The MSPs that do server and workstation management only will be dinosaurs very soon."

"PSA-plus-RMM is so first-generation. The MSPs that do server and workstation management only will be dinosaurs very soon."

Fred Voccola, CEO, Kaseya

The technology for BMS comes from Vorex, a Dallas-based PSA vendor that Kaseya recently acquired in a deal first disclosed in the BMS announcement. Voccola said Kaseya and Vorex together invested more than $25 million over the last three years in joint development. It was not clear whether the purchase price of Vorex was included in that sum.

Aside from the price per seat, what marks Kaseya BMS as a second-generation platform, according to the company, are a cloud-based system with authorized access from Web-enabled devices, an open platform, automated staff scheduling, a streamlined process for rolling out new service offerings, and project management and billing advances.

In the interview, Voccola objected to a question about whether the Vorex purchase and BMS release were defensive moves against PSA-RMM vertical consolidation by competitors, such as ConnectWise, which acquired RMM vendor LabTech in 2010.

"PSA-plus-RMM is so first-generation. The MSPs that do server and workstation management only will be dinosaurs very soon. We have over 1,000 customers who are using our Office 365 migration and management solution [365 Command]," Voccola said. "Instead of fighting the current, they're going with the current. RMM-plus-PSA just limits what MSPs need to do to be competitive in the next five to six years."

Posted by Scott Bekker on February 09, 20160 comments

Six months after telling partners that Microsoft FastTrack would only offer free cloud migration services to customers with more than 150 seats, Microsoft this week announced that the threshold is now dropping to 50 seats.

Partners contacted by RCP were scrambling to adjust their business models, after having already adapted to a major expansion of the FastTrack program to cover additional products and data migration workloads that was disclosed around the Microsoft Worldwide Partner Conference in July.

"Starting today, customers with 50 to 149 seats of Office 365 enterprise and small business plans can take advantage of our customer success service Microsoft FastTrack. Previously available only to customers with 150 seats or more, FastTrack provides resources and dedicated engineers who can assist you, or the Microsoft Partner you work with, to implement Office 365, onboard users and get the most business value from your investment," Microsoft said earlier this week in a blog post attributed to the Microsoft Office Team.

Said one partner, who asked not to be identified, "It would be nice if they would tell us what they're going to do, and then just do that for a while. They've never really done that fully. I get it -- it's the constant state of change and the speed of that change. But if it's hard for them, imagine how hard it must be for the partner ecosystem to keep up with it."

Another partner contended that the value of partners to Microsoft appeared to be "very much under fire." Of Microsoft's ongoing push into free services, the partner, requesting anonymity, said, "I expect this to continue across all fronts as they drive to the cloud."

There was a silver lining in Microsoft's simultaneous expansion of the Fiscal Year 2016 Adoption Offer to include Office 365 small business plans. Under the offer expansion, partners are now eligible for a payout of $25 per seat for 50 to 149 seats, alongside the existing payouts for 150 seats and above. The amount pales in comparison to the usual value of migration services, but, on the other hand, Microsoft's terms for the free migrations are quite limited. Outside of a narrow set of conditions, partners must frequently be called in to handle migrations anyway.

"We're choosing to look at it as a positive thing," said Pete Zarras, founder and president of CloudStrategies Inc. in Cedar Knolls, N.J. "We're looking to surround Microsoft services with our own additional services."

In fact, CloudStrategies is charging ahead of Microsoft. For customers with fewer seats than Microsoft's new 50-seat threshold, CloudStrategies is now offering free migrations itself on terms similar to Microsoft's if the customer signs up with CloudStrategies as their Cloud Solution Provider (CSP).

"We've already been selling free mailbox migrations modeled after Microsoft's services even if you have 20 seats. That's something we've been softly doing, and we're ready to go big with that," Zarras said.

Another partner looking to leverage the new seat minimums is Christopher Hertz, president of New Signature, the Washington, D.C.-based, two-time Microsoft U.S. Partner of the Year.

"As to the expansion of FastTrack to customers with 50 to 149 seats, we see this as an opportunity where the FastTrack service supports the customers' challenges. FastTrack has a fairly narrow and rigid service description, so it isn't a good fit for every customer, but where we can take advantage of it, we certainly do. That frees up our customers' budgets to focus on delivering higher-value activities -- like those related to governance, compliance and security," Hertz said.

Posted by Scott Bekker on February 04, 20160 comments

Microsoft is recalling 2.44 million AC power cords for Surface devices sold in the U.S. and Canada due to fire and shock risks.

According to a recall statement published Tuesday by the U.S. Consumer Product Safety Commission, "Microsoft has received 56 reports of the AC cords overheating and emitting flames and five reports of electrical shocks to consumers."

Affected Surface power cords include ones sold separately (left) and do not have a 1/8-inch sleeve on the end that connects to the power supply (right). Source: Consumer Product Safety Commission.

Affected Surface power cords include ones sold separately (left) and do not have a 1/8-inch sleeve on the end that connects to the power supply (right). Source: Consumer Product Safety Commission.

The affected power cords were manufactured in China, Taiwan and the United Kingdom, and were sold either standalone or bundled with a Microsoft Surface Pro, Surface Pro 2 or Surface Pro 3 computers before March 15, 2015.

The recall affects 2.25 million units in the United States and 190,000 in Canada. In the United States, the products were sold online at Microsoft.com or at Microsoft Stores, Best Buy, Costco and other stores between February 2013 and March 2015.

Posted by Scott Bekker on February 02, 20160 comments

Microsoft's cloud business is red-hot, but the company may have found a new way to keep its cloud server farms cool.

During Microsoft's earnings call last week, CEO Satya Nadella gave investors an update: "Our commercial cloud run rate surpassed $9.4 billion, up over 70 percent year over year and almost halfway to our [fiscal year 2018] goal of $20 billion." As one impressed financial analyst put it in the Q&A portion of the call, that run rate is "up $1.2 billion quarter to quarter, 70 percent year over year."

With that increased usage comes increased investments. Microsoft CFO Amy Hood said investments in datacenters and servers to respond to the demand included $2 billion in the last quarter, up from $1.5 billion the quarter before.

On Monday, Microsoft revealed where some of its R&D budget is going -- straight into the Pacific Ocean via an effort code-named Project Natick.

Providing air conditioning and power for tens of thousands of servers has always been a problem for the cloud megavendors. Microsoft, Google and others have pioneered different next-generation datacenter designs over the last decade. The earliest reports about Microsoft's huge datacenter buildout featured former Microsoft senior executive Ray Ozzie poring over maps for remote sites with enough water and power for the huge facilities.

But since the middle of last year, Microsoft has been testing an eight-foot-diameter steel capsule sunk 30 feet underwater off the coast of California. The ocean water keeps the servers cool, and Microsoft is theorizing about ways to use ocean currents to provide power.

"Microsoft researchers do believe this is the first time a datacenter has been deployed below the ocean's surface. Going under water could solve several problems by introducing a new power source, greatly reducing cooling costs, closing the distance to connected populations and making it easier and faster to set up datacenters," according to Microsoft's account of the project. See the full description and related video here.

It's not Microsoft's first go at the ocean in its cloud buildout. Over the last two years, Microsoft announced a number of major undersea cable projects. With Project Natick, though, Microsoft could completely change the way datacenters are built and deployed.

Posted by Scott Bekker on February 01, 20160 comments

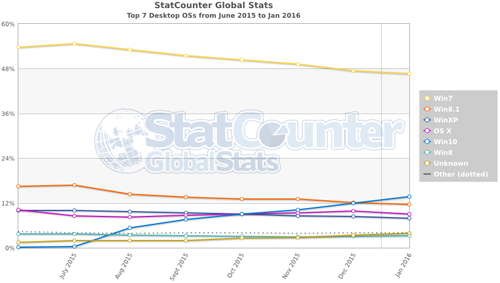

The goal of Windows 10 on a billion machines still looks like a challenge, but at least Microsoft has managed to turn back to the clock to 2010 adoption rates when it comes to the Windows client.

Independent Web analytics company StatCounter reported Monday that Windows 10 has overtaken Windows 8.1 globally for the first time. Windows 10 now has 13.7 percent market share for desktop usage. Windows 8.1 is at 11.7 percent. Windows 7 is still the gorilla in the room with 46.7 percent.

[Click on image for larger view.]

Top 7 desktop OSes from June 2015 to January 2016. (Source: StatCounter)

[Click on image for larger view.]

Top 7 desktop OSes from June 2015 to January 2016. (Source: StatCounter)

But Windows 10 now has a strong comparable to Windows 7. Windows 10, with the tailwind of the free upgrade offer, has now outpaced Windows 7 in market share in its first six months. Windows 10 is two-tenths of a percentage point ahead of where Windows 7 was (13.5 percent) after six months on the market in April 2010.

"Microsoft's determined promotion of Windows 10 seems to be having an impact," said Aodhan Cullen, CEO of StatCounter, in a statement. "However, there remains a lot of loyalty to Windows 7 and it will be interesting to see if it becomes the equivalent of XP which, 14 years after launch, refuses to lie down and still has a 8 percent global share in terms of desktop Internet use."

| |

Windows 10

(January 2016) |

Windows 8

(April 2013) |

Windows 7

(April 2010) |

| Worldwide |

13.7% |

5.0% |

13.5% |

| United States |

15.7% |

5.8% |

14.7% |

| United Kingdom |

22.4% |

6.6% |

15.2% |

Desktop Internet usage share for sixth calendar month since launch. (Source: StatCounter)

The StatCounter figures are roughly in line with, but slightly behind, what Microsoft executives said last week while discussing the company's second quarter financial results.

"We also made progress towards our goal of more than 1 billion Windows 10 monthly active devices. We crossed the 200-million milestone, and Windows 10 is outpacing adoption of any of our previous operating systems. In fact, adoption is nearly 140 percent faster than Windows 7," said Microsoft CEO Satya Nadella. "As far as the upgrade momentum, the fact that we crossed 200 million active devices, we feel very, very good about that."

Microsoft CFO Amy Hood also made the point that the Windows 10 adoption is coming in a declining PC market. "Our total OEM business declined 5 percent this quarter, outperforming the overall PC market," she said.

Nadella called out three areas where he sees additional growth opportunities for Windows 10.

Enterprise pilots are currently underway that will result in a big wave of enterprise deployments in Microsoft's second half of the year, which runs through the end of June, Nadella predicted. "I've never seen a Windows release in the enterprise with this level of accelerated deployment planned," Nadella said. "More than 76 percent of our enterprise customers are in active pilots, including organizations like Kimberly-Clark and Alaska Airlines, and 22 million enterprise and education devices are already running Windows 10. We're well positioned to grow our commercial device footprint in the second half."

The other areas to drive Windows growth, Nadella said, will be new monetization through services across a unified Windows platform and innovating new device categories in partnership with OEMs similar to the Microsoft Surface, which generated $1.3 billion in sales in the October to December quarter and which has spurred similar 2-in-1 machines from several vendors.

Posted by Scott Bekker on February 01, 20160 comments

AppDirect, one of the major players in the Microsoft Cloud Solution Provider (CSP) ecosystem, on Wednesday announced the acquisition of Radialpoint, a provider of cloud and technical support services for small businesses and consumers.

San Francisco-based AppDirect is one of just a few cloud marketplace technology providers in the Microsoft CSP ecosystem that combine their own systems with Microsoft's CSP API to handle functions like activating the Microsoft cloud service, license provisioning and recurring billing. AppDirect offers similar functionality for many non-Microsoft cloud applications, allowing Microsoft CSPs to offer richer bundles of services.

According to executives for both companies, the addition of Radialpoint will help AppDirect's CSP partners wrap services around Office 365 and other products.

"Customers can buy augmented support or migration services right at the time that they buy that app, and that goes with any app that's bought through the cloud marketplace," said Warren Levitan, president and CEO of Montreal-based Radialpoint, in a telephone interview.

Levitan joins AppDirect to lead the Radialpoint business as a subsidiary of AppDirect. All of the company's 80 employees will also join AppDirect, the companies said.

AppDirect is offering three new premium technical support services as a result of the Radialpoint acquisition: Cloud Services Support for Microsoft Office 365, Cloud and IT Helpdesk, and Consumer Technical Support.

AppDirect President and Co-CEO Daniel Saks says the addition of Radialpoint addresses the key "human element" of sales and support for AppDirect partners. "Business owners still need real people to help them get the most out of those services," Saks said.

The other major cloud marketplace technology provider in the U.S. CSP market, Odin, was acquired in December by distribution giant Ingram Micro.

For more detail on the CSP ecosystem, see RCP's guide here.

Posted by Scott Bekker on January 27, 20160 comments

Microsoft on Thursday announced tweaks to its internal systems to recognize more partners for the work they do to help customers get to the cloud in customer engagements where more than one partner is involved.

Over the last year, Microsoft has urged partners to work together to get customers actively using more of the eligible workloads within their cloud subscriptions, such as the less-used Yammer and Skype components of an Office 365 subscription. Lighting up those workloads is a priority for Microsoft as a corporation, with some in the investment community noting the risk to the company if customers don't perceive value in their cloud bundles and cancel their subscriptions.

However, even as it urges partners to cooperate, Microsoft's internal systems only recognize partners in a winner-take-all way. In the Digital Partner of Record process that has been fully in place since July, there is only room for one partner.

The moves announced Thursday will not change one critically important element: Incentives will still only be paid to the one partner who is the Digital Partner of Record, a designation given by the customer to an eligible partner from within Microsoft's customer portal.

There are other boons to be handed out, though. Microsoft wants to measure partners' services capacity and to track how many seats partners are involved with for the purpose of advancing a partner to a gold competency.

That last element could be difficult for a partner specializing in something like Yammer where they are the third or fourth partner involved with a customer, are paid directly by the customer, and therefore fly far below the Partner of Record radar.

"We've run into a challenge where in many situations there are actually multiple partners helping the same customer because of the number of workloads in Office 365," said Microsoft Worldwide Partner Group General Manager Gavriella Schuster in a telephone interview. "We got a lot of feedback from partners, not necessarily where incentives were concerned, but much more where earning the competency was concerned. They couldn't earn the competency even though they were helping partners because they were the secondary or even the third partner in the same customer."

Now Microsoft plans to use proof from several of its other systems to count seats on behalf of partners for competency purposes. Schuster said Microsoft will now also use:

- Records from Microsoft sales for the transacting partner of Enterprise Agreements and Open licenses

- The Cloud Solution Provider (CSP) Commerce Platform

- Conversations with Microsoft employees in the Microsoft FastTrack Onboarding Center

- Delegated Admin Privileges per workload

While the new procedures and integration of back-end systems should be fully up and running later this quarter or in April, Schuster said that Microsoft will begin counting seats toward partner competency targets as of the announcement Thursday.

Posted by Scott Bekker on January 14, 20160 comments

Channel-focused business recovery vendor StorageCraft Technology Corp. is getting a private equity investment of $187 million, as well as a new chairman and CEO in SonicWALL veteran Matt Medeiros, the company announced Wednesday.

Medeiros was the longtime president and CEO of SonicWALL when Dell bought the channel-centric security company in 2012. He had been at Dell as a vice president and general manager of security products since the acquisition.

The investment comes from TA Associates, a private equity firm based in Boston that has raised $24 billion in capital since it was founded in 1968. Some of the firm's previous technology investments include AVG, Nintex and Idera.

With a signed definitive agreement to invest, the deal is pending regulatory approval in Australia and is expected to close by the end of the month. As part of the changes, StorageCraft CEO Jeff Shreeve is retiring. Medeiros will have an ownership stake in the company, as will previous owner-executives Curt James, Scott Barnes, Brandon Nordquist and Mike Kunz. TA Associates Managing Directors Jonathan W. Meeks and Jason P. Werlin will join the StorageCraft Board of Directors.

"Our organic development is really working. It doesn't mean we won't be looking at inorganic opportunities."

"Our organic development is really working. It doesn't mean we won't be looking at inorganic opportunities."

Matt Medeiros, Chairman and CEO, StorageCraft

In a telephone interview Wednesday morning, Medeiros said StorageCraft's channel partners should expect even more attention and commitment from the 300-employee company, which opened a new headquarters facility in Draper, Utah, last year.

"We are, in fact, a channel company. We only have one way to go to market, and that's through our channel," Medeiros said. Both directly and through relationships with remote monitoring and management (RMM) providers and OEMs, StorageCraft's products are in use by more than 10,000 MSPs.

"Part of the reason TA's investing in the company is how do we double our partner count globally in the next 18 months?" Medeiros said. While the biggest greenfields for partner count growth are in the Asia/Pacific region, Japan and Latin America, Medeiros said there are also still opportunities for expansion in North America.

StorageCraft has traditionally developed its technology organically, including the recent broadening of its ShadowProtect technologies from its Windows base to also cover Linux and the development from the ground up of a new architecture for cloud backup.

Asked if the infusion of private equity money would lead to growth by acquisitions, Medeiros suggested that would not be his immediate focus. One of the reasons the investment was attractive to TA Associates, Medeiros said, was because StorageCraft had a large amount of intellectual property for a company of its size.

"In the near term, I think we have a lot in our development pipeline, and we're very pleased with it. Our organic development is really working. It doesn't mean we won't be looking at inorganic opportunities," he said.

Meanwhile, the company is also planning to ramp up its resources for partners, with overhauls of the partner program and the partner portal in the second half of the year, said Curt James, vice president of marketing and business development. The company also plans to launch its first partner conference in 2016 and make the show an annual event.

Posted by Scott Bekker on January 13, 20160 comments

One of our most popular recurring features over the years has been "Marching Orders," a collection of advice and predictions from channel luminaries about what to do and what to expect in the year ahead.

For 2016, we'll be running individual Marching Orders entries all through the month of January. Check back often for updates. This week look for entries from other 1105 Media editors from RCP's sister publications, including Redmond, Virtualization Review and MSDN. Next week, we'll carve out space for RCP columnists and contributors. The following week, Microsoft and other channel executives will weigh in. In the last week of the month, we'll hear from partners, analysts and other industry experts.

This first installment of Marching Orders is a look at some of the handrails that could help you plan for the coming year. Historically, the health of the Microsoft channel has tracked a few macro indicators, primarily sales of PCs, servers and storage. Mobility and cloud have become critical more recently. Last month, market researchers at IDC released Q3 2015 results, projections for the full year and some expectations for 2016. It's a very mixed bag.

- PCs: Following a dismal year, which saw PC shipment volumes drop a projected 10.3 percent, IDC is looking for the bleeding to slow in 2016. IDC still expects a soft market in the first half of the year, with a tailwind of commercial replacements and Windows 10 business upgrades in the second half. Still, the net effect is for a slight drop in shipments for 2016 from already low levels. A bright spot that the Framingham, Mass.-based analyst house sees is in detachable systems, such as the Microsoft Surface and its clones. Counting detachables as part of the PC market might be enough to flip a slight fall in shipments into a slight increase.

- Servers: Last year was a relatively strong year for server sales. The third quarter (the most recent available) marked the sixth consecutive quarter of year-over-year revenue growth. The biggest boost was earlier in the year with the combination of Windows Server 2003 end of support and Intel Grantley platform refreshes. More opportunities for growth of the modest, single-digit variety exist in early 2016 with the end of support for SQL Server 2005 on April 16. IDC estimates that there are 800,000 servers globally running SQL Server 2005. As you'd expect, most growth is happening in the rack-optimized, blade and density-optimized sectors, with towers on the decline. A lot of those rack-and-blade-style servers are going to the cloud megavendors, rather than to more traditional server customers.

- Storage: The picture for disk-based storage is similar to that for servers. Overall, the market is growing, but slight declines in enterprise shipments are masked by booming growth in shipments direct to hyperscale datacenters.

- Smartphones: Looking at smartphones as a proxy for mobility, there's no question that mobility continues to be a huge market force, but the go-go period where vendors rushed to fill every hand with a smartphone appears to have run the most profitable part of its course. IDC expects that when all the data is in, 2015 will prove to be the first year of merely single-digit growth in worldwide smartphone sales, albeit high single digits (9.8 percent). While that's a challenge for carriers and handset manufacturers, it speaks to the ongoing huge opportunities for the channel in enabling mobility, helping manage devices and creating cloud-based applications that help customers get the most business value out of their devices.

As with almost every year since the Great Recession started almost a decade ago, the core technology infrastructure business has problems but seems able to float traditional Microsoft partner infrastructure businesses for another year. The real growth, though, as in most of the last few years, appears to be available only to those partners who can harness the trickier opportunities in cloud and mobility.

More Marching Orders 2016:

Posted by Scott Bekker on January 04, 20160 comments

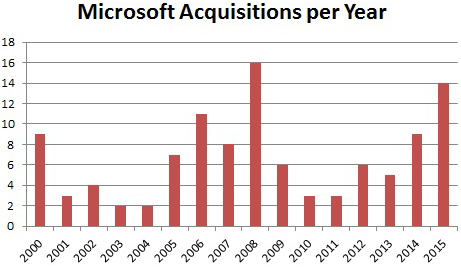

Microsoft was busier on the merger-and-acquisition front in 2015 than it has been in any year since 2008.

With two weeks still to go, Microsoft has acquired 14 companies in a calendar year that has seen a ton of M&A activity across the industry.

"It's white-hot," said Mike Harvath, CEO of Revenue Rocket Consulting Group, the Minneapolis-based firm that does a lot of M&A consulting in the channel, of the overall acquisition environment in 2015. Industry deal volume growth is expected to be up by double digits in 2015 with more of the same coming next year. "The bigs like Microsoft are buying around SMAC and the small guys are consolidating," Harvath said, using an abbreviation for social, mobile, analytics and cloud.

Many of the companies that industry giants like Microsoft are snapping up got investments right after the downturn and founders and owners are looking to monetize, Harvath said. "We've got some bubble and frothiness on the low end of the market due to this pressure to transform, and there's a bubble at the top end, primarily led by SMAC."

To be clear, there are different metrics for M&A activity. This year is clearly busy, although some of the years with fewer deals had some blockbusters. Case in point, 2014, when Microsoft completed only 11 acquisitions, but one of them was the $2.5 billion deal for Minecraft developer Mojang.

Source: Microsoft Investor Relations

Source: Microsoft Investor Relations

Looking at the company's purchases in 2015, many fit Microsoft's unique spin on SMAC, with a focus on personal productivity, machine learning-heavy analytics and security-specific cloud acquisitions, while at the same time padding strategic products like Office 365, Dynamics CRM and System Center with acquisitions that complement the existing feature set.

Mobile/Personal Productivity

In CEO Satya Nadella's nearly two years at the helm, Microsoft has de-emphasized Windows as a mobile phone platform and instead focused on making Microsoft software the best personal productivity software no matter the device OS. A big signifier of that trend was Microsoft's decision in late 2014 to buy someone else's smartphone e-mail software (Acompli) and slap the Outlook brand on it. It was a big move for Microsoft to essentially say, "Outlook is one of our most storied products, but someone else made a better version for the iPhone so we'll buy it and make that the new Outlook."

This year saw the continuation of Microsoft snapping up mobile app providers for other traditional Outlook functions, calendaring and task lists. The specific acquisitions in that area where Sunrise, a calendar-app maker for iOS and Android, and 6Wunderkinder, maker of the popular Wunderlist to-do list app.

Another mobile productivity acquisition with implications for Office 365 and Office Graph is Mobile Data Labs, which specialized in mobile apps that simplify and automate mileage, expenses, time tracking and reimbursement for what Microsoft describes as the "self-directed workforce."

Combining mobility, personal productivity, analytics and social is Datazen Software, which Microsoft acquired in April. Datazen made one of the most promising early Windows 8 apps for data visualization and Microsoft plans to plug the technology into its Power BI strategy.

Ed.'s Note: Microsoft also acquired teleconferencing firm Talko on Dec. 22, after this blog was published. Read about that acquisition here.

Analytics

Another analytics acquisition with a foot in the personal productivity world is organizational analytics specialist VoloMetrix, which Microsoft acquired in September. The company's software is supposed to help Microsoft's customers answer complicated questions like, "How can I improve my e-mails to ensure my communications are impactful?" and "Am I spending my time focused on my priorities?" according to Rajesh Jha, Microsoft corporate vice president for Outlook and Office 365. Microsoft plans to integrate the VoloMetrix technology with Office 365, Office Graph and Delve Organizational Analytics.

At the beginning of 2015, Microsoft bough Equivio, which the companies described as a provider of machine learning technologies for e-discovery and information governance. Microsoft has already productized Equivio in one of its most strategic product lines -- Office 365. At the beginning of this month, Microsoft launched the top-tier Office 365 E5 SKU, which bundles Equivio Analytics for e-discovery as one of several exclusive features along with secure attachments and URLs, access control, Power BI Pro, Delve Analytics, cloud PBX and PSTN conferencing.

Key to machine learning is statistical computing and predictive analytics. Microsoft got back to its programming language roots while also increasing its vertical integration in that strategic area with the acquisition of Revolution Analytics. The company was a commercial provider of software and services for R, a programming language for analytics.

Ed.'s Note: After this blog was published, Microsoft acquired analytics firm Metanautix on Dec. 18. Read about that acquisition here.

Cloud

While Microsoft has a huge arsenal of cloud technologies, Redmond buffed its capabilities in security and application management in 2015 via acquisitions.

Adallom, one of several Israeli companies Microsoft bought this year, has a cloud access security broker that works as a Security as a Service solution. Microsoft plans to use the Adallom technology to complement Office 365, the Enterprise Mobility Suite and Microsoft Advanced Threat Analytics.

Microsoft also acquired close partner Secure Islands, which built a data protection solution on top of Microsoft's rights management technology. Microsoft expects Secure Islands' technology to enhance the capabilities of the Azure Rights Management Service.

Just as Secure Islands works across on-premises systems, Microsoft cloud services, third-party services and Windows, iOS and Android devices, another acquisition, BlueStripe Software, gives Microsoft a quick step up into a hybrid environment. Microsoft customers were already using BlueStripe to extend System Center with application-aware infrastructure performance monitoring, according to a blog post by Mike Neil, Microsoft general manager for Enterprise Cloud, announcing the acquisition. Microsoft planned to discontinue BlueStripe as a product and integrate it into System Center and the Operations Management Suite.

Dynamics CRM

Improving Dynamics CRM was the focus of three separate acquisitions in the second half of 2015.

Adxstudio Inc. is another longtime partner that became part of Microsoft via acquisition. The company's Adxstudio Web portals are built natively on Dynamics CRM to allow customers to connect and engage with sales and customer services, according to Microsoft Corporate Vice President for Dynamics CRM Bob Stutz, who said the solutions will be available to all Dynamics CRM customers, both on-premise and in the cloud.

Microsoft also picked up FieldOne Systems LLC for its field service management solutions that include work order management, automated scheduling, workflow capabilities and mobile collaboration. Microsoft positions FieldOne as a fit with the functionality Microsoft acquired with Parature in early 2014.

Although the company name doesn't sound like it, the acquisition of Incent Games Inc. was also Dynamics CRM-related. Incent developed FantasySalesTeam, a sales gamification platform that Microsoft is integrating with its CRM product.

Microsoft had one other large acquisition in 2015, but it's on the pure gaming development side of the business. Microsoft bought Havok, the real-time 3-D physics creator, from Intel. Microsoft plans to include Havok in its tools and platform components for developers and to continue to license the development tools to Havok's existing partners.

Microsoft 2015 Acquisitions

| Date |

Company |

| Nov. 9 |

Secure Islands |

| Nov. 5 |

Mobile Data Labs |

| Oct. 2 |

Havok |

| Sept. 28 |

Adxstudio Inc. |

| Sept. 8 |

Adallom |

| Sept. 3 |

VoloMetrix |

| Aug. 3 |

Incent Games Inc. |

| July 16 |

FieldOne Systems LLC |

| June 10 |

BlueStripe |

| June 2 |

6Wunderkinder |

| April 14 |

Datazen Software |

| Feb. 11 |

Sunrise |

| Jan. 23 |

Revolution Analytics |

| Jan. 20 |

Equivio |

Source: Microsoft Investor Relations

Posted by Scott Bekker on December 16, 20150 comments