News

Report: Alibaba Giving Chase to Cloud Leaders AWS and Azure

- By David Ramel

- February 06, 2018

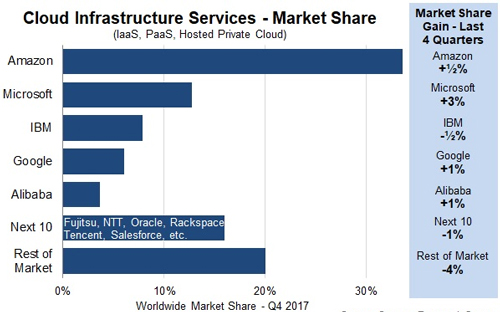

Cloud upstart Alibaba is edging its way into the leader pack of the global cloud computing market, according to recently released data from Synergy Research Group.

In its report for Q4 2017, Synergy echoed the general theme of previous quarters: Amazon Web Services (AWS) remains the unquestioned cloud leader, and is primarily challenged by the likes of IBM, Google and especially Microsoft, whose Azure platform is sometimes said to have the edge over AWS in some areas.

However, multinational conglomerate Alibaba Group Holding Ltd., based in China, has now positioned itself as a viable competitor with its Alibaba Cloud.

"AWS maintained its dominant position with revenues that exceeded the next four closest competitors combined, despite huge strides being made by Microsoft," Synergy said in a Feb. 2 statement. "A notable change in Q4 was that a doubling of cloud revenues at Alibaba enabled it to join the ranks of the top five operators for the first time."

Fourth-quarter cloud market standings. (Source: Synergy)

Fourth-quarter cloud market standings. (Source: Synergy)

AWS, Microsoft and Alibaba each announced their latest quarterly financial reports last week. AWS reported revenue for the period at $5.1 billion, a 45 percent year-over-year increase. Microsoft reported a 98 percent year-over-year increase in Azure revenues, but didn't break out a specific dollar amount. Trailing distantly, but growing rapidly, was Alibaba, whose cloud earned $553 million in revenue in the last quarter, representing a 104 percent year-over-year jump.

Synergy said AWS and its second-tier chasers -- now including Alibaba -- all gained market share at the expense of smaller players. Overall, the arena is seeing good growth, as spend on cloud infrastructure services increased 46 percent from the final quarter of 2016.

"We fully expected a year-end boost in cloud growth rates but the numbers came in a little stronger than anticipated, which says a lot about just how robust are the market drivers," said Synergy exec John Dinsdale. "As demand for cloud services blossoms, the leading cloud providers all have things to be pleased about and they are setting a fierce pace that most chasing companies cannot match. Smaller companies can still do well by focusing on specific applications, industry verticals or geographies, but overall this is a game that can only be played by companies with big ambitions, big wallets and a determined corporate focus."

About the Author

David Ramel is an editor and writer at Converge 360.