News

AWS Keeps Cloud Lead Despite 'Strong Growth' by Microsoft

- By Gladys Rama

- February 07, 2017

Amazon Web Services (AWS) is still the runaway leader of the public cloud market, recent gains by other vendors aside, according to a pair of recent studies.

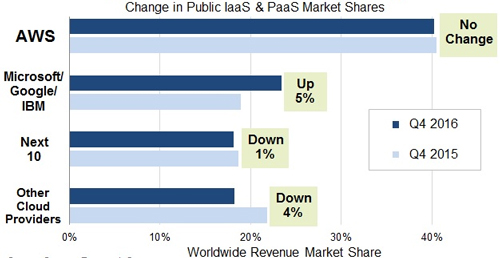

AWS' market share in the fourth quarter of 2016 was just over 40 percent, according to newly released data from Synergy Research Group on the state of the public Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) market. That's almost double that of its three nearest competitors -- Microsoft, Google and IBM -- which together made up 23 percent.

On the other hand, Synergy's data indicates that AWS' market share was basically stagnant between 2015 and 2016. Its recent fourth quarter earnings report hinted at a slowdown, showing just 47 percent year-over-year revenue growth -- still impressive but, by the cloud giant's standards, its slowest on record.

In contrast, the three-vendor chase group behind AWS collectively grew by 5 percent last year, "helped by particularly strong growth [by] Microsoft and Google," according to Synergy. In its own recent earnings report, in fact, Microsoft indicated that revenue from its Azure cloud platform ballooned by 93 percent.

For the rest of the public cloud field, however, the race looks grim. The next group of 10 vendors -- notable members include Alibaba and Oracle -- saw their collective market share slip by 1 percent year over year in the fourth quarter. That's bad news for Oracle, which has lately been ramping up its IaaS portfolio in a bid to directly challenge AWS. The rest of the market, which includes an unspecified number of "small-to-medium sized cloud service providers," dropped by 4 percent.

Source: Synergy Research Group

Source: Synergy Research Group

"While a few cloud providers are growing at extraordinary rates, AWS continues to impress as a dominant market leader that has no intention of letting its crown slip," said Synergy Chief Analyst and Research Director John Dinsdale in a prepared statement.

AWS has demonstrated a commitment to expanding both its infrastructure and its services portfolio, according to Dinsdale. In its earnings report last week, AWS said it opened 11 new cloud datacenter regions and added 1,017 new services in 2016. Such expansion is key to "achieving and maintaining a leadership position," Dinsdale said.

A separate study by analyst firm Canalys also highlights the importance to cloud infrastructure providers of expanding their datacenter footprints. In a media alert released Monday, Canalys noted that ever-increasing demand for cloud infrastructure services worldwide has necessitated massive datacenter build-outs among the leading providers -- particularly in geographies where data sovereignty laws are stringent.

"Strict data sovereignty laws and customer demand are pushing cloud service providers to build data centers in key markets, such as Germany, Canada, Japan, the UK, China and the Middle East; where personal data is increasingly required to be stored in facilities that are physically located within the country," said Canalys Research Analyst Daniel Liu in a prepared statement. "Expanding data center locations across the world and into key economies has been critical in supporting multi-national customers in their digital transformation initiatives."

Source: Canalys

Source: Canalys

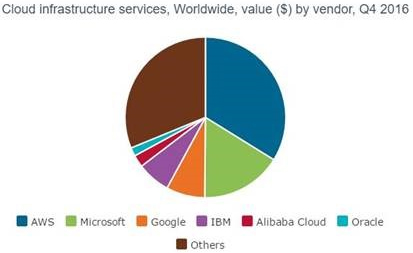

Canalys' market share figures differ from Synergy's -- not surprising, given the variations in each companies' proprietary datasets and measurement tools -- but the top standings are the same. The lion's share of the cloud infrastructure arena in the fourth quarter belonged to AWS, according to the firm, with 33.8 percent of the market. Behind it were Microsoft, Google and IBM, which together accounted for 30.8 percent. Trailing the leaders, once again, were Alibaba and Oracle, with 2.4 and 1.7 percent of the market, respectively.