In-Depth

How Can Microsoft (and Its Partners) Leverage LinkedIn?

With Microsoft’s monster acquisition closed, partners look ahead to the opportunities. Dynamics 365 and Learning are obvious highlights, but details from Redmond remain scarce.

- By Barb Levisay

- March 06, 2017

In June 2016, when Microsoft announced its intention to acquire LinkedIn, the move appeared to be more defensive block than strategic vision. Microsoft's big bet on Dynamics, with its customer relationship management (CRM) foundation, was at risk if Salesforce.com Inc. took ownership of the LinkedIn data. A lack of bravado and specific next steps when the deal closed in December suggest that all parties are just now figuring out where they go from here.

For the time being, the partner community is left to figure out how or if the acquisition presents them with new opportunities or challenges to their turf. So far, those paying the most attention to the acquisition are Dynamics and Learning partners, but there's a little-known data play that may surprise the wider partner community.

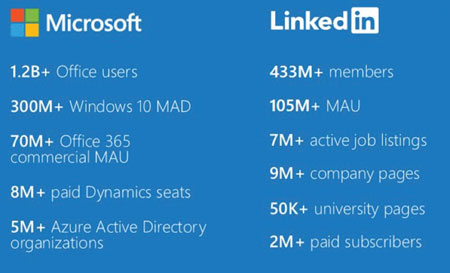

The initial vision laid out by Microsoft to justify the $26.2 billion acquisition focused on how the firms would expand engagement with business professionals across LinkedIn, Office 365 and Dynamics. The numbers on both sides are impressive, and together the global giants touch the entire professional lifecycle -- from high school to retirement.

On Dec. 8, 2016, the day the deal closed, Jeff Wiener, CEO of LinkedIn, described the path ahead in an open letter to LinkedIn employees: "We'll continue to remain focused on growing LinkedIn and creating value for our members and customers. Over the coming months, we'll start sharing more about how we're integrating products, especially in areas where we can leverage Microsoft's scale, [for example]:

- LinkedIn identity and network in Microsoft Outlook and the Office suite

- LinkedIn notifications within the Windows action center

- Enabling members drafting résumés in Word to update their profiles, and discover and apply to jobs on LinkedIn

- Extending the reach of Sponsored Content across Microsoft properties

- Enterprise LinkedIn Lookup powered by Active Directory and Office 365

- LinkedIn Learning available across the Office 365 and Windows ecosystem

- Developing a business news desk across our content ecosystem and MSN.com

- Redefining social selling through the combination of Sales Navigator and Dynamics 365."

The same announcement was released to Microsoft employees by CEO Satya Nadella, confirming LinkedIn's independence and directives. With such broad-stroke statements from Nadella as "connecting the world's leading professional cloud with the professional network, we can create more connected, intelligent and productive experiences," there appears to be much work to do on the details.

One change that seems critical to success is to move LinkedIn employees off Google Apps and on to Office and Dynamics 365. If LinkedIn employees are going to be driving the use cases for integrations with Microsoft productivity and business solutions, they should be using the applications.

Reinforcing Commitment to Business Solutions Market

If the driving force behind the LinkedIn acquisition really was to block Salesforce, it confirms Microsoft's commitment to building Dynamics 365 into a business management solution powerhouse. That commitment is a good signal for partners. Allowing Salesforce to take ownership of the world's leading professional networking community would have delivered a competitive blow to both Office 365 and Dynamics partners.

"Microsoft is up against Salesforce, which is currently ahead in market share," says Steve Mordue, CEO of Forceworks. "Microsoft appears to have overpaid to keep it away from Salesforce, which wouldn't have been good for Microsoft's trajectory in business solutions. I wouldn't want to be in a compete opportunity and have to admit Salesforce just bought LinkedIn."

Mordue is already seeing the benefit from that decision in sales opportunities. "Even today, before we know what the real benefits will be, customers who are looking at Dynamics versus Salesforce understand the implications," Mordue says. "Even though the details are still being fleshed out, the fact that we have LinkedIn has a lot of appeal. Businesspeople use it, salespeople use it. LinkedIn is important to them, so we are using it in sales conversations."

Salesforce itself tried to block the Microsoft acquisition to protect its own interests, claiming that Microsoft would unfairly block access to the data. Microsoft President and Chief Counsel Brad Smith outlined the commitments made to assure U.S. and international regulatory agencies that the acquisition would not be anti-competitive. For the next five years, Microsoft will continue to support the Office Add-In program, which allows third-party professional social networking services to integrate into Microsoft Outlook, Word, PowerPoint and Excel.

At the same time, Smith didn't mince words laying out Microsoft's opinion of its fierce competitor: "The LinkedIn data is public today and we want to make that data useful in lots of new ways. We're committed to continue working to bring price competition to a CRM market in which Salesforce is the dominant participant charging customers higher prices today."

It's All About the Data

Smith's statement, focusing on data, is really what the LinkedIn acquisition is all about. With lots of information -- from education and job history to skills and job descriptions -- collected from more than 400 million users worldwide, LinkedIn sits on a huge, largely untapped store of data.

Partners see the potential in that data, which could be integrated into and delivered through any of the Microsoft solutions, from Office and Dynamics to Azure-developed services and apps. "The more interesting outcomes of the acquisition are going to be around analytics. I expect we will see effort around Dynamics 365 and Azure on the analytics side with machine learning," says Mordue, whose company, Forceworks, focuses on Dynamics CRM. "For example, you could receive an alert that reflects unusual activity on LinkedIn associated with one of your customers. If half of the senior management team changed jobs, or a whole bunch of new hires are brought on, you would know about it."

User and member counts presented during the June 13, 2016, acquisition announcement. Source: Microsoft

User and member counts presented during the June 13, 2016, acquisition announcement. Source: Microsoft

The opportunity for partners to help customers use the LinkedIn data is already supported to some extent through at least two products. The LinkedIn Sales Navigator for Dynamics surfaces public profile data, and InsideView is a Dynamics add-on for aggregating data. Based on the goals set out by Weiner and Nadella, there is likely to be significant advancement and expansion of the data connections. Crucially, balancing the privacy of members with the interest of marketers will always be a challenge.

Another developing form of LinkedIn's data potential, with more far-reaching implications, is the Economic Graph. With lofty ambitions, the Economic Graph is a digital mapping of the global economy. According to the Web site, "It will include a profile for every one of the 3 billion members of the global workforce, enabling them to represent their professional identity and subsequently find and realize their most valuable opportunities. It will include a profile for every company in the world, who you know at those companies up to three degrees to help you get your foot in the door, and the product and services those companies offer to enable you to be more productive and successful. It will digitally represent every economic opportunity offered by those companies, full-time, temporary and volunteer, and every skill required to obtain those opportunities. It will include a digital presence for every higher education organization in the world that can help members obtain those skills. And it will overlay the professionally relevant knowledge of every one of those individuals, companies and universities to the extent that they want to publicly share it."

[Click on image for larger view.]

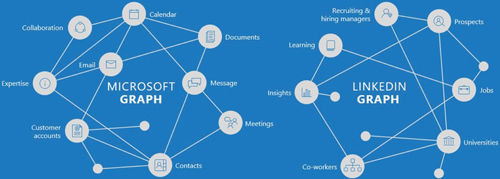

Professional world information sources as viewed from the two organizations. Source: Microsoft

[Click on image for larger view.]

Professional world information sources as viewed from the two organizations. Source: Microsoft

For partners, the opportunities to help customers take advantage of a digital map of the global economy that includes every member of the global workforce and their skills, all open jobs, all employers and all educational institutions seem limitless. For public sector partners, the Economic Graph presents interesting potential to add value to municipality and education projects. Through the data on local job growth and skills needs, governments can use better data and analytical capabilities to pursue workforce reskilling and economic development strategies. A pilot project with the Denver metro area, called Rework America Connected, reflects the potential use of the skills data being collected on LinkedIn.

LinkedIn has released a couple of specialized applications that illustrate how the Economic Graph data could be used in general business. They also, presumably, are a way to collect information to build the data set. The applications include LinkedIn Salary, which provides salary data by job title, and LinkedIn Profinder, which is a freelancer matching service. By creating these applications, LinkedIn is wisely trying to add services that will attract members to the site for more than just recruitment, job searching and networking.

While the rich data sources of LinkedIn clearly bring opportunity to partners, there's no immediate competitive advantage based on the assurances made by Microsoft to not restrict data access for competitors. The advantage partners do have is a more direct connection to the source of information about progress of the Economic Graph vision. Plus, customers are likely to see the relationship between Microsoft and LinkedIn as a long-term value, assuring data access after time limits have expired.

LinkedIn Learning and Skill-Set Development

In 2015 LinkedIn acquired Lynda.com, a training platform, to expand engagement with members through workforce and skills training. Now known as LinkedIn Learning Solutions, some Microsoft Learning Partners have expressed concern over competition from the skills development aspect of the acquisition.

"When the acquisition occurred, there were Learning Partners who were very concerned about competing with training that would be out there for free," says Jennifer Didier, president and CEO of Directions Training Center. "The whole training industry is going through a digital transformation. Different customers are looking for different ways of learning."

"We are looking forward to seeing how they integrate the LinkedIn data into the Office products."

Jennifer Didier, President and CEO, Directions Training Center

So far, the acquisition hasn't impacted Directions business, which is focused on formal learning as opposed to do-it-yourself training videos. "We create scenarios where customers can break and fix. They don't have to worry about setting up the labs and technology," Didier says. "The value to our clients is that students get to try it, do it and interact with the instructor. There is still a big market for the formal learning that requires a sandbox environment and expert trainers."

Didier is very positive on the acquisition from two perspectives -- the value Microsoft ownership will bring to Directions Training Center's own sales and HR teams, as well as the longer-term positive impact on the field of skills development.

"We were really excited about the acquisition. Being part of Microsoft as a gold managed partner, we are looking forward to seeing how they integrate the LinkedIn data into the Office products," Didier says. "Both our sales team and our HR team expect to see improvements with tighter connections."

At a higher level, Didier sees huge potential in Microsoft and LinkedIn working together to impact the STEM skills gap. "This is definitely an opportunity to integrate learning partners to extend outreach and overcome the shortage of technical people," says Didier. "It is especially important to reach kids who may not be college-bound, help them get the skills for good jobs and place them with the technology companies that are struggling to expand."

With the challenge partners are currently facing in finding qualified employees, more Microsoft focus on technology training can only be helpful. In his memo, Brad Smith called out Microsoft's commitment: "While technology tools are not a panacea for current economic challenges, we believe they can make an important contribution. Microsoft and LinkedIn together have a bigger opportunity to help people online to develop and earn credentials for new skills, identify and pursue new jobs, and become more creative and productive as they work with their colleagues. Working together we can do more to serve not only those with college degrees, but the many people pursuing new experiences, skills and credentials related to vocational training and so-called middle skills. Our ambition is to do our part to create more opportunity for people who haven't shared in recent economic growth. With the combination of Microsoft and LinkedIn, we can take new steps to help people learn added skills and seek better jobs."

Internal Use of LinkedIn Sales and Marketing

For partners thinking about how they'll help customers take advantage of the Microsoft/LinkedIn relationship, the old adage, "Eating your own dogfood," applies. Especially for Dynamics partners, using the LinkedIn connectors and tools for internal use allows salespeople to speak from experience to translate the benefits customers will realize. For those partners not yet using internal rights licenses of Dynamics 365, there's plenty of help on the Microsoft Partner Network (MPN) portal to get started.

Using LinkedIn for marketing can deliver multiple benefits, according to Nurture Marketing, a consulting firm that specializes in advising Microsoft partners. "We recommend LinkedIn over other common other SEM [Search Engine Marketing] tools based on the ability to 'hypertarget.' Hypertargeting allows you to target your advertisement to geography, industry, seniority, skills, type of LinkedIn group, among other data categories," says Eric Rabinowitz, Nurture Marketing's CEO/CMO. "When a person meeting your criteria views their LinkedIn timeline, your advertisement is displayed on the right-hand panel. When they click on the ad, they're taken to a landing page that includes a compelling call-to-action such as a white paper chosen for the specific persona."

Perhaps more important, LinkedIn is a great way to test targeting and messaging on a small budget. "Through a low budget ($500-$1,000) text ad campaign you can generate some leads, but the real value is the information back from the reports -- it's like a mini R&D exercise," says Erik Frantzen, president and COO at Nurture Marketing. "LinkedIn text ads are powerful because that allow you to use that hypertargeting to test and refine your message and offers."

Senior Microsoft partner executives also have big ambitions for transforming the way Microsoft connects partners with one another and with customers using LinkedIn. Whether the LinkedIn platform would replace Partner Center and other tools or augment them hasn't been clarified, but it would make sense.

In an interview at the Microsoft Worldwide Partner Conference (WPC) last July, Microsoft Worldwide Partner Group Corporate Vice President Gavriella Schuster brought up the LinkedIn acquisition in response to a question about the way some customers, like GE, are becoming partners in certain respects.

"There's so much I need from [LinkedIn] to help me create this whole new professional network of all of [our partners and customers] to create these connections."

Gavriella Schuster, CVP, Worldwide Partner Group, Microsoft

"That's kind of what this next generation of the ecosystem is. And why Microsoft has to stop being like, 'Oh, we're the hub and you're all spokes.' It's more like we're a connector. Our job is to create connections between you. To create opportunity between you and to let you then take that wherever it goes. That's what I see as the next generation of the partner network. Our job is that we create connections, and that's why I'm so thrilled about this LinkedIn acquisition," Schuster said at the time.

"There's so much I need from [LinkedIn] to help me create this whole new professional network of all of [our partners and customers] to create these connections," Schuster said. "Then figure out how do we help people plug into each other in all these new ways."

Since the deal closed, communication to partners about the impact of the acquisition has been limited, but the investment that Microsoft made in LinkedIn speaks volumes. Microsoft has placed a $26 billion strategic bet, further committing to provide an end-to-end set of business solutions to customers. Partners who want to build a closer relationship with Microsoft should consider joining the charge to grow Dynamics 365 market share, which will require a larger pool of partners selling both CRM and ERP. This is an opportune time to get on the path that Microsoft has staked.

For the time being, Microsoft and LinkedIn appear to be wrapping their arms around the potential of integration with the business solution ecosystem and how to balance their antitrust commitments -- all without alienating members with advertising overload. When asked to comment for this article, Microsoft declined to share additional plans at this time. Inspire, the recently changed name for the WPC, is often the launching ground for emerging plans, so July may be a target date for announcements.

For partners, the true value from the LinkedIn acquisition will clearly be in the data. Integrations to individual and company profiles will continue to improve social selling and relationship building through Dynamics 365. The Economic Graph provides a fresh platform of information to fuel Azure-based services and applications. Connecting the next generation with the tools and skills they need to participate in the digital revolution will be a win for society and the channel. With potential on that scale, a channel of entrepreneurs is bound to find creative ways to bring more value to customers.