A line of APC surge protectors that have been out of production for a decade just got recalled over fire safety concerns.

"The surge protectors can overheat, smoke and melt, posing a fire hazard," the U.S. Consumer Product Safety Commission (CPSC) said in its recall statement issued earlier this month.

According to the CPSC, about 15 million units are covered by the recall, which involves APC 7 and 8 series SurgeArrest protectors.

The APC 7 Series (top) and the APC 8 Series (bottom).

The APC 7 Series (top) and the APC 8 Series (bottom).

"The firm has received 700 reports of the surge protectors overheating and melting and 55 claims of property damage from smoke and fire, including $916,000 in fire damage to a home and $750,000 in fire damage to a medical facility. There are 13 reports of injuries, including smoke inhalation and contact burns from touching the overheated surge protectors," the CPSC statement said.

It took the CPSC and APC, now owned by Schneider Electric, more than a decade to recall the devices, which were sold between 1993 and 2002 at Best Buy, Circuit City, CompUSA and other stores for between $13 and $50.

A Schneider Electric/APC page lists the affected model numbers and instructions for getting a free replacement.

The CPSC statement notes that it is illegal to resell or attempt to resell a recalled product.

Posted by Scott Bekker on October 08, 20130 comments

Steve Ballmer's replacement as Microsoft CEO is likely to take home a much bigger annual paycheck.

Ballmer, who has been CEO since 2000 and was under pressure to leave from activist investors, announced in August that he would retire within the next 12 months.

On Friday, Microsoft posted its 2013 proxy statement, and there was some media attention paid to the relative meagerness of Ballmer's bonus. He earned $1.26 million for the year, which consisted of a base salary of $697,500 and a bonus worth 79 percent of that at $550,000.

On a percentage basis, it was the lowest of the bonus payouts to named executive officers in the statement. In explaining Ballmer's bonus, the proxy statement balanced record revenues against the 18 percent decline in Windows operating division revenue and the $900 million Surface RT inventory charge.

That aside, the proxy statement makes clear that the Compensation Committee of the Microsoft Board of Directors believes that Ballmer, by his own request, is severely underpaid.

A chart labeled "CEO pay comparison" shows Ballmer's maximum compensation could have been $2.1 million, compared with a "Dow 30 and Technology Peer Group (average)" of $16 million.

[Click on image for larger view.]

The "CEO pay comparison" chart from Microsoft's 2013 proxy statement.

[Click on image for larger view.]

The "CEO pay comparison" chart from Microsoft's 2013 proxy statement.

"Consistent with longstanding practice and his request, Mr. Ballmer does not participate in the equity component of the Incentive Plan. His award is payable entirely in cash, and is correspondingly smaller than those made to the other Named Executive Officers," the proxy statement read. "As the principal leader of Microsoft, Mr. Ballmer focuses on building our long-term success, and, as one of our largest shareholders, his personal wealth is tied directly to Microsoft's value. While the Committee and the Board believe Mr. Ballmer is underpaid for his role and performance, they have accepted his request."

Ballmer owned 3.99 percent of all common shares of Microsoft stock as of Sept. 13.

The other named executive officers listed in the proxy statement's 2013 compensation tables all took home much higher pay packages (mostly in stock awards):

- Kevin Turner, COO, $10.4 million

- Satya Nadella, president, Server and Tools Business, $7.7 million

- Kurt DelBene, president, Microsoft Office Division, $7.6 million

- Amy Hood, CFO, $7.5 million

- Peter Klein, former CFO, $4.1 million

Posted by Scott Bekker on October 07, 20130 comments

Microsoft is Bill Gates' company in the popular imagination.

After all, he co-founded the company 38 years ago and outlasted co-founder Paul Allen. Gates is also reported to be spending a lot more time on the Microsoft campus lately.

However, the August announcement that CEO Steve Ballmer would retire in 12 months fueled questions about how much control Gates still had in the boardroom. More possible evidence that his legendary grip on the board might be slipping comes in the form of reports of a lobbying campaign by three top investors to force Gates out. As reports about the campaign note, investors have been calling for Ballmer's head for years over the stock's flat performance, but the recriminations rarely included Gates.

In an effort to fund his philanthropic efforts and to gradually remove himself from Microsoft, Gates set a plan in motion years ago to reduce his financial stake in the company. If the plan continues, he'll have no financial stake in Microsoft in 2018, according to Reuters.

A look at proxy statements filed by Microsoft from 1994 up through the 2013 document filed on Friday shows how much of his financial influence over Microsoft Gates has sold off.

He owned 49 percent of the company when Microsoft went public in 1986. By 1994, he'd already cut his stake in half to 24.6 percent. In 2000, when he handed the CEO reins to Ballmer and stepped into the chairman and chief software architect role, he still held 13.7 percent of the common shares. When he backed away from any day-to-day role in 2008, he owned 8.76 percent. This year, Gates is down to 4.52 percent, which is close to Ballmer's current stake of 3.99 percent.

Although Gates is still the largest individual shareholder, it's possible that his diminishing financial stake has reached a tipping point that no longer warrants him getting his way in the boardroom.

Posted by Scott Bekker on October 07, 20130 comments

At the SMB Nation Fall Conference in October, Harry Brelsford and I will be presenting a session on why most partner programs fail. It's a (slightly) tongue-in-cheek approach to the topic of what makes a good channel program from a solution provider's perspective.

While Harry and I have lots of ideas of our own, we'd like to make sure the presentation is grounded in the reality that you're seeing out there every day. Help us out by taking this very brief, completely anonymous survey on what you value in a partner program these days.

Click here to take the survey.

Think about attending the conference, as well, if your schedule permits. Lots of discussion on Windows XP end-of-life, partnering in the post-Small Business Server world, mobility and new security realities. Should be a productive and fun few days in Las Vegas.

Posted by Scott Bekker on September 30, 20130 comments

When it comes to the value of global brands, Microsoft held steady in 2013 even as Google and Apple vaulted ahead, according to a widely watched report on brand value.

Brand consultancy Interbrand released its 14th annual Best Global Brands report on Monday. It valued Apple's brand at $98 billion for first place. It was the first time anyone displaced Coca-Cola for first place in the history of the report. But Apple wasn't the only company beating Coca-Cola this time around. Google, valued by Interbrand at $93 billion, also beat out the soft-drink maker, valued at $79 billion.

IBM came in fourth at almost $79 billion and Microsoft rounded out the top five with a $59 billion value.

[Click on image for larger view.]

The top 28 brands in Interbrand's list. Download full PDF here.

[Click on image for larger view.]

The top 28 brands in Interbrand's list. Download full PDF here.

Apple and Google also rode to the top on a rocket, with their calculated brand value going up 28 percent and 34 percent, respectively, compared to the 2012 results. Coca-Cola, IBM and Microsoft all had brand values going up between 2 percent and 4 percent.

To calculate brand value, Interbrand says it uses a combination of the financial performance, the brand's role "in influencing consumer choice" and the brand's "strength to command a premium price."

Tech was well represented at the top of the list. In addition to holding four of the top five spots, the tech sector held two more top 10 slots -- Samsung and Intel. Those two companies, however, were on different trajectories. Samsung had a 20 percent increase in brand value, while Intel had a 5 percent drop, according to Interbrand.

Other big gainers on the list from tech were Facebook, with a 43 percent increase in brand value for 52nd on the list, and Amazon, with a 27 percent gain for the 19th spot.

Being a top-five brand was a plus for Microsoft, but the report showed a strongly negative trend for Microsoft's recent acquisition, Nokia. With a drop in value of 65 percent to No. 57 on the list, Nokia experienced the largest decline in brand value in the history of Best Global Brands, according to Interbrand.

Even there, it arguably could be worse: Yahoo and BlackBerry fell of the list entirely.

Posted by Scott Bekker on September 30, 20130 comments

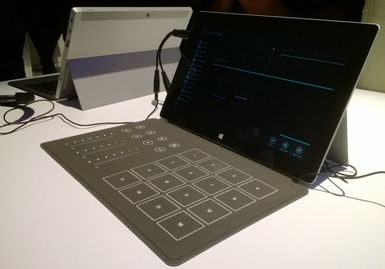

The Surface 2 launch this week drew legitimate fire for a number of things -- the focus on speeds and feeds as if we were still in the PC refresh era, the lack of a mini version, and the failure to acknowledge or address serious pricing problems.

Microsoft deserves credit for one thing, though -- continuing to provide leapfrog innovation in user input. The real jaw-dropping component of the first-generation Surface was the Touch Cover. Microsoft started with the brilliant idea of the Apple iPad 2's magnetic cover and took it an inspired step further by converting the cover into a keyboard.

Even though the Surface hasn't caught on, Microsoft continues to pour R&D resources into the device -- and the team working on the Touch Cover in particular is hitting its stride. What Microsoft's Surface leader Panos Panay unveiled this week was a Touch Cover 2 that opens up the possibilities for Surface as a platform, and for the first time makes a clear case for special Surface apps distinct from other Windows 8 apps.

Inside the Touch Cover 2 [foreground] is a versatile grid of 1,092 sensors. The original Touch Cover [back] had 80 sensors corresponding to key positions. (Photo credit: Scott Bekker.)

Inside the Touch Cover 2 [foreground] is a versatile grid of 1,092 sensors. The original Touch Cover [back] had 80 sensors corresponding to key positions. (Photo credit: Scott Bekker.)

The core change is a radical upgrade in the number of sensors in the Touch Cover (see photo above). The original Touch Cover had 80 sensors corresponding precisely to where the keys were printed on the outside of the cover. The Touch Cover 2's innards will sport a grid of 1,092 sensors, and they're more sensitive, as well.

Overkill for typing, you say? No doubt, but that's not where the action is in this game. We could be talking about all manner of applications. On display at the launch in New York was a custom Touch Cover 2 for music mixing (see photo below). Panay also showed a video of a Microsoft visit to an art school, where design students imagined all sorts of scenarios for Touch Cover 2s, from fold-out piano keyboards to drawing pads.

The grid of sensors in the Touch Cover 2 enables limitless input layout possibilities. (Photo credit: Scott Bekker.)

The grid of sensors in the Touch Cover 2 enables limitless input layout possibilities. (Photo credit: Scott Bekker.)

Getting game developers interested in the platform represents a huge opportunity. Casual games exploded on touchscreen phones and tablets, but the interface has limited input options for more advanced games, and leaving finger grease all over the screen gets old.

Panay dropped some interesting hints about upcoming attachments called "blades." Game designers and other app developers could certainly design and print their own exteriors and resell the Touch Covers, although that approach swims against the tide of inexpensive apps and games. Building the price of a new $119 Touch Cover 2 into every software sale will only work for high-end applications.

It stands to reason that Microsoft would also release a versatile Touch Cover with a slot for ISVs to insert their own custom input layouts for their games or apps. They could box and mail the inputs or even conceivably have customers print them out themselves from a blueprint in the Surface Store. We'll find out more when Microsoft launches surfacemixproject.com on Oct. 22.

The Touch Cover 2 sensors are an exciting technical innovation, but Microsoft will need ISVs to sign on. The miniscule share of Surface devices in the overall tablet market won't make that an easy sell. Could this be the innovation that helps Microsoft shake off its recent habit of leading parades with no followers? Leave your thoughts below or send an e-mail to [email protected].

Posted by Scott Bekker on September 26, 20130 comments

In a brainstorming session about four months ago, Condusiv Technologies CEO Jerry Baldwin decided his company's partner program needed another tier.

Formerly known as Executive Software and then Diskeeper, Condusiv still sells the defragmentation software those brands were best known for. But Baldwin has steered the company's technology toward a heavier focus on I/O optimization for virtualized environments and the company's business toward a 100-percent channel model.

"Our product line and our story is not one that is easily told through advertising and websites," Baldwin said. It takes face-to-face engagement to discuss solutions to the complex I/O problems customers have with virtualization, and having channel partners make that case is the most efficient approach, he contended.

The latest tweak as Baldwin focuses exclusively on channel-led success is an Elite Partner Program launched on Monday. Initial Elite Partners are Champion Solutions Group based in Boca Raton, Fla. and Green Pages Technology Solutions with headquarters in Kittery, Maine.

In addition to the distribution partners that source all of Condusiv's products, the company's program is now a three-tier model consisting of Registered, Premier and Elite partners. There are about 1,500 Registered Partners, but it's the 18 to 20 partners at the Premier level so far that are generating sales volume for Condusiv.

As Baldwin looked at the U.S. wall map in his office showing geographic circles of Premier partner coverage, it occurred to his team that they could spur more business by partnering more deeply with a special kind of existing Premier partners.

"I am looking for partners that really, really get it and whose business direction is the same as mine," Baldwin said. "They're focused on virtualization and cloud performance, and they only handle 15 to 20 vendors max, so all their salespeople, all their support people, know the vendors and know the products."

Other criteria are a horizontal model with a midmarket emphasis and strong regional outside sales and technical support. VMware certifications are key, along with experience in Microsoft and Citrix virtualization technology.

To Baldwin, personality and style are also important: "I'm looking for the kind of person I could do business with on a handshake. We wouldn't need contracts."

Champion meets those criteria for the Southeastern United States, and Green Pages is the Elite partner for the Northeast. Baldwin says to expect more announcements in short order, filling in an Elite partner for each of the four major remaining regions of the country, along with possibly another one or two later.

Baldwin doesn't expect conflict between Elite partners and the Premier tier, which will also probably expand by a handful of partners. Premiers are more likely to be extremely strong in one metropolitan area, have a vertical focus, represent Condusiv solutions to either SMBs or the enterprise, or carry Condusiv software as part of a very large line card. He also anticipates Elites to partner with Premiers on a regular basis.

"When we err, we err on the side of less partners," he said.

Posted by Scott Bekker on September 23, 20130 comments

The 2013 hurricane season has been a bust so far -- to the relief of businesses up and down the East Coast.

AccuWeather.com reported earlier this week that when Humberto graduated to hurricane status on Sept. 11, the world was a few hours away from breaking the satellite-era record for the latest first hurricane. (That mark is still held by 2002.)

Nonetheless, there's plenty of time left in hurricane season. Forecasters are still expecting about six hurricanes this year, two of them major, and a total of 16 tropical storms.

The lack of hurricanes thus far is an opportunity for IT managers and managed service providers to test those disaster recovery (DR) and business continuity implementations, though. Any time big storms and outages aren't sweeping across the country is like the eye of a hurricane -- a chance to make sure the systems in place are actually working.

A business continuity plan that hasn't been tested in the last six months or so isn't a plan so much as a fantasy. Systems change, hardware is replaced, patches get applied and key new applications get added to the environment. This lull in hurricane season is a great time to make sure the DR systems are working, that data is being properly backed up, and that when it fails back, it will come back online.

Related:

Posted by Scott Bekker on September 19, 20130 comments

Ross Brown has been out of Microsoft for about a year. He marked that anniversary this week with a blog entry about pitfalls in channel sales that's interesting in light of the senior channel role he held in Redmond.

Brown now works at The Spur Group, a consultancy based a block away from the Microsoft campus in Redmond. When he was at Microsoft he managed incentives, among other things, as the vice president of Worldwide Partner Strategy.

The blog entry is called "Sand, Rocks, and Boulders: Is your focus on the enterprise hindering your revenue growth?" In his metaphor, he categorizes technology sales as sand, the run-rate of reorder business; rocks, channel-led projects that are departmental wins; and boulders, the large, high-profile enterprise deals.

What Brown is saying, without mentioning Microsoft by name, echoes what many non-enterprise partners have been arguing for a few years: The corporate culture at Microsoft has clamped down on expenses at every turn, especially investments and incentives that would influence revenues generated by smaller partners.

"A 1 ton boulder weighs as much as one ton of sand, and both weigh the same as a ton of rocks. Revenue is similar -- $1 million from small accounts, transacted efficiently, can be a better business than a $1m deal in an enterprise and similarly 10 $100k sized deals may be the best business for a technology company," Brown writes.

Describing companies' "almost genetic drive" toward focusing on enterprise customers, Brown outlines two common pitfalls in the approach.

One comes from retooling the sales force to capture enterprise deals. "The urgency to gain traction in the enterprise, the culture of direct account control with enterprise sellers and the external and internal focus on the big 'named' deals drive attention, often creating active conflict with the channels that created the opportunity in the enterprise or creating a scenario of 'benign neglect' where investments shift rapidly to the enterprise customer segment and away from channels and renewals," Brown writes.

Focusing too much on enterprise sales can also have pernicious effects in the SMB sector, Brown argues: "Many SMB vendors fall into the trap of imitating boulders -- they're still sand, just packed into a boulder shape -- by working only with distribution or internet retailers who do volume as a proxy for the smaller reseller and small business customers."

Brown's blog entry provides a valuable framework for analyzing any vendor's channel approach (although his recent experience makes it especially relevant to Microsoft). We'll be keeping an eye on his blog in the future.

Posted by Scott Bekker on September 18, 20130 comments

The plan to acquire close smartphone partner Nokia's devices and service business for $7.2 billion reveals a lot about Microsoft.

1. Devices & Services Just Got Real

Microsoft's "Devices & Services" strategy is Steve Ballmer's baby. The idea is to grow beyond Microsoft's roots as a software company and use those software skills to support two new branches -- devices like convertibles and smartphones, and services, or in other words, cloud. Ballmer introduced the phrase in October 2012 and seemed to put the finishing touches on it with his "One Microsoft" reorganization with him at the center in July.

Just when it seemed he'd cemented Microsoft's direction, however, came the surprise announcement that he would retire within 12 months, and lots and lots of hints that retirement wasn't his choice. The Microsoft Board of Directors issued a statement confirming that Devices & Services would still be the company's strategic direction, but Ballmer's apparent ouster made that seem highly questionable.

Now Microsoft is "all in," as the company once said of cloud. Devices went from a notion and aspiration, backed mainly by a Microsoft Surface convertible/tablet that recently suffered a $900 million inventory-related writedown, to a $7.2 billion purchase of Nokia's product lines with 32,000 new employees. Unless investors or regulators derail the deal, the "device" part of Microsoft being a "Devices & Services" company is now inarguable.

2. Securing Microsoft's Flank on Windows Phone

When it comes to Windows Phone, there is only one partner that really matters to Microsoft -- Nokia. HTC may have produced the first flagship Windows Phone 8 device, and Samsung sells a few. But Nokia accounts for more than 80 percent of Windows Phone sales. If Nokia were to stop selling Windows Phones for any reason, it would be the death knell for Microsoft's smartphone platform.

The pressure on Nokia CEO Stephen Elop to reverse course on his decision a few years ago to focus on Windows Phone has been intense and non-stop. He's held steady, but Microsoft has always faced the possibility that Nokia would 1) go bankrupt, 2) oust Elop and change direction or 3) keep Elop but end the exclusive future focus on Windows Phone.

There was a lot of happy talk by Ballmer and Terry Myerson, executive vice president of Microsoft's Operating System Engineering Group, in the investor call Tuesday morning about the efficiencies and messaging improvements that would be gained by combining the companies' mobile efforts under one umbrella. Ballmer's best point there was a good joke about the unwieldy name of the companies' latest joint effort: "We can probably do better than the 'Nokia Lumia Windows Phone 1020.' Just take that as a proxy for a range of improvements we can make."

Nonetheless, it's hard to imagine two companies working together more closely than what Microsoft and Nokia have done. Knowing the reputation that Microsoft divisions have for working together (remember that cartoon organizational chart with each division pointing guns at other divisions?), the Nokia team's best collaboration days with their Microsoft peers may be behind them.

Asked by an analyst, however, Ballmer briefly acknowledged that Microsoft was securing its key delivery partner by buying its business. Other observers have suggested that the financing included in the deal is a clue that Microsoft was forced to act now in order to save Nokia from bankruptcy.

Whether or not Microsoft's hand was forced by bankruptcy or by a threat to expand to Android when the companies' joint agreement comes up next year, this move will secure a handset maker for Windows Phone. Nokia was always committed, but whether the company, or its management, would survive was a constant question.

3. The Dynamics with ValueAct Are Weird

Late on the Friday before the U.S. Labor Day weekend, Microsoft posted a little-noticed news release about a cooperation agreement with ValueAct Capital. That's the San Francisco-based investment firm run by Mason Morfit, an activist investor who has taken a $2 billion position in Microsoft stock. What Morfit wants, other than a higher Microsoft stock price or a bigger dividend, is a closely held secret. But rumors have Morfit agitating for a recommitment to Microsoft's software fundamentals and less emphasis on devices, like the Xbox or presumably the Surface and Nokia phones.

The timing is very interesting. There's more to the Aug. 30 date than an effort to sneak in some news before Labor Day. According to an Aug. 22 report in the Puget Sound Business Journal, that was the deadline for ValueAct to notify Microsoft if it would engage in a proxy fight. So Microsoft locked up a cooperation agreement with ValueAct that prevents the investor from speaking out publicly against Microsoft, confirms it won't try to gain a 4.9 percent share of the company or launch a proxy fight, gives it the ability to consult with Microsoft, and offers Morfit a spot on the board after the 2013 shareholders meeting (a huge concession). That done, Microsoft a few short days later announces the Nokia deal, which there's a good chance ValueAct would have opposed.

Nomura Securities analyst and longtime Microsoft watcher Rick Sherlund asked the most pointed question during the investor call about the Nokia deal: Was ValueAct consulted? Ballmer passed the question to Microsoft's chief counsel Brad Smith, who said, "You would not expect the company to disclose material, non-public information to an entity that doesn't have an appropriate non-disclosure agreement, so the answer is no."

So the intriguing possibility is that Microsoft maneuvered ValueAct out of a proxy fight, then immediately closed a deal that cements Ballmer's "Devices & Services" strategy (see No. 1). Maybe Microsoft's old pugilistic, legalistic ways aren't completely over.

4. Elop Seems To Have the Inside Track for Microsoft CEO

Of the internal candidates to be the next CEO of Microsoft, Satya Nadella seemed to have the best portfolio. No one inside the company had serious devices experience outside the Xbox unit. With devices off the table, Nadella offered leadership for either direction. If Microsoft returned to the fundamentals, he had the server and tools business experience, a business that has continued to grow despite struggles elsewhere at Microsoft. For a Microsoft going the "Devices & Services" route, Nadella's also been heavily involved in cloud.

But the sudden return of Stephen Elop at the head of 32,000 new Microsoft employees makes a strong case for the man in Finland. Elop ran the Office business before he left Microsoft to take over Nokia, so he spent quality time at the very top of Microsoft. And now he has deep experience that is unique to Microsoft in the intricacies of all the Nokia device businesses that will be coming to Microsoft.

Nokia CEO Stephen Elop (left) with Microsoft CEO Steve Ballmer.

Nokia CEO Stephen Elop (left) with Microsoft CEO Steve Ballmer.

One other point -- Elop is Microsoft's biggest fan outside of Redmond. The guy actually bet the company that he ran on Microsoft technology rather than Android, and he wasn't drawing a Microsoft paycheck at the time.

By no means is the choice down to two people, but the complexities of integrating a huge hardware company and his proven belief in Microsoft give Elop the inside track.

5. This Is a Huge Bet

As Jeff Schwartz reported, this is one of the biggest deals Microsoft has ever done:

"The deal is Microsoft's second largest -- its 2011 acquisition of Skype is its biggest at $8.5 billion -- and puts an even larger bet on its expansion into hardware. The company's third-largest acquisition was that of aQuantive for $6 billion, which Microsoft wrote off last year."

The number of employees coming over from Nokia makes it even more consequential.

6. Julie Larson-Green's Roller Coaster Ride

Among executives assigned major roles in Ballmer's reorg, Julie Larson-Green got one of the biggest career bumps. Larson-Green was on a level with Satya Nadella, Terry Myerson and Qi Lu as the executive vice president of an engineering group under the reorg. She runs the Devices and Studios Engineering Group. In his internal memo announcing the Nokia deal, Ballmer explained that Elop would be coming over as executive vice president of devices and Larson-Green would be on his team. That's several months away, and if Elop ends up as CEO, she could have another opportunity.

Here's the text of Ballmer's e-mail regarding roles for Elop and Larson-Green once the acquisition closes:

"1. Stephen Elop will be coming back to Microsoft, and he will lead an expanded Devices team, which includes all of our current Devices and Studios work and most of the teams coming over from Nokia, reporting to me.

"2. Julie Larson-Green will continue to run the Devices and Studios team, and will be focused on the big launches this fall including Xbox One and our Surface enhancements. Julie will be joining Stephen's team once the acquisition closes, and will work with him to shape the new organization."

7. A 50-Million Phone Hurdle

Microsoft clearly established the lowest bar that these combined businesses must clear for the collaboration to be a success. In a slide deck accompanying the investor call, Microsoft states, "Operating income breakeven when Smart Device units exceed ~ 50M." That's not a huge figure compared to Android and iPhone volumes, but 50 million units is a big increase over Windows Phone's current run rate. Executives on the call repeatedly mentioned that there were 7.4 million smart Windows Phones in the last quarter. That's an annual run rate of about 30 million phones.

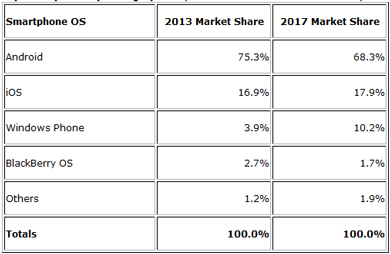

8. A 15 Percent Share Assumption

Another slide covering the revenue opportunity revealed something of the two companies' expectation as far as market share goes. The slide was based on achieving 15 percent market share in 2018. That's a lower assumption than the two companies persuaded analysts they'd be able to achieve when they first launched their partnership. At the time, IDC and Gartner both pegged Windows Phone's 2014 share at about 20 percent based on Nokia's smartphone market share at the time. In the interim, Nokia legacy platforms lost share extremely quickly and Windows Phone didn't gain it that quickly. IDC numbers released Wednesday are more conservative. IDC estimates Windows Phone share at just under 4 percent for all of 2013 and project a 10 percent share in 2017.

Top Smartphone Operating Systems, Forecast Market Share and CAGR, 2013–2017 (Source: IDC).

Top Smartphone Operating Systems, Forecast Market Share and CAGR, 2013–2017 (Source: IDC).

9. Other Handset Partners

Doing a huge deal with one handset partner tends to alienate your other partners. However, with Windows Phone, this alienation has been happening for a while. Samsung is having huge success with Android and has paid only marginal attention to the Microsoft platform, although Samsung did release a phone for Windows Phone 8. HTC, also, is far more focused on the Android opportunity than the Windows Phone opportunity.

When one partner (Nokia) accounts for 80 percent of the volume, there's not that much difference between having one partner and having a few. During the investor call, Ballmer said other handset manufacturers were greeting the Microsoft-Nokia news with enthusiasm and getting more interested in Windows Phone, and said that he expected other partners to account for more than the current 20 percent of the total shipment volumes in the future. He didn't offer a rationale for that counterintuitive interpretation.

10. At Least Microsoft Didn't Buy BlackBerry

If Microsoft was destined to buy a struggling handset company, at least it didn't buy BlackBerry. Whatever limited success the Microsoft-Nokia partnership has had compared to the Android and iOS platforms, they've done better together than BlackBerry has. There had been ample calls for Microsoft to buy BlackBerry. That would have married a struggling strategy (Microsoft-Nokia) to a flailing one.

The annals of business success are filled with tales of companies steadily pushing at a flywheel in one direction. If Microsoft's mobile efforts are to succeed, continuing to push in the same direction and trying to build momentum seems the most likely route. The Microsoft-Nokia strategy has a chance to one day break out. Buying Blackberry would have been a guarantee of 18 to 24 months of chaos followed by a new, and unlikely-to-succeed, strategy.

Related:

Posted by Scott Bekker on September 04, 20130 comments

It's been obvious since the PRISM revelations came to light earlier this summer that they could hurt the momentum of public cloud services.

PRISM is the reported, wide-ranging U.S. National Security Agency (NSA) data collection program revealed by Edward Snowden that allegedly operates with the cooperation of major technology companies, including Microsoft, Google, Yahoo and others. Whether that cooperation is voluntary and broad or forced and narrow is a matter of heated debate.

This month, a new study by an industry group tries to calculate what the damage will be to the major U.S. companies that the NSA is supposed to be getting PRISM data from.

The question is posed by the report's title, "How Much Will PRISM Cost the U.S. Cloud Computing Industry?" Daniel Castro wrote the report for the International Technology & Innovation Foundation, a Washington, D.C.-based lobbying organization, which includes academics, IT lobbyists and attorneys, as well as executives from tech companies, such as Microsoft, Cisco and HP.

Castro connects several dots related to European sentiment about increasing their cloud infrastructure so as not to be dependent on the United States; Europeans' growing investments in cloud infrastructure; and European business and government concerns about the privacy of their data stored in U.S.-based companies' servers.

According to the report:

"While much of [the] projected growth was until recently up for grabs by U.S. companies, the disclosures of the NSA's electronic surveillance may fundamentally alter the market dynamics."

"On the low end, U.S. cloud computing providers might lose $21.5 billion over the next three years. This estimate assumes the U.S. eventually loses about 10 percent of foreign market to European or Asian competitors and retains its currently projected market share for the domestic market.

"On the high end, U.S. cloud computing providers might lose $35.0 billion by 2016. This assumes the U.S. eventually loses 20 percent of the foreign market to competitors and retains its current domestic market share."

To be sure, lobbying group studies almost always overestimate the costs to industry of government actions. Nonetheless, the potential loss of $21 billion to $35 billion to U.S. businesses of the PRISM efforts are an important new data point in the discussion.

Related:

Posted by Scott Bekker on August 19, 20130 comments

Each year at the Microsoft Worldwide Partner Conference (WPC), Microsoft sends out COO Kevin Turner for a closing keynote that gives partner attendees an entertaining but forceful kick in the pants to go home and redouble their sales efforts.

In Houston, Turner was a little less incendiary than in years past, with fewer disparaging things to say about competitors and with less of his presentation time dedicated to making fun of others in the industry.

Here are 10 of the most interesting, and in some cases inflammatory, things Turner said this year:

10. "Best deployment numbers"

"We've got the best deployment numbers in the history of our company. Right now we're 73 percent current on Windows in the enterprise and 62 percent current on Office. And that's not good enough. But boy, we're making progress. We're pushing, both of us collectively."

9. Called Surface "A hero platform"

"We designed our first first-party hardware with Surface RT and Surface Pro...We put those in market to have a hero platform, to have a beautiful stage to put Windows 8 on. Is it a tablet or is it a laptop? Do you need two devices? We don't think so. And we took a different point of view with that."

8. "You're going to care about Haswell"

"Intel's got a great new chip out called Haswell. And you're going to care about Haswell, because it has the ability to operate fanless devices. So thinner, better battery life is on the way across the ecosystem."

7. "86 percent"

As in previous keynotes, Turner trotted out Secunia statistics on security. "This past year, ladies and gentlemen, 86 percent of all the vulnerabilities in the most popular platforms were not on the Microsoft platform. Eighty-six percent of the vulnerabilities were on the other guys' platforms."

6. "Feel free to use our stores as an extension of your office"

Turner, who came from retail, is a huge internal advocate of Microsoft Stores. He encouraged attendees to bring customers and their teams to the Microsoft Stores.

5. "Dude, this is Microsoft"

"No other company in the world has 20,000 cloud partners. Some people would say, 'Hey, we should celebrate that, that's great.' Dude, this is Microsoft. We're a company for partners, built by partners, with partners. I want all 600,000-plus selling and transacting in the cloud."

4. "You're Getting Scroogled"

The phrase appeared on one of his slides; Turner didn't actually repeat it. He did say, "Google goes through every word of every Gmail that's sent or received to sell ads. Outlook.com is different. You won't see ads based on keywords from your personal e-mail."

3. KT said something nice about the competition...

"We should absolutely have high respect [for], but absolutely no fear of any one of these competitors. Respect everyone, fear no one."

2. ...and left the hammer (partly) to Oracle

"Ironically, we found some common ground with Oracle. This came from Larry Ellison: 'Salesforce.com's Force.com platform is the roach motel of cloud services, amounting to the ultimate vendor lock-in due to its use of custom programming languages.' I think Larry said that very, very well. Don't let our customers go to the roach motel."

1. "It's about frickin' time, don't you agree?"

Turner said after playing a pair of new Microsoft ads pitting the Microsoft Surface RT against the Apple iPad.

Posted by Scott Bekker on August 05, 20130 comments