When it comes to cloud, Cisco just shifted from acting as an "arms dealer" to becoming a cloud services provider in its own right, according to analysts at Technology Business Research (TBR).

My colleague Jeffrey Schwartz covered Cisco's announcement earlier this week at the networking giant's Las Vegas partner conference. Here's how Jeff described the news:

The company [Monday] said it will invest $1 billion over the next two years to offer what it argues will be the world's largest cloud. But rather than trying to beat Amazon Web Services, Microsoft, Rackspace, IBM, Hewlett-Packard, Salesforce.com, VMware and other major providers that offer public cloud services, Cisco said it will "join" them together, figuratively.

Cisco said it will endeavor to build its so-called "Intercloud" -- or cloud of clouds -- aimed at letting enterprise customers move workloads between private, hybrid and public cloud services.

Cisco's expanded cloud strategy, revealed at this week's Cisco Partner Summit. (Source: Cisco)

Cisco's expanded cloud strategy, revealed at this week's Cisco Partner Summit. (Source: Cisco)

In an analysis Thursday, TBR's Michael Sullivan-Trainor and Scott Dennehy characterized the announcement as a notable change for Cisco:

The move is a significant departure from the company's previous strategy of being just a cloud "arms dealer" (i.e., providing the infrastructure elements to service providers and enterprises that enable public and private clouds).

Changing positions in the cloud world holds some significant risks for Cisco, according to the TBR analysts:

TBR believes the new cloud strategy will negatively impact Cisco's hardware sales, particularly in the service provider segment, as customers will be able to leverage Cisco's application-centric, network-aware services without buying routing and switching infrastructure for their cloud environments. ... the move will place Cisco into competition with other key partners, such as IBM, as well as customers like Verizon that sell public cloud services using their own infrastructure. ... TBR believes Cisco will face challenges executing its new cloud strategy, as the focus on applications and services does not play to the company's core strengths in hardware.

For all those challenges, the TBR analysts say they expect Cisco to "quickly establish itself as a key player" by investing in additional partnerships and tuck-in acquisitions.

Posted by Scott Bekker on March 27, 20140 comments

Hewlett-Packard President and CEO Meg Whitman is calling for a change in the way HP and its partners relate.

"The New Style of IT requires a new style of partnering," Whitman said in a statement this week from the HP Global Partner Conference in Las Vegas. "Together HP and our partners have become the go-to technology provider for the New Style of IT with industry-leading technology solutions, programs and incentives that help partners drive growth."

What does the new style of IT mean to Whitman?

During her keynote, Whitman delineated four major trends undergirding the "new style" -- cloud, security, big data and mobility. She also noted the shift in the way technology is consumed, paid for and delivered, and changes in how infrastructure is built, apps are written and data is consumed.

She implied that the sheer volume of content and data being created through social media and ubiquitous cameras puts legacy datacenter approaches on a path that isn't sustainable in terms of space, energy or cost.

Whitman said HP is looking for partners to help customers achieve IT goals, including lower costs, greater agility, simplicity and speed.

"HP, with our partners, is the only company with the breadth and depth of innovative products and services to help customers succeed in this new reality," Whitman said. "With HP as your partner, you will have the broadest array of channel-optimized products and programs suited for technology refreshes, upsell and cross-sell opportunities."

Down where executive strategy meets channel engagements, Whitman's themes translate to several changes coming to the HP PartnerOne program this year. The changes broaden the types of companies who can become part of the formal HP PartnerOne program and bring cloud more formally into the partner program.

The expanded channel company types eligible for PartnerOne will soon include service providers, systems integrators, OEM integrators, ISVs and distributors.

On the cloud side, HP is launching HP PartnerOne for Cloud, aimed at partners who can help customers build hybrid cloud solutions that bring together private, public and managed cloud deployments. HP joins other major vendors, including Microsoft, IBM, Amazon and Google, in trying to build hybrid capacity in the channel. (See this feature from the April issue of RCP for a roundup.)

HP is also adding what it calls the HP PartnerOne Cloud Reseller Specialization. The label will supports partners who resell HP Public Cloud, HP Managed CloudSystem Matrix and cloud services from HP PartnerOne Service Providers.

Posted by Scott Bekker on March 27, 20140 comments

In a week, Microsoft is going to release Office for iPad. Or it won't. It's rumor at this point.

One of the themes for now, however, is the "controversy" that Microsoft would be releasing a touch-first iPad version of Office before releasing a touch-first version of Office for the Surface.

The argument goes that Microsoft is somehow throwing Surface under the bus by prioritizing iPad for Office.

This is a clear case of missing the forest for the trees. One of the core design goals of the Surface RT and Surface 2 was to make them work with Office. With Surface, you got full-featured versions -- better than any touch-optimization workaround for the productivity challenges of a tablet. Office is the whole reason the somewhat kludgey desktop appears at all in the RT version of Windows 8. And the whole Surface device, with its click-in keyboard, was built, basically, to be a tablet that runs Office extremely well.

Could Microsoft make a more touch-optimized version of Office for Surface eventually that improves the experience? Sure, but it's silly to say the company is prioritizing the iPad in any way on that.

Now, what's the long-term differentiator for Surface if iPad has Office, too?

Well, that's a much tougher question. But I'm still not sure that much is changed for Surface if Microsoft finally starts grasping for the Office-on-iPad revenues that it's been leaving on the table all these years. Surface is already decidedly not setting the world afire with sales. The strategy of keeping Office exclusive demonstrably did not work, and that's been clear since long before this iPad decision.

What Microsoft is left with is what it claimed to want for Surface all along: a hybrid tablet that serves as a reference design for OEM partners and a tablet for people for whom productivity is as important as entertainment.

For Microsoft partners, meanwhile, Office on iPad would be nothing but a win. Being able to extend their Office-based solutions to the growing legions of corporate iPad users is all good for the Microsoft channel.

Posted by Scott Bekker on March 20, 20140 comments

As part of the Microsoft Hosting Summit, Microsoft released a wealth of detail from a massive customer survey it commissioned about cloud and hosting adoption trends.

The global survey, "Hosting and Cloud Go Mainstream," by 451 Research drew responses from more than 2,000 companies and organizations of all sizes from 11 countries, with more than a third of respondents coming from the United States.

I'm still going through the 75-slide deck, and I'll be talking to Marco Limena, vice president of hosting service providers at Microsoft, on Thursday about the results. But a few data points jumped out already:

- Cloud is taking off. Asked "Which of the following best describes your organization's adoption of cloud computing models?" only 1 percent said they weren't even looking at cloud. Of the rest, 27 percent were in discovery and evaluation, 27 percent were in running trials/pilot projects, 29 percent were engaged in initial implementations of production apps, and 16 percent reported broad implementation of production apps.

Tackling the same theme with a different question, 451 Research asked, "What is your organization's goal for the proportion of applications or resources that will be part of a cloud computing environment in two years?" The average of responses was 39 percent.

- SaaS leads the way in cloud services. Asked which type of cloud and hosting service they were using, a whopping 71 percent said Software as a Service (SaaS), followed closely by hosted infrastructure services at 69 percent. Other types followed at a greater distance -- outsourcing services stood at 43 percent, Platform as a Service (PaaS) was at 37 percent, and colocation services were at 27 percent.

- Best practices are pretty consistent. The researchers fished for organizations' emerging best practices around cloud computing projects and got remarkably similar answers across regions and organizational sizes. As an example, the top five best practices for North America in descending order were: "Have a well-defined architecture for security," "Understand who the end users are," "Train users to be cautious with access and security," "Have a well-defined architecture for performance" and "Start with projects that are non-disruptive to end-users."

There were, of course, some differences. Enterprise organizations with more than 500 users rated the performance architecture higher and advocated a phased approach with pilot testing. SMBs of fewer than 100 companies, on the other hand, recommended "Have an 'undo' plan to make it easy to move off the provider."

- A puzzling result on PRISM. The survey also included a head-scratcher about PRISM, the U.S. National Security Agency's surveillance program defined in the survey as giving the U.S. government access to metadata and content from public cloud providers such as Google, Microsoft, Facebook and Yahoo. Overall, 53 percent of respondents were aware of PRISM, with higher awareness in North America and among organizations with more than 500 employees and lower awareness in Asia and South America.

The puzzler is a question assessing the impact of PRISM revelations on customers' perceptions of cloud computing. The largest group, 39 percent, reported a positive impact on their perception of cloud computing (31 percent had a negative impact and 30 percent were in a "no impact" category). It would be interesting to hear the thinking behind answers by respondents who had a more positive view of cloud computing based on hearing that the NSA is accessing the data of major cloud providers.

Microsoft is sharing a lot of 451 Research data here with a lot of information about customer psychology regarding cloud, hosting and buying decisions. Surveys like this are one of those services for partners that Microsoft, because of its scale, can provide that few smaller partners can match. Dig into the results yourself here.

Posted by Scott Bekker on March 19, 20140 comments

Microsoft unleashed three major enhancements to OneNote on Monday, most of which are aimed at making the synchronized note-taking platform easier and free to use from more device types.

OneNote for Mac made its debut Monday. While OneNote was originally available as a desktop application for Windows PCs and came with several Office bundles, it never made its way to the Office for Mac side.

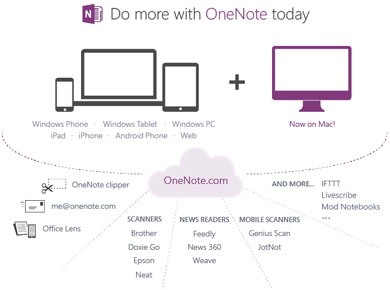

The Mac version brings OneNote to multiple platforms, including Windows desktops, Windows tablets (an RT version), Windows Phones, iPhones, iPads, Android phones and the Web. Data created on any of the devices is stored in a Microsoft account with 7 GB of capacity and can be accessed from any of a user's other supported devices.

Unlike the original full-featured PC version, OneNote for Mac is a free application. Also, Microsoft released a free version of OneNote for Windows desktops. Microsoft is now taking a two-tier approach with free versions available for every supported platform and paid upgrade options available for some platforms.

Previously, regular Windows desktop users were the only ones who had to pay to use a OneNote application, but all other users had access to a slightly less functional free app. Now premium features, such as SharePoint support, version history and Outlook integration, will be available to paid customers based on features, not necessarily on platform. The move wipes out a disincentive to Windows PC users for taking advantage of the baseline functionality of the OneNote platform.

[Click on image for larger view.]

Image: Microsoft

[Click on image for larger view.]

Image: Microsoft

In the blog post detailing the changes, David Rasmussen, partner group manager for OneNote, also announced the availability of a cloud API for the OneNote service. An initial wave of production-ready examples of new Microsoft products taking advantage of the cloud API include a OneNote Clipper that save Web pages to OneNote, [email protected] for e-mailing notes to OneNote and a Windows Phone app called Office Lens that captures documents and whiteboards.

New third-party support for OneNote includes news feeds from Feedly, News360 and Weave; document scanning from Brother, Doxie Go, Epson and Neat; Livescribe for writing notes with pen and paper; mobile document scanning from Genius Scan and JotNot; and Mod Notebooks for scanning physical notebooks.

Posted by Scott Bekker on March 17, 20140 comments

With a month to go to the April 8 support deadline, is Windows XP fading away or hanging on? Depends whose data you look at.

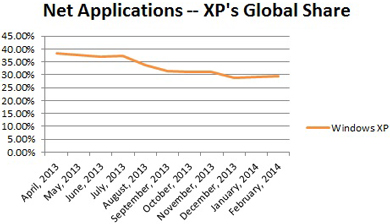

Net Applications reported its data this week, and it shows that through February, Windows XP not only stuck around but gained a little share for the second month in a row. According to Net Applications, Windows XP went from 28.98 percent share of desktop operating systems worldwide in December up to 29.3 percent in January and then 29.53 percent in February. The figures show Windows XP dropping in a stair-step pattern from the high 30 percent range through July, then settling around 31 percent in September and October before dropping into the 29 percent range, where it's stayed the last three months. Despite the impending deadline, there's no evidence of a precipitous drop due to late movers.

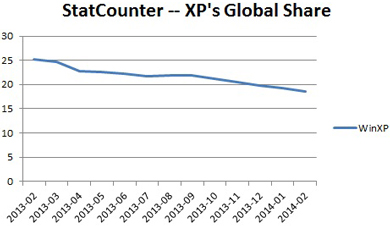

Another market research firm shows a different trend, with Windows XP steadily falling away. StatCounter has shown Windows XP's global share to be much lower over the course of the last year -- starting out last February at only 25 percent and dropping relatively smoothly to 18.6 percent for February 2014.

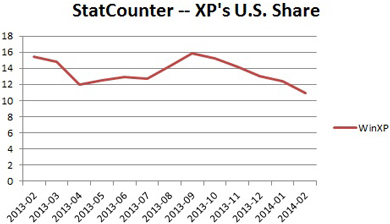

Domestically, StatCounter puts Windows XP's usage share even lower. The OS had a weird trough where it dropped from February 2013 to April 2013 then started climbing again. But since reaching nearly 16 percent share in September, StatCounter has shown XP's usage share falling rapidly to 10.93 percent in February 2014.

Both track browser information, although StatCounter uses pageviews while Net Applications uses unique visitors, among other differences in their approaches.

It's hard to say what's accounting for the difference, but one other metric tracked by Net Applications hints at an interesting possibility.

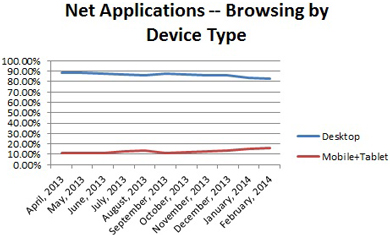

Net Applications also tracks browsing by device type and the last few months have seen a strong gain in the "mobile + tablet" browsing category at the expense of desktop browsing.

Could we be looking at Windows XP users continuing to access the Web at similar rates as in the past, while adopters of newer operating systems are increasingly browsing with tablets and smartphones? Could that give Windows XP an apparent bump in desktop share even as the old OS' share is actually dropping?

Either way, it's a difficult situation for Microsoft. One possibility is that Windows XP share isn't falling, in which case Microsoft faces stark choices about its responsibility for the security of the entire Internet, not just customers who don't upgrade, as the pool of Windows XP machines becomes an unprotected haven for botnets and other malware. The other possibility is that mobile browsing, in which Microsoft is still not a significant player, is really taking off.

For more on Windows XP's support deadline, go here.

Posted by Scott Bekker on March 06, 20140 comments

As part of Microsoft Convergence this week in Atlanta, Anya Ciecierski of the ERP Software Blog asked a Microsoft spokesperson for an update on the number of Dynamics customers worldwide by product.

According to the blog, it's a NAV world when it comes to Microsoft's customer base.

Microsoft Dynamics NAV accounts for 102,000 companies, followed by Dynamics GP at 47,000, Dynamics Retail Management System at 45,000, Dynamics CRM at 40,000, Dynamics AX at 19,000, and Dynamics SL at 13,500.

Of those, Dynamics GP is growing the fastest, followed closely by Dynamics NAV, while Dynamics SL is stagnant. Ciecierski's blog has more detail and analysis here.

For more Convergence coverage, check out Gladys Rama's keynote roundup here.

Related:

Posted by Scott Bekker on March 05, 20140 comments

Jon Roskill, former Microsoft worldwide channel chief, is joining SMB-focused cloud ERP vendor Acumatica as CEO.

Acumatica is a fast-growing, channel-focused, 7-year-old company with about 100 employees. It has its headquarters in Kirkland, Wash., with other offices in Washington, D.C., Russia, Mexico and Singapore. Its major products are organized into four suites: Financial Management, Distribution Management, Project Accounting and Customer Management.

"It's very much a disruptive play," Roskill said in an interview about Acumatica and his new role there. The company closed a $10 million Series C funding round in November 2013 led by Runa Capital and Almaz Capital. At that time, company executives said Acumatica was on track for 350 percent revenue growth in 2013 and Almaz Capital investor Alexander "Sasha" Galitsky predicted the company would reach $1 billion in revenue within 10 years.

The company's partner focus was key for Roskill. "The part which really closed the deal for me is that everything that this company is doing is with and through partners," Roskill said, who ran Microsoft's channel for three years.

"It's a fairly sophisticated partner model for a company this size," Roskill said, referring to Acumatica's mix of VARs, ISVs, OEMs and hosting partners.

In November, Acumatica claimed about 250 partners. "My goal is to double and triple that this year, and literally start to fill out the map. Some places are really well-covered, like Minneapolis, but if you look at places like Southern California, we're not as well-covered," Roskill said. In addition to North America, Acumatica has also been expanding aggressively in Asia and Europe.

During Roskill's tenure at Microsoft, the base of Office 365 resellers expanded dramatically, and he hopes to persuade some of those partners to add Acumatica to their solutions. "For a partner that has started a cloud practice, or the new born-in-the-cloud guys, it's very easy for them to pick up Acumatica, hire a CPA, get into the business if they want to and expand their business," he said.

Roskill left Microsoft Sept. 20, 2013, after nearly 20 years there in a variety of product and business roles. He was corporate vice president of the Microsoft Worldwide Partner Group from July 1, 2010, to Aug. 29, 2013.

Posted by Scott Bekker on March 05, 20140 comments

After doing the math on Microsoft's late-January announcement about the new $475 price of the Action Pack (it's a 44 percent increase for solution provider subscribers), I hadn't been back to Diane Golshan's original blog post.

When I posted yesterday that the new Action Pack went live this week, a reader responded to ask if it's too late to renew under the old price. To find the answer (yes, it's too late), I revisited the post by Golshan, who blogs for the U.S. Partner team.

It turns out a lot of Action Pack subscribers have been to her Jan. 29 post since I last visited, and they're not a happy bunch.

Between Feb. 7 and Feb. 24, there were 45 visible comments. The new Action Pack went live on Feb. 24 and presumably commenting was turned off then [ed.'s note: see update]. The ratio of unhappy to happy posters was a whopping 12:1, with 36 opposed and three arguing that the Action Pack remains a good value. Golshan had four of the posts, starting on Feb. 12 after some among the flood of negative commenters started to wonder if Microsoft was reading the responses.

The first 15 responses and 29 of the first 30 were extremely negative about the Action Pack price, Microsoft's attitude toward small business-focused partners and the discontinuation of several other small partner-focused programs.

"[T]he price increase is SUBSTANTIAL, with no real benefit to my organization," said Jim Cason, one of the first commenters. (All commenters are identified by the names they chose to post with on the Microsoft blog.)

"In order to sell and support MS software, 'partners' need to assess and familiarize ourselves with MS products. Requiring $475 yearly to do so, just does not make sense to me," said another, Annie Blevins.

Steve T, who identified himself as a Microsoft partner since the 1980s, commented on the historical value of the Action Pack and older, similar programs that involved the core benefit of the Action Pack -- the not-for-resale (NFR) software.

"It was a great opportunity to try new software in a production environment (our office) and also help serve our customers better by testing different scenarios for them with NFR software in our lab -- so that the solution we came up with was a good 'fit' for them. ... I thought it was well worth the small investment though for BOTH us and Microsoft," Steve T wrote. Then he warned, "Don't gouge us with this. You will receive far greater return on your investment if we are treated like partners, rather than 'frenemies' [that another] poster described."

Another commenter identifying himself as Slyfox sounded a similar theme. "I have profited financially from my knowledge of M$ products, and M$ has profited from my knowledge of M$ products. Now the question is, after this many years and thousands of Action Pack dollars, do I want to now pay AGAIN for the few licenses I am using, or completely dump M$? As a partner I feel like they have dumped me."

While many of the negative commenters implied they'd drop their Action Pack subscriptions, Slyfox was one of a dozen who said outright that they'd be canceling their subscriptions. Many said the time had come to pursue competitive offerings, such as Linux and Google Apps for Business.

Microsoft emphasizes other benefits than the NFR software in the Action Pack, but several posters dismissed the value of those elements.

One, posting as Active IT Design, said, "I'm not a developer, I don't build apps, I just don't need anything MSDN. So now the price for me goes up from $329 (Action Pack Solution Provider) to $475 for a 'universal' Action Pack subscription that includes features I don't need. Prices going up, no added benefit and unwanted 'features' (Bing credits come to mind), little value, you can find free coupons for them all over the place."

Like some other commenters, Active IT Design linked the price hike to other recent, unpopular changes. "Killing TechNet and now this, just doesn't make sense to me. It's not about the price either, it's about the price and seeing absolutely ZERO added benefit for a lot of Microsoft Partners. You're slowly killing your smaller Partners. I network with a large group of IT people here in Charlotte, NC and a lot of them are heavily looking into options for themselves and customers that are anything BUT Microsoft."

A commenter named Mark Welte interpreted the change as similar to what's happened among Dynamics partners: "I have been involved in the ERP side of MS for years and they have publicly stated that they do not like to deal with the SMB partners. They have done their best to eliminate all of the small ERP consultants and drive that work to the large shops. This is just the next step with the desktop and server side."

A handful of partners responded that they still find substantial value in the Action Pack.

"I still think that $475.00/yr is a bargain to license my server, 3 workstations and have all my employees using Office 365 E3. The E3 licenses alone are worth the price," wrote M McGovern. Another, Dave Lipman, wrote, "For $500 bucks I have all the software I need to run my business, it's a great value to me. My business exists to support Microsoft products, thank you Microsoft."

Before apparently closing the thread, Golshan wrote, "Thank you all for taking the time to post your candid feedback and comments about the Action Pack changes. I have read all of your comments, and I have also asked our program design team in the Worldwide Partner Group to read them."

The announcement this week of the new Action Pack didn't seem to include any changes in light of the feedback other than in tweaking the messaging to say that small business partners remain important to Microsoft, however. In an announcement blog post, Phil Sorgen, the corporate vice president of the Microsoft Worldwide Partner Group, said, "With so many technology choices facing SMBs, partners bring relevant business solutions to life for customers around the world, and in many ways you make those solutions better. Our many smaller partners make the Microsoft partner ecosystem the most robust and active in the industry."

Sorgen noted that benefits of the Action Pack can reach $40,000, and in a separate blog post, MPN General Manager Julie Bennani said that Action Pack subscribers earn three times more revenues than Microsoft Partner Network members (the MPN tier below subscribers).

UPDATE: First off, the comment portion of the Golshan blog is not closed -- at least two additional comments were posted after this blog went live. I also followed up by phone with Bennani about the negative reaction to the Action Pack price announcement.

Bennani said Microsoft made no changes to the Action Pack based on the review of the blog comments, but contended that Microsoft could have done a more aggressive job communicating the benefits of the new Action Pack approach.

"My team spends quite a bit of time on designing elements. We've been bouncing this around for over a year. We've been testing it with [groups like our] Partner Advisory Councils for that period of time," Bennani said. "As we've seen over and over again, when change is imminent, even when you do those things, you see people two weeks before who are saying, ['I need to check this out.'] We can't catch everyone. We feel great about the offering. We feel great about the price strategy. There's a couple transition scenarios on the IUR [Internal Use Rights] piece that we're continuing to explore with the product groups."

When pricing partner program elements, Bennani said Microsoft uses an equation of $10,000 in benefits for every $100 in partner cost. "It's a 1 percent or less coverage," she said. While she declined to break out how Microsoft arrived at the $40,000 in value, she did push back on criticism of the Bing benefits as having little value. "They're also getting ad credits on Bing, which is hugely important in the future," Bennani said.

Many of the vocal critics indicated they came from the Action Pack Solution Provider side. Bennani agreed that was natural but hopes those partners will give Microsoft a chance. "The Solution Provider subscription was in the on-premise world. We're also sending a message in complement with our Devices & Services strategy. We want those partners to come with us. But there needs to be an opening of the mind of what that means and a trying mentality," she said.

Bennani contended that the new approach with the six Resource Centers represents a radical change to the Action Pack that gives partners ways to experiment with different business models.

"This Action Pack subscription is a different paradigm than the two options we had in market before. They were discrete. You had to pick one or the other and you had to pick different price models. What we've launched is all the benefits, plus. We've blown out the number of business models that we're providing assets around [including training for each], in addition to providing cloud IUR by bringing in Cloud Essentials," she said. Adding in MSDN subscriptions and Azure helps Microsoft build capacity of partners who can develop custom business and mobile apps and integrate customers' infrastructure with the cloud. "That's at one price point," she said.

"We need that healthy broad ecosystem that we've always had. We're continuing to add value to the non-managed and the longer-tail set of partners and/or those building business practices. In some cases, existing partners [start new or experimental practices in] new offices. We want to assist in partners building new practices in predictable ways. That's why we took the Resource Center approach," Bennani said.

The comment section of the U.S. subsidiary blog isn't the whole story, either, Bennani implied: "What's interesting is we've had the biggest sign up days in a row in the history of these subscriptions. What was our previous high, we've beaten Monday, Tuesday and now Wednesday."

Posted by Scott Bekker on February 27, 20140 comments

The latest era in the Action Pack saga began this week.

Microsoft formally changed to one Action Pack in this generation from the previous version, which had been split into two offerings: Action Pack Solution Provider (APSP) and Action Pack Developer & Design (APD&D).

Now partners will simply subscribe to the Action Pack and select any of six Resource Centers for specific benefits. The Resource Centers are Professional Services, Reselling, Application Design and Development, Managed Services, Hosting, or Device Design and Development.

"There is now one universal subscription with more flexibility to explore and leverage resources across business models. Six Resource Centers have been created based on our partner community's core value delivery models -- choose one, many, or all at no additional cost or administrative hassle," said Julie Bennani, general manager of the Microsoft Partner Network (MPN), in a blog post.

The basic benefits remain the same -- internal use rights of products like Windows 8 and Windows Server, access to developer tools, support, advisory hours and training. Changes include Bing credits and the integration of internal use rights (IURs) for cloud services, such as Office 365, Windows Intune and Dynamics CRM Online.

Microsoft communicated the Action Pack changes last year and has stuck to those plans for Action Pack, even as many other planned changes to the MPN announced at the same time have been canceled or delayed. The only detail left out until last month was pricing, which Microsoft revealed in late January would be a hike of 11 percent for APD&D subscribers and 44 percent for APSP subscribers.

As a pocket of small business-focused partners, the Action Pack is one of the most popular areas of Microsoft's channel program. Many of these partners have expressed a general sense that Microsoft is growing less supportive of small business-focused partners and point for evidence to the Action Pack price hike among other changes, such as the elimination of TechNet subscriptions, the retirement of Windows Small Business Server and a perceived large-partner orientation in the MPN in general.

Announcing the rollout of the new Action Pack this week, Phil Sorgen, corporate vice president of the Microsoft Worldwide Partner Group, emphasized that SMB-focused partners remain critical to Microsoft.

"In the news we hear a lot about billion dollar companies doing big business with other billion dollar companies. But for the millions of Microsoft customers who need help with their small to medium-size business, smaller partners are often their unsung heroes," Sorgen wrote on his Channel Chief blog. "With so many technology choices facing SMBs, partners bring relevant business solutions to life for customers around the world, and in many ways you make those solutions better. Our many smaller partners make the Microsoft partner ecosystem the most robust and active in the industry."

Sorgen and Bennani both sought to soften the blow of the price hike by putting it in different contexts. Sorgen noted, "In the United States the cost of Microsoft Action Pack is $475 and offers partners resources and benefits that can reach over $40,000 USD in value. That includes cloud IURs, earnable advisory hours and a variety of support and training."

Bennani put the cost in opportunity terms: "Microsoft Action Pack subscribers earn 3X more revenue than Network Members given they engage with more resources we provide and are more committed to Microsoft."

Look for a more detailed breakdown of the Action Pack changes and opportunities that are included in the benefits in an upcoming issue of Redmond Channel Partner magazine. Not a subscriber? Sign up here.

Posted by Scott Bekker on February 26, 20140 comments

As Parallels opens its annual conference on Monday, the company is releasing a new version of its survey about how businesses are using the cloud.

Parallels' user base gives it a remarkably broad, insider view of cloud service usage. While the company itself isn't a household name, its customers are the major telcos and hosting providers of all sizes who use the Parallels platform to provision the cloud services offerings that they resell to businesses worldwide.

John Zanni, Parallels chief marketing officer and vice president of strategic alliances, service providers, is particularly interested in one area that's changed since the last time Parallels fielded its survey.

"As these businesses are getting their services, they're getting them from different providers. They're actually going to the provider that has the best-in-class service. They're managing IT and their service providers instead of managing their business," Zanni said in an interview.

That's, of course, a trend that Parallels has been betting would occur as it built out support for more than 500 cloud services that cloud service providers can enable using its platform.

But the speed is increasing. Zanni said that survey respondents for now are using an average of five different cloud services. By 2016, they expect to be using an average of nine.

"We're seeing the start of service-provider sprawl," Zanni said.

SMBs are a big chunk of the end customers of Parallels partners/customers. Their buying is concentrated in two growth areas -- online business applications and unified communications.

It will be interesting to watch as the cloud market tries to strike a balance between best-of-breed versus integrated bundles. Tech has seen this kind of fight before -- in the data management/business intelligence space back in the 1990s and even with the Microsoft server software stack versus LAMP and other options in the last decade.

Whichever way things come out -- whether pick-and-choose positioning wins in the cloud or a couple of super-bundles come to dominate -- there's a lot of room for both approaches in the near term.

Posted by Scott Bekker on February 24, 20140 comments

Continuum, the Boston-based vendor of solutions for managed service providers, is taking another run at MSPs who are using backup and recovery solutions from troubled rival Zenith Infotech.

This week, Continuum reiterated a free conversion offer for MSPs using Zenith's backup and disaster recovery (BDR) solutions to switch to Continuum's competing Vault.

Continuum acquired the kernel of its business from Zenith in late 2011, but the relationship quickly went from collegial to confrontational as Zenith's management immediately started having problems with investors back in India.

In renewing the free conversion offer this week, Continuum CEO Michael George said, "News reports are questioning Zenith Infotech's future, and hundreds of MSPs have come to us concerned regarding the safety of their clients' data, and we are helping them to provide the best service for their clients as easily and as cost-effectively as we can."

George was referring to the Business Standard, which reported in mid-December that the Bombay High Court had ordered Zenith Infotech to sell off its cloud computing business to repay bondholders. At the time, Zenith Infotech CEO Akash Kumar Saraf said he planned an appeal.

The Continuum pitch is a more aggressive version of the one the company rolled out a year ago with the introduction of Continuum BDR Revive in January 2013. At that time, George had said, "We've heard from many of our partners that they want to repurpose existing hardware that they have already invested in."

As before, BDR Revive is a re-imaging tool stored on a USB stick, and it works on hardware appliances from Zenith Infotech, Dell AppAssure, Axcient, HEROWare, Chartec and others meeting the minimum hardware requirements of a 64-bit dual core processor, at least 8 GB of RAM, 2 NIC cards and 7200 RPM HDDs.

Plugging in the memory stick and entering a conversion code turns a supported hardware appliance into a Continuum Vault appliance in about 30 minutes, a Continuum spokesperson said. According to Continuum, the free BDR Revive offer represents a value of at least $350 and is worth more for MSPs converting multiple, high-capacity BDRs.

Posted by Scott Bekker on February 14, 20140 comments