Microsoft is making huge strides in the enterprise with its "land-and-expand" strategy for Office 365, according to a new study by cloud services security vendor Skyhigh Networks.

Partners have been encountering that land-and-expand, or consumption-based, strategy in recent incentives and other Microsoft campaigns designed to drive additional usage by customers who are already subscribed to Office 365.

A cloud access security broker, Skyhigh regularly uses the data it gathers from 27 million users at 600 enterprises worldwide to report on trends in cloud service usage. In its "Office 365 Adoption & Risk Report," released this month, Skyhigh found a big gain in usage between the third quarter of 2015 and the second quarter of 2016.

The percentage of companies with more than 100 Office 365 users -- a sort of baseline indicator of some level of Office 365 subscription -- barely budged, going from 87.3 percent to 91.4 percent. But the percentage of enterprise users who are active on Office 365 went from 6.8 percent to 22.3 percent, showing that usage within those existing customers more than tripled.

"A key goal for [Microsoft] is driving more Office 365 usage, also referred to as 'consumption,' and their efforts appear to be working," the report states.

Looking at Office 365 app by app, the suite is led by OneDrive, followed by Exchange Online and Skype for Business Online, with SharePoint Online and Yammer bringing up the rear.

Skyhigh goes to some lengths to try to explain why OneDrive leads Exchange Online in both the categories of percentage of companies with 100 or more users (79 percent to 67 percent) and percentage of employees who actively use the app (19 percent to 8 percent).

"It makes sense that OneDrive is deployed at so many organizations because it is included in every Office 365 plan, even the entry level ProPlus plan that primarily gives access to Office applications on the desktop," the report notes of OneDrive.

Of Exchange, the report says: "One way to interpret this data is that enterprises are beginning to migrate to Exchange Online from on-premises versions of Exchange but that -- owing to the scale of these migration projects -- they are migrating in phases."

With independent validation that Microsoft's land-and-expand strategy is bearing fruit, it's probably safe for partners to expect more, not less, of those consumption-oriented drives out of Microsoft.

Posted by Scott Bekker on May 25, 20160 comments

Being the first in the door to sign a customer is proving to be as important in the cloud as it is anywhere else in business.

"Despite the inherent flexibility of the cloud model, we're seeing very high vendor loyalty rates," said Aziz Benmalek, vice president of Worldwide Cloud and Hosting Services Providers for Microsoft.

Microsoft this month released a survey, designed and conducted on its behalf by 451 Research, of 1,700 IT decision makers worldwide. The survey, "The Digital Revolution, Powered by Cloud" (available here), came out in conjunction with the Microsoft Cloud and Hosting Summit last week.

Benmalek spoke to RCP about the survey and also blogged about it. Supporting his comment about vendor loyalty were three stats:

- Ninety-five percent of respondents intend to renew their contract with their primary cloud and hosting provider.

- More than 80 percent of customers have an annual or longer-term contract with their primary cloud and hosting provider.

- Forty-three percent have a contract of two years or longer with their provider.

Asked how providers were earning that loyalty, Benmalek suggested that range was important. "The breadth of the solution, as well as the breadth of the experience that's going in the cloud space [is important]," he said. "Having that ability to extend from the breadth of offerings, as well as the breadth of services."

Indeed, while the survey suggests customers are loyal and existing providers have clear advantages for now, the market is by no means locked down, nor is spending even close to reaching its potential.

As one example, customers reporting that they are beyond the "discovery phase" on cloud is 85 percent. But those reporting that they have reached "broad implementation"? Only 15 percent.

Says Benmalek: "These findings underscore the opportunity for service providers to drive organic business growth by nurturing long-term relationships."

Posted by Scott Bekker on May 19, 20160 comments

The unwinding of the blockbuster Nokia deal entered a new phase Wednesday as Microsoft sold its feature phone unit for $350 million to a subsidiary of Hon/Hai Foxconn Technology Group and a newly formed close partner of Nokia Corp. called HMD Global Oy.

The feature phone business was never a strategic play for Microsoft, which bought Nokia's phone business mainly for the Lumia smartphone line as part of a plan to drive adoption of Windows Phone.

Championed by former Microsoft CEO Steve Ballmer, the Lumia-Windows Phone combo never gained market traction and Microsoft ended up taking a $7.6 billion charge last July against the value of the assets it acquired when the deal closed in April 2014. Microsoft also took a restructuring charge of $750 million to $850 million and announced layoffs at the time for 7,800 employees.

Now Microsoft is selling its entry-level feature phone assets to FIH Mobile Ltd., the Foxconn subsidiary, and HMD. FIH will get Microsoft's Hanoi, Vietnam, manufacturing facility, and 4,500 employees will "have the opportunity to join" FIH or HMD, according to Microsoft's brief statement about the deal.

The sale coincides with a major Nokia announcement about a strategic return to the Nokia-branded mobile phone and tablet business. Under the deal, Nokia will grant HMD "an exclusive global license to create Nokia-branded mobile phones and tablets for the next ten years." HMD will pay royalties to Nokia for sales of those Nokia-branded mobile products. As part of that deal, Nokia said, "HMD has conditionally agreed to acquire from Microsoft the rights to use the Nokia brand on feature phones, and certain related design rights."

The CEO of HMD will be Arto Nummela, a former Nokia executive who is currently the head of Microsoft's Mobile Devices business for Greater Asia, Middle East and Africa, and of Microsoft's global Feature Phone business.

Getting out of the feature phone business doesn't tell us anything about Microsoft's intentions or core business. It's almost surprising that these business lines and facilities weren't part of the earlier cutbacks. A feature phone business has little to do with Windows or Microsoft's strategic plans.

Meanwhile, Microsoft did little in its brief statement to quell rumors that the days of new Lumia-branded smartphones running Windows may be over. In spite of Microsoft Windows and Devices Group chief Terry Myerson's leaked e-mail last month about the ongoing commitment to Windows 10 Mobile, Microsoft did not promise new Lumia devices in its statement Wednesday.

"Microsoft will continue to develop Windows 10 Mobile and support Lumia phones such as the Lumia 650, Lumia 950 and Lumia 950 XL, and phones from OEM partners like Acer, Alcatel, HP, Trinity and VAIO," the company said in its statement.

That word "support" could be telling, as rumors of a pivot to a Surface Phone brand have been making the rounds for the last few months. It's also unclear how many people and assets are left on the Lumia design and engineering side after all the post-acquisition layoffs.

While the feature phone business sale is consistent strategically, the Lumia statement -- like the previous three or four public statements by Microsoft on the subject -- sheds very little light on what Microsoft is planning in mobile hardware.

Posted by Scott Bekker on May 18, 20160 comments

BitTitan took another step this month in its ongoing effort to expand its cloud migration tools into a platform that Microsoft partners can run their businesses on.

Previous milestones in the effort included the launch of the MSPComplete and CSPComplete packages in October. Those bundles packaged BitTitan's existing tools in an "onboard" pillar and added a "sell" pillar and a "service" pillar.

While BitTitan's sell pillar included machine learning-generated leads and sales scripts, an equally or more important part of the sales process was in the service pillar. Part of that pillar was a "HealthCheck" tool that highlighted upsell and cross-sell opportunities for partners at their existing customer sites. This month, BitTitan released a greatly expanded version of that feature called the Upsell Engine as part of MSPComplete.

"The Upsell Engine might even be the most important thing we do," said Rocco Seyboth, general manager of products for BitTitan, in a telephone interview. "The way that a partner is going to maximize customer lifetime value is not just growing one or two services that they broke into the customer with; they're going to do it by upselling additional services they can make money from."

Previously, the opportunities that the HealthCheck tool discovered were surfaced in the HealthCheck tool itself. Now the Upsell Engine is part of the MSPComplete dashboard, and it is drawing from a wider array of information sources and providing a broader set of suggested upsell/cross-sell opportunities, along with tools to pursue them, Seyboth said.

Upsell packages within the toolset include migrating Box, Dropbox and Google Drive to OneDrive, Salesforce to Dynamics CRM Online, SQL Server 2005 to Azure SQL, and Amazon AWS Blob to Azure Blob.

One other benefit of the tool for partners is BitTitan's close working relationship with Microsoft. A Platinum Sponsor at the Microsoft Worldwide Partner Conference (WPC) this July, BitTitan is tailoring much of the Upsell Engine to take advantage of Microsoft's constantly changing incentives.

For example, Seyboth discussed why the online file storage alerts are a priority for BitTitan's tool at the moment: "We know that a lot of Microsoft partners right now are trying to figure out ways to sell more OneDrive. For FastTrack funds, you need a second workload that will drive active usage. If you can get a customer to get their documents into OneDrive, finding opportunities in the Upsell Engine to recommend and drive OneDrive sales is a big priority. There's quite a lot of alerts related to OneDrive."

Posted by Scott Bekker on May 12, 20160 comments

Microsoft is moving some senior partner executives around as it comes into the home stretch of its fiscal year, which ends next month.

After a nearly three-year stint as corporate vice president of the Microsoft Worldwide Partner Group, Phil Sorgen will become corporate vice president of the U.S. Enterprise and Partner Group (EPG), a Microsoft spokesperson said in an e-mail Tuesday.

"Gavriella Schuster will step in as interim vice president of Worldwide Partner Group until the permanent replacement is hired. Microsoft is committed to the Worldwide Partner Group and its vast partner ecosystem," the spokesperson said. Sorgen hired Schuster, a 20-year veteran at Microsoft, as general manager of Worldwide Partner Programs in May 2014.

Sorgen is now the corporate vice president of the U.S. Enterprise and Partner Group, a role previously held by Ron Markezich, a former Microsoft CIO and the corporate vice president for Microsoft Online during the seminal 2007-2011 period when Business Productivity Online Services (BPOS)/Office 365 was getting off the ground.

L to R: Phil Sorgen, Gavriella Schuster and Ron Markezich.

L to R: Phil Sorgen, Gavriella Schuster and Ron Markezich.

"Ron took a new role in Office Marketing a few months ago. He leads Office Services Marketing, and is responsible for core product marketing for Exchange & Outlook, Yammer, SharePoint & OneDrive, Skype & Skype for Business, and shared Office 365 services," the spokesperson said.

Markezich, who has been in the U.S. Enterprise and Partner Group role since 2011, describes the job this way in his LinkedIn bio:

Corporate vice president of Microsoft's U.S. Enterprise and Partner Group, serving the 1,500 largest commercial customers in the US with Microsoft's full suite of enterprise offerings, cloud services and cool Microsoft hardware. Responsible for leading U.S. enterprise sales and marketing, including national and field sales, partners, marketing, operations and vertical industry teams. Ron is responsible for $8.5B of annual revenue growing at >10% per year.

Sorgen's appointment marks a return to EPG for him. From 2003 to 2005, he was general manager of EPG National Sales, according to his LinkedIn profile. After those roles he was president of Microsoft Canada, then corporate vice president for the U.S. Small and Mid-Market Solutions Group.

Posted by Scott Bekker on May 11, 20160 comments

In a merger of high-profile Microsoft partners, U.S.-based New Signature bought U.K.-based Dot Net Solutions in a deal announced Tuesday.

New Signature is the 2014 and 2015 Microsoft U.S. Partner of the Year; Dot Net is the 2014 Microsoft U.K. Partner of the Year.

The merger brings New Signature's headcount to 320, up from about 90 people before a $35 million investment from Columbia Capital a year ago enabled the acquisitions of CMS Consulting, Infrastructure Guardian, imason Inc. and InfraScience.

"Microsoft is clearly positioned to be a market leader in cloud computing and we are delighted with how Dot Net's existing capabilities, team and overall mission fits with the New Signature strategy," said New Signature CEO Jeff Tench in a statement.

Dot Net's management team will remain intact, with Managing Director Paul Cosgrave now reporting to Tench. New Signature Founder and President Christopher Hertz will run the North American operations, also reporting to Tench.

The next step is to replicate the expansion in the United Kingdom in the same way that New Signature has in the United States in Canada. "Dot Net can now accelerate its tremendous growth in the U.K., building on its position of leadership as a combined Microsoft public cloud integrator and managed services provider via a number of specific, targeted acquisitions," Cosgrave said in a statement.

Meanwhile, the trans-Atlantic nature of the company will improve each side's ability to offer round-the-clock support, and the two also intend to replicate each other's best practices. Dot Net has a mature process for application migration to Azure and a strong Office 365 support playbook that New Signature looks forward to using, Hertz said in an interview with RCP. Meanwhile, Dot Net will benefit from New Signature's broader experience across the Microsoft stack, both in the cloud and on-premises, Hertz said.

Posted by Scott Bekker on May 03, 20160 comments

More internal use rights (IURs) are now available to certain categories of Microsoft partners to allow them to broaden their experience with the new Office 365 E5 suite and to better enable them to create customer demos for Dynamics CRM Online.

Gavriella Schuster, general manager of Microsoft Worldwide Partner Programs, unveiled the new benefits this week in a blog post that also discussed the availability of the new Windows and Devices competency.

Microsoft released the E5 SKU of Office 365 in December and previously only made its IURs available to partners with the Gold Cloud Productivity competency. Some of the features exclusive to the enterprise-focused E5 suite include analytics for business intelligence and e-discovery, secure attachments and URLs, access control, cloud PBX and PSTN conferencing.

Under the new IUR scheme for E5, 100 IURs are available to Gold Cloud Productivity and Gold Communication competency partners. Partners at the silver level for either competency now get 25 IURs.

At the same time, Microsoft is making changes on the Dynamics CRM side to give partners more flexibility to create demo environments for customers.

"We hear from many CRM Online partners that you're building complex demo environments to showcase the value of the solution, and a renewable, 12-month demo environment would help you make full use of what you've built," Schuster wrote in the blog. "So, we're extending demo tenants for CRM and Cloud CRM competency partners: All CRM and Cloud CRM competency partners now receive up to 10 instances of Office 365 E3 and Microsoft Dynamics CRM Online Professional through the Microsoft Partner Download portal."

The changes are among a number of tweaks that Schuster has announced over the last few weeks as Microsoft readies changes to the Microsoft Partner Network for its next fiscal year, which starts July 1.

Posted by Scott Bekker on April 27, 20160 comments

SkyKick added three senior leaders with Microsoft experience to its executive team as the company acts to bolster its marketing and accelerate its global expansion.

Seattle-based SkyKick, which provides tools for migrating and backing up Office 365 and managing Software as a Service (SaaS) accounts from multiple vendors, announced on Monday the hiring of Chike Farrell as vice president of marketing; Kathryn Saducas as general manager of Western Europe, the Middle East and Africa; and Anthony Philips as general manager of business development EMEA.

"We're really investing all up and down the stack with partners with technology and with people. We're trying to put all the resources and assets in place to help partners build successful cloud practices," said SkyKick Co-CEO Todd Schwartz in a telephone interview about the moves.

The three new hires deepen SkyKick's senior leadership team to 10 executives and support an effort to expand the business, especially internationally. While SkyKick has around 5,000 partners in 125 countries, about 60 percent of the company's revenues currently come from the United States, said Co-CEO Evan Richman.

L to R: New SkyKick executives Chike Farrell, Anthony Philips and Kathryn Saducas.

L to R: New SkyKick executives Chike Farrell, Anthony Philips and Kathryn Saducas.

The marketing role is a new one for SkyKick, Schwartz said. "We actually have built SkyKick without a head of marketing. Bringing on Chike as VP of marketing really drives more engagement and education to grow our global partner base," Schwartz said. "This gives us the ability to give them more information, more content, more education and engagement. It's not around sell, sell, sell. It's about helping more partners engage with our technology and engage with our platform."

Farrell's B2B and B2C marketing experience includes Fortune 500 company marketing roles and a stint as co-founder and CEO of Caribbean Ideas Ltd., a digital and inbound marketing agency. Previously he had product management and advertising roles in the Online Services Group at Microsoft.

Saducas comes to SkyKick after a decade of channel-focused roles at Microsoft, including the launch of Office 365 in Australia, Surface commercial channel development in APAC, and cloud channel development in Latin America. She is based in SkyKick's Amsterdam office.

Philips, a lawyer who spent about 14 years at Microsoft in global business development, marketing, media strategy and other roles, will focus on telcos, hosters and large resellers in EMEA for SkyKick.

Posted by Scott Bekker on April 25, 20160 comments

Three months after closing the North American portion of its EVault acquisition, Carbonite this week began rolling out a new partner program to accommodate its broader product portfolio.

Carbonite announced the $14 million cash acquisition of the EVault assets from Seagate Technology in December. Founded in 1997, EVault had been part of Seagate since 2007. The North American portion of the acquisition closed in mid-January, although the European Union part of the deal stretched further into the year.

While EVault offered an SMB spin on business continuity and disaster recovery, its products take Carbonite higher up into the midmarket than it had been able to reach before.

The EVault products added as part of the acquisition included EVault Cloud Backup and Recovery, a software-only solution for server backup; the EVault Backup and Recovery Appliance; and EVault Cloud Resiliency Services, which provides Disaster Recovery as a Service (DRaaS) for failover in the cloud.

"With this acquisition, Carbonite is taking a big step forward in meeting the data protection and business continuity needs of the entire SMB market from home offices to medium-sized businesses," said Mohamad Ali, president and CEO of Carbonite, when the EVault acquisition was announced. "EVault's proven technology, which includes a line of highly scalable appliances and advanced disaster recovery as a service (DRaaS) capabilities, enables us to round out our portfolio and immediately provide the features and functionality larger businesses require to support their complex environments."

A product pyramid graphic in a slide deck that Carbonite provided to RCP about the new program (see above) shows EVault products dominating in the top four tiers -- from a 25-99-employee small business tier to a 1,000-plus-employee enterprise tier. Carbonite Server Backup is the product of choice for very small businesses (10-24 employees) and small office/home office (1-9 employees). Carbonite Pro and the Advanced Pro Bundle overlap some of those lower tiers. The Carbonite Personal line is mostly for consumers.

Along with the product segmentation, Carbonite is rolling out a number of other changes to its partner program, including revamped margins, more generous deal registration rewards and new roles within its channel team.

Posted by Scott Bekker on April 20, 20160 comments

Three major providers of managed service provider-focused platforms revealed substantial expansions or integrations of their platforms in the last week, highlighting the arms race among top-tier vendors to provide a one-stop toolset for an MSP's business.

Autotask on Monday announced the unification of its professional services automation (PSA) and remote monitoring and management (RMM) tools. Newly dubbed the Autotask PSA and Endpoint Management platform, the unification is supposed to make technicians at MSP companies more efficient by eliminating the need for them to toggle between systems, while also leading to new insights as they see previously disparate information in the same user interface.

"We believe services and devices are the foundation of any IT practice, and belong together in a single product experience," said Patrick Burns, vice president of product management for Autotask, in a statement. "We are delivering the ability to perform work via a single interface, and providing business stakeholders with unified analytics to better understand the relationship between service delivery and computing environments leading to more informed, strategic decisions about the business."

On the same day, SolarWinds N-able announced a more thorough job of pulling a recently acquired technology into its MSP portfolio. Last October, SolarWinds N-Able released remote control access and support product MSP Anywhere, based on the acquisition of BeAnywhere. Initially, MSP Anywhere was a paid product for secure remote support of Windows PCs, Macs and iOS and Android devices.

This week, SolarWinds N-able integrated the functionality into its flagship N-central RMM platform. Called MSP Connect, the remote support and access feature is now a free component of the newly released 10.2 version of N-central.

In the most old-school of the recent batch of integrations, ConnectWise late last week announced a partnership with CentreStack, which offers a multitenant file sync and share product that competes with offerings such as Dropbox and Box. ConnectWise helped drive the RMM-PSA integration push with its investment in RMM provider LabTech in 2010, and also acquired the ScreenConnect remote control platform last year. The CentreStack integration is initially with LabTech, but ConnectWise intends to integrate it with its PSA platform soon.

Posted by Scott Bekker on April 20, 20160 comments

Microsoft on Monday launched a new Windows and Devices Competency, designed to highlight Microsoft partners with expertise in Windows 10 and mobility, with a fee waiver for partners who sign up for the silver level in the next two months.

The competency becomes the 29th competency in the Microsoft Partner Network (MPN). However, Microsoft announced plans last week to retire a dozen competencies over the next 18 months, including a Devices and Deployment competency that the Windows and Devices competency partially replaces.

"We had introduced the Devices and Deployment competency back with Windows Vista," said Gavriella Schuster, general manager of Microsoft Worldwide Partner Programs, in an interview. "The new Windows and Devices competency is based on Windows 10 and a lot of the new devices in the market. We want to shift partners out of this kind of amorphous Devices and Deployment competency, which also included Office and other things, and shift them into the Windows and Devices competency so customers understand that these are the partners that can help with Windows 10 and mobility."

The new competency was originally announced at the Microsoft Worldwide Partner Conference (WPC) in July 2015.

Some benefits of the new program include 50 additional product licenses for partners' internal use at the silver competency level and 100 additional licenses at the gold level.

Microsoft currently has four skills assessment path options -- system builder, deployment partners, Internet of Things (IoT) device builders, and application builders. Microsoft plans to release details later for a Certified IP path and a performance path for partners who are already selling Windows 10 devices.

Microsoft is also offering a short-term waiver for the silver competency fee. "To help you invest in your future, this silver competency fee is no-cost (through June 30, 2016)," Microsoft's Web page for the new competency reads. The gold competency will cost $4,730 for U.S. partners.

Posted by Scott Bekker on April 18, 20160 comments

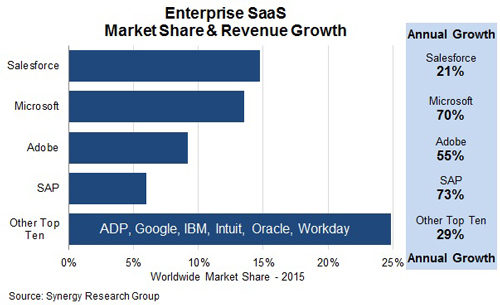

Microsoft is breathing down Salesforce.com's neck in the enterprise Software as a Service (SaaS) market, according to a new research report.

Synergy Research Group, which specializes in quarterly tracking and segmentation of IT and cloud markets, on Monday released a report showing Microsoft barely behind market leader Salesforce.com in the competitive enterprise SaaS market.

In an e-mail interview, John Dinsdale, Synergy's chief analyst and research director, said that while Salesforce.com is primarily a CRM play in SaaS, it was Office 365 that made the difference for Microsoft in 2015.

"Microsoft got really serious about migrating its huge Office customer base to a subscription-based model. Dynamics CRM Online is growing for sure, but it's Office 365 which is driving the SaaS market share gains," Dinsdale said.

Synergy did not release specific figures to the media, but an accompanying market share graphic (see below) shows Salesforce.com with just under 15 percent of enterprise SaaS revenues and Microsoft just a few percentage points behind.

"To give you a sense of where the two leaders have come from in terms of relative market position, in 2013 Salesforce enterprise SaaS revenues were over 2.5x those of Microsoft. In terms of current run rate, they are pretty much on a par with each other," Dinsdale said.

If current trends continue, Microsoft should overtake Salesforce.com in 2016. Microsoft had 70 percent year-over-year growth in 2015, compared to Salesforce.com's 21 percent, according to Synergy, which does not include home sales of Office 365 in its estimates.

Adobe is the next biggest enterprise SaaS revenue player, at just under 10 percent share, while SAP, at just over 5 percent, is fourth but growing the fastest with 73 percent annual growth. Rounding out the top 10 by market share are ADP, Google, IBM, Intuit, Oracle and Workday.

The enterprise SaaS market grew 40 percent overall in 2015, and Synergy forecasts that the market will triple in size over the next five years. Dinsdale said that although SaaS is a more mature market than other cloud categories, such as Infrastructure as a Service (IaaS) and Platform as a Service (PaaS), it is still "early days in terms of market adoption" for SaaS.

Posted by Scott Bekker on April 18, 20160 comments