In-Depth

Microsoft's Menu of Indirect CSP Partners Gets Bigger

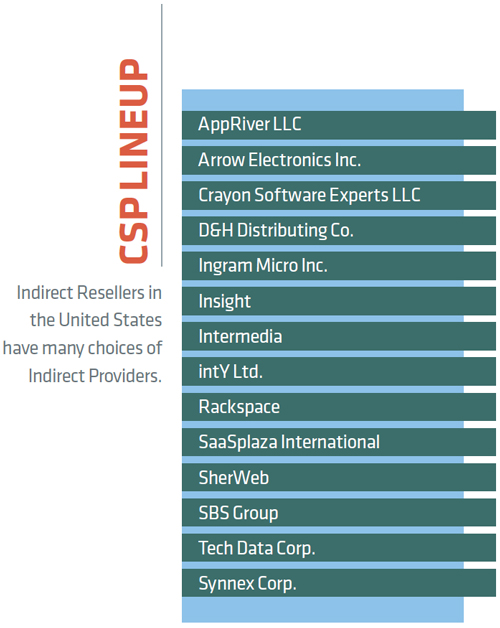

In the last few years, the number of Cloud Solution Provider Indirect Providers operating in the United States has jumped from just five to more than 14. Indirect Resellers have lots of choices, ranging from distys to LSPs to cloud distys to CSP specialists.

- By Scott Bekker

- December 13, 2017

Microsoft partners participating in the Cloud Solution Provider (CSP) program as Indirect Resellers are benefitting from a buyer's market when it comes to choosing the bigger companies with which to partner.

Three years after Microsoft introduced the CSP program, the number of strategic partners supporting the CSP partner community is expanding rapidly in the United States with new Indirect Provider partners, including both distributors and more specialized providers, and new tools offerings.

CSP was Microsoft's answer to the long-standing request among rank-and-file partners for the ability to resell Microsoft cloud products to end customers, bill for them monthly and bundle them with their own or other services, thus exercising some control over their own margins.

From its launch in 2014 up until sometime in 2016, partner sales under the CSP model were nearly 100 percent Office 365. But in the last year, Microsoft's ongoing efforts to introduce other products into the CSP model have started paying off. So while Office 365 volume of sales under CSP grows by double digits every month, the productivity suite's overall share of the CSP pie is down to about 80 percent. Azure and Dynamics 365 are the next best sellers, and the CSP product mix also includes Enterprise Mobility + Security (EMS) and Windows 10 Enterprise, among other things.

Sales have really taken off since Microsoft built out a structure for the CSP community in 2015 -- and that architecture has held steady, although some of the names have changed. If you think about the Microsoft CSP partners as a pyramid, the top of the pyramid are the Indirect Providers, originally called 2-Tier Distributors. These are the handful of distribution giants and other megapartners who transact with Microsoft and then nurture their own communities of channel partners. Those channel partners, now known as Indirect Resellers, and previously called 2-Tier Resellers, sell directly to customers and get their Office 365 and other Microsoft subscriptions from the Indirect Providers. Of Microsoft's roughly 8,000 CSP partners in the United States, roughly 90 percent of them are Indirect Resellers, so that's the base of the CSP pyramid.

The middle of the pyramid consists of the Direct Providers -- maybe 800 U.S. partners -- who are living the CSP dream. These are the partners who are able to do what partners have said they always wanted to do -- buy the cloud subscriptions directly from Microsoft and turn around and resell them to customers. Microsoft has no billing relationship with the customer, and the customer pays the price that the partner sets.

Occupying that middle tier is challenging, however. Those partners are responsible for billing customers, providing product support and operating Web portals. A Microsoft spreadsheet designed to help partners work out whether Direct or Indirect is the model for them suggests Direct Providers need 22 months to break even, while Indirect Resellers need only five months.

Expansion of the Indirect Providers

All the action in the CSP program on the indirect side is drawing more and more Indirect Providers into the business. In the fall of 2015, there were just five Indirect Providers servicing all the Indirect Resellers in the United States. That original group included Ingram Micro Inc., Tech Data Corp., Synnex Corp., AppRiver LLC and Intermedia. Two years later there are 14 U.S. Indirect Providers, with two of them having joined in just the last few months.

Distributors a Natural Starting Point

The most familiar and least surprising group of Indirect Providers is the distributors. For years, preceding the cloud push, Microsoft leaned on distributors to handle license sales. The distributors had big partner networks of their own, and Microsoft often left it to distributors to engage directly with partners, especially smaller partners. Moreover, the distys already have lots of certified Microsoft experts on staff and solid relationships at all levels of the Microsoft field organization. Finally, distributors have a culture of helping partners bring together all the elements of a solution on behalf of a customer. With one of the main selling points of CSP being the ability to bundle different cloud solutions for a customer, a distributor is a natural fit.

In addition to the Ingram Micro, Tech Data, Synnex group that was there at the start, other traditional distributors have spun up Indirect Provider businesses. Arrow Electronics Inc. entered the fray in April 2016. D&H Distributing Co., with its focus on small to midsize business (SMB) resellers, is also participating now.

The Broader Cloud Resellers

All of the distributors can also be lumped into a larger class of Microsoft Indirect Providers, which is companies selling Microsoft CSP as part of a broader cloud marketplace that they offer for their partners to take to customers. In other words, Microsoft cloud offerings are among many products in a cloud portfolio. The marketplaces aren't Microsoft-first. Office 365 may be an anchor product in the marketplace, but it's not the focus.

Nearly all of the distributors position their CSP participation in this way. For example, clicking from the master list of U.S. Indirect Providers on Microsoft's Web site, Ingram Micro takes partners to a splash page inviting them to become an Ingram Cloud Reseller. The page makes no mention of Microsoft, focusing instead on features of the Ingram Micro Cloud, such as education, training, business development, technical support and financing. A link to a cloud portfolio list includes more than 200 products from dozens of vendors. That list includes Microsoft and its products, but doesn't favor them.

Which is not to say that the more broadly focused distributor-based Indirect Provider programs don't have sophisticated stories for Microsoft Indirect Resellers. For example, Arrow points Microsoft CSPs to splash pages for Arrow Cloud, its cloud marketplace, but has pitches deeper on its site for how its ArrowSphere program can help Microsoft Indirect Resellers quadruple their margins compared to a non-Arrow CSP. Regardless of how reliable the multiples are or aren't, it's just an example of how even within broader cloud marketplace programs, Microsoft CSPs are still a valued commodity.

Beyond traditional distributors, the group of broader cloud resellers includes some newer-generation companies. Intermedia, which has had an on-and-off relationship with Microsoft's cloud suites over the years, is one example. The company has a long history as a hosted Exchange partner, and positioned its own Exchange partner program against Microsoft's for a while. With the launch of the CSP model, Intermedia became an enthusiastic early adopter as an Indirect Partner. The Intermedia CSP program, much like those of the distributors, is a mix of Microsoft and third-party products, with a white-label option that puts the Indirect Partner front and center, rather than Microsoft or Intermedia. Rackspace is another Indirect Provider that qualifies as a broader cloud reseller, with a CSP offering that emphasizes a suite of cloud products, as opposed to a Microsoft-centric offering.

The CSP Specialists

Another group of Indirect Providers is going all in on Microsoft CSP. These companies have some cloud-based services of their own that they aim to move alongside the Microsoft cloud products, but they've made a marketing choice to put Microsoft and CSP partners at the center of their messaging.

SherWeb, for example, has loaded up its welcome page for Microsoft partners with CSP-focused resources for starting up a CSP business, as well as partner case studies and CSP-related tools and services. The company also provides frequent blog content with CSP sales and technical tips covering Office 365 and other Microsoft cloud products.

AppRiver, which was part of the syndication program that served as a precursor to CSP, also keeps a tight focus on the Microsoft cloud stack and partner support. Emphasizing Office 365, AppRiver bills its trademarked Phenomenal Care round-the-clock support as a differentiator. Almost as an aside, the AppRiver partner landing pages mention the company's e-mail security, encryption and archiving offerings.

A recent addition to the U.S. stable of Indirect Providers, intY Ltd. has a similar background. A Hosted Exchange partner since 2007 and a syndication partner in 2012, intY offers its own branded Cascade cloud marketplace, but tailors and focuses its offerings for Microsoft CSP Indirect Resellers. The company, which is shifting in the United States from a focus on the Pacific Northwest to more of a national presence, has aggressive expansion plans that could mean extra incentives for partners. In a public statement in September, intY announced plans to triple its U.S. partner network over the next 12 months.

The Licensing Solution Providers

For partners who have worked closely and successfully with the Microsoft partners known as Large Account Resellers (LARs)/Licensing Solution Providers (LSPs), a few of the Indirect Providers come out of that heritage. Insight has a CSP program alongside its successful partner program for the Microsoft Services Provider License Agreement (SPLA). Software asset management specialist Crayon Software Experts LLC is also now working with CSPs in the United States. Both companies have been Indirect Providers internationally since the beginning of Microsoft's program, but became part of the U.S. program more recently.

Rise of the Dynamics Specialists

When it rebranded and rearchitected its online Dynamics products as Dynamics 365, Microsoft moved those business applications from their traditional place as a side hustle into its main strategic drive for cloud leadership. Two of the Indirect Providers specialize in the parts of the CSP program that involve Dynamics. SBS Group has experience working with Dynamics partners from its participation in the Master VAR program, which involved a handful of big Dynamics partners working with many smaller Dynamics partners to address business opportunities on a large geographic scale. In many ways, being a CSP Indirect Provider is a similar role, and the company is leveraging both that business model experience and its Dynamics experience through its Stratos Cloud Alliance. Another Indirect Provider focusing mainly on Dynamics is SaaSplaza International, which specializes in management of Dynamics AX deployed on Azure.

Tools Get Developed

Indirect Providers aren't the only ones offering assistance to Indirect Resellers. There's been a lot of activity lately among the tools vendors who sprung up around the Office 365 migration market, both in the area of helping Indirect Resellers move new customers to Microsoft cloud tools, as well as managing them once they're using the services. In the spring, Binary Tree launched the Azure-based Power365 for merger-and-acquisition projects involving multiple Microsoft Office 365 tenants. Just ahead of Microsoft Inspire this summer, SkyKick Inc. released new versions of its Office 365 Migration Software Suite and its Cloud Backup product. In September, Quadrotech Solutions began previewing two products, Office 365 Management and Office 365 Self Service. BitTitan revamped its MSPComplete platform in October at its inaugural user conference Elevate '17.

Whether a partner is looking for a broad line card, white-glove treatment or a Dynamics focus, there is an Indirect Provider for that. Microsoft CSP partners going the indirect route for the first time have a lot of options. For those who selected their provider when pickings were slimmer, it may be time for another look.