News

Windows 8 Market Share Still Struggling Six Months After Launch

- By Kurt Mackie

- May 03, 2013

Windows 8 adoption progressed very little in April, inching upward by less than 1 percentage point over the month, according to the latest data from Net Applications.

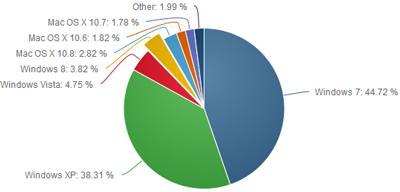

Roughly 3.8 percent of desktops used Windows 8 in April, up from 3.2 percent in March. Windows 7 led with 44.7 percent use, with Windows XP in second place at 38.3 percent.

It's already acknowledged that adoption of Windows 8, which launched about six months ago in October, is lower than that of Windows Vista, based on adoption rates four months out from each OSes' launch. Not even analyst and consulting firm Gartner Inc. expected such a market response in its early assessment of Windows 8.

Microsoft is mostly facing competition from itself in the desktop OS market. Microsoft can't seem to shake users off Windows XP, which is a near-12-year-old OS that will lose security patch support in less than a year from now. The April Windows XP use rate of 38.3 percent is down by less than 1 percentage point from Net Applications' March 39 percent estimate.

[Click on image for larger view.]

Desktop OS market shares, April 2013. (Source: Net Applications)

[Click on image for larger view.]

Desktop OS market shares, April 2013. (Source: Net Applications)

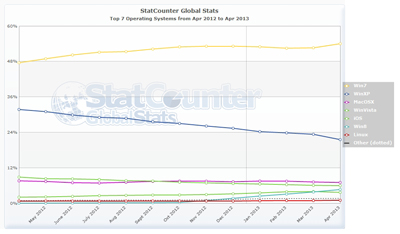

Some industry observers see such numbers as indicating a stall in Windows XP's downward decline. A perusal of OS use trends compiled by StatCounter does suggest that there was a period between January and March where the Windows XP decline had flattened out a bit. However, StatCounter showed Windows XP resuming its plummeting trajectory in April with 21.6 percent use, which is a much lower estimate than Net Applications' 38.3 percent estimate.

StatCounter has a different approach to measuring OS use compared with Net Applications, and its numbers vary accordingly. StatCounter reported Windows 7 use leading at 54 percent in April compared with Net Applications' 44.7 percent use. Windows 8 use in April was at 4.7 percent per StatCounter, representing a higher figure than Net Application's 3.8 percent estimate for Windows 8.

[Click on image for larger view.]

Global desktop OS market shares, April 2012 to April 2013. (Source: StatCounter)

[Click on image for larger view.]

Global desktop OS market shares, April 2012 to April 2013. (Source: StatCounter)

However it gets measured, the slow adoption of Windows 8 is being interpreted as a "failure" for Microsoft. Analysts such as IDC have suggested that the current down-trending economy is not to blame for the poor showing of Windows 8. Early on, there were shortages of touch-screens for Windows 8 devices hitting the market, which may have dampened sales somewhat, according to the research and consulting firm.

Microsoft has responded to the dampened uptake of Windows 8 with oblique plans for an OS update called "Windows Blue" or "Windows 8.1," but the details have been inadequately described. The company is cutting the price of Windows 8 to its OEM partners. It's also promised to respond with the introduction of smaller form factors running Windows 8, possibly tapping the new Intel Haswell and Bay Trail chipsets that are expected to arrive in the second half of this year. Lower-priced Windows 8 devices, such as $200 notebooks driven by Bay Trail chips, have been promised by Intel.

Such Windows 8 devices running the new Intel chips could make a first appearance next month at Microsoft's Build developer conference, scheduled for June 26. That's where Microsoft plans to talk more about Windows Blue.

About the Author

Kurt Mackie is senior news producer for 1105 Media's Converge360 group.