Survey Documents MSP Struggles with COVID-19

A major new survey of managed service providers (MSPs) finds that revenues are down, customers are struggling to pay their bills and interest in mergers and acquisitions is flagging in the midst of COVID-19's twin health and economic crises.

IT Glue, an IT documentation provider for IT professionals and MSPs, released results of the survey on Monday. Originally fielded in February with 1,500 participants, IT Glue conducted a follow-up survey in May to gauge sentiment after the effects of the pandemic had begun to hit the United States, which is home to about three-quarters of the respondents. That follow-up survey had about 500 respondents.

"The pandemic has created an unprecedented landscape for all businesses," said Nadir Merchant, general manager of IT Glue, which was acquired by MSP powerhouse Kaseya in December 2018.

At a high level, the report described the effect of COVID-19 on MSPs' business this way: "We know that the work from home scramble in March was replaced by a slowdown in April. In our follow-up survey, we found that around half of MSPs saw their monthly revenue decrease as the result of the coronavirus shut down, though some MSPs reported an increase in revenue as well."

In other words, MSPs that felt the slowdown in business definitely weren't alone. The specific number reporting monthly revenue decreases was 51 percent.

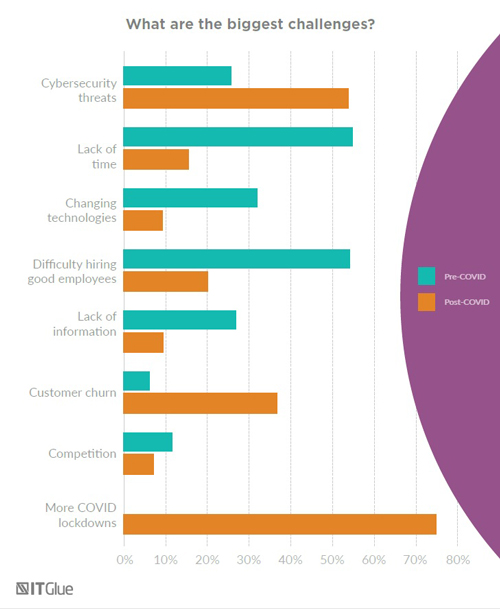

A chart from IT Glue's survey report shows how drastically MSPs' priorities have changed between February and March of this year. (Source: "2020 Global MSP Benchmark Report: A Pre and Post COVID Analysis," IT Glue)

A chart from IT Glue's survey report shows how drastically MSPs' priorities have changed between February and March of this year. (Source: "2020 Global MSP Benchmark Report: A Pre and Post COVID Analysis," IT Glue)

A slowdown in pay, or customers being outright unable to pay, also showed up in the follow-up survey. Some 29 percent of MSPs reported seeing their accounts receivable increase. A few MSPs reported that their accounts receivable impact increased by 50 percent or more. Just under 40 percent said their accounts receivable was flat. A surprising 23 percent had their accounts receivable impact decline, the survey found.

As MSPs deal with pandemic-related issues, interest in mergers and acquisitions has taken a big hit. Having done this survey for three years, IT Glue noted a major shift in the number of firms that expressed "no interest" in M&A. "While this figure has been steadily rising, the pandemic has marked the most profound shift in M&A sentiment in the MSP space," the report stated.

In the February run of the survey, 48 percent of respondents were not considering acquiring or merging with another MSP. By May, that figured had soared to 63 percent.

That's the buy side. On the sell side, sentiment is even more heavily anti-M&A. In February, 73 percent were not looking to sell. By May, that figure was 85 percent.

There were also major change in the challenges that MSPs considered important from February to May.

Cybersecurity threats, already a major concern for MSPs, approximately doubled from 27 percent to more than 50 percent. Customer churn also went way up as a concern. Going the other way were concerns about challenges related to lack of time, difficulty hiring good employees and changing technologies.

Meanwhile, 74 percent of respondent MSPs in May saw the potential for a renewed lockdown in the fall as a major challenge.

Posted by Scott Bekker on June 15, 2020