A Detour in Hyperscale Service Provider Spending?

We're on a slight detour in the steady drive by hyperscale service providers toward ever more compute, storage and networking gear in their datacenters.

The hyperscale service providers are companies like Amazon Web Services (AWS), Microsoft and Alphabet, which each are building and expanding dozens of datacenters worldwide to provide public cloud services to business and government customers.

As those companies and a few other huge competitors have physically positioned themselves to dominate the public cloud service market, their massive purchases have become an increasingly large portion of overall IT infrastructure spending.

IDC this week released figures for the second quarter of 2019 (April-June), showing a decline of 15 percent compared to the year-ago quarter in vendor revenue from hardware infrastructure sales to public cloud environments. The revenue total was $9.4 billion for the quarter.

As the Framingham, Mass.-based research company's statement put it: "This segment of the market continues to be highly impacted by demand from a handful of hyperscale service providers, whose spending on IT infrastructure tends to have visible up and down swings."

In all, sales of IT infrastructure products for cloud environments dropped by 10 percent quarter-over-quarter, when including private cloud spending, which also decreased but at a less severe pace of about 1 percent.

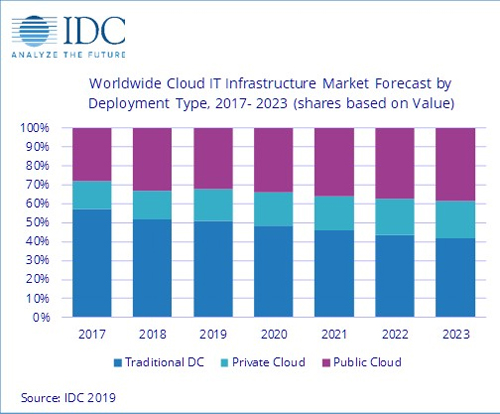

IDC sees cloud IT infrastructure sustainably overtaking traditional datacenter spending in 2020. (Source: IDC)

IDC sees cloud IT infrastructure sustainably overtaking traditional datacenter spending in 2020. (Source: IDC)

The market researchers had anticipated declines this year after a free-spending 2018. In the first-quarter report back in June, IDC's Natalya Yezhkova cautioned against reading too much into the expected drop-off.

"As the overall IT infrastructure goes through a period of slowdown after an outstanding 2018, the important trends might look somewhat distorted in the short term," Yezhkova, research vice president of Infrastructure Systems, Platforms and Technologies at IDC, said in a statement. "IDC's long-term expectations strongly back continuous growth of cloud IT infrastructure environments. With vendors and service providers finding new ways of delivering cloud services, including from IT infrastructure deployed at customer premises, end users have fewer obstacles and pain points in adopting cloud/services-based IT."

With its September update, which includes Q2 results, IDC is now calling for the public cloud IT infrastructure segment to drop by nearly 7 percent from 2018 to about $42 billion in vendor revenues for all of 2019.

The pullback in spending is delaying the crossover point when more money will be spent on cloud infrastructure (both public cloud and private cloud) than on traditional IT environments. While cloud IT infrastructure spending was already briefly higher than traditional IT infrastructure spending in the third quarter of 2018, IDC now forecasts that for the full year of 2019, slightly more money will be spent on traditional IT infrastructure than cloud IT infrastructure. As for the public/private cloud mix, about two-thirds of cloud IT infrastructure spending comes from the hyperscale, public cloud providers.

This detour aside, IDC anticipates steady growth in spending on cloud IT infrastructure in 2020 and beyond -- leading to the cloud side outpacing the traditional side in revenues on a sustained basis.

Posted by Scott Bekker on September 26, 2019