Office 365 Sales Put Microsoft in Close 2nd in Enterprise SaaS

Microsoft is breathing down Salesforce.com's neck in the enterprise Software as a Service (SaaS) market, according to a new research report.

Synergy Research Group, which specializes in quarterly tracking and segmentation of IT and cloud markets, on Monday released a report showing Microsoft barely behind market leader Salesforce.com in the competitive enterprise SaaS market.

In an e-mail interview, John Dinsdale, Synergy's chief analyst and research director, said that while Salesforce.com is primarily a CRM play in SaaS, it was Office 365 that made the difference for Microsoft in 2015.

"Microsoft got really serious about migrating its huge Office customer base to a subscription-based model. Dynamics CRM Online is growing for sure, but it's Office 365 which is driving the SaaS market share gains," Dinsdale said.

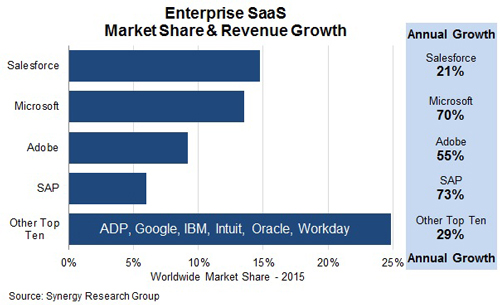

Synergy did not release specific figures to the media, but an accompanying market share graphic (see below) shows Salesforce.com with just under 15 percent of enterprise SaaS revenues and Microsoft just a few percentage points behind.

"To give you a sense of where the two leaders have come from in terms of relative market position, in 2013 Salesforce enterprise SaaS revenues were over 2.5x those of Microsoft. In terms of current run rate, they are pretty much on a par with each other," Dinsdale said.

If current trends continue, Microsoft should overtake Salesforce.com in 2016. Microsoft had 70 percent year-over-year growth in 2015, compared to Salesforce.com's 21 percent, according to Synergy, which does not include home sales of Office 365 in its estimates.

Adobe is the next biggest enterprise SaaS revenue player, at just under 10 percent share, while SAP, at just over 5 percent, is fourth but growing the fastest with 73 percent annual growth. Rounding out the top 10 by market share are ADP, Google, IBM, Intuit, Oracle and Workday.

The enterprise SaaS market grew 40 percent overall in 2015, and Synergy forecasts that the market will triple in size over the next five years. Dinsdale said that although SaaS is a more mature market than other cloud categories, such as Infrastructure as a Service (IaaS) and Platform as a Service (PaaS), it is still "early days in terms of market adoption" for SaaS.

Posted by Scott Bekker on April 18, 2016