News

Microsoft No. 2 Behind Amazon in Cloud Market Share

- By David Ramel

- August 02, 2016

Amazon Web Services (AWS) is the leading cloud services provider by a considerable margin, but Microsoft Azure is leading the small pack that's chasing it, according to recent data from Synergy Research Group (SRG).

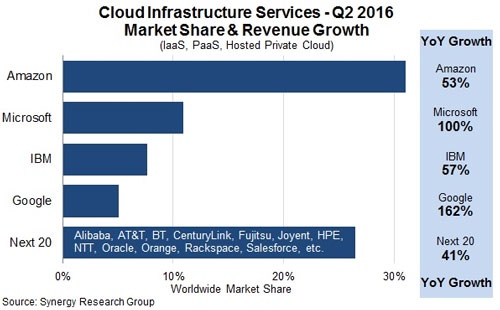

In a report released Monday on the second-quarter market shares of Infrastructure as a Service (IaaS), Platform as a Service (PaaS) and hosted private clouds, SRG found that AWS' market share of about 31 percent is significantly larger than those of its three main competitors -- Azure, IBM and Google. Microsoft's cloud is leading the chase pack, with about 11 percent of the market, while IBM and Google have about 5 and 8 percent, respectively.

Meanwhile, the next 20 cloud providers -- which include Rackspace, Hewlett Packard Enterprise, Salesforce.com and Oracle -- combine for a market share that's well below AWS'.

In terms of year-over-year growth, Google enjoys the lead at 162 percent, while Azure has grown by an even 100 percent. AWS is in fourth with a 53 percent year-over-year growth rate, according to SRG.

"In a variety of ways Amazon and the other big three players have distanced themselves from the competition in this market and continue to widen the gap," said SRG analyst John Dinsdale in a statement. "What marks them out as different is their global presence, marketing muscle, ability to fund huge investments in hyperscale data centers and, in most cases, a determination to succeed in the market. The ranking of the next 20 largest cloud providers features some interesting companies, with Alibaba and Oracle growing particularly strongly, but they are all starting from a long way behind Google, which is itself growing by well over 100 percent per year and yet remains only a sixth the size of Amazon."

The new SRG findings mirror previous reports by the company, like this one in May and this one in February. However, U.K.-based cloud comparison service Compare the Cloud ranked providers in March of last year and indicated that AWS was losing mind share. If so, that hasn't been realized in market share rankings -- nor in financial earnings. AWS recently reported $3 billion in revenue for its second quarter, giving it a run rate well over the $10 billion that Amazon.com CEO Jeff Bezos projected earlier this year.

By comparison, Microsoft said in most recent earnings report that its cloud business has a run rate of $12.1 billion. However, that figure combines all of Microsoft's commercial cloud products, including the Office 365 productivity suite, in addition to Azure. Microsoft claimed last September that Azure differentiates itself from AWS by being in more regions and having an edge in the hybrid and PaaS spaces.

According to SRG, though, it doesn't appear to be a very competitive race between the four cloud leaders and their challengers.

"In aggregate the big four grew their cloud infrastructure service revenues 68 percent in Q2, while the next 20 largest cloud providers grew by 41 percent and all other smaller providers grew by 27 percent," the company said. "The market as a whole grew by 51 percent. Amazon remains in a league of its own, almost three times the size of its nearest competitor and with a clear lead in all major regions and most segments of the market. Meanwhile Microsoft and Google can point to substantially higher growth rates, while IBM continues to feature strongly thanks primarily to its leadership in the hosted private cloud segment."

About the Author

David Ramel is an editor and writer at Converge 360.