News

Microsoft's Mobile Market Share Falls Below 1 Percent

- By Gladys Rama

- May 23, 2016

Microsoft's beleaguered smartphone platform continues to lose ground in global market share standings.

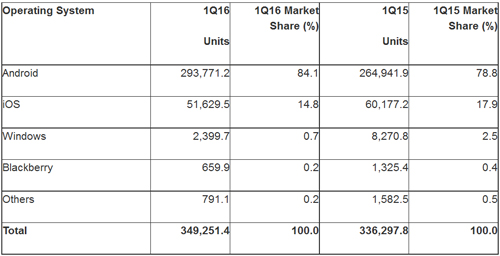

According to data released last week by research firm Gartner Inc., Windows Phone and Windows 10 Mobile shipped on less than 2.4 million devices in the first quarter of 2016, giving Microsoft a global smartphone market share of 0.7 percent.

That's down sequentially from the 1.1 percent market share (on 4.4 million devices shipped) that Microsoft recorded in Q4 of 2015. Year over year, Microsoft smartphone shipments dropped by over 70 percent in Q1.

At the top of the OS standings are perennial leaders Google Android and Apple iOS. First-place Android closed Q1 with 84 percent of the market and 294 million devices shipped, while iOS had 15 percent of the market and shipped on 52 million devices.

[Click on image for larger view.] Worldwide smartphone sales (thousands of units) to end users by operating system in Q1 2016. (Source: Gartner Inc.)

[Click on image for larger view.] Worldwide smartphone sales (thousands of units) to end users by operating system in Q1 2016. (Source: Gartner Inc.)

Overall, the smartphone market grew by 4 percent year over year, a very modest increase compared to the double-digit growth of years past.

"In a slowing smartphone market where large vendors are experiencing growth saturation, emerging brands are disrupting existing brands' long-standing business models to increase their share," said Gartner Research Director Anshul Gupta in a prepared statement.

Gartner's findings come close on the heels of Microsoft's announcement last week that it is selling off its feature phone business, which it acquired from Nokia in 2013 for over $7 billion, to Nokia partner HMD Global Oy and Foxconn subsidiary FIH Mobile Ltd. The sell-off is expected to net Microsoft $350 million.

In turn, Nokia, HMD and FIH announced a joint partnership to revive Nokia's phone and tablet business using the assets acquired from Microsoft. Nokia has given HMD the license to "create Nokia-branded mobile phones and tablets for the next ten years," while FIH will provide supply-chain and manufacturing support.

Gartner cautions that Nokia-branded devices will face an uphill battle in the current smartphone market.

"In today's market it takes much more than a well-known brand to sell devices. Making good hardware won't be an issue for Nokia, but users need a compelling reason to remain loyal to the same brand," Gupta said. "Furthermore, that the smartphone market is slowing down makes it difficult for mobile phone vendors to reach previous levels of growth. New company HMD is entering the market at a less prosperous time, making it even more difficult for the vendor to do well in the short term."