Software-defined networking (SDN) is usually discussed as a solution for cloud computing giants and enterprises with large datacenters, but one Plano, Texas-based company believes there's an SMB-scale opportunity in the technology for managed service providers.

Netsocket Inc. this week rolled out a packaged offering for MSPs called Netsocket Virtual Edge, which is targeted at SMBs and enterprise remote offices.

"Managed service providers must find a way to provide affordable network services to smaller business customers and at a profit," said Netsocket President and CEO Fletcher Hamilton in announcing Virtual Edge. "We are very excited to pioneer the path for MSPs by delivering a solution that can virtually revolutionize their business and profitability model and, in short, result in new revenue streams."

SDN represents an effort to abstract the network logic and policies from the networking hardware -- placing it instead on a server, where it can be modified with more user-friendly tools that work across multiple types of hardware from many vendors. The idea is to create a "control plane," which is configurable from a server and which is separate from a "data plane" of packet-routing activity carried out in real time.

Based on Netsocket's SDN framework called Netsocket Virtual Network, Virtual Edge consists of a standard x86, pre-configured server that acts as a server, router and Layer 3 switch. The package can be shipped to the customer, eliminating the need for an MSP to visit each customer site.

Once the customer plugs in the server and attaches a cable, the system is designed for an MSP to centrally manage the virtualized network, along with those of other customers through a multi-tenant management interface. From the management console, MSPs can manage edge routing, switching, firewall and tunneling capabilities to distributed environments, while the on-site server can also support additional third-party SDN solutions, according to Netsocket.

Netsocket's channel building effort is still in the early stages and the company is looking for new MSP partners.

One prominent Microsoft National Systems Integrator (NSI) partner with an MSP practice, Catapult Systems based in Austin, Texas, is trying out the Netsocket SDN solutions in its own branch offices to evaluate if SDN represents a workable model for small and remote office customers.

In a statement, Catapult Systems IT Director Joe Stocker reported good results internally: "Utilizing the NVN Web-based GUI, I've been able to make adds and changes to the network within mere minutes."

Posted by Scott Bekker on February 14, 20140 comments

CDW, one of Microsoft's biggest partners generally and especially for Office 365 resales, announced plans this week to start reselling Google Apps for Business.

The deal drew immediate speculation that CDW closed the Google deal in response to Microsoft's Jan. 25 cuts in partner reimbursements. Those cuts affecting partner payouts for deploying Office 365 seats sold under Enterprise Agreements reduced the amount partners received by as much as 56 percent for some SKUs.

It is speculation that was partly encouraged by CDW's outside PR agency, which, in e-mailing the news release to some reporters Tuesday, used the subject line: "Google Gains Strategic Ally CDW in Cloud Services Battle." Whether intentional or not, the phrasing implied that CDW might be picking a new side in the cloud suite faceoff.

CDW Chairman and CEO Thomas E. Richards hit back hard against any retaliation, or side-picking interpretation in an earnings call on Thursday. During the Q&A portion of the call, Richards said of the new Google deal, "Look, this isn't about us doing anything other than finding a particular partner that had an opportunity in the marketplace and us building off of the success we had with the [Google] Chromebook." CDW started partnering with Google in February 2013 to sell Chromebooks.

Without naming names, Richards implied Microsoft when he continued, "I don't think it's going to have any impact on other partners. In fact, as it was, I think, reported in some places, it had nothing to do with our partnership with other people. We're excited about our partners and I think the strategy some of our other partners are deploying about pushing people like CDW to the cloud is absolutely the right thing to do. We've been planning for it, investing for it and feel really good about it."

"We are absolutely excited about that [Google] partnership, but it's not at the expense of other partnerships. Trust me," Richards said.

Richards' comments suggested that CDW will offer Office 365 and Google Apps for Business side-by-side to customers, which in itself is a win for Google and a loss for Microsoft. Because CDW has been one of Microsoft's strongest cloud suite partners since the Business Productivity Online Suite days and is a past Microsoft Large Account Reseller Partner of the Year award winner, the high-profile move could be a catalyst for hundreds of other partners to broaden their cloud portfolios to include Google.

Richards said that Google will develop professional services capacity to migrate and deploy Google Apps for Business seats, but for now will use partners to help bridge that expertise gap. CDW's first professional services partner is Denver-based Tempus Nova Inc., a Google Apps Premier Reseller, and CDW is looking to work with more partners.

A transcript of the question in the earnings call and Richards' answer follows:

Question from Brian Alexander of Raymond James Financial: Tom, you guys announced [an] interesting partnership with Google this week. I was hoping you could expand on the scope of the relationship; reselling versus services and implementations; the motivation for partnering more deeply with Google; and if there's any offsets with other major software partners that we should consider as you grow this business?

Answer from CDW CEO and Chairman Thomas E. Richards: There was a lot in that one question. Let me answer the last first. Look, this isn't about us doing anything other than finding a particular partner that had an opportunity in the marketplace and us building off of the success we had with the Chromebook.

I don't think it's going to have any impact on other partners, in fact, as it was, I think, reported in some places, it had nothing to do with our partnership with other people. We're excited about our partners and I think the strategy some of our other partners are deploying about pushing people like CDW to the cloud is absolutely the right thing to do. We've been planning for it, investing for it, and feel really good about it.

The actual relationship is...customers are looking for us to represent and include in our recommendations to help them reselling some of those apps as a software as a service.

As we've talked about a lot, especially on the IPO roadshow, when a customer is moving to a cloud-based solution, there is an integration and aggregation opportunity [that] exists as it gets built into their IT infrastructure. I think as we talked about, Brian, that takes some services skillsets. We don't have those today, resident, in a meaningful way to scale so we're going to use partnerships to get there.

But just as we've done in other parts of our service business, as we build momentum and we build density, then we're going to look to add that to our service portfolio.

We are absolutely excited about that partnership, but it's not at the expense of other partnerships. Trust me.

Posted by Scott Bekker on February 13, 20140 comments

Kevin Turner, Microsoft's incendiary and controversial chief operating officer, appears to have an ally in Microsoft's new CEO.

Satya Nadella, newly appointed Microsoft's third CEO, twice singled out Turner as a valuable asset to Microsoft during a webcast Tuesday afternoon designed to introduce Nadella to customers and partners.

"Kevin" was the first Microsoft executive Nadella mentioned during the 20-minute webcast, citing the COO's recently concluded worldwide tour of Microsoft subsidiaries. Later, Nadella said, "I'm blessed to have a fantastic leadership team with Kevin and the others on the [Senior Leadership Team]."

New Microsoft CEO Satya Nadella (left) and Microsoft COO Kevin Turner.

New Microsoft CEO Satya Nadella (left) and Microsoft COO Kevin Turner.

Microsoft turned the webcast camera several times to the front row of an audience of executives and customers on the Microsoft campus, showing Turner nodding in agreement with various points Nadella was making.

Turner was one of several senior Microsoft insiders mentioned as possible replacements for Steve Ballmer, who announced in August that he would step down within a year. Other names in regular circulation were Tony Bates, executive vice president of business development and evangelism, and Stephen Elop, who is returning to Microsoft with the acquisition of Nokia's mobile phone business.

While working with other executives who were in line for the same job will be a tightrope for Nadella to walk, there has been speculation that Turner may be on the way out as Microsoft reorganizes at the top. Earlier in the day, Kara Swisher, the well-sourced Re/code reporter who broke a number of stories about the Microsoft CEO search, wrote, "It will be interesting to see what happens to Turner, as well as advertising and strategy head Mark Penn, the well-known political operative who has been -- to say the least -- an internally controversial Ballmer appointment."

Turner is a staple of the Microsoft Worldwide Partner Conference, where he regularly entertains attendees with hyperbolic swipes at Microsoft's competition. However, many partners and former Microsoft employees privately contend that Turner is driving cost containment efforts in the channel that are penny-wise and pound-foolish.

Related:

Posted by Scott Bekker on February 04, 20140 comments

By now you've heard the news: Microsoft settled on internal candidate Satya Nadella as its next CEO effective today. Bill Gates is stepping down as chairman but will stay on the board and spend a third of his time advising Nadella. John Thompson becomes chairman, and Steve Ballmer joins the board.

As the independent voice of the Microsoft channel community, Redmond Channel Partner magazine wants to know what you think. Give us your opinions about Microsoft's blockbuster executive and boardroom moves and the company's overall direction in this quick, 12-question survey.

Posted by Scott Bekker on February 04, 20140 comments

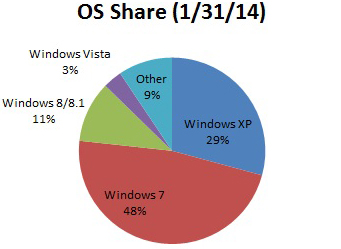

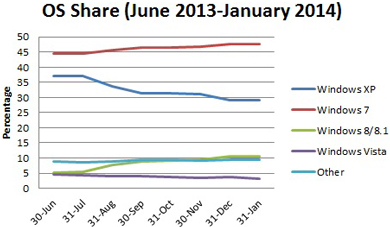

With 64 days remaining until Microsoft officially ends Windows XP support, the aging OS is holding stubbornly onto its market share.

Net Applications.com published its month-end numbers on Feb. 1, showing Windows XP at 29.23 percent share. At a time when users and organizations globally should be jettisoning the operating system, the usage share is actually a very slight increase in Windows XP's 28.98 percent share for the close of 2013.

Source: Net Applications.com

Source: Net Applications.com

The Net Applications figures are based on data extracted from visitors to the company's global network of thousands of partner sites.

Windows XP has followed a stair-step pattern in usage drops over the last half year, falling from about 37 percent in June and July to roughly 31 percent from September through November before hitting its current plateau.

Source: Net Applications.com

Source: Net Applications.com

Meanwhile, Windows 8/8.1 showed very slight growth to around 10.5 percent share in January, narrowly widening its lead against the "other" category, which includes Apple Macintoshes, Google Chrome OS, Linux and everything else. Other OSes also plateaued from December to January at 9.4 percent.

Posted by Scott Bekker on February 03, 20140 comments

One of the best not-for-resale software deals in the channel is getting a hefty price hike, although it's still a relative bargain.

Microsoft this week unveiled the long-awaited changes to the Microsoft Action Pack, one of the most popular components of the Microsoft Partner Network.

One of the biggest changes is the price, which is going up by as much as 44 percent.

Starting Feb. 24, the Action Pack subscription will cost $475 in the United States. The new subscription price consolidates pricing from what was previously two packages -- the $329 per year Action Pack Solution Provider (APSP) and the $429 a year Action Pack Development & Design (APDD). The new cost is a 44 percent increase for former APSP subscribers and an 11 percent bump for APDD subscribers.

Next month, all partners will subscribe to one universal Action Pack, and choose among five tailored business model packages: application development and design, device design and development, hosting, managed services, professional services or reselling.

The core value of the Action Pack is internal-use Microsoft software licenses to support a 10-person partner business. Those include full licenses for Windows desktops and servers, as well as other server products, such as SQL Server, Exchange Server, SharePoint Server and Lync Server.

At the same time, the Action Pack will soon replace Cloud Essentials as the least expensive way for partners to get internal-use seats of Office 365, Dynamics CRM Online and Windows Intune and Windows Azure usage credits. In that case, the Action Pack is an even bigger price jump because Cloud Essentials, which will be discontinued June 30, was free.

Where the on-premise default in the Action Pack is for 10 seats, Microsoft is being slightly stingier with cloud licenses. Subscribers get five seats each of the E3 SKU of Office 365 and of Windows Intune. Dynamics partners are also eligible for five seats of Dynamics CRM Online. The subscription also includes $100 in monthly Windows Azure credits.

However, Microsoft offers a few ways for subscribers to increase their seat counts for Office 365. One is to trade some of the on-premise core benefits for Office 365 seats. Another way is an incentive -- partners are eligible for another five seats of Office 365 if they've sold 25 seats of Office 365 to customers in the last 12 months.

Other benefits included in the Action Pack include technical support, developer tools, marketing campaign materials and services and $100 in Bing advertising credits for the subscriber and $500 for the subscriber's customers.

Posted by Scott Bekker on January 31, 20140 comments

Kaseya, the managed services provider (MSP) and IT management software and services company, which has been under new management for the last seven months, on Friday issued a cleanup release of its core management platform that the company's CEO said is all about restoring trust.

Yogesh Gupta, an executive with senior management experience at CA and FatWire Software, came aboard as Kaseya's president and CEO in June, when New York-based Insight Venture Partners made a significant investment in the Swiss company. Kaseya Virtual System Administrator (VSA) 6.5, released Friday after a three-week beta testing phase, is the result of new development processes at Kaseya, Gupta said in an interview.

"Over the last four-and-a-half months, we have transformed the way we manage our product," Gupta said. "We identified over 400 bugs that were serious -- about 100 were identified by customers and 300 we found through internal testing. Some of those bugs are quality issues, some are usability issues and some are performance issues."

Other than the 400 bug fixes, the 6.5 release includes a number of enhancements. The new version brings support for Windows 8.1 and Windows Server 2012 R2, architectural enhancements to facilitate third-party integrations and previously promised enhanced integrations with Kaseya Anti-Virus (KAV), Kaseya Anti-Malware (KAM) and Kaseya Backup (KBU).

The 6.5 release, along with a planned schedule of releases every four months with regular patches in between are "all about trying to rebuild trust," Gupta said. "For this release, we had to do a lot of cleanup. The next release is going to be a very exciting release."

Even ahead of the 6.5 release, Gupta said new company processes, such as rigorous pre-release testing of patches, a predictable, every-other-week patch release schedule and the elimination of random new features in patches, are having an impact.

"The number of incoming support calls in December was half what it was in July," Gupta said.

As for what might be in the next release, Gupta wasn't ready to say. "I'm being fairly deliberate about how we go about communicating to customers," he said. A full roadmap for the major features of the every-four-month VSA releases should be forthcoming at the Kaseya Connect conference in Las Vegas from April 14-16.

A few major integrations are obvious candidates for that roadmap. Within a few months of Insight Venture Partner's investment, Kaseya acquired Rover Apps, Zyrion Inc. and 365 Command. All have been rebranded as standalone Kaseya products but await full integration into Kaseya's core suite.

In the meantime, Gupta said future acquisitions are always possible but he suggested that they weren't a top priority at the moment. "The acquisitions we did, we did very quickly," he said. "I was working [with Insight Venture Partners] both on looking at Kaseya and helping us find assets. We started rolling on them before we came to Kaseya."

Posted by Scott Bekker on January 31, 20140 comments

Partners will have the opportunity to bill their own customers for Microsoft's Windows Intune service and the soon-to-be-released Power BI service starting in April.

"Windows Intune will be available for resale through Open Volume Licensing beginning April 1, 2014. Intune joins Office 365, and the upcoming Power BI for Office 365 offer, as the latest in our suite of cloud services available for resale," wrote Lori Dennis, senior director, Server & Cloud Breadth Channel Marketing, in a blog post this week.

Windows Intune is Microsoft's cloud-based device management service, which will be getting a minor update next week. Power BI is a suite of mostly online components designed to help Excel users create visualizations from data. Power BI was announced at the Microsoft Worldwide Partner Conference (WPC) in July and is expected to be released early this year. Microsoft revealed Power BI pricing earlier this month.

With online products, the Open Volume Licensing approach allows partners to buy the license for Microsoft products on behalf of the customer and then bill the customers themselves. Partners argued for years for the ability to bill their own Office 365 customers -- saying owning customer billing both gave them more peace of mind that Microsoft wouldn't poach accounts and gave partners the ability to bundle services, including Office 365, together and present customers with one price, which also allows them to set their own margins.

Microsoft granted partners billing capability for Office 365 in the spring of 2013, although it only applied to Office 365 and not to Windows Intune.

Partners have generally responded positively to the Open licensing opportunity with one major caveat: As it's currently constructed, partners must pay for an entire year's worth of the license upfront on behalf of customers who are mostly interested in monthly payments.

Posted by Scott Bekker on January 30, 20140 comments

Citrix Systems Inc. is looking for a new CEO.

Mark Templeton, who has been the public face of Citrix for more than a decade, is returning from a leave of absence, but intends to retire within the next year, subject to naming a successor, the company announced Wednesday.

Templeton went on a leave in October, following the death over the summer of his youngest child, Pierce, 27. Executive Vice President and Chief Financial Officer David Henshall filled in as acting CEO.

Templeton is returning to the CEO role, and the Citrix board of directors has started a search process to find the next CEO. Henshall has been promoted to chief operating officer, and will also retain his previous titles.

"I would like to express my deep appreciation to the board of directors for allowing me time to support my family," Templeton said in a statement. "I remain fully committed to Citrix until my successor is named and the CEO transition is complete."

According to his company bio, Templeton joined Citrix in 1995 as vice president of marketing and became president in 1998 and CEO in 2001.

"Under his leadership, Citrix has been transformed from a $15 million organization with one product, one customer segment and one go-to-market path, to a global powerhouse," the bio states.

On Wednesday, Citrix reported revenues of $2.92 billion and net income of $340 million for all of 2013. The company has also built a powerful channel presence in that time, with an estimated 10,000 business partners.

Posted by Scott Bekker on January 30, 20140 comments

The U.S. chapter of the International Association of Microsoft Channel Partners (IAMCP) passed the baton to two new top officers this week.

"Congratulations to the new U.S. president, Jon Sastre, and vice president, Ro Kolakowski. The new leadership team [for] IAMCP US was installed today," wrote outgoing IAMCP U.S. President Rudy Rodriguez in a LinkedIn post Wednesday.

Sastre had served as vice president of the IAMCP during Rodriguez's term. He is president of Conquest Technology Services Corp., a Miami-based company specializing in Microsoft unified communications, Office 365 and managed services.

Kolakowski is a partner at 6th Street Consulting, a Los Angeles area consulting and managed services firm and Microsoft's 2013 Partner of the Year winner for Collaboration and Content.

The IAMCP was formed in 1994 as a peer-to-peer networking organization for best-of-breed Microsoft partners and to give those partners an organized feedback mechanism to communicate partners' needs and concerns to Microsoft in a unified way. The U.S. chapter, one of five country or regional chapters in the worldwide organization, has 36 sub-chapters and 844 members in the United States.

Rodriguez's note also thanked members for more than two years of support at IAMCP and encouraged them to stay tuned. "The new board has an aggressive agenda and will need our support in continuing [to] grow our relationships with Microsoft and helping our partners grow their business," Rodriguez said.

The IAMCP's semi-annual board meeting is scheduled for Feb. 22-23 in Washington, D.C., where Microsoft will also hold its Worldwide Partner Conference in July.

Posted by Scott Bekker on January 30, 20140 comments

Less than a week after reaching a deal to buy IBM's x86 server business, Lenovo turned around and cut a deal with Google for the Motorola Mobility smartphone business.

In a deal announced Wednesday, Lenovo will pay approximately $2.91 billion for the smartphone business.

Google will hang on to a "majority" of the patent assets, which was one of the main reasons Google bought Motorola for $12.5 billion in a deal that closed in May 2012. Google CEO Larry Page had said when the deal was announced in August 2011, "Our acquisition of Motorola will increase competition by strengthening Google's patent portfolio, which will enable us to better protect Android from anti-competitive threats from Microsoft, Apple and other companies."

Lenovo's purchase will involve $1.41 billion at close, including $660 million in cash and $750 million in Lenovo stock, with the remaining $1.5 billion coming via a three-year promissory note.

The fact that Google is selling Motorola's handset business for about a quarter of the price that it paid shows which part of the business (patents versus phone manufacturing) Google values more. Lenovo will receive more than 2,000 patent assets and a license to use the larger cache of patents that Google is retaining.

Last Thursday, Lenovo and IBM reached a $2.3 billion deal for IBM's x86 server business.

If the Google deal closed today, Lenovo would be the No. 3 Android smartphone manufacturer in the United States and also command strong positions in the Latin American and Western European markets, according to Lenovo.

"The acquisition of such an iconic brand, innovative product portfolio and incredibly talented global team will immediately make Lenovo a strong global competitor in smartphones. We will immediately have the opportunity to become a strong global player in the fast-growing mobile space," said Yang Yuanqing, chairman and CEO of Lenovo, in a statement.

Yuanqing said Lenovo's experience at "embracing and strengthening" the IBM Think brand after acquiring IBM's PC business in 2005 will serve the Chinese company well in integrating the Motorola business.

In a statement, Page also indicated that Lenovo's previous experience with the PC business was important to Google, as well. "Lenovo has the expertise and track record to scale Motorola Mobility into a major player within the Android ecosystem. This move will enable Google to devote our energy to driving innovation across the Android ecosystem," Page said.

If the deal clears regulatory hurdles, and Microsoft's Nokia deal also goes through, it will leave Microsoft alone as a vendor with both an OEM business model for its smartphone OS and its own handset manufacturing division. When Google acquired Motorola, there had been speculation that the move would scare away other handset manufacturers. However, Android smartphone sales have continued to rocket upward and Samsung, rather than the Google-owned Motorola, has been dominant.

Meanwhile, it could mean that Lenovo, one of Microsoft's most important OEM partners in the PC and, soon, the server business, would be a serious rival to Redmond on smartphones.

Posted by Scott Bekker on January 29, 20140 comments

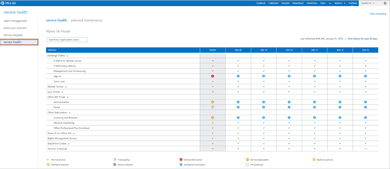

Microsoft partners managing the Office 365 service on behalf of customers now have a tool that will help them keep on top of Microsoft service outages, potentially before angry calls from customers start flooding in.

Microsoft unveiled the Office 365 Partner admin center this week and plans to roll it out worldwide over the next few weeks.

The product is not only a service-outage notification service for partners. According to a blog entry by Adam Jung, a senior product manager on the Office 365 team, the tool has four main functions. In addition to being able to view customers' Office 365 service health status and details, the partner admin center allows partners to get a single view of all the customers they have delegated admin privileges for; create, edit and view service requests on behalf of customers; and perform administrative tasks on behalf of customers.

For partners, the tool supersedes an Office 365 admin center that didn't consolidate all of a partner's customers and was more focused on selling new or additional services. "Previously, with Partner tools in the Office 365 admin center, you could perform delegated administration tasks on behalf of customers and create trial invitations, purchase offers and offers for delegated administration," Jung wrote.

[Click on image for larger view.]

Drilling into the "service health" tab of the new Office 365 Partner admin center shows the status of various customer services at a granular level.

[Click on image for larger view.]

Drilling into the "service health" tab of the new Office 365 Partner admin center shows the status of various customer services at a granular level.

Assuming the new admin center works as advertised, with accurate and timely service outage updates from Microsoft, the tool could greatly help partners provide the kind of visible value to customers that will help them retain their Partner of Record status with those customers and keep their Microsoft maintenance fees rolling in year after year.

According to screenshots of the interface, a "client management" tab will show all of a partner's customers along with any alerts next to each customer's name about their service health. Drilling into the "service health" tab for each customer shows a granular list of the services a customer uses.

Each service has a green check mark for the day if all is well, or one of a number of symbols if all is not well. Trouble signals include service interruption, service degradation, restoring service, extended recovery, investigating, service restored or additional information.

"This gives you better visibility into events or issues that may be impacting a customer's environment, including existing incidents and upcoming planned maintenance events," Jung said.

Posted by Scott Bekker on January 29, 20140 comments