Intrepid reporters at Bloomberg look like they've solved a big mystery of the last week: Which giant HPE client cut server orders so dramatically that President and CEO Meg Whitman was compelled to bring up the setback in an investor call?

Citing anonymous sources, Bloomberg reported that the client was Microsoft, one of the biggest server buyers on the market as it continues its global buildout of Azure, Office 365, Dynamics 365 and other public cloud infrastructure and services. Microsoft and HPE did not offer on-the-record comments to the report.

The question emerged last Thursday on an HPE earnings call. "We saw a significantly lower demand from one customer and major tier 1 service provider facing a very competitive environment," Whitman said in her opening remarks. Following up with detail in explaining HPE's overall 11 percent drop in server revenue for the quarter, EVP and CFO Tim Stonesifer confirmed that the loss in demand involved "our largest tier 1 customer."

Stock analysts were intrigued enough by that revelation that it came up five times in the Q&A session, according to the Seeking Alpha transcript of the call. During that portion, it emerged from Whitman that the drop in sales was significant enough that it could "throw [HPE] into slightly negative growth for 2017" on revenues and that the tier 1 deals, with their lack of attached services, weren't a particularly profitable area for the company.

The huge shift in compute capacity from business and government datacenters and server closets to public cloud datacenters was guaranteed to impact the way servers were sold.

Early on, it was clear that SMB-focused servers would be the first category to suffer, with major server providers shifting engineering and sales talent toward landing huge contracts with Microsoft, Amazon Web Services, Google, Facebook and larger hosting companies as those megavendors sopped up a greater share of the world's back-end computing. Releases of SMB-focused servers have slowed to a trickle and lack any marketing fanfare as those customers are steered relentlessly to cloud services.

As mid-market and enterprise customers adopt the cloud, the emphasis on even rack-based infrastructure servers is sure to become a compressed part of the market, as well. Yet Whitman's comments suggest that the biggest server players of today may not be nimble enough, or hungry enough, to compete to provide the infrastructure for the growing public cloud server business.

Public cloud vendors like Microsoft have very different priorities from traditional server providers like HPE. For HPE, high-touch, services-attached engagements are the best. For public cloud providers, low-cost designs that plug easily into their established and efficient datacenter management processes are ideal.

Asked specifically on the call whether the client was looking for less capacity or had turned to another provider, Whitman said she didn't know. For what it's worth, IDC this week indicated that the overall server market declined in Q4 in part due to a slowdown in hyperscale datacenter growth.

"Some public cloud datacenter deployments are being delayed and there are indications that overall levels of deployment and refresh may slow down even through the long term as hyperscalers continue to evaluate their hardware provisioning criteria," said Kuba Stolarski of IDC in a statement.

Microsoft isn't confirming that it cut its order with HPE, let alone offering a reason why. Yet it's hard to imagine that hyperscale datacenter growth won't resume, if it's actually slowed, with the rate of revenue growth that those hyperscale vendors are seeing in public cloud infrastructure.

What is clear from Whitman's comments is that current server market leaders may not be completely sold on chasing that business.

Posted by Scott Bekker on March 02, 20170 comments

Detachables may be slightly heavy on hype at the moment, according to a PC market researcher, but there's no denying that the sector that's drawing in a steady stream of new entries, such as one from HP over the weekend, has potential.

"Regardless of what marketers are saying, detachable tablets are simply not putting pressure on notebooks yet," said IDC analyst Jitesh Ubrani in a statement about the market research firm's latest PC market projections.

IDC's emphasis seems to be on the "yet." Detachable tablets -- a category largely created by the Microsoft Surface about four years ago and since joined by several vendors, most notably Apple -- are growing sales faster than the overall PC market.

Well, they are gaining in annual terms. Poor performance in the just-finished fourth quarter is part of the reason it's too soon to say detachables are living up to marketers' words. The detachable tablet market saw what IDC called a "dramatic decline" in Q4 -- dropping 26 percent. IDC attributed the decline to the segment's dependence on product launch cycles from Microsoft and Apple.

Ubrani argued that right now, the allure of detachables may actually be slightly helping other categories of PCs.

"Consumers are just starting to graduate from old, consumption-based, slate tablets to a more productive detachable tablet. At the same time, the benefits of having a thin, touch-sensitive, productivity-based machine is shining light on the traditional PC category, causing vendors and consumers to focus on more premium devices in the Convertible and Ultraslim space," Ubrani said.

Over the next five years, IDC contends detachable tablets will make up a greater and greater share of overall PC sales. In 2016, detachable tablet shipments amounted to 21 million units, compared to 103 million desktops and workstations and 157 million notebooks and mobile workstations. But current trends point to a downward trajectory for the desktop category over five years, and a flat trajectory for the notebook/mobile workstation category. IDC assigns a 21 percent compound annual growth rate over the five years for detachable tablets -- projecting the category to amount to 56 million units in 2021.

That's a prediction HP is banking on, based on comments by Michael Park, vice president and general manager for mobility and personal systems at HP Inc., surrounding the launch at Mobile World Conference 2017 of the HP Pro x2 612 G2. The G2 is HP's second-generation detachable tablet, with a much more direct line of descent from the Microsoft Surface Pro than was apparent in HP's first-generation version. Telltale signs of the G2's heritage are a bar-like kickstand, a pen and an angled, magnetically-attached keyboard.

The HP Pro x2 612 G2

The HP Pro x2 612 G2

"Today, more than 60 percent of Millennials work from more than one location and by 2020 they will be a majority of the workforce," Park said Sunday of the G2. "They want sexy mobile devices that meet their on-the-go work styles and IT needs these devices to be manageable, serviceable and secure."

Posted by Scott Bekker on February 27, 20170 comments

Tech Data Corp.'s acquisition of the Technology Business Solutions business of Avnet Inc. is complete, the distributor said on Monday.

The cost to Tech Data is $2.6 billion, which was the amount that Tech Data said it expected to pay when the companies originally announced the deal in September. Funding included $1 billion from Tech Data's recent public debt offering, $1 billion from bank term loans, $400 million from drawings under other credit facilities and cash on hand and nearly 2.8 million shares of Tech Data stock.

Tech Data expects the transaction to add to earnings per share in the first full year, with annual cost savings of about $100 million coming within 24 months and one-time costs of about $150 million to achieve those savings.

In a statement, Tech Data CEO Bob Dutkowsky called it "a momentous day" in Tech Data's history.

"Our combined company is perfectly positioned at the epicenter of the IT ecosystem -- with the scale and scope to serve dynamic markets throughout the world -- giving our customers access to an end-to-end portfolio of IT solutions and efficiently bringing our vendors' products to new customers in more markets," he said. "Together, we will be an even stronger company, capable of doing more for our channel partners than ever before."

In the pitch for the deal, Tech Data said Avnet's Technology Business would add substantial datacenter capability to its portfolio and broaden its international reach.

Posted by Scott Bekker on February 27, 20170 comments

Microsoft's exclusive P-Seller partner community in the United States on Monday received 28 days' notice that they would be shut out of the Microsoft corporate network and moved to a new area of the Microsoft Partner Network (MPN) portal, leading some partners to fear that many of the resources they regularly use to sell Microsoft solutions and escalate customer issues will be unavailable.

Partner Sellers, or P-Sellers, are among Microsoft's closest partners, and they help Microsoft drive significant revenue through co-selling engagements. In the United States, the invitation-only program includes 1,139 individuals from 289 managed partner organizations. Those individuals carry the P-SSP (Partner Solution Sales Professional) or P-TSP (Partner Technology Solutions Professional) designations.

In a PowerPoint deck sent to P-Sellers on Feb. 20 and obtained by RCP, Microsoft emphasized that the partners would be invited to a new P-Seller Resource Portal on the MPN in order to make it simpler for partners to find resources and make the program more scalable for Microsoft globally. Microsoft was detailing the changes to P-Sellers in Q&A sessions Tuesday, Wednesday and Thursday.

"We will no longer provide P-Sellers with access to Microsoft's corporate network. Our goal is to provide assets to our P-Sellers [in] a timely manner, in conjunction with our methods for deploying assets to our Microsoft Sales Teams," read a slide in the partner deck. "The MPN P-Seller Resource Portal will act as the 'one-stop shop' for Microsoft P-Sellers, and will drive simplicity and convenience for P-Sellers to help them quickly locate assets, training, learning paths via Partner University, enablement, sales & marketing, entitlements, support, level branding and competency attainment and other benefits. All information is through a single source and will have content specifically geared for P-Sellers. We've built a designated readiness portal that will be exclusive to P-Sellers and populated with Microsoft field facing content."

Ending P-Seller access to Microsoft's corporate network, eliminating their @microsoft.com e-mail addresses, removing the access chips from their purple badges and the short notice of the change were the steps that seemed most concerning to partners, according to a Microsoft partner on one of the calls.

Issues associated with being shut out of the corporate network for these partners means losing access to the Microsoft Global Address List, which helped partners properly escalate customer and technical issues; the Microsoft Calendar; distribution lists internal to Microsoft; NDA content such as battle cards, decks and positioning statements; the internal Azure Calculator; Microsoft's dogfood site for accessing pre-release software; the Microsoft Glossary; and the ability to schedule sessions at Microsoft Technology Centers.

Another partner on the call said Microsoft's desire to lock down its own information was understandable but called the changes "super problematic" for partners. "Having the ability to go in and pull everyone's calendar to set up meetings, to go find content out in their network that may help move a deal along or get you connected to what's actually happening is a big deal for all partners. It was literally a game-changer," the partner said. Of the new curated site, the partner added, "The moving stuff over, it always takes longer when there's another step. Some of the selling tools that are for Microsoft employees, they would open up access for P-Sellers. Now there will have to be a decision."

Microsoft did note in a slide that P-Sellers will be able to request to have assets added to the new P-Seller Resource Portal.

Through a spokesperson, Microsoft declined several requests for telephone and e-mail interviews, providing only a short e-mailed statement. "We're making changes and investments to optimize the Microsoft P-Seller Program, including a new one-stop resource portal, to help ensure these partners have everything needed to realize stronger mutual customer relationships and sales goals," the spokesperson said.

In the slide deck, Microsoft emphasized other positives in the changes, including reduction of password resets, a streamlined operations process and a new Partner Seller Microsoft logo for participants. Also, an onboarding freeze in the United States has been lifted as of Feb. 20.

Many other key benefits of the P-Seller program will remain, including deep engagement with Microsoft teams and access -- now through the MPN -- to some resources that are normally available only to Microsoft employees. P-Sellers will also continue to have access to the Microsoft Social Selling Program, which includes use of the premium LinkedIn Sales Navigator service, along with coaching and marketing content for use in social selling. However, it emerged on the call that details on how P-Sellers will access the social selling tools without their Microsoft credentials have yet to be worked out.

While Microsoft's deck doesn't disclose how many P-Sellers there are worldwide (the U.S.-only numbers cited above did come from the slides), other text in the deck suggests Microsoft is clamping down on the network access in anticipation of P-Seller program growth.

"In order to scale this program globally, we must shift to digital experience that is curated specifically for P-Sellers on MPN. Building on top of MPN as our partner enablement resource we are driving parity across P-Seller roles and subs to have the same experience," the deck said.

It's understandable for security, administrative and program management reasons that Microsoft would want to limit the number of outsiders galloping freely through its network, especially if P-Seller numbers are, in fact, about to increase. However, P-Sellers who had that special access were made to feel like valued partners and insiders, and they used that access creatively to improve both their and Microsoft's business. Getting bounced out of the network and into a walled garden has to sting.

Posted by Scott Bekker on February 22, 20170 comments

Managed services entrepreneur Matt Nachtrab says he's getting the same feeling of disruptive possibility about eFolder's backup technology that he had about remote monitoring and management (RMM) back when he started LabTech Software.

The LabTech founder, who sold that company to ConnectWise and stayed at the professional services automation (PSA) giant until the LabTech integration was completed early last year, is officially joining eFolder this week as chief strategy officer.

"When I look around at the different parts of the MSP space, after RMM and PSA the third most important thing is backup," Nachtrab said in an interview. "I look at the technology that eFolder has brought together, [and for which] they own the IP from the ground up, and it's a pretty amazing place with a lot of potential to disrupt the backup and management protection space."

The technologies Nachtrab is referring to include eFolder's original cloud backup technology, along with business continuity, backup and disaster recovery (BDR) software, services and appliances, and file sync services. Nachtrab seems most excited about the Replibit business continuity software platform, which eFolder acquired in June and which the company says grew 200 percent year-over-year for all of 2016.

Just as Nachtrab started out running a working MSP (Nemsys), eFolder has a similar corporate DNA, having started as a local VAR in the Atlanta area. As he was considering the job, Nachtrab says he hit it off with Kevin Hoffman and often found himself engaged in long, backyard phone conversations with the eFolder CEO.

"Kevin Hoffman is a brilliant technologist. I love having those conversations, going in deep and learning about that," said Nachtrab, who calls himself technical but believes his bigger strength is on the business side.

In his strategy position, his role will follow his enthusiasm for listening to customers and bringing their feedback to product development. He says that will mesh well with Hoffman's strengths and those of Francois Daumard, a veteran of Microsoft and Apple channel programs who joined the 100 percent channel-focused eFolder in October as senior vice president of sales.

"With my slant toward sales, marketing and business, Francois' ability to execute on sales and account management, and Kevin's leadership and technology strengths, I think that we're going to be really effective," Nachtrab said.

Posted by Scott Bekker on February 21, 20170 comments

In an effort to boost demand for its cloud-based backup and disaster recovery as a service (DRaaS) technologies, Veeam Software and participating partners are offering up to $1,000 per customer worth of cloud product usage.

Spread across the company's base of 230,000 customers, Veeam executives say, the credits could amount to up to a $200 million giveaway.

Even a fraction of that would be a substantial outlay for a company that reported $607 million in revenues last year, but Veeam executives see only upside.

"If you look at how cloud revenue generates, it looks like a wedge moving over to the right. We think of this as long-term customer value, long-term revenue growth. We're highly confident that this level of investment will be well-eclipsed by future revenues," said Paul Mattes, vice president of the global cloud group at Veeam, in a telephone interview this week.

The program works with the Veeam Cloud Connect technology that integrates with the Veeam Availability Suite, Veeam Backup and Replication product, and Veeam Backup Essentials. Going by the 3:2:1 rule of backup -- three copies of the data on two types of media with one backup kept offsite -- Cloud Connect enables a cloud backup/DRaaS option hosted at a Veeam partner datacenter or with a public cloud provider. With its 100-percent channel model, Veeam does not offer its own option to do a cloud backup to a datacenter it controls.

Partners, mostly participants in the Veeam Cloud & Service Provider (VCSP) program, will be responsible for half of the credits, but their responses to that financial burden so far have been positive, Mattes said. "We're asking the partners to share in the incentive. Every partner to date has said that's no problem. It's just the tip of the iceberg when they see the revenue growth that can happen over time."

In marketing the new program to the channel, Veeam points to recent Gartner estimates that the DRaaS market will nearly triple within the next three years to $3.4 billion in revenues by 2019.

The bulk of Veeam's business now comes through its 45,000 reseller partners, who deal mostly in the company's virtualization-based availability and backup and recovery software. Veeam and its fast-growing base of 14,000 VCSPs hope the giveaway program will radically increase the share of business that involves cloud-based backup from a relatively small base, Mattes said.

Both parties also hope the program will spark profitable new connections between Veeam resellers and the VCSP community. Said Mattes, "Part of the goal of this program is how do we empower that connection?"

Posted by Scott Bekker on February 16, 20170 comments

Hosting and managed cloud services provider Rackspace is doubling down on its Microsoft commitments, at least in terms of earning Microsoft competencies.

Rackspace announced Thursday that it went from five Microsoft competencies a year ago to 10 competencies now.

Rackspace renewed gold competencies in Cloud Platform, Cloud Productivity, Collaboration and Content, Hosting, and Small and Mid-Market Cloud Solutions. The San Antonio, Texas-based provider added gold competencies in Application Development and Data Center and silver competencies in Data Analytics, Data Platform and Messaging.

The company also touted individual Microsoft certifications by its employees, referred to officially by the company as "Rackers" -- 1,000 technical certifications and 800 sales and licensing certifications. Without providing specifics, a spokesperson said the individual certifications marked a "significant increase" from 2015 to 2016.

The investment in technical expertise and competencies comes during a time that Rackspace has been undergoing major changes as a company. The company went private in a $4.3 billion deal that closed in November.

At the same time, Rackspace has been aggressively expanding from its traditional hosting business to add a substantial practice involving providing managed services for public clouds and hybrid clouds.

For what would be Rackspace's final public earnings release last August, CEO Taylor Rhodes said the company was providing managed services for nearly 600 customers on Amazon Web Services (AWS), Microsoft cloud services and OpenStack. "Demand is scaling rapidly for the expertise and managed services that we provide to businesses that use AWS, the Microsoft cloud and our OpenStack private cloud," Rhodes said at the time.

Although AWS has the bigger share of the total cloud platform market, Rackspace's emphasis so far has been heavier on the Microsoft side, which befits its 15-year partnership with Microsoft as a major hosting provider. The five-time Microsoft Partner of the Year Award winner's Microsoft technology products and services include Fanatical Support for Microsoft Azure, Rackspace Private Cloud powered by Microsoft Cloud Platform, Fanatical Support for Office 365 and Rackspace Support for Microsoft SQL Server.

That said, the company is rapidly building up its AWS expertise in parallel. The Rackspace Web site currently claims more than 700 individual AWS technical certifications, up from 500 in November and 300 in July.

While Rackspace is a major Microsoft partner in its own right, the company serves as an intermediary between Microsoft and a lot of other Microsoft partners, as well. Rackspace has referral and reseller programs and stepped up within the Microsoft Cloud Solution Provider (CSP) program last July from being a marquee Tier-1 CSP to becoming a Tier-2 CSP, a distribution role that allows companies in the Rackspace Partner Network to resell Office 365 and Azure.

Posted by Scott Bekker on February 16, 20170 comments

During its annual customer and partner conference this week, workflow and content automation platform vendor Nintex unveiled extended relationships with six key technology partners.

"Nintex is pleased to recognize our expanded partnerships with Adobe, Box, DocuSign, Dropbox, Microsoft and Salesforce -- all technology innovators driving digital transformation," said Nintex CEO John Burton in a statement.

RCP contacted Nintex via e-mail to get more information about what's new for the Nintex Workflow Cloud with each partnership. Here's what Burton had to say:

- Adobe/DocuSign: "[The] relationships are extending beyond Salesforce-based document production with e-signatures to additional platforms such as Office 365 through connections to Nintex Workflow Cloud."

- Box/Dropbox: "New actions within Nintex Workflow Cloud are designed to automatically integrate with Box and/or Dropbox. An event in either system can trigger workflow action in Nintex Workflow Cloud."

- Salesforce: "[The] relationship is extending beyond our initial work in document generation (AppExchange: Nintex Drawloop) to the remainder of our product suite thanks to Nintex Workflow Cloud."

- Microsoft: "[The] relationship is extending beyond SharePoint and Office 365 to Azure. Nintex Workflow Cloud is built on Azure which also extends workflows running in Azure."

Posted by Scott Bekker on February 15, 20170 comments

When it comes to partnering with a tech giant like IBM, the options and programs can be overwhelming.

Which is why it makes sense that when IBM is trying to nudge its partners into the "cognitive era," the company would turn to Watson, its question-answering computer system.

The company on Tuesday announced a new Watson-based support tool, which is voice- and text-activated, on the portal for PartnerWorld, the IBM partner program. The announcement came as part of the 2017 PartnerWorld Leadership Conference in Las Vegas.

"To help Business Partners quickly find information related to the PartnerWorld program structure, Competencies, program levels, incentives contracts and more, the company has developed IBM PartnerWorld Advisor," IBM said in a statement. "Building PartnerWorld support with Watson technology is another example of IBM's focus on simplification and is geared toward providing Business Partners with all the resources they need to do business with IBM."

There's a lot for Watson to help partners with, even those who have been working with IBM for a long time. IBM launched a redesigned, competency-based PartnerWorld on Jan. 1. Many partners have already hit the new tiers -- 5,000 are Silver, 2,500 are Gold and 75 are Platinum -- but many more are trying to find their way back into IBM's new partner structure. It's complex with 40 competencies at the start and more on the way in Q2.

"We've expanded and redesigned the PartnerWorld program to guide Business Partners of all types and models in developing capabilities aligned to our cognitive solutions and cloud platform strategy to deliver high client value," said Marc Dupaquier, general manager for IBM Global Business Partners, in a statement.

Partners will see changes at the top and bottom of the program -- from deep enterprise and ISV engagement to SMB volume. IBM this week announced new programs and initiatives to engage more deeply with ISVs developing for the IBM Bluemix cloud platform, as well as enhanced software incentives coming in April for partners conducting high-value activity, such as autonomous selling or bringing business in the commercial segment. In April, an IBM Express Start offering is supposed to provide a faster onboarding process for new partners to resell entry-level products. In the hybrid cloud arena, IBM and VMware are also expanding their partnership to allow IBM partners to more easily sell VMware Cloud Foundation and other VMware cloud services within IBM solutions.

It's a lot of change at a lot of levels that a well-implemented Watson-based tool could help new and longtime partners navigate. The question that only repeated partner trials can answer is whether IBM's PartnerWorld Advisor is guru or gimmick.

Posted by Scott Bekker on February 14, 20170 comments

Brad Smith sometimes uses his perch as Microsoft president and chief legal officer to draw disparate strands of tech, security, privacy, law and international relations together to make a larger point about emerging realities in the world.

He was at it again Tuesday at the RSA Conference in San Francisco, advancing a novel argument about the way cyberwar shuffles the responsibilities of nations, citizens, companies and soldiers.

Here's an excerpt from the speech (emphasis mine):

Let's face it, cyberspace is the new battlefield. The world of potential war has migrated from land to sea to air and now cyberspace. But cyberspace is a different kind of space. Not only can we not find it in the physical world, but cyberspace is us.

For all of us in this room, it is us. Cyberspace is owned and operated by the private sector. It is private property. Whether it's submarine cables or datacenters or servers or laptops or smartphones, it is a different kind of battlefield than the world has seen before. And that puts us in a different position, it puts you in a different position, because when it comes to these attacks in cyberspace, we not only are the plane of battle, we are the world's first responders.

Instead of nation state attacks being met by responses from other nation states, they are being met by us. And as we think about that change in the world, we should reflect upon one other, as well. It's a sobering thing to think about, but consider this: For over two-thirds of a century, the world's governments have been committed to protecting civilians in times of war. But when it comes to cyberattacks, nation state hacking has evolved into attacks on civilians in times of peace.

This is not the world that the Internet's inventors envisioned a quarter of a century ago, but it is the world that we inhabit today. And above all else, I think nation state attacks call on us as employees, as an industry, as private citizens to ask ourselves one fundamental question. What are we going to do?

The point about governments not protecting civilians in cyberwar is a bit overdone. Ask anyone who has both survived being shot and endured being pwnd to say which of the two experiences they'd prefer to go through again, and I think the answer would be pretty obvious. Or, maybe I should say, it is a bit overdone right now. The Stuxnet attacks made physical damage from a virtual attack a documented reality. Still, I suspect that should cyberattacks ever start actually killing or maiming civilians, nations will take a radically more aggressive stance on defending their citizens.

Smith's point about who is currently responsible for defense, though, is a solid one. It's possible to look at IT infrastructure through a lens that reveals that every person connected to the Internet has effectively been conscripted to stand guard at the nation's border. IT departments and security professionals are the first responders to international incidents, just as Smith describes.

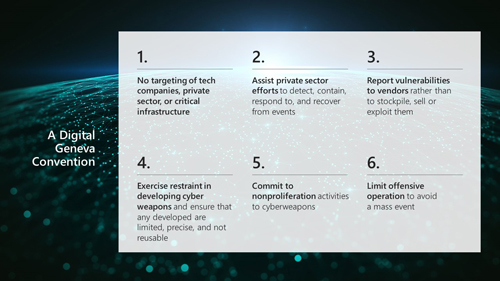

Smith's attempt at a solution is what he calls a Digital Geneva Convention with six points. This slide from a related blog post on Tuesday lists the points:

[Click on image for larger view.] Source: Microsoft

[Click on image for larger view.] Source: Microsoft

While Smith's description of the new issues we face are largely spot on, five of those six points probably don't have much of a chance. Governments should and probably will beef up efforts on No. 2 (assist private sector efforts to detect, contain, respond to and recover from events). For the rest of the points, the fruits of digital warfare are too alluring to nation states. The costs appear very low compared to the catastrophic effects of kinetic warfare, and cyberweapons are more appealing to state actors due to their deniability.

This Digital Geneva Convention seems unlikely to prevail, but Smith has hit on an enormously important issue about the responsibilities of nation states to their citizens and to their private sectors as they engage in cyber operations against their enemies and allies. Shining a spotlight on the effect of digital warfare on every country's own population elevates an important element in policy deliberations.

Posted by Scott Bekker on February 14, 20170 comments

Access problems with Microsoft's online partner resources, noted by several partners Tuesday morning, have been fixed, according to a Microsoft spokesperson.

"Some partners may have experienced difficulties accessing the Microsoft Partner Center, and this has been fully resolved," the spokesperson said in an e-mail exchange. The spokesperson declined to respond to follow-up questions about what caused the problems, which Microsoft resources were affected or how long any problems lasted.

Several partners Tweeted about problems with the Partner Center around 9 a.m. Eastern Time on Tuesday.

Posted by Scott Bekker on February 14, 20170 comments

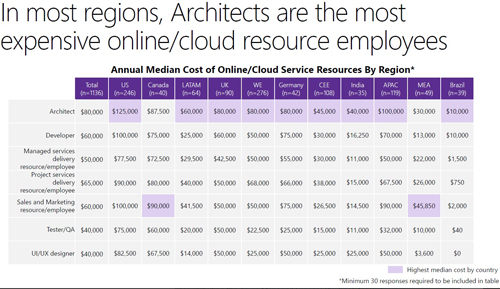

Architects are the most expensive employee type for Microsoft Azure partners in most regions of the world, according to new Microsoft partner research.

Microsoft this month released details of a survey conducted in November of more than 1,100 Azure partners with active cloud practices worldwide.

The architect category was the most expensive cloud resource in every geography except for Canada and the Middle East/Africa (MEA), and architects were second in both of those geographies.

[Click on image for larger view.]

Source: Microsoft

[Click on image for larger view.]

Source: Microsoft

In the United States, the median cost of an architect was $125,000. The next closest categories were developers and sales/marketing employees, which both checked in at $100,000.

Sales and marketing was the most expensive employee type in Canada and in the MEA, according to the survey. In Canada, a sales/marketing resource was $90,000, while the median for an architect was $87,500. The difference wasn't that slight in MEA, where architects commanded about $30,000, while sales/marketing was at $45,850.

As for locating employees, respondents reported that referrals were the most important source. Seven out of 10 of the partners said they found employees through referrals. The next most popular method, according to the survey, was LinkedIn, with 59 percent identifying Microsoft's newly acquired social network as a key place to identify potential hires.

Microsoft's full 39-slide deck summarizing the survey findings is available here.

Posted by Scott Bekker on February 13, 20170 comments