News

Datacenter M&As Surged to $20 Billion in 2017

- By John K. Waters

- January 19, 2018

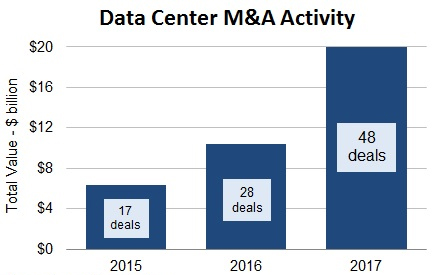

Significant datacenter mergers and acquisitions (M&As) closed at a rate of nearly one every week in 2017, according to a recent report by Synergy Research Group.

The year ended with a total of 28 datacenter M&A deals, three more than the number of deals that closed in 2016 and 2015 combined. All together, datacenter M&A transactions amounted to $20 billion in 2017 -- and that pace shows no signs of slowing. Four major datacenter acquisitions valued at over $2.6 billion combined are expected to close in early 2018, according to Synergy.

The largest datacenter deal that closed last year was the $7.8 billion acquisition by Digital Realty Trust of the purpose-built datacenters of DuPont Fabros Technologies. That deal, announced in June, allows San Francisco-based Digital Realty to grow in top markets, such as northern Virginia, Chicago and Silicon Valley, the company said at the time. (DuPont Fabros is based in Washington, D.C.) The acquisition "will significantly expand Digital Realty's hyper-scale product offering and improve its ability to meet the rapidly growing needs of cloud and cloud-like customers," Digital Realty said in the statement.

Source: Synergy

Source: Synergy

Deals closed last year involving Equinix, Cyxtera, Peak 10 and Digital Bridge were worth a billion dollars or more, Synergy reported, and another 12 deals were valued in the $100-million-to-$1-billion range, with 31 smaller deals valued at up to $100 million each.

What's behind this interest in datacenters? John Dinsdale, Synergy's chief analyst and research director, says it's not about acquiring assets.

"Above all else, what is driving the datacenter M&A activity is enterprises focusing more on improving IT capabilities and less on owning datacenter assets," Dinsdale said in a statement. "That shift is driving huge growth in outsourcing, whether it is via cloud services, or use of colocation facilities, or sale and leaseback of datacenters. The dramatic growth of cloud providers is also driving changes in the datacenter industry, as datacenter operators strive to help them rapidly increase scale and global footprint. We expect to see much more datacenter M&A over the next five years."

It's worth noting that only three of the 45 M&A deals closed in 2015 and 2016 hit the billion-dollar-plus range. The largest deal in those two years was the Equinix acquisition of European retail colocation provider TelecityGroup for $3.8 billion. During that period, Equinix and Digital Realty were the largest investors in datacenters. Equinix has made major acquisitions in all four regions of the world; Digital Realty has focused its M&A activity on the United States and Europe.

The list of "notable acquirers" the Synergy researchers cited included CyrusOne, Peak 10, Digital Bridge, NTT, Carter Validus, Iron Mountain, Cyxtera and Elegant Jubilee.

About the Author

John K. Waters is the editor in chief of a number of Converge360.com sites, with a focus on high-end development, AI and future tech. He's been writing about cutting-edge technologies and culture of Silicon Valley for more than two decades, and he's written more than a dozen books. He also co-scripted the documentary film Silicon Valley: A 100 Year Renaissance, which aired on PBS. He can be reached at [email protected].