News

Microsoft Earnings Up in Q1 Despite Consumer Licensing Dip

- By Kurt Mackie

- October 23, 2014

Microsoft exceeded Wall Street estimates in its fiscal first quarter report on Thursday.

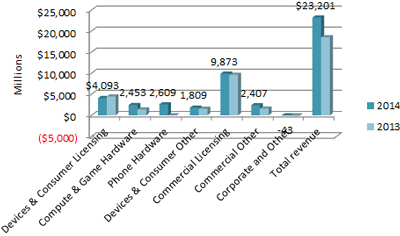

Revenue was $23.2 billion for the quarter ended Sept. 30, marking a 25% increase year over year. Net income was $4.54 billion, while earnings per share was $0.54.

Analysts had expected revenue of about $22 billion and earnings per share of about $0.49. Microsoft had layoff costs of $1.1 billion that pushed down its earnings per share by $0.11. The company had announced an 18,000 personnel workforce cut back in July.

Microsoft mostly showed revenue increases across its seven business segments, quarter over quarter (see chart). The exception was its Devices and Consumer (D&C) licensing revenue.

Microsoft's fiscal Q1 2015 revenues by segment. Source: Microsoft investor relations site.

Microsoft's fiscal Q1 2015 revenues by segment. Source: Microsoft investor relations site.

Microsoft's 10-Q report for the quarter (p. 37) attributed the D&C revenue decline mostly to Windows Phone licensing, which caused a 9% revenue decrease. Windows OEM licensing revenue also was a bit soft. In addition, the transition of consumers to Office 365 from Microsoft Office licensing was described as having a negative 5% effect on Microsoft's Q1 revenues:

D&C Licensing revenue decreased $391 million or 9%, due mainly to a $176 million decline in Windows Phone revenue, as well as lower revenue from licenses of Windows and Office Consumer. Windows Phone revenue decreased, primarily due to lower per unit royalties based upon the mix of devices sold by our licensees. Windows OEM revenue declined 2%, primarily due to declines of 4% in OEM Pro revenue and 1% in OEM non-Pro revenue, consistent with dynamics in the commercial and consumer PC markets. Office Consumer revenue declined 5%, reflecting the transition of customers to Office 365 Consumer.

Microsoft is now offering its Windows Phone operating system to some OEMs without royalty fees, which may have affected its revenues for this quarter. Windows Phone has long clung to third place in the mobile OS market behind Android and iOS, with just a 2.5% market share.

Despite those dips in D&C licensing, Microsoft claimed an overall 47% increase in revenue for the D&C business segment. The company now has "more than 7 million" Office 365 Home and Personal edition subscribers, representing a 25% increase quarter over quarter. Surface Pro 3 sales delivered $908 million for the quarter. Microsoft also reported phone hardware revenue exceeding $2.6 billion, which represents its Nokia acquisition results.

Microsoft's Commercial business segment showed a revenue increase of 10% for the quarter. Highlights include a 13% increase in server products and services revenue, a 5% increase in Office revenue, a 10% revenue increase for Windows volume licensing and a 128% increase in cloud revenue.

Microsoft's Q1 financial reports can be accessed at the company's investor relations page here.

About the Author

Kurt Mackie is senior news producer for 1105 Media's Converge360 group.