Salary Surveys

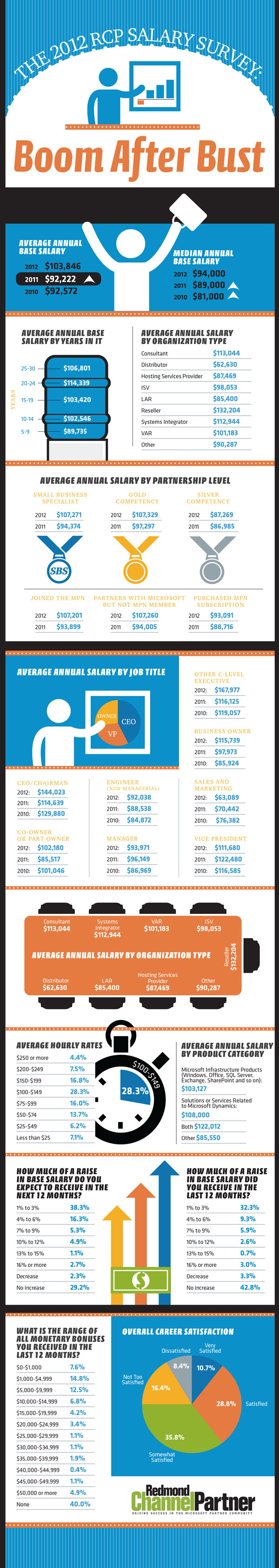

2012 RCP Salary Survey: Boom After Bust for Microsoft Partners

By all accounts, the market for technical employees is tight. Even as national unemployment remains high, partners across the country report low tech unemployment and intense competition for talent. Against that backdrop, we release the sixth annual RCP salary survey.

- By Gladys Rama

- September 05, 2012

- Check out the full-sized version of this year's salary survey infographic, with Web-only charts, here.

While much of the country is still feeling the effects of the recession, for Microsoft partners, 2012 brings good news: Salaries are higher -- way higher -- than they've been since 2007, when

RCP first began tracking them.

It probably helps that 2012 is one of the biggest years for Microsoft products in recent memory. Microsoft System Center 2012 and SQL Server 2012 were both released earlier this year, while Windows 8, Office 2013 and Windows Server 2012 all saw daylight and are expected to become available by year's end or early 2013. On the cloud side, Microsoft is planning to release Windows Azure-based iterations of Dynamics NAV and Dynamics GP by the fourth quarter. And Office 365, now more than a year old, is steadily gaining momentum (though Microsoft still won't release official subscription numbers).

Here are the most important bits from this year's salary survey: Respondents reported an average annual salary of $103,846 -- a 12.6 percent increase from the 2011 average of $92,222 and the highest year-over-year jump in this survey's six-year history. The median salary is lower at $94,000, though that's also up from last year's median salary of $89,000.

In short, salaries are moving emphatically upward for a change, compared to the incremental jumps -- and dips -- of previous years.

It also doesn't hurt that tech workers seem to have weathered the economic storm better than workers in most other industries. A recent Dice.com report shows that while the national unemployment rate hovered at just above 8 percent in the first quarter of 2012, the unemployment rate among IT professionals was only 4.4 percent, with competition for talent among companies growing.

IT consulting, in particular, is in high demand, according to Dice.com. In fact, Microsoft partners at consulting firms were among the highest earners in our survey, reporting an average salary of $113,044. Only partners working in reseller companies outearned them, with an average salary of $132,204.

More good news: Participation in the Microsoft Partner Network (MPN) is paying dividends. For the 2011 survey, which was published just seven months after Microsoft flipped the switch on the MPN, partners with gold competencies reported an average salary of $97,297. This year that average jumped by 10.3 percent to $107,329. The story is the much same for those designated as Microsoft Small Business Specialists, whose salaries ballooned from an average of $94,374 last year to $107,271 this year -- a 13.7 percent jump.

In fact, it doesn't seem to hurt to simply join the MPN. Partners whose companies are MPN members reported an average salary of $107,201, up significantly from last year's $93,899.

It's hard to tell whether this wave of rising salaries will continue through 2013, but partners certainly appear more optimistic than they did last year. When asked how they expect their salaries to change over the next 12 months, only 29.2 percent said they expect their salaries to stay the same compared to 40 percent last year. And only 2.3 percent said they expect their salaries to decline compared to 4 percent in 2011. That's despite the fact that nearly 43 percent of partners reported not receiving a raise at all this year, with 3.3 percent actually experiencing a pay cut.

With the economic picture still cloudy, it'll be interesting to note whether this optimism will bear out in the 2013 RCP salary survey. Check back next year to find out.

[Click on image for the full-sized version]

[Click on image for the full-sized version] Methodology

A link to this year's survey was e-mailed to print issue and online newsletter subscribers for whom we had e-mail addresses. Within a two-week period in May and June, we obtained 543 responses, which were whittled down to 314 responses after we culled bad responses or responses with

missing data.