In-Depth

Office in the iPad Era: 25 Things Microsoft Partners Should Know

From licensing issues to potential problem points, here's what partners should know about positioning and selling the Microsoft flagship productivity suite to businesses on the world's most popular tablet.

- By Scott Bekker

- June 02, 2014

A new era is upon us for the venerable and still-dominant Microsoft Office suite.

After about three years of rumors and executive hemming and hawing, Microsoft officially posted Office for iPad in the Apple App Store on March 27.

Microsoft partners were immediately enthusiastic as they looked at the opportunities in pairing the most widely used business suite with the most widely used tablet. "We're definitely very excited about Office for iPad," says Pete Zarras, president of managed services provider CloudStrategies LLC. "It should be pretty good for Microsoft and Apple and even better for customers."

What follows are 25 things for partners to know about Office for iPad, from the basics of the offering and hot opportunity areas to licensing options, potential sticking points and what the launch says about the tech industry and Microsoft's place in it.

The Basics

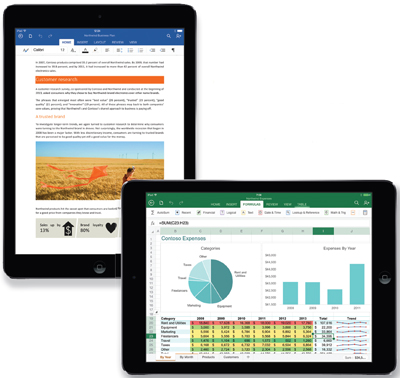

1. Three core apps are included. When Microsoft launched the Office suite in 1989, it had three applications in it. For all the Office applications that have come and gone in the intervening 25 years, Microsoft launched Office for iPad with the same three basic apps -- Word, Excel and PowerPoint. Microsoft Word for iPad is a 259MB file, Microsoft Excel for iPad is a 233MB download and Microsoft PowerPoint for iPad consumes 216MB. Another product under the Office umbrella, OneNote, was already available for free in the App Store.

2. It's a freemium model. Speculation about Office for iPad pricing was all over the map. Would they charge for the base apps and upsell certain functionality? Would Microsoft pick a high, one-time price point similar to the desktop model? Would there be suite offerings? Would the apps simply be a log-in screen without an Office 365 subscription? Microsoft obviously had a lot of options from which to choose. Ultimately, Microsoft chose a freemium model. The apps are free to download, and the free versions are capable of displaying documents, spreadsheets and presentations.

3. Office 365 subscriptions light it up. To really use Office in the way that the roughly 1 billion users worldwide are accustomed to requires an Office 365 subscription. Creating and editing documents in Word, Excel and PowerPoint all require an Office 365 subscription, and Microsoft even created a lower-cost Office 365 subscription that seemed aimed at capturing the maximum number of iPad users. For more detail on licensing and cost, see the licensing section.

4. Users need iOS 7.x. Microsoft made the engineering decision to support only version 7 and later of the Apple iOS. Apple released iOS 7 in September 2013, but for Microsoft partners who might not be familiar with iOS adoption trends, that's not as restrictive a decision as it would be, say, for Microsoft to only support Windows 8 and later. Apple's mobile users are famous for their quick adoption of the latest OS, and iOS 7, despite its significant changes from previous versions, was no exception. According to the Apple Developer Support Center Web site, 88 percent of iPhones and iPads were using iOS 7 as measured by the App Store during a seven-day period ending May 4.

5. They're native apps. Microsoft didn't just port a kludgy version of Microsoft Office to the iPad, bolt on some touch options and call it a day. All three of the apps were designed carefully and intentionally for the iPad, and the attention to detail shows. Microsoft stresses that these are native apps for the iPad.

The release of an iPad version of the core Microsoft Office apps gives partners a new reason to strike up conversations with new and existing customers.

The release of an iPad version of the core Microsoft Office apps gives partners a new reason to strike up conversations with new and existing customers.

6. It is truly touch-first. Users of touch functionality in the versions of Office for the Microsoft Surface RT and Surface 2 know that the touch optimizations are just that, optimizations. Surface, after all, is intended as a more productive tablet. Microsoft's design goal was to create something that functioned as a tablet for entertainment, but boasted a tightly integrated (though optional) keyboard when it was time to do real work. The touch elements seem designed more for light edits on the go rather than full-fledged content creation. With the iPad version, Microsoft recognizes that many -- if not most -- iPad users want to do everything by tapping on the screen. Office for iPad is designed accordingly, and presumably many of those changes will eventually make their way to touch-first versions of Office for Windows. There's a precedent for this kind of thing, after all. Office for Mac came out in 1989; the first Office for Windows shipped in 1990.

7. Smartphone versions are free now. Office Mobile for iPhone or for Android-based smartphones existed before the iPad releases. Originally, Microsoft required Office 365 subscriptions to use those mobile apps, but as of March, they're free to download and use from the Apple App Store and Google Play. That said, the license is for home use. Business users are supposed to have a qualifying Office 365 subscription to create, edit or save documents. Office Mobile apps lack a lot of the functionality of the Office suite products, but users do have the ability to view and edit Word documents, Excel spreadsheets and PowerPoint presentations. Users can also create Word and Excel files, but not PowerPoint presentations. The iPhone app, which includes Word, Excel and PowerPoint, is a 49MB download.

Opportunities

8. iPad has a massive install base. Apple made a huge market in tablets with the 2010 release of the iPad. While the growth in tablets is clearly slowing, the number of iPads already in user hands makes for a huge opportunity for Microsoft partners peddling Office-based solutions. On an earnings call in late April, Apple CEO Tim Cook said that Apple has sold 210 million units in the four years since launching the iPad. There was some concern about a sales drop in iPad units from the year-ago quarter to this one, but Apple executives explained most of it away as a channel backlog issue with iPad sell-through trending at nearly the same pace as the year before. Meanwhile, Apple had some very strong numbers to report from emerging markets. Apple probably won't be as dominant in tablets in the next few years, but it is likely to remain dominant for a while.

9. EMS may be the most important opportunity. Announced alongside Office for iPad and released May 1 is Microsoft's Enterprise Mobility Suite (EMS). EMS includes Windows Intune, Microsoft Azure Active Directory (AD) Premium and Azure Rights Management Services. Azure AD Premium provides cloud-based identity and access management with single sign-on to many third-party tools and services, while Intune was expanded to support the Samsung KNOX platform and Remote to My PC capability for Android and iOS devices. Looking back on the Office iPad launch day from the vantage point of a late April earnings call, Microsoft CEO Satya Nadella suggested EMS was "the most strategic" announcement of the day.

"We now have a consistent and deep platform for identity management, which, by the way, gets bootstrapped every time Office 365 users sign up; device management and data protection, which is really what every enterprise customer needs in a mobile-first world, in a world where you have SaaS application adoption and you have BYOD, or bring your own devices, happening. So, to me, the Office 365 growth is, in fact, driving our enterprise infrastructure growth, which is driving Azure growth, and that cycle to me is most exciting," Nadella said, according to a Seeking Alpha transcript of the call.

As a Microsoft partner, Ric Opal, vice president at Peters & Associates, agrees with Nadella on the significance of EMS. "Office for iPad is whip cream on the sundae," Opal says. "The bundling and the pricing [of EMS] is going to be attractive to the enterprise" in a way that will be strategic for Microsoft and its partners, Opal says.

Opal views EMS through the lens of the big battle right now over where enterprise customers park their cloud assets. "If I'm a corporate account, I'm making a decision to keep infrastructure local, to do some hybrid implementation or to throw it all up in the cloud. Microsoft wants that to be in Azure. Customer choices are also co-lo, Rackspace, Amazon [and so on]," Opal says. "If I were going to use Azure AD Premium, that basically says my directories are married to Azure. If I'm going to trust my directory to Azure, then why wouldn't I take that next step and put some databases up in SQL Azure? If I can get the customer to buy EMS, that puts customers on the bridge to the Microsoft cloud."

10. Office for iPad is a conversation starter. The release of an iPad version of the core Office apps gives partners a new reason to strike up conversations with new and existing customers. Being ready to guide customers in turning on the iPad functionality in their existing Office 365 subscriptions, and helping them get the most out of it, is a foot in the door for all sorts of opportunities.

11. Overcoming c-level objections. In some smaller businesses, partners report, the lack of a native iPad version was a roadblock to Office 365 subscription sales. Matt Scherocman, president of Interlink Cloud Advisors Inc., is enthusiastic about the message iPad support sends about Microsoft's cross-platform commitment. "You're taking the cross-platform veto away. Some CEOs don't want to buy Office 365 because they've already got iPads," Scherocman says. While he's been showing naysayers that they can run Office through different iPad workarounds for a while, he expects the native-touch client to make a difference. "Today, it's more efficient than it was."

12. There's an enterprise opportunity. On the earnings call, Cook claimed 98 percent of Fortune 500 companies use the iPad in some capacity and said, "According to Good Technology, who looks at activation of tablets, the latest data we have from them is that 91 percent of activation of tablets in the enterprise were iPads." The raw numbers of iPads deployed at individual customers can also be enormous. During the call, Apple executives noted that Eli Lilly has 20,000 iPads and the U.S. Department of Veterans Affairs has 11,000.

13. Leverage those Office custom development skills. There's more than a breadth opportunity in new or extended Office 365 subscriptions with the iPad. All along, some partners have taken advantage of the general iOS development opportunity. Now that opportunity is expanded by the ability to create more robust custom corporate apps that integrate with Office -- something that's right in many Microsoft partners' wheelhouses. Corporate customers have already demonstrated an ample appetite for internal iOS apps. Apple noted during its call that Deutsche Bank had 40 of them and Siemens and Eli Lilly had 50 each.

Licensing

14. There's a 30-day trial. To check if an Office 365 subscription brings enough value to justify a purchase, customers can sign up for a 30-day trial (office.com/try) that gives them the rights to use Office 365 on a PC, Mac and iPad.

15. How SMBs license it. Smaller businesses have two main routes to licensing Office for iPad. One is Office 365 Small Business Premium, which costs $12.50 a month or $150 a year per user. Each user gets to install Office applications on five devices, including, now, the iPad. For Zarras, the iPad availability improves the story behind the Office 365 subscriptions he already sells to customers. "I think it really ensures the value proposition of five copies of Office per Office 365 user. When you say one of those can be on your iPad, too, that's the instant translation," he says. That subscription works for organizations with up to 25 users. Office 365 Midsize Business, at $15 a month or $180 a year, is for businesses with up to 300 users.

16. How enterprises and educators license it. For enterprise organizations, Microsoft lays out two main routes for iPad use. The devices are supported through the Office 365 E3 and E4 packages or through the $12-a-month Office 365 ProPlus, which is also an option for SMBs. There are three specialty subscriptions for bringing Office to iPads for education -- Office 365 Education A3 and A4 and Office 365 University.

Problems

17. Some subscriptions are a headache for business. In this BYOD era, expect to see some users bringing iPads to work with the $6.99-a-month Office 365 Personal or the $9.99-a-month Office 365 Home subscriptions. Both are attractive options for home users. The problem is, as with the pre-installed versions of Office on the Surface RT and Surface 2, the license specifically prohibits using the software for commercial, non-profit or revenue-generating activities. Partners will need to make their customers aware of this licensing pitfall and help steer them around it.

18. Cross printing off the problem list. One problem that's already been fixed is printing, which was sorely lacking in the March 27 release. Microsoft updated all three Office for iPad apps on April 29 to add the ability to print. "Your top request is here," Microsoft wrote of the change in the update description for Word.

19. Dropbox and other file-sharing services are boxed out. When it comes to user complaints, right up there with printing is lack of support for Dropbox, the cloud-based file storage and synchronization service. Microsoft's tactical incentive is clearly to steer as many users as possible to its own OneDrive service. It isn't clear whether OneDrive was the low-hanging fruit for Microsoft to integrate with or whether it's a competitive move (or both). In an April 8, Ask Me Anything (AMA) session on Reddit, the Microsoft Office for iPad team left the door open: "OneDrive storage is an integral part of the Office 365 subscription. Office 365 is a service, we'll continue to evaluate the integration with third parties in the longer term."

20. What about Outlook? Not included in the suite was an iPad version of a powerful Outlook client. Opal says there's a groundswell of demand for a great Outlook experience on the iPad. "When you talk to iPad users who are connected to a back-end infrastructure, they all still will clamor for Outlook," he says. For now, the main options remain an Outlook Web Access (OWA) app from Microsoft and the Apple iPad Mail app.

21. No route for non-subscription customers. Customers who have committed to traditional licensing of Office on physical devices and aren't at a stage to renew and reconsider moving to an Office 365 subscription are struggling to find a cost-effective way to license Office for iPads. In the same Reddit AMA, the Microsoft team confirmed there are no plans to offer a non-subscription license for Office on iPad.

Big Picture

22. It's time for another look at rent vs. buy. Microsoft's decision not to offer a full-featured version of Office for iPad that doesn't include an Office 365 subscription is an important new factor in the calculations over whether it makes more sense to rent or buy Office. For many organizations, iPad support will tip the scales toward a subscription.

23. Microsoft is a significant app developer on iOS. Microsoft has a long history of being the most important third-party application developer for Apple platforms. That tradition of being a significant player on the Mac now extends to iOS. The three new Office apps actually cap an impressive amount of iOS development in Redmond over the years. Microsoft's roster of iOS apps also includes the previously mentioned OneNote, OWA, Office Mobile, OneDrive for Business and OneDrive for Consumer, along with Lync, an Office 365 admin console, Remote Desktop Protocol (RDP), Xbox SmartGlass, Bing and Yammer.

24. Apple is happy to have Microsoft in the App Store. According to the Microsoft Reddit AMA, Apple let Word, Excel and PowerPoint into the App Store on Microsoft's first submission. And Apple CEO Tim Cook Tweeted a welcome when the Office apps went live. Clearly, Office for iPad competes with Apple's own productivity suite of Keynote, Pages and Numbers, but Cook took a rising-tide-lifts-all-boats position on the Apple earnings call.

"There [are a lot] of alternatives out there from a productivity point of view, some of which we brought to the market, some of which many, many innovative companies have brought," Cook said. "But I do see that Office is still a very key franchise in the enterprise, in particular. And I think having it on iPad is good, and I wholeheartedly welcome Microsoft to the App Store to sell Office. Our customers are clearly responding in a good way that it's available. So I do think it helps us particularly in the enterprise area."

25. Microsoft still moves the needle. The Saturday (March 29) after launching, Office dominated Apple's Top Free Apps chart. Word was first, Excel was second and PowerPoint was third. The attention of its higher-profile Office brethren hauled the older OneNote up to fourth place. In-app purchases of Office 365 Home Edition subscriptions also put the Office apps among the top-grossing apps in the store. Even a month and a half later, Word and Excel remain in the top 100 grossing apps in the App Store at No. 27 and No. 50, respectively. Looking more narrowly at productivity apps, it's no contest. Word is No. 1, Excel is No. 2 and PowerPoint is No. 4. For all the talk about Microsoft's diminishing influence on the tech industry, the company can still make a splash