In-Depth

2009 RCP Salary Survey: Salaries in a Year of Recession

At a time of economic turmoil, RCP's third annual salary survey shows base pay for Microsoft partners is slightly higher than in 2008. But there are cracks around the foundation, as raises and bonuses will be harder to come by in the coming year.

- By Michael Domingo

- August 01, 2009

The economy is the biggest story anywhere. The sagging of global economic fortunes has trickled down to affect us all in some way. In fact, if we were to identify the most important technology issue impacting us in this year and the next, it would clearly be the ongoing global recession.

It was against this backdrop that we conducted the third annual Redmond Channel Partner Salary Survey. Microsoft partners rely on clients to upgrade or deploy new technology in order to keep the cash flowing. But with a full-blown recession, clients have found it necessary to turn to survival-mode spending by scrutinizing budgets and slashing spending where they can. It's a direct hit to partners' bottom lines and, in turn, it affects compensation in profound ways.

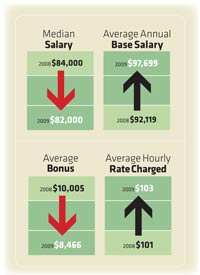

The recessionary effect produced a mixed bag of results this year. The most interesting finding this time: The recession hasn't negatively impacted the big compensation picture. Respondents reported higher overall compensation to the tune of just tad more than 6 percent from last year's figure. Base salaries appear to be recession-defying, at least for now.

The compensation picture blurs just as quickly when we dig in a little bit: Bonuses came in lighter at about 15 percent lower than 2008, and there are some numbers that appear troubling when we look more closely at job title, job role and other salary minutiae. As they say, the devil's in the details-and we'll delve into those details in this story.

[Click on image for larger view.] |

From the Top of the Heap

Let's take it from the top: Respondents overall reported an average base salary of $97,699. That's a 6 percent hike-or an additional $5,580-from last year's figure. It's better than the 4.9 percent hike between the first and second years of this survey, and just a wee bit stronger than the Social Security Administration's cost-of-living adjustment for 2009 (5.8 percent).

[Click on image for larger view.] |

As many respondents reported, that increase can be attributed partly to companies hiking salaries to keep employees, and partly to some companies being able to improve the salaries of personnel remaining after staff reductions. "I suspect there was an increase from the prior year because most got raises before the economy cratered," said Rick S., a data manager in the Southwest region. (Note: Some respondents talked to us on condition of anonymity.)

Median salary experienced a hiccup, with the center making a negative move down by $2,000 from last year's $84,000.

[Click on image for larger view.] |

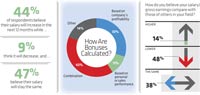

Here's where it gets interesting. We asked partners to predict where salaries are headed next year. A healthy number, 44 percent, still believes salaries will be higher yet again next year, with only 9 percent believing that a decrease is inevitable. It's a good indication that optimism still rules in the recession age among Microsoft partners. Even so, nearly half (48 percent) of all respondents on the whole believe they're not compensated as well as others in IT.

If there's one real trouble spot in our results, it's most evident in the wide salary disparity between the sexes. Salaries for men far outpace those for women, whose salaries average 31 percent lower. That's a difference of $28,112, or about the price of a new Toyota Prius today. It's the first time we've made the comparison, so we have no number to compare to from last year. Nonetheless, we've noticed that 49 percent of the women responding to our survey were working full time for a partner company, but listed themselves in the "Other" category-which, as we cover later, was among the lowest salary segments by organization.

Level Playing Field

We'd be remiss if we neglected to look at how salaries break out among partner levels. This is, after all, Redmond Channel Partner magazine, and partners are what give our survey its raison d'tre. Considered the elite group, Gold Certified Partners this time came in at 5 percent lower than last year's figure, making $93,940, or $4,969 less. The real winners this time were Microsoft partners who haven't become formal members of the program but work closely with Microsoft, both in percentage increase from last year (18 percent) as well as total dollars ($96,513). Certified Partners also reported better results over Gold Certified Partners in a percentage/dollar comparison.

Registered Members dipped slightly below the $90,000 line, at $89,247 (a 2.6 percent drop). Still, it's significantly better than the 2007 result that topped out at $81,273.

[Click on image for larger view.] |

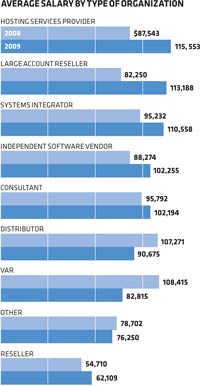

Org Charts

By type of organization, large account resellers came away like unscathed prize fighters, leapfrogging last year's result by 37 percent. LAR salaries also broke six figures, as did several other organizational categories. Right below LARs, for example, is hosting services, bettering last year's salary by 32 percent, but also making $115,553-tops in dollars. In total, execs in six organization types reported salaries above the $100,000 mark.

[Click on image for larger view.] |

Faring the worst are VARs, dropping a precipitous 23.6 percent in income from a six-figure high a year ago. Distributors didn't do as poorly, but compared to distributors from last year, things do look dismal for this segment. Salaries here continued to drop another 15 percent from last year.

Based on the percentages, those who said they work part-time for a partner company did reasonably well since last year, bringing in 14 percent more income than in 2008 (a difference of $8,986 on the plus side). All else was relatively flat here, except for those who said they were co-owners or part owners: they made 5.7 percent less than last year. Converted to dollars, their $95,222 is only $198 higher than 2007's result. Seeing the worst drop were those who labeled themselves in the significant but ambiguous "Other" category, at 8.9 percent less income ($72,863).

[Click on image for larger view.] |

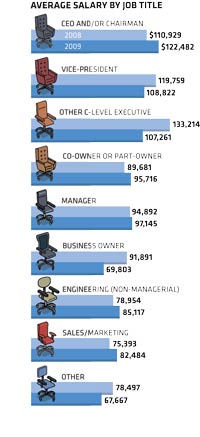

Job title also plays a key role in salary. Much like what's happening in general financial news, CEOs took home the biggest portion-$122,482, which is a 9 percent improvement from last year (in 2008, CEOs were actually in the second spot). Vice presidents and other C-level executives did well ($108,822 and $107,261, respectively), but they both saw salaries shrink-5 percent for VPs and 6 percent for other execs from last year's figures.

[Click on image for larger view.] |

Playing from the percentages, those who claimed non-managerial engineering titles did the best: They saw a 27 percent increase from last year ($85,117), with managers following them at 21 percent ($97,145).

Time on Your Side

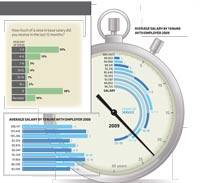

It would seem logical that those who reported the best salaries last year-which were those who had been working one to two years with their employers as of last year-would be the winners again this year, but in the two-to-three year categories. If that were your guess, you'd be half right. This time out, those who claimed two years' tenure reported a 9.8 percent drop in salary from last year (now at $94,900). Those who made it to year three progressed a cool 8.4 percent. As was the case last year, those who've been working for more than a quarter-century did well, at a 13 percent improvement over 2008 salaries (now at $94,725).

[Click on image for larger view.] |

The big losers on the tenure scale were those in year one, who reported 11.6 percent less in income. It's very likely that last year's six-figure salary was a hiccup, with this year's $89,853 more closely resembling reality, as companies have been more cautious to dole out salaries to new employees at recession rates.

Microsoft's financial reports are depicting a year in some turmoil, as Microsoft recorded its dips in revenue and profits. The results of this year's Average Salary by Products Sold category reflect Microsoft's fortunes somewhat.

The big weakness comes in salaries among those who sold solutions/services related to Dynamics. Those dropped by a sharp 21 percent, dipping just below the century mark at $99,482. Those who sold solutions based on Microsoft's infrastructure products managed to maintain near-break-even at $90,096-just a negligible 0.21 percent above last year. Those who put their eggs in both baskets did better, recording a 3.58 percent increase above 2008.

[Click on image for larger view.] |

Working for Yourself

There weren't many respondents this year who claimed to own their own businesses or who were working as consultants charging clients for IT services rendered. As it stands now, there are just 181 of you who filled out the survey, which is 14.8 percent of the valid response pool. Your group managed a meager but recession-proof increase of $2 over last year's hourly billing rate. It's a testament to your clients' reliance on your expertise if they continue to want to pay for your services.

About one-fourth of you said you typically billed around 31 to 40 hours, with 27 percent working an extra one to 10 hours.

Recession-Weary Bonuses

Flipping to the other side of the compensation picture, it's pretty evident that the recession has had a profound impact on bonuses. As we mentioned earlier, companies handed out some pretty nice bonuses last year, but the generosity didn't garner a repeat this year.

Overall, bonuses were down 15 percent from last year. The result is lower than the first year's budget figure, at $8,909. Robert D., a systems architect for a Phoenix-based Gold Certified Partner, said that the company he works for wasn't awarding bonuses this year. "Last year was a boon-until last quarter," he explained. The Ozark, Mo., company where technical services manager Chris Bingham works has done well despite the recession, however. "Fortunately my company has already hit our sales quota for the year, so I expect a positive salary experience for myself and employees," Bingham said.

What to Expect for Next Year

All in all, we should give thanks that IT workers who specialize in Microsoft technology are wanted and employable, even amid a recession. Bonuses may be lacking, but the difference seems to be made up a bit with the higher reported salaries across the board as partners find new ways to make money.

"We've been hiring consistently throughout the last year, and continuing to drive revenues higher," said Randy Barger, president and owner of Emineo Group in Waverly, Neb. "This growth in business will mean growth in my take-home pay."