It's way too early to draw conclusions about PRISM, the supposed, wide-ranging U.S. National Security Agency data collection program revealed by Edward Snowden that allegedly operates with the cooperation of major technology companies, including Microsoft. (The companies, including Microsoft, publicly and vigorously deny having voluntary or knowingly participated.)

With secret government programs, the details, and even the major structural elements, often don't come to light for decades. No matter what Microsoft partners feel about the legitimacy of the program or the reliability of the facts so far, it's hard to see the existence of the rumors about a secret U.S. government backdoor to customers' data as anything other than a stumbling block for trust in public cloud computing. The idea that the big public cloud vendors might have standing agreements with the U.S. government to share customer data runs counter to the spirit, if not the legalistic language, of any privacy policy.

Here's a brief primer on PRISM elements of interest to Microsoft partners:

PRISM

PRISM is a wide-ranging U.S. National Security Agency data collection program aimed at tracking terrorists and revealed earlier this month by former Booz Allen Hamilton contractor Edward Snowden via the Washington Post and the Guardian. Unveiled simultaneously with revelations about NSA access to information about call logs through the major telecoms, PRISM more directly affects the public cloud. According to the Post's article:

"The National Security Agency and the FBI are tapping directly into the central servers of nine leading U.S. Internet companies, extracting audio and video chats, photographs, e-mails, documents, and connection logs that enable analysts to track foreign targets, according to a top-secret document obtained by The Washington Post."

The Guardian, meanwhile, reported that Britain's equivalent of NSA, called GCHQ, is also able to tap into the servers of the nine organizations.

Special Source Operations

In one of the most explosive elements of the story for the IT industry, NSA has a special seal, or logo, for the companies whose servers are accessed. It's called "Special Source Operations," and the Post's annotation of the leaked four-slide NSA deck defines SSO as, "The NSA term for alliances with trusted U.S. companies."

Microsoft's Special Position

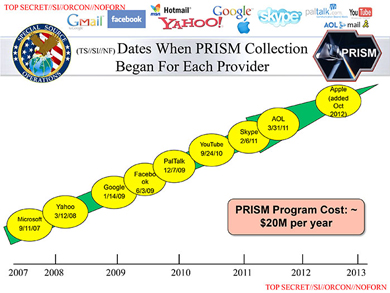

While the SSO badge isn't good for any of the companies' privacy credentials and Google seems the most alarmed about damage to its reputation, Microsoft has more explaining to do than the others. According to a slide in the leaked NSA deck titled, "Dates When PRISM Collection Began For Each Provider," Microsoft was the first partner recruited. According to the slide, Microsoft came aboard Sept. 11, 2007. Yahoo appears next in March 2008, followed by Google in January 2009, Facebook in June 2009, PalTalk in December 2009, YouTube in September 2010, Skype in February 2011 (before the Microsoft acquisition), AOL in March 2011 and Apple in October 2012.

Source: Washington Post

Source: Washington Post

Companies Push Back

Understandably, the Internet companies have been pushing back aggressively. Microsoft was out immediately with a denial:

"We provide customer data only when we receive a legally binding order or subpoena to do so, and never on a voluntary basis. In addition we only ever comply with orders for requests about specific accounts or identifiers. If the government has a broader voluntary national security program to gather customer data we don't participate in it."

Other companies made similar statements, and Google went further, writing an open letter to U.S. Attorney General Eric Holder and FBI Director Robert Mueller on June 11 pressing for permission to make public how many government requests it gets.

In the wake of that letter, Microsoft last week revealed how many requests it has gotten from federal, state and local governments -- between 6,000 and 7,000 requests affecting as many as 32,000 accounts.

Meanwhile, Google continues to push back the hardest of any of the companies on the story. David Drummond, senior vice president and chief legal officer at Google, participated in a Web chat Q&A at the Guardian on Wednesday.

In response to one question, Drummond wrote:

"I'm not sure I can say this more clearly: we're not in cahoots with the NSA and theirs is [sic] no government program that Google participates in that allows the kind of access that the media originally reported. Note that I say 'originally' because you'll see that many of those original sources corrected their articles after it became clear that the PRISM slides were not accurate. Now, what does happen is that we get specific requests from the government for user data. We review each of those requests and push back when the request is overly broad or doesn't follow the correct process. There is no free-for-all, no direct access, no indirect access, no back door, no drop box."

Project Chess

This week, The New York Times added a new code name to the privacy/secrecy stew with some reporting on a Skype program predating the Microsoft acquisition, called "Project Chess." As the Times explains it, based on anonymous sources, Skype began Project Chess as a secret program "to explore the legal and technical issues in making Skype calls readily available to intelligence agencies and law enforcement officials."

The Times added: "Microsoft executives are no longer willing to affirm statements, made by Skype several years ago, that Skype calls could not be wiretapped. Frank X. Shaw, a Microsoft spokesman, declined to comment."

Posted by Scott Bekker on June 20, 20130 comments

Microsoft's channel chief Jon Roskill has contended for more than two years that Microsoft and its partners are grossly underestimated when it comes to cloud computing.

Roskill's latest version of the argument is that a company with more than $1 billion in annual revenue run rates each for Office 365, Azure and Service Provider License Agreements (SPLAs) is hard to classify as anything but a cloud leader.

In an interview for RCP's July cover story previewing the Microsoft Worldwide Partner Conference, Roskill provided an update on the size of Microsoft's Cloud Essentials program. Partners who sign up for the free Cloud Essentials get access to Internal Use Rights for seats of Office 365 and other Microsoft cloud products, as well as sales and marketing resources.

A change to Microsoft's back-end systems late last year put the sign-up option for Cloud Essentials right in the middle of the partner enrollment and re-enrollment process.

As of mid-June, Roskill said Microsoft currently has 140,000 partners signed up for Cloud Essentials.

"Our ramp rate right now is we're having weeks that are over 5,000 partners a week joining," Roskill said. "Just to put that in perspective, if you look at our competitors' partner programs, we believe that the bigger ones -- Google, Amazon, Salesforce -- their entire program is less than 5,000. We're growing a Google partner program every week here."

We'll have more of Roskill's interview in our July cover story both in print and online. Nevertheless, Roskill's comments indicate that he, CEO Steve Ballmer and COO Kevin Turner will be every bit as pugnacious as ever when their WPC keynotes roll around July 8-10.

Posted by Scott Bekker on June 19, 20130 comments

Microsoft partners looking for a little beach reading just got access to a treasure chest's worth.

Eric Ligman, formerly the Microsoft Partner Experience Lead and now a sales excellence program manager at Microsoft, this week posted links to the complete text of 64 books about Microsoft technical topics.

Ligman did this last summer, too, and says the posting led to 1 million downloads worldwide.

"As with the past collections, these eBooks are completely FREE, they are not time-bombed, there is no catch, and yes, please let your friends, family, colleagues, or anyone else that you think would benefit from these know that they are available here and to come download the ones they are interested in," Ligman wrote.

The eBook topics include Office and Office 365, SharePoint, SQL Server, System Center, Visual Studio, Web Development, Windows, Windows Azure and Windows Server.

Links to the free eBooks are available here.

Posted by Scott Bekker on June 18, 20130 comments

In case you missed it, we posted a cheat sheet this week of some of the most interesting-looking sessions on the Microsoft Worldwide Partner Conference agenda. Meanwhile, RCP isn't the only organization curating lists of intriguing sessions for the upcoming partner confab.

The Aberdeen Group is out with a "Worldwide Partner Conference Primer." The document breaks down WPC by seven Aberdeen research areas overseen by 10 analysts who point to the most significant WPC sessions in their areas of expertise. Each section includes a quick overview on the subject area with a little recent research, a pointer to a couple of interesting sessions and links to related (registration-required) reports for reading on the plane to Houston.

The document is definitely worth a look if you're heading to WPC. You can find it here.

Related:

Posted by Scott Bekker on June 18, 20130 comments

Microsoft, its partners and consultants will expound on literally thousands of topics during hundreds of sessions at the Worldwide Partner Conference (WPC) in Houston next month. Here are some of the sessions, outside of the main keynotes, that promise to be especially interesting:

WINVK01

Windows: The Next Wave of Innovation and Partner Opportunity

Microsoft is promising an update to its flagship client OS called Windows 8.1 later this year. This session promises to cover why the new version will be better for business and the enterprise than Windows 8.

MPNVK

Microsoft Partner Network in a New World: Enabling Partners To Win with Services, Devices and Applications

Microsoft Partner Network (MPN) General Manager Julie Bennani leads an update on the evolution of the MPN to help partners take advantage of trends, including cloud, big data, mobility and enterprise social.

WIN09

"Here, Take My Money": All of the Windows Campaigns for FY14 Explained

This session should win an award for the best session title. The content looks pretty good, too. This is a small to midsize business (SMB)-focused session covering Microsoft's fiscal year 2014 incentives, such as Windows Accelerate and Get2Modern.

US24

How U.S. Partners Can Monetize Windows Azure IaaS

The addition of Infrastructure as a Service (IaaS) capabilities to Windows Azure is a big deal. The session, intended for business development managers and practice leads, covers funding, incentives, sample go-to-market activities and sample statements of work.

WIN10

Getting Off Windows XP in 30 Minutes or Less

And you thought this whole Windows XP support sunset in April 2014 would be a big deal for your customers. This is a technical how-to session for taking users from Windows XP all the way to Windows 8 using free tools from Microsoft.

US14

Winning and Growing in the U.S. SMB Relationship Era

Attendees will hear from longtime Microsoft SMB leader Cindy Bates and Microsoft North America President Judson Althoff in his first WPC since leaving his post as Oracle's channel chief. Topics will include FY 14 priorities and incentives for SMBs.

SC35

People-Centric IT: Addressing BYOD and Mobile Device Management

This session covers the Microsoft-centric view of how to use the company's on-premises and cloud tools to support the Bring Your Own Device (BYOD) and mobile device management trends.

DYN22

MarketingPilot: What It Means for the New Marketer and Your Business

Microsoft CRM partners and partners who use Dynamics CRM can get an introduction to the technology of MarketingPilot, which Microsoft acquired in October. The session will cover the technology, including campaign automation and marketing resource management, as well as Microsoft's roadmap for integrating MarketingPilot into Dynamics CRM.

US12

A Guided Tour of U.S. Partner Programs and the Resources that Keep You Informed

Diane Golshan and Julie Golding, two of the social media faces of Microsoft's U.S. channel organization, provide a guided tour of the Microsoft Partner Network resources and how to find them and use them. The session is for both managed and unmanaged partners.

Posted by Scott Bekker on June 17, 20130 comments

Business continuity is typically an add-on sale for partners, a way to garner some extra revenue on top of their main solution. Done properly, it's good protection for the customer's business and good money for the partner. Done poorly, it's a, well, disaster.

Many partners focus on the technical questions comparing one solution to another. But properly setting up a customer for a solid business continuity solution requires that the partner engage in important non-technical discussions with the customer, as well.

What follows are four key, non-technical questions to spark important discussions between partners and their customers:

1. What Files Are Most Important to Your Business?

This is a deceptively simple question. The answers will start with the obvious back-end systems such as the order database, the customer relationship management (CRM) system or the Exchange file store. As you get deeper into the discussion, secondary systems invariably emerge as customers think through the actual implications of not having them for a day or a week.

Then there's the whole issue of granularity. While servers don't go out all that often, how frequently does the boss accidentally delete a critical e-mail and need it restored? How much time does the internal or external IT department spend on those issues? This conversation is the foundation of any business-continuity plan. Before talking about potential solutions in any way, the conversation has to cover the business realities.

2. What Physical Systems Are Most Important?

This discussion can be divided into a few buckets. First, there's the question of which servers need to be backed up and at what priority. But there's also the question of whether desktops and even mobile devices need to be included in the business-continuity plan. The answer depends entirely on the business. Some companies have employees who store critical information only on their C drives. Maybe those companies should implement policies that require everyone to back up their local files to a server and rely on that server only for business continuity. Yet that kind of requirement can be unrealistic in the sense that it sounds good in theory, but the users won't actually change their behavior. In some cases a device-by-device backup process will be business-critical.

3. Is There Data in a Cloud Service that Needs To Be Copied Locally?

There are a lot of things that appeal to small and midsize businesses (SMBs) about contracting with a cloud services provider for some critical business function, such as e-mail or CRM. One business driver is offloading responsibility for backup and recovery of those critical systems to the cloud services provider, who presumably is going to handle that technical task far better than an SMB customer ever could with their limited or nonexistent IT staff. In some cases, though, it's prudent to consider whether the customer should be keeping a local copy of the cloud data just to be on the safe side.

4. How Often?

This is one of the most fundamental questions, and again, it's not really a technical consideration. What's the daily, weekly, monthly or quarterly cycle for that business? Does a particular application need a huge string of point-in-time snapshots to allow recovery from a failure at any moment, or is a less-comprehensive schedule entirely sufficient?

Related:

Posted by Scott Bekker on June 12, 20130 comments

The June issue of RCP featured a detailed gallery of interesting new Windows 8 PCs. We highlighted the Acer Aspire R7, P3 and V Series; the Dell XPS 18; the Lenovo IdeaCentre Horizon and ThinkPad S431; the Sony VAIO Fit; HP 400 ProBook and 200 series; the ASUS VivoBook S500; the VIZIO Thin +Light Touch and All-in-One Touch PC; and the Toshiba KIRAbook.

The reason for running the gallery in this latest issue is that with Windows 8 passing the six-month mark, PC OEMs seemed to be doubling down with a raft of new systems built to exploit the platform. The wave of new systems announced through early May also supported some Microsoft executives' recent statements about how many touch-enabled systems were starting to become available for Windows 8, a necessary precursor to spurring sales.

Predictably, though, the Computex show in Taipei, Taiwan, this week demands an update to that gallery. Computex is annually one of the most important hardware showcases in the industry and this year was no exception. Several of the devices announced in Taipei this week deserve a mention in any discussion of the current Windows PC ecosystem.

Acer Iconia W3

The biggest Windows device news out of Computex, as reported by

Kurt Mackie, by far was the demonstration of the Acer Iconia W3. It's one of the smaller Windows 8 form factors that Microsoft publicly confirmed a few months ago. Its most important spec is the 8.1-inch screen that puts the Iconia squarely in the mini-tablet category. The tablet weighs 1.19 pounds, is 0.45 inches thick, has a battery rated at eight hours and sports front and rear cameras. An optional keyboard dwarfs the tablet, giving users a larger surface to type on. The device is scheduled to ship later this month. Acer also unveiled a handful of other Windows 8 systems.

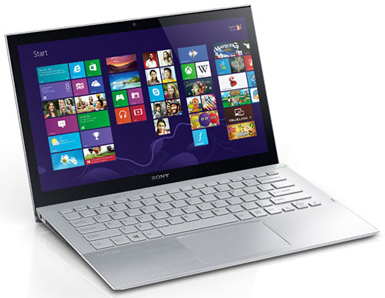

Sony VAIO Pro

Sony substantially upgraded its line of VAIO PC notebooks for Windows 8. The company unveiled the VAIO Pro 11 and VAIO Pro 13 Ultrabooks. They come in black or silver and will be available next week for $1,149 for the 11-inch-screen model and $1,249 for the 13-inch version. Sony also updated the Duo line -- the hybrid with the screen that slides down into a tablet mode. The new Duo 13 will retail for $1,399 next week.

ASUS Zenbook Infinity

ASUS announced several new devices. The most visually arresting is the Zenbook Infinity, which sports a new type of Gorilla Glass, among other features. Pricing, specifications and availability will be announced later. Other new ASUS models include 27-inch and 23-inch all-in-ones.

Dell XPS 11

Dell also used Computex to launch a new convertible Ultrabook -- the Dell XPS 11. It's a tight-looking little laptop with a screen that rotates 360-degrees to a tablet, with just a 15-mm thickness and a weight of 2.5 pounds. More details will come later in 2013. Meanwhile, Dell has also redone its "flip hinge" Dell XPS 12 to boost performance and battery life and add Near Field Communications and location awareness.

Posted by Scott Bekker on June 06, 20130 comments

- Read the first part of reader reactions here.

A few more readers are weighing in on my column "Is the 'Peak PC' Period Over for Microsoft."

One thinks I'm a clown for even asking whether we're at peak PC or PC pause:

"Peak PC." A joke right? And a poorly thought out one, at that.

Most small businesses have consistently upgraded on a 5- to 7-year cycle in economic good times and SMBs still haven't seen a recovery. (Statistically, small businesses of 25 or fewer employees employ half of America; 26 to 100 employees another 25 percent; and 15 percent government.)

Median business upgrade of XP was around 2005 and median for Windows 7 was around 2011. (So median for Windows 8 will be around 2017?)

Note, in the hoopla about XP: The fact that Server 2003 will continue a few more years (i.e., NT5.2 codebase updates will continue) lessens the urgency, a fact that "ID10T" people at Gartner, IDC, et al. aren't smart enough to figure out.

Also consider that Vista/Server 2008 was NT6.0 codebase; Windows 7/Server 2008 R2 was NT6.1 codebase; and Windows 8/Server 2012 is NT6.2 codebase -- not an appealing argument for upgrade. If you have "partner" access to Microsoft's knowledgebase, you will note that XP bugs "to be fixed in 6.1" are still present in Windows 8 (NT6.2 codebase). So Windows 8.1 will be NT6.3 codebase or NT6.21. Either way, most of us will wait for a true code refresh from Microsoft before considering upgrades.

Not just Windows: Note that Linux fanboys also wait for kernel updates before upgrading.

And what is the installed base of SBS? Most of our Small Biz customers have upgraded SBS 2003 to SBS 2011 Standard recently or are going without a Microsoft server. Office 365 is not a substitute for "Exchange Lite." (And Exchange drives Outlook drives Microsoft Office sales.)

Meanwhile, Ian argues for a third way and coins his own law:

Sorry if I'm coming late to the party, but the answer is, "Neither." We're at "PC Morph"! The PC has morphed from desktop to something more portable. The "something more portable" as we have it now handles some new use cases very poorly...and the tablet is the response. But the tablet hasn't really defined itself yet. Is it a super-smartphone, a dumbed-down PC or a portable media portal (or something else, they were only "forinstances")?

[Ian's] Law No. 2 (I'm feeling arrogant this morning) has just been defined and says, "Devices consolidate to meet the maximum number of use cases achievable at a given price point." I suspect for a while there will still be a hunger for distinct business and consumer devices, but that eventually there will be a single consolidated "something else."

Related:

Posted by Scott Bekker on June 06, 20130 comments

- Read Scott's original column here.

There was a lot of response to my column, posted yesterday, posing the question of whether the precipitous declines in PC shipments mean we've passed Peak PC or we're at some sort of PC Pause.

Check out the article itself for some insightful commentary in the discussion session at the bottom. I've also gotten a few thoughtful e-mails. From the mailbag, Bill argues for option 2:

We are at "PC Pause."

Tablets and phones just do not have enough power or screen real-estate to get my tasks done.

Maybe my grandma would be happy with only a tablet.

When I am at home, or at work, I simply need LOTS more power and disk space than any tablet can give.

Reader "W.T.W." argues the Peak PC case:

Four things make me think that we are at -- or already beyond -- "Peak PC."

1. People who just played Solitaire on their PC and used the Web for e-mail: These users were a huge portion of the build-up of the PC (and Windows) customer base beyond businesses, when Macs were more expensive and had little advantage in those areas. PCs and Windows are now much less attractive (more cumbersome, more expensive) in these environments than tablets and smartphones.

2. Applications that are moving to other platforms and form factors from PCs, as those platforms become more powerful (home accounting, photos, etc.): Beyond those users in #1, the main reason most people bought PCs was because of the breadth of applications available for it, from Quicken/QuickBooks to Photoshop to Word. With the Apple and Android app stores, the requirement to use PCs for these applications no longer exists. This has been due to Microsoft alienating huge swaths of developers as much as the growing ubiquity of those other platforms. Outside of .NET, Microsoft has failed to modernize its OS APIs; and then .NET evolution seemed to splinter into more and more obtuse and abstruse directions, negatively impacting performance and developer adoption. And then the Windows 8 freeze/abandonment of .NET/C# debacle hit. Developers moved on. Most people I know no longer use MS Word or Quicken.

3. Microsoft's ongoing effort to turn Windows and PCs into "consumer" items, and failing miserably: In the tradition of Microsoft Bob, continuing through Vista/Windows 7, and now fully realized with Windows 8, many of Windows' most obnoxious traits are due to Microsoft trying to make Windows into "systems for dummies" rather than productivity tools, and never getting it right. Where, despite the hassles of using Macs, Apple was able to maintain an aura of things "just working," Microsoft never has. Everything from the form factors to the interface designs to the computing power required argue that "consumer" and "productivity" arenas are disparate scenarios with very different requirements. And mistakes such as limited Windows Phone functionality/programmability and the flat Metro/Modern (actually, retro 1920s-1950s-era sparse/minimalist) design -- with that design philosophy taking precedence over usability and functionality -- haven't helped.

4. Local storage is no longer necessary for holding your files, photos, even videos. The ongoing adoption of cloud-based storage means users don't have to have a local hard drive to hold all that stuff -- and therefore don't need a PC on a desk to hold or access it. The increased use of OTT video over the Internet -- which now just about dominates TV viewing, vs. over-the-air or even direct cable -- means that the PC is not only no longer needed for these uses, but its use becomes awkward in these contexts.

In short, I think Microsoft has grossly misjudged its market, and the market for PCs in general -- not only in terms of numbers but in its very nature. Its emphasis on maintaining a "dumb consumer" as a Windows customer -- when that is a hopeless task, given market conditions today -- is also costing it its real (potential) market in the areas of increased productivity, whether in the home or in business. And that means that usage of PCs, and Windows, will NOT continue to grow, but will start to shrink, as other options take up the slack that Microsoft itself has created.

Richard goes with more of a "Pause" argument, and makes things political:

Having been in this industry since well BM (Before Microsoft), I have seen a lot of trends. Most are actually driven by politics, strange though it may seem. Your point about the additional devices (tablets and phones) is interesting, but in my opinion they will simply provide additional points of access to the data rather than replacing the PC. I now use laptops, as well as an iPhone and iPad. But I keep my laptop with me even when I travel!

Sales cycles in this industry follow perceived economic trends. Businesses buy when the economy is going up or going down. They do not buy when the economy is stagnant (either at the top or at the bottom). Business will prepare for the boom or the bust but when they cannot determine what is happening, they will pause.

This also applies to that period from June to November every four years when we elect a new president and, to a lesser, extent during the Congressional elections in between. Businesses halt investments, waiting to see who is elected. Generally (with some recent exceptions), no matter who is elected, after the election, business increases.

The current period happens to be one of those exceptional times when businesses are now waiting to find out how many employees they will need to terminate to be able to afford "Affordable Health Care." To a business, survival of the business is the primary focus, not the employment of the masses.

Microsoft is, in my opinion, protecting their presence by pushing businesses to "The Cloud." This new push into an old paradigm is simply repeating an old paradigm (yes, before PCs there were remote servers shared by many firms, like SaaS providers) designed to make it easier for small businesses to get entangled in the Microsoft solution stack. But that's OK. We still need a portal device, and the PC -- with it's tactile keyboard and separate mouse and monitor -- is still the leader.

As for the PC, since the inception of computers, businesses needed access to their data. Since the advent of the desktop system, that system has been the leading port (replacing paper reports from mainframes). Again, iPads and iPhones provide additional portals but I do not see them replacing the PC. I do, however, believe the PC will continue getting stronger and smaller at the same time.

P.S. My first desktop system cost $2,500 retail and contained 32 K of RAM and two floppy disks. We have come a long way so far.

Related:

Posted by Scott Bekker on May 30, 20130 comments

The worldwide server market suffered another ugly quarter, according to reports issued this week by IDC and Gartner.

IDC's report, released Wednesday, was the grimmer of the two. The Framingham, Mass.-based research firm found server revenues fell by 7.7 percent in the first quarter of 2013 compared to the same period in 2012. In all, server sales amounted to $10.9 billion, down from $11.8 billion. IDC also reported that server unit shipments fell by nearly 4 percent to 1.9 million units.

Leading the way down were market leaders HP and IBM, with revenue declines of 14.8 percent and 13.4 percent, respectively.

Gartner's findings, released a day earlier, were that revenues dropped 5 percent to $11.8 billion from $12.4 billion and shipments fell a little less than 1 percent to 2.3 million units. Gartner's reckoning has IBM, rather than HP, as the market revenue leader, although the Stamford, Conn.-based market research firm reported nearly the same revenue declines for both server makers as IDC reported.

The hardest-hit company in percentage terms was Oracle with a revenue drop of either 26 percent (IDC) or 27 percent (Gartner).

Some vendors managed to execute well despite the brutal market. Relative server-market newcomer Cisco enjoyed soaring revenues with growth of 35 percent to $450 million for the quarter, according to IDC. That was good for a three-way tie for fourth place in the global server market with Fujitsu and the fast-dropping Oracle.

[Click on image for larger view.]

[Click on image for larger view.]

Also growing in the quarter was Dell, which saw revenues increase 10 percent, according to IDC, and 14 percent, according to Gartner. Both analyst firms put Dell's market share at 18 percent. The gain for the No. 3 worldwide server vendor, combined with the sizable drops by IBM and HP, put Dell in a much closer third place than it was a year ago. It will be interesting to see if Dell can continue to execute amid the corporate ownership turmoil of the second quarter.

The Windows end of the server market largely held steady for the quarter. IDC estimated that Windows server hardware revenue declined 4 percent to $5.7 billion. But even with that drop the platform picked up 1.9 points of market share to reach 52.2 percent.

Posted by Scott Bekker on May 30, 20130 comments

For partners with practices in more than one country, Microsoft is making a significant change to its partner program qualifications.

Called "Country Qualification," the central idea is that for every country that a partner wants to brand itself as having a Microsoft Competency, the partner organization must meet all Competency requirements in that country.

So, say for example, a partner wants a Business Intelligence Gold Competency practice in both the United States and the United Kingdom. The partner would need to have full Competency infrastructure, such as Microsoft Certified Professionals, in both countries.

"If you have practices in more than one country, your organization is most likely impacted by this change. Please ensure you are ready to meet the Competency requirements in each Country where you want to market yourself as a branded Microsoft Competency partner," Microsoft Partner Network General Manager Julie Bennani wrote in a blog post this month.

Some smaller countries are grouped together, meaning partners with practices in Central and Eastern Europe, Latin America and Africa may be able to operate in several countries on a single Competency infrastructure.

The change goes into effect in October of this year.

Posted by Scott Bekker on May 23, 20130 comments

Enterprise IT management vendor SolarWinds on Tuesday announced plans to acquire MSP vendor N-Able Technologies for $120 million.

Executives for Austin, Texas-based SolarWinds said they expected the deal would close by the end of the month.

Kevin Thompson, president and CEO of SolarWinds, said that Ottawa, Canada-based N-Able's business would open the "S" in SMB to SolarWinds for the first time. Thompson estimated the size of that market as $2 billion in the United States and $2 billion internationally.

Praising N-Able's cloud-based and lightweight approach, Thompson said SolarWinds would be able to disrupt the market of remote monitoring and management (RMM) vendors. "The market really is served by a fragmented set of companies. For the most part, a number of small companies are serving that market. What we've seen with N-Able over the past 24 months or last 36 months is that they have emerged as that leader," Thompson said on a conference call about the deal.

The disruption will extend to N-Able's 2,600 current MSP customers, who will need to shift entirely to selling a subscription model. N-Able currently sells both perpetual and subscription licenses. Subscribers will still be able to choose between running N-Able's products in the cloud or installing them on-premises.

Thompson did say SolarWinds will continue to sell N-Able products through MSPs. "We don't see any need or reason to change that go-to-market approach. We think it's the right one," he said.

SolarWinds is bringing on all 180 N-Able employees. The SolarWinds executives praised N-Able CEO Gavin Garbutt's approach, although Garbutt was not on the call to discuss the deal. SolarWinds has about 700 employees.

SolarWinds had about $200 million in annual revenues in 2011. N-Able's revenues were $24 million in 2012, according to executives on the call.

Posted by Scott Bekker on May 22, 20130 comments