The Microsoft Surface Book is the first covet-worthy laptop of the Windows 10 era.

Microsoft's inaugural first-party hardware entry in the crowded laptop market hit general availability on Monday. I spent an hour Monday morning at the Microsoft Store in Arlington, Va., getting a hands-on demo of the Surface Book and the new Surface Pro 4. (Click here for the Surface Pro 4 article.)

The first thing you notice is the hinge. Microsoft calls it a dynamic fulcrum hinge, and the parts move to expand the hinge as the laptop opens. Closed, this laptop doesn't fold flat like almost every other notebook. Instead, it makes a wedge shape, which is wider at the hinge end. Some reviewers are concerned that the hinge makes the keyboard and screen more likely to collect dust and dirt when not in use. Still, the toothlike edges of the hinge give the closed Surface Book a snarling quality, like it's waiting impatiently for you to come back and let it spring into action.

That wild hinge isn't an extravagance -- it's a functional form designed to allow the screen to come off and become a tablet. As such, the quality is critical. Time will tell, but the hinge looks and feels like it's built to last.

Unlike some other 2-in-1 attempts at removable screens, the Surface Book has a keyboard button along the top row that releases the screen. A long press results in a green light on the key when the tablet is unlocked from the hinge. It slips out seamlessly. Reconnecting the tablet provides an onscreen prompt that it has been securely reattached. At that point, you can grab the screen and shake or grab the keyboard and shake. The connection is rock-solid.

Removed from the keyboard, the tablet itself feels nicely balanced and ridiculously lightweight for its large size (it's a 13.5-inch display). Technically, Microsoft calls the tablet a clipboard because of the magnetic pen attached to the top. Microsoft works its lightweight magic by putting the graphics processor and the bulk of the battery in the keyboard. Used as a laptop with the keyboard battery, the device is good for 12 hours of video playback, according to Microsoft. In clipboard mode, the tablet part is supposed to have about three hours of standalone battery life.

Reattaching the keyboard facing backward opens up a few more usage modes, including a folded shut mode for drawing.

As a laptop, the device is less than 3.34 pounds. Using it on your lap is a big improvement over trying to balance a Surface Pro-and-keyboard assembly, but the real parallel here is that it's the same as any other lightweight laptop.

Despite having the CPU, RAM and storage up behind the screen, the counterweight of the graphics processor and battery in the keyboard make for a balanced system. Pushing on the top of the screen doesn't tip the Surface Book over on its back.

The keyboard itself is a selling point. Microsoft engineers focused on the typing experience, emphasizing things like "travel" in the keys. I'm not sure what that means, but the keyboard was a joy to use. Microsoft may be a relative newcomer to PC manufacturing, but it's been making keyboards for decades. Some of the biggest innovations on the Surface and Surface Pro tablet lines have been in the keyboard, and the same thought and quality has gone into the Surface Book's keyboard, too.

From the hinge to the magnesium casing with its silver Microsoft logo, this is one attractive and powerful business machine. The biggest questions revolve around whether Microsoft's laptop is worth it.

From a buyer's perspective, it boils down to the price, and whether it's worth it for that individual's circumstance. The Surface Book runs from $1,499 for a 128GB, Core Intel i5 model with 8GB of RAM to $3,199 for a 1TB, Core Intel i7 with 16GB of RAM, a high price range for a business laptop.

From an industry standpoint, there's an open question as to whether the payoff will be high enough for Microsoft to justify having released this product. After all, Microsoft plays a deep game -- offering first-party products that it hopes will sell well but that it also hopes will inspire its OEM partners.

Back when Microsoft launched the original Surface, several OEMs were angry. They hadn't gotten a heads up that Microsoft was getting into hardware. Fast-forward a few years and the results are looking pretty good for Redmond. HP and Dell are reselling the Surface Pro, and the productivity tablet is spawning direct copycat models in the VAIO Canvas and the Lenovo Miix 700 and an indirect copycat model in the Apple iPad Pro.

With the Surface Pro, though, Microsoft was launching a new category of device and was willing to shell out a few billion dollars in the effort when OEMs partners weren't investing there on their own. The Surface Book isn't creating a new category. It's improving on a category OEMs have been delivering on since Windows 8 launched.

For argument's sake, let's call the Surface Book a 5 or 10 percent improvement on the next best 2-in-1 laptop.

Even if this is "the ultimate laptop," as Microsoft's Surface architect Panos Panay said repeatedly in unveiling the Surface Book, it's an incremental ultimate laptop, not a revolutionary one. It's hard to see the Surface Book spurring on Microsoft's OEM partners, as the Surface Pro did, so much as just making them grumble.

Posted by Scott Bekker on October 26, 20150 comments

The old truism that Microsoft gets a product right on its third try held for the Surface Pro 3. Not wanting to mess with a good thing, Microsoft limited itself to refinements for the new Surface Pro 4.

The fourth generation of Microsoft's category-creating productivity tablet become generally available on Monday. I spent an hour Monday morning at the Microsoft Store in Arlington, Va., getting a hands-on demo of the Surface Pro 4 and the Surface Book. (Read my Surface Book review here.)

Familiar to Surface Pro 3 users will be the magnesium alloy body, the dynamically adjustable kickstand, the microSD slot, the USB 3.0 port, and the height and width. Discerning users might notice that the tablet is slightly thinner, slightly lighter and that the picture is slightly sharper.

There are also the types of specification upgrades you'd expect from one generation to the next as underlying technology improves or gets cheaper, or both. Gone is the 64GB storage option, replaced at the high end with a new 1TB model. The battery life claim is now 9 hours of video, up from 9 hours of Web usage. The rear camera boasts 8MP now from 5MP before. The Intel Core i3 processor at the low end in the Surface Pro 3 has been replaced with a fanless model sporting an Intel Core M processor, which leads to a slightly lower overall weight than the Intel Core i5 and Intel Core i7 options for the Surface Pro 4.

Aside from specs, Microsoft is moving the ball forward in several areas. A hallmark of Surface innovation from the beginning has been the magnetically attached cover/keyboard. This time around, Microsoft is improving on the angled keyboard of the previous Surface Pro model with movable keys that are spaced wider apart in a chiclet arrangement. The typing action is smooth and less cramped than previous Surface keyboards. The other mainstream improvement in the keyboard is a glass, rather than a plastic, trackpad. Also new is an optional keyboard with a fingerprint sensor built in. The base keyboard/cover costs $130; the fingerprint ID model adds $30 to the price.

While the device dimensions haven't changed from 201mm x 292mm, thank Windows 10 in part for a bigger screen area. The capacitive Windows button, which was previously required by the Start button-free Windows 8 operating system, has been removed. That helps save some bezel space, and the new screen is 12.3 inches instead of 12 inches.

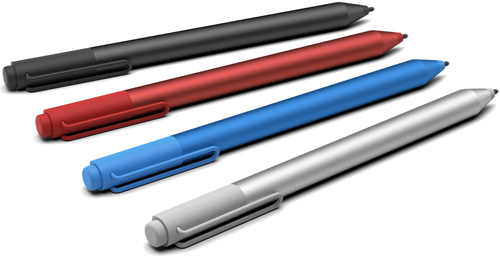

Central to the identity of the Surface Pro is the integrated pen, and Microsoft engineers iterated that input method as well for the fourth generation. According to Microsoft, the pen and tablet together now register four times as many pressure levels as the previous pen. A new eraser eliminates the need for one of the buttons on the old pen, and the other button is now hidden in the magnetic strip that attaches the pen to the edge of the Surface Pro. Additionally, Microsoft now offers interchangeable pen tips at varying thicknesses.

Outside the base package, Microsoft completely overhauled the docking system. Versions for the Surface Pro 3 consisted of a stand that the tablet plugged in to with several ports on the back. Given the adjustable kickstand that's built into the Surface Pro, the stand actually limited the tablet to only one viewing angle. The new $199 Microsoft Surface Dock is a port-filled block that's about the same size as its own power brick, which includes multiple ports and connects to the Surface Pro via the magnetic charging port.

The Surface Pro 4 comes in several configurations ranging in price from $899 to $2,699. Available now are the Intel Core m3 model with 128GB of storage and 4GB RAM, and the Intel Core i5 models with 4GB, 8GB or 16GB of RAM and 128GB to 512GB of storage. Shipping by Nov. 20 are Intel Core i7 models with 8GB or 16GB of RAM and 256GB or 512GB of storage. The top model -- an i7 with 16GB of RAM and 1TB of storage -- ships by Jan. 22.

Posted by Scott Bekker on October 26, 20150 comments

Paris-based Thales SA will pad its data protection capabilities with a $400 million acquisition of enterprise encryption company Vormetric.

Thales this week announced a definitive agreement to acquire San Jose, Calif.-based Vormetric in a deal expected to close in the first quarter of 2016.

Vormetric will be a part of the e-security portion of Thales' security business. The European company also has aerospace, space, defense and transportation business lines.

"The acquisition of Vormetric is a great opportunity to accelerate the growth of our cybersecurity activities. Combining Thales' critical IT systems protection capabilities with Vormetric's know-how in data protection will create a global leader in data security, offering comprehensive solutions for protecting enterprises against cybersecurity threats," said Patrice Caine, chairman and CEO of Thales, in a statement.

The Vormetric Data Security Platform centralizes key management and offers file-level encryption, application-layer encryption, tokenization, cloud encryption gateway and security intelligence logs. Those cryptography tools complement Thales' hardware security modules, encryption technology and digital signature technology.

According to the companies, Vormetric has about 200 employees and a current fiscal year revenue runrate of $75 million. That unit will join a Thales e-security team that consists of 540 employees in the United States, the United Kingdom and Hong Kong.

In a letter about the merger, Vormetric President and CEO Alan Kessler told customers and partners that Thales' "significantly funded R&D" would enhance the Vormetric products.

"We look forward to developing even more valuable solutions for our customers and we will continue to invest in the strong partner ecosystem that has been such a core part of our success," Kessler wrote.

Posted by Scott Bekker on October 21, 20150 comments

Western Digital Corp. is acquiring SanDisk Corp. in a storage hardware megadeal worth $19 billion.

The companies entered into a definitive agreement, announced Wednesday, involving cash, new debt financing and Western Digital stock. The boards of directors for both companies have approved the deal, which is expected to close in the third calendar quarter of 2016. The deal still depends on SanDisk shareholder approval, and if a pending Unisplendor Corp. investment in Western Digital falls through, Western Digital shareholders will also have to give their blessing.

According to 45-year-old, Irvine, Calif.-based Western Digital, the acquisition will double its addressable market and improve its position in higher-growth segments. The companies listed their complementary product lines as hard disk drives, solid-state drives, cloud datacenter storage solutions and flash storage solutions.

"This transformational acquisition aligns with our long-term strategy to be an innovative leader in the storage industry by providing compelling, high-quality products with leading technology," said Steve Milligan, chief executive officer of Western Digital, in a statement. "The combined company will be ideally positioned to capture the growth opportunities created by the rapidly evolving storage industry."

Milligan will be CEO of the combined company, with headquarters remaining in Irvine. SanDisk President and CEO Sanjay Mehrotra is expected to join the Western Digital board of directors when the deal closes. A long-term strategic partnership between Toshiba and SanDisk will continue, the companies said.

After closing the deal, Western Digital expects to find $500 million in synergies within 18 months and to be earnings per share accretive (non-GAAP) within a year.

Posted by Scott Bekker on October 21, 20150 comments

The surprising Surface Enterprise Initiative, which brought Dell and HP aboard as Surface Pro resellers for Microsoft, won't include the Surface Book yet for the two OEMs.

"You can expect HP and Dell to continue to evaluate new devices as part of the partnerships announced last month, but the product was just announced, so nothing more specific at this point," a Microsoft spokesperson said in an e-mail.

Under the initiative, Dell and HP will bundle Surface Pro devices and accessories with their own service and support offerings.

The decision makes some sense for Dell and HP with the Surface Pro 3 and forthcoming Surface Pro 4. With those devices, Microsoft created a category of a productivity tablet, and it's a space where Dell and HP don't have their own products.

On the other hand, the newly announced Surface Book -- which, like the Surface Pro 4, will be available next week -- will compete directly with many of the Windows 10 laptop models HP and Dell designed themselves and already sell.

Executives for HP and Dell both reportedly said at a recent industry event that they're selling Surface Pro and related services in response to requests from large customers who want a single contract with their main IT supplier. At the same event, Lenovo revealed that it had rebuffed a Microsoft overture to take part in the Surface Enterprise Initiative.

Accenture is also part of the Surface Enterprise Initiative, but as a systems integrator rather than an OEM, it's a different type of partner.

"They are more building the solutions, not only for Surface but Surface Hub and Lumia phones," Cyril Belikoff, director of marketing for Microsoft Surface, told my colleague Jeff Schwartz in an interview. "We are working with them to engage enterprise customers around their business needs and [our] set of category-making devices."

As for Dell and HP channel partners, the Surface Enterprise Initiative is not transferable -- so Dell and HP can't deputize their substantial numbers of partners to resell Surface Pros. Instead, Microsoft recently greatly expanded its Surface reseller program through distribution to nearly 5,000 partners worldwide.

Posted by Scott Bekker on October 21, 20150 comments

Lenovo and Microsoft get close, Lenovo and Microsoft push each other away.

The strains of being an operating system vendor, reliant on your OEM partners one day and then simultaneously competing with them another day, came into full view this week in the Microsoft-Lenovo relationship.

First, the happy face of the partnership.

Microsoft's Joe Belfiore (left) with Lenovo's Dilip Bhatia at the San Francisco launch event of the new Yoga devices. Source: Microsoft.

Microsoft's Joe Belfiore (left) with Lenovo's Dilip Bhatia at the San Francisco launch event of the new Yoga devices. Source: Microsoft.

Microsoft's Joe Belfiore was on hand in San Francisco this week for Lenovo's launch of two Windows 10-optimized devices, the Lenovo YOGA 900 Convertible Laptop and the Lenovo YOGA Home 900 Portable All-in-One Desktop.

Belfiore blogged, "Windows 10 was designed to help people do great things, and these new Lenovo YOGA devices were built to maximize Windows 10's incredible features. We worked closely behind the scenes with Lenovo to ensure its new products really brought to life the best of Windows 10, and we're excited to see customers' reactions to these new YOGA PCs."

The Yoga 900 Convertible Laptop (top) and the Yoga Home 900 Portable All-in-One (bottom). Source: Microsoft.

Now, the angry face of the relationship.

At a recent Canalys Channels Forum, Lenovo COO Gianfranco Lanci reportedly told attendees that Microsoft approached Lenovo about reselling the Surface Pro, a deal that both Dell and HP accepted. "I said no to resell their product," The Register last week reported Lanci as saying. "[Microsoft] asked me more than one year ago, and I said no I don't see any reason why I should sell a product from within brackets, competition."

As Lanci reportedly put it, Lenovo views Microsoft as a "partner on certain things" and a "competitor" on others. Microsoft, with many similar relationships (see Salesforce.com, Oracle, SAP, Dell, HP, IBM, etc.), surely also views things the same way.

In light of Microsoft's surprise decision to release its own Surface Book laptop, Lanci is probably even happier about his decision to rebuff that Surface Pro resale offer.

Posted by Scott Bekker on October 20, 20150 comments

Microsoft executives said Tuesday that nearly 5,000 resellers have signed up worldwide to sell Microsoft Surface business tablets, but that they expect growth of this new partner ecosystem to settle down after that initial rush.

"Today we're now at nearly 5,000 resellers across Surface markets. So the interest has been tremendous," said Phil Sorgen, corporate vice president of the Microsoft Worldwide Partner Group, in a telephone interview Tuesday. "It really reflects the unprecedented response to Surface Pro 3 that we've seen from business customers."

It's a substantial bump from the controlled model of several hundred Surface Pro resellers who were authorized as recently as July, when Microsoft relaxed the rules governing which partners could sell the category-creating, Windows-optimized tablets with magnetic keyboards and integrated pens. At that time, Sorgen said publicly that the program would go from hundreds to thousands of resellers, but he said the speed at which the channel filled out took him by surprise.

Even with the interest in the new Surface Pro 4 and Surface Book that come out next week, Sorgen said he doesn't expect to see the Surface reseller community continue to expand as quickly.

"[As for] the pace to 5,000, those that were interested and knew they were interested and have been interested for some time absolutely jumped in, and it wasn't hard for them to get engaged. They already had relationships with their distributors," he said. "We don't have a target, but I wouldn't expect the continued growth of what we saw. I think that was opening the door and there was some pent-up demand and interest to participate. That's happened, and now I think we'll be in a more steady state from this point forward."

Prior to this July, authorized device resellers, such as CDW, Insight and SHI, and distributors had to meet a lot of criteria to sell the Surface.

"There is significantly less hurdle for the rest," Cyril Belikoff, a director of Surface marketing at Microsoft, explained to my colleague Jeff Schwartz in an interview. "This is really important so we can help those customers who want to buy from their resellers. We think it's important for the customers, and it's a big moment for our partners, too, as we're able to move out and broaden the reseller base and give them the opportunity to service the customers that they've been asking for. The theme here is making sure we and our partners are ready to sell Windows 10 and Surface as we move into the holiday period."

According to Sorgen, the profile of the new Surface resellers runs the gamut. "They're your classic value-added resellers that go through the distributors. Some of them sell hardware, other lines of hardware, some sell hardware and software, some do project services, and there are some examples of vertical players that are integrating Surface into their vertical solutions and going to specifically one set of customers," he said.

Citing the quiet period before Microsoft's upcoming earnings statement, Sorgen declined to say how many Surface devices the new partners have sold.

The partner momentum number came amid a number of Surface announcements Tuesday, including some customer wins and two new programs being added to the Surface Enterprise Initiative.

One program, called Microsoft Complete for Enterprise, makes changes to the warranty, service and support offerings for enterprise customers. A headline feature of that program is the ability to pool warranty claims by company rather than by individual device. So, for example, while the warranty previously limited a device to two replacements, a company can now pool warranties so that accident-prone employees can replace a system after three, four or five coffee spills and drops -- basically borrowing replacements from employees who never need a device fixed.

Another part of Microsoft Complete for Enterprise follows a new theme across Microsoft of creating on-boarding centers to take over responsibilities that were previously often handled by partners -- in this case, training. The on-boarding center will ensure "IT staff and employees have the ability to maximize productivity" and "a premium ramp-up experience to match a premium device," according to a company statement.

Posted by Scott Bekker on October 20, 20150 comments

The select group of 2-Tier distributors in Microsoft's growing Cloud Solution Provider (CSP) U.S. ecosystem grew by one this month, with the addition of SherWeb to the program.

Launched as a pilot last year and greatly expanded this year, the Microsoft CSP program is a cloud reseller program that sets up partners to directly manage their entire customer lifecycle, including direct billing and support.

Some partners, called 1-Tier partners, can order seats on behalf of customers directly from Microsoft. Most partners, however, will be 2-Tier partners, working through a 2-Tier distributor, rather than directly with Microsoft.

The U.S. 2-Tier distributor list initially consisted of AppRiver, Ingram Micro, Intermedia, Synnex and Tech Data.

This month, Canadian-based SherWeb joined the list of approved U.S. 2-Tier distributors. SherWeb originally was approved as a 2-Tier distributor only in Canada.

Jason Brown, director of product management for SherWeb, said the cloud services provider will deliver a very quick get-to-market experience for any U.S. 2-Tier partners that work with SherWeb.

"SherWeb is a new kind of distributor in the cloud services market," Brown said in a statement. "What differentiates us from the others is our free 24/7 support and migration. The fact that we can offer multiple cloud services to clients in a single move is key to a partner's success in the cloud."

SherWeb has about 4,000 partners serving 25,000 customers worldwide on its Hosted Exchange, Infrastructure as a Service and other solutions.

RCP has compiled a directory of the offerings of U.S. 2-Tier distributors here. We'll update it soon with details from SherWeb.

Posted by Scott Bekker on October 15, 20150 comments

Microsoft is making its Onboarding Center (OBC) more aggressive in its mission of converting cloud customers to active users, leaving partners for the second time in three months to figure out whether the new OBC will trample their existing business models or augment them.

Launched in 2014, OBC is an internal unit at Microsoft designed to provide free, personalized and remote services to customers to help them turn cloud licenses into active seats. Initially, the hundreds of employees worldwide in the unit provided Office 365 e-mail migrations for customers with more than 150 seats.

With a focus for this fiscal year on consumption, Microsoft's term for getting users activated and using multiple Microsoft services in the cloud, Microsoft expanded the OBC in July to cover data migrations, Enterprise Mobility Services (EMS) and enterprise voice.

On Wednesday, Microsoft unveiled another round of significant changes to OBC. At a superficial level, Microsoft is changing the name of the OBC to the FastTrack Center. The name change should reduce confusion, because the center has been delivering migration services as part of a customer offer called FastTrack.

The more significant changes are a broader mission for the FastTrack Center that includes an ongoing element.

"First, we're changing FastTrack from a one-time benefit to an ongoing benefit. This enables you to request support in onboarding new users and capabilities at any time, and as many times as needed, for the life of your subscription," Arpan Shah, senior director for the Office 365 team, wrote in a blog post for customers.

Microsoft is now sandwiching two new elements around the original migration service. FastTrack now consists of three experiences, the new "Envisioning" and "Drive Value" experiences and the "Onboarding" experience, which was the scope of the previous OBC.

The Envisioning experience through a FastTrack.microsoft.com Web site will offer resources and tools for customers to use prior to deployment. The Drive Value experience for post-deployment use will include best practices, guidance and resources.

That Drive Value experience seems like a candidate to generate ongoing outbound calls to customers from the FastTrack Center. Partners have complained that outbound calls to customers from the original OBC generated some confusion over the last year. However, the Drive Value experience is also intended to be a source of new partner business. As Shah wrote in the customer blog, "[We] will connect you as needed with qualified partners who can help you do more."

One other significant difference is that the FastTrack Center's broader mission will bring it into contact with all of Microsoft's customers. While the original OBC was intended for customers with more than 150 seats -- and the Onboarding experience continues at that seat level -- the other two services are expressly intended for all customers.

Gavriella Schuster, general manager of the Microsoft Worldwide Partner Group, positions the changes as part of an overall demand-generation effort that will lift all partners on a wave of new business opportunities.

"These updates fully leverage the partner-led engagement model with the FastTrack Center. Partner engagement helps us drive higher customer satisfaction and opens opportunities for you to drive adoption of advanced workloads by delivering high-value services such as business process consulting, managed services, LoB integration and app development," Schuster wrote in a blog post.

The moves reinforce the advice Jon Sastre, CEO and president of ConQuest Technology Services, gave to fellow International Association of Microsoft Channel Partners (IAMCP) in a blog post recapping the July Microsoft Worldwide Partner Conference (WPC).

"The message is loud and clear, they will be doing the design and architecture and all the complex aspect of this work in addition to the commodity stuff. The even bigger concern is the relentless outbound marketing and call downs to clients offering the service," Sastre wrote of the OBC. "My big lesson here that I learned at WPC was lead with the OBC story and capabilities in your own sales motions. Let them know that Microsoft has a high volume output for mass migrations that would still dramatically benefit from your own project management, documentation, complex integration and training offering in addition to your IP as part of a real comprehensive migration strategy. Nothing that Microsoft does will ever match our speed and agility to pivot on client needs."

The FastTrack Center resources are available immediately in English. Microsoft plans to release content in November in Brazilian, Portuguese, French, German, Italian, Japanese, Spanish and Traditional Chinese.

Posted by Scott Bekker on October 07, 20150 comments

Symantec Corp., newly re-focused on IT security, on Monday launched a new partner program called Symantec Secure One.

The security vendor is in the process of selling the Veritas data-management arm of its business to private equity firm Carlyle Group and Singapore sovereign wealth fund GIC for $8 billion. That deal is expected to close by the end of the year, but Symantec and Veritas have been working out the details of a split on the same timetable since the October 2014 announcement of the separation plans.

According to Symantec, Secure One will give partners higher earnings potential, faster payments and streamlined achievements.

"With an increased focus on cybersecurity and a strengthened portfolio aimed squarely at solutions that address today's most sophisticated attackers, we're rolling out Symantec Secure One to enable our partners to leverage our products and services to grow their businesses," said John Thompson, global senior vice president of partner and channel sales at Symantec, in a statement.

Here are the highlights, according to Symantec:

- Higher earning potential -- Our Growth Accelerator Rebate (GAR) sets one goal on net new business and pays out from the first transaction. Once a partner reaches the Platinum tier in any of the Integrate competencies (Threat Protection, Information Protection or Cyber Security Services), partners participate in a predictable, profitable GAR across the entire security portfolio, including Core Security.

- Get paid faster -- Partners don't have to wait until the end of the year, which translates into quicker cash flow. Plus, the earning opportunity in quarter is 50% higher than before.

- Easier achievements -- It's easier than ever for partners to achieve Platinum status. We've streamlined specific requirements (technical validation, customer references, sales certification requirements), so that our partners can earn revenue faster and with fewer hurdles.

For more details, visit partnernet.symantec.com.

Posted by Scott Bekker on October 05, 20150 comments

The Microsoft-Google relationship appears to be entering a less hostile phase.

The companies issued a joint statement Wednesday bringing to an end five years' worth of patent lawsuits covering about 20 cases in the United States and Germany:

"Microsoft and Google are pleased to announce an agreement on patent issues. As part of the agreement, the companies will dismiss all pending patent infringement litigation between them, including cases related to Motorola Mobility. Separately, Google and Microsoft have agreed to collaborate on certain patent matters and anticipate working together in other areas in the future to benefit our customers."

Terms of the agreement weren't disclosed, and Microsoft's patent infringement agreements with Android device manufacturers don't appear to be affected.

In short, the agreement doesn't end all areas of conflict between the companies, by any means. But it does line up with the less combative style of Satya Nadella compared to his predecessors in the Microsoft CEO role.

Nadella's Microsoft has been much more visibly collaborative with competitors, which, frankly, has always been a sign of Microsoft at its best. When your product portfolio has as much surface area as Microsoft's does, it only makes sense to work with companies in some areas while competing vigorously in other areas.

The Google move is of a piece with a commentary on Microsoft's partnering guidelines last week by Peggy Johnson, executive vice president of business development at Microsoft. Pointing to the collaboration with Microsoft frenemies like Salesforce.com and Dropbox in Office 2016, Johnson laid out five principles -- respect, listen, say what you mean and mean what you say, stay focused, and don't be afraid to take a pause or hit reset.

This latest Google agreement would qualify as a reset.

Posted by Scott Bekker on October 01, 20150 comments

Editor's Note: This entry has been updated throughout based on an interview with Gavriella Schuster, general manager of the Microsoft Worldwide Partner Group.

Microsoft has slashed the minimum number of Office 365 seats partners need to sell to earn a cloud competency by about three-quarters.

The move was one of several reduced competency requirements announced Monday in a blog post by Gavriella Schuster, general manager of the Microsoft Worldwide Partner Group. The blog post provides specifics for changes that Schuster outlined at the Microsoft Worldwide Partner Conference (WPC) in July.

In the biggest reduction, partners aiming for the silver level in the Small and Midmarket Cloud Solutions (SMCS) competency will now only need to sell 40 seats of Office 365 to four new Office 365 customers. That's down from the 150 seats and 10 customers that were required when the competency was introduced a year ago. For the gold level, Microsoft also relaxed the requirements, but less dramatically. To get gold, partners must now sell 250 seats at 25 customers, down from 300 seats at 30 customers last year.

In a telephone interview, Schuster said a lot of partners engaged in the original SMCS competency, but that the higher seat-count was sending a "bad message."

"As we started to work with [customers and partners], what we found is that we really wanted them to spend more time with their customers to ensure that they actually got them up and going and were driving the usage. By having the number of customers so high, we were pushing them in a way that we didn't actually want to. We were pushing them to get to volume rather than quality," Schuster said.

In a separate cloud competency focused on Azure, called the Cloud Platform competency, Microsoft also reduced the sales requirement to achieve silver. In this case, it's about a 40 percent reduction from $25,000 in Azure consumption previously to $15,000 now. That $15,000 requirement applies to what Microsoft calls "developed markets." The requirement for "developing markets" is $10,000.

Benefits are changing for partners with the Cloud Platform competency, as well. The silver level now carries $6,000 per year in Azure credits, up from $3,000 per year before. Gold is also doubled to $12,000 per year from $6,000. Microsoft also ramped up the MSDN and Visual Studio 2015 licenses available to Cloud Platform partners -- doubling silver to 10 licenses and more than tripling gold from 10 before all the way up to 35 licenses now.

For a third cloud competency, Cloud Productivity, which is similar to SMCS but focused on larger customers, Microsoft is shifting its partner-tracking metrics from seats sold and revenues to active use and consumption -- in line with a broad company strategy along those same lines.

"We previously defined performance as seats assigned for Office 365," Schuster wrote in her blog. "Now, achievement comes when you drive Active Entitlements (active users) for silver and gold. You can meet the active user requirement across any Office 365 workload (Exchange, SharePoint Online, etc.) or with Office 365 ProPlus."

Microsoft's internal systems previously could only track Exchange activations, Schuster explained. Now the systems are able to track multiple activations, making it possible to see how deeply a customer is using the Microsoft stack.

Where previously, 500 seats assigned for Cloud Productivity was the bar for silver and 1,500 seats was the bar for gold, the numbers are higher now. Microsoft is now looking for 2,000 Active Entitlements for silver and 4,000 Active Entitlements for gold.

However, that can translate to the same number of end users as before for silver and fewer end users than before for gold, Schuster explained. "If they were on E4, they would have had an entitlement across four different products, so it's essentially equivalent to say that if it was 500 seats, it should be 2,000 Active Entitlements on that same number of seats if they had activated everything," Schuster said.

The blog entry also confirmed official availability of several other WPC announcements. One is the end of the requirement for partners to individually track and assign unique Microsoft Certified Professionals to a specific competency. Another is the official launch of the previously announced Enterprise Mobility Management (EMM) competency.

Eligibility for silver and gold in the EMM competency will also depend on Active Entitlements. Partners will need to register 500 Active Entitlements for silver and 2,000 for gold. Because EMM involves two products -- Microsoft Intune and Azure Active Directory Premium -- the actual number of users could be as little as half those numbers if partners sell both products for every user.

Additionally, Microsoft will continue for a second year to waive the silver competency fee for all of the cloud competencies in order to encourage participation and allow partners to invest the money in growing their businesses rather than paying Microsoft, Schuster said. The credit applies to all five of the cloud competencies -- SMCS, Cloud Platform, Cloud Productivity, Cloud CRM and EMM. The fee to join the Microsoft Partner Network with a silver competency is ordinarily $1,665 in the United States.

Posted by Scott Bekker on September 28, 20150 comments