News

Microsoft Reports 14 Percent Year-over-Year Jump in Q2 Earnings

- By Kurt Mackie

- January 23, 2014

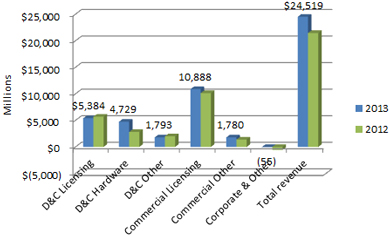

Microsoft's earnings report for the second quarter of fiscal-year 2014 reflected positive results, with overall revenue at $24.5 billion for the period.

That figure, which met financial analyst estimates, represents a 14% increase compared to Q2 2013. Diluted earnings per share, at $0.78 for the quarter, exceeded analyst expectations of about $0.68 per share.

Microsoft also reported a gross margin of $16.2 billion, operating income of almost $8 billion and net income of $6.6 billion for the quarter. Microsoft's fiscal Q2 period ended on Dec. 31, 2013, reflecting holiday purchasing (see chart).

Microsoft Q2 2014 revenue earnings across segments.

Microsoft Q2 2014 revenue earnings across segments.

Microsoft's Windows desktop revenue was a little rocky in Q2, as occurred with Microsoft's Q1 earnings. Microsoft's Windows performance likely reflects the 10% plunge in PC sales that was reported by analyst firms for the 2013 holiday quarter, as well as a general trend toward consumer use of mobile computing devices running Android or Apple's iOS operating systems. However, Microsoft CEO Steve Ballmer nonetheless claimed that "our Devices and Consumer Segment had a great holiday quarter," according to a released statement accompanying Microsoft's Q2 financials.

Overall, the Devices and Consumer (D&C) segment showed a 13% revenue increase at $11.9 billion. Microsoft's new financial reporting structure (see table) lumps the Windows desktop operating system into a "Devices and Consumer (D&C) Licensing" segment for non-volume licensing consumer sales and a "Commercial Licensing" segment for volume licensing sales. Microsoft's Q2 announcement reported a 3% revenue decline from Windows OEM sales, representing the consumer market. However, the Windows OEM Pro market was up 12%, according to Microsoft.

The Devices and Consumer segment also includes Microsoft Office and Windows Phone financials. Microsoft reported Microsoft Office revenue being off in its Form 10-Q report, with Windows Phone revenue increasing:

Consumer Office revenue declined $244 million or 24%, reflecting the transition of customers to Office 365 Home Premium as well as continued softness in the consumer PC market. Windows Phone revenue increased $340 million or 50%, reflecting higher sales of Windows Phone licenses and an increase in mobile phone patent licensing revenue.

Microsoft also reported revenue from its Surface computer sales. Surface Q2 revenue was $893 million vs. $400 million in Q1. No breakdown was provided on sales of Surface Pro vs. Surface RT devices.

Overall, Microsoft's Commercial revenue was up 10% in Q2 at $12.7 billion. Microsoft has two Commercial financial reporting segments that are called "Licensing" and "Other," which largely reflect its server sales to businesses. Microsoft reported double-digit growth for Q2 for SQL Server, System Center and cloud services. The company reported triple-digit growth ("more than 100%") for "Office 365 commercial seats and Azure customers" in Q2. However, the figures weren't broken out in Microsoft's announcement.

| Microsoft Segment |

Products or Services |

| Devices and Consumer Licensing |

- Windows OEM licensing, other non-volume licensing and academic volume licensing;

- Microsoft Office consumer non-volume licensing;

- Windows Phone patent licensing and other patent licensing revenue.

|

| Devices and Consumer Hardware |

- Xbox gaming consoles;

- Xbox Live subscriptions;

- Vendor video games sales;

- Surface;

- Microsoft PC accessories.

|

| Devices and Consumer Other |

- Resale associated with Windows Store, Xbox Live and Windows Phone Marketplace;

- Search advertising;

- Display advertising;

- Subscriptions associated with Office 365 Home Premium;

- Studios associated with first-party video games;

- Microsoft retail stores;

- Other consumer products and services not included in the categories above.

|

| Commercial Licensing |

- Server products, including Windows Server, Microsoft SQL Server, Visual Studio and System Center;

- Windows Embedded;

- Windows commercial volume licensing, excluding academic;

- Commercial Office, including Microsoft Office for business, Exchange, SharePoint and Lync;

- Client Access Licenses;

- Microsoft Dynamics, excluding Dynamics CRM Online;

- Skype.

|

| Commercial Other |

-

Enterprise Services, including Premier support services and Microsoft Consulting Services;

- Cloud Services, including commercial Office 365 (but excluding Office 365 Home Premium), plus other Microsoft Office online offerings, Dynamics CRM Online, and Windows Azure;

- Other commercial products and online services not included in the categories above.

|

| Corporate and Other |

|

Microsoft's business segments. Source: Form 10-Q, Sept. 30, 2013.

|

About the Author

Kurt Mackie is senior news producer for 1105 Media's Converge360 group.