What's that you say? Microsoft is doing all right for itself, and as a Microsoft partner, so are you. Satya Nadella is a visionary CEO who is leading the company in the right direction. In fact, Microsoft made the Fortune 25 last year for the first time ever. (I'm sure you all have your Fortune 500 parties ready for later this spring. Can Walmart repeat? Will Apple fall? The suspense is gripping.) Is all of that right?

Actually, it is. (Well, hopefully it is in the case of partners doing all right for themselves. We're cheering for you.) Microsoft is on the up overall, and that's good for pretty much anybody who is reading these words right now. But as the former editor of this newsletter (and now a writer seeking assignments -- hit me up!), I can't help but wonder what might have been had Microsoft been able to shake a certain obsession about a decade ago.

Not long ago, a report revealed that Android has passed Windows as the operating system most frequently used to access the Internet. This comes as no surprise to most of you, who are probably reading this on your phones. And while Windows will continue to be a profitable and important product for Microsoft, as it has been for decades, we go back, as most of you do, to the days when Windows was the be-all and end-all of the software industry, the "Win" in the old "Wintel" juggernaut that crushed the rest of the market under the heel of its Eddie Bauer boot.

A decade ago, Microsoft released a version of Windows called Vista, and just this week, the Seattle titan ended its life, withdrawing support for it for good from the 14 unfortunate souls who were still using it. If you weren't there, and even if you were, it's hard to fathom just how much hype Vista got in the mid-aughts. Microsoft took forever to release it. Bill Gates basically had the whole company focused on it. People named their children after it. Somebody in Sweden, if we remember correctly, recorded a dirty-mouthed (honestly, why?) song about the tortured excitement of waiting for it, but since an extremely cursory Google search didn't turn that song up, we're not going to post a link to it here.

Of course, Vista turned out to be one of Microsoft's biggest disasters (not unlike my old blog photo) -- and even Gates, for whom Vista was basically Willie Mays-with-the-Mets moment -- essentially admitted as much. RCP back then had a field day making fun of Vista before the OS landed in the dustbin of history. But if you think the Vista debacle doesn't still haunt Microsoft, think again. First, there was this, a surprisingly prescient paragraph from a 2006 blog entry:

"But while software as a service (or SAAS, as it's much easier to write) might still be a gangly teenager in terms of development, it's growing all the time. And by the time Vista and Office 2007 reach retirement age -- think five years or more from now -- SAAS should be a full-grown adult. By then, will we care about local compute power in our PCs and other devices, or will we just need a connection and a browser to user whatever apps we need with whatever functionality we require? And is Microsoft -- or anybody else -- prepared to serve its partners and customers in that world?"

The answer turned out to be...sort of. Office 365 is absolutely whipping Google's (sorry, Alphabet's) G Suite in the enterprise and pretty much everywhere else. So, score that one for Microsoft in a big way. And credit where it's due -- Office 365 started out as a G Suite (Google Apps back then) chaser and has ended up a champion. Well done, Redmond and Redmond channel partners.

But let's take a look at some other key markets. In the cloud-platform space, Amazon Web Services is the dominant leader; note that in the chart on this page, Microsoft, Google and IBM are all lumped in together in terms of market share behind AWS. Now, let's see...when did AWS make its debut? That's right, 2006. And what was Microsoft obsessed with in 2006? Windows, and specifically Vista.

There's more, of course. Apple kicked off the smartphone revolution with the 2007 release of the iPhone. What had Microsoft been working on feverishly in the run-up to that date? That's right: Vista. And when Google decided to join the smartphone fray in 2008 with the Android OS, what was Microsoft desperately trying to do? Fix Vista, or at least get Windows 7 out as quickly as possible. These days, Windows Mobile (if it's even still called that) is in a heated battle with "other" in the basement of the mobile OS market share rankings.

Back in the '90s, Bill Gates darn near missed the Internet and had to use the dominant Windows platform to provide a big assist to get Internet Explorer over the top of Netscape. (Now, of course, there is no more Internet Explorer, but that's another topic altogether.) In the mid-2000s, though, when Microsoft missed both cloud computing and mobile because it couldn't get its head out of Windows, there was no dominant platform there to save its market share. Windows was irrelevant in both spaces. Still is. So, focusing on Vista so heavily in the 2000s not only produced a garbage OS, it also turned Microsoft from a leader into a chaser in the technology industry.

In mobile in particular, some of Microsoft's attempts to catch its rivals were hilarious. There was, of course, the Zune, Microsoft's answer to the iPod, which wasn't a bad product but was characteristically uncool and a sad pretender to Apple's throne. The iPod re-launched Apple. The Zune made Microsoft a laughing stock. (Oh, and then there was search, and Bing, and aQuantive, and "we're going to make a quarter of our revenues through advertising"...but there's too much there to get back into now.)

And when it came to phones, the humiliations were arguably worse. T-Mobile seemed to deeply regret its involvement with something called the Sidekick. (Did you have one? Neither did I. Nobody did.) Then there was my personal favorite Microsoft failure, the Kin!

Not only did it sound like something from a Beverly Hillbillies script, it actually tried to take consumers back down market just as they were snapping up smartphones as if they were free pancakes. (Seriously, would you rather walk around with the sum total of all human knowledge in your pocket or carry a phone that barely texts? Who signed off on this one?)

Microsoft spent a pretty hefty amount of money advertising the Kin, a phone that did almost nothing, offering commercials that featured, as memory serves, a guy breaking up with his girlfriend...or something. Tone-deaf isn't the right expression. There wasn't even any music playing. Microsoft couldn't make the Kin go away fast enough. We intend to make live forever, at least on the RCPmag.com domain.

We could, of course, also dig back into the Courier (What? Oh, it ended up being called the Surface), the tragic Nokia saga with Stephen Elop sent north as the harbinger of doom, or the bizarre tales of Ray Ozzie and Kevin Turner during their times in Redmond.

But for those still soldiering through this entry, let's go back to the very beginning. Yes, Microsoft is doing great. It might not be the world's biggest brand anymore, but it's plenty powerful enough to drive profits to its partners. And it's headed in the right direction with Nadella in charge and America's least successful billionaire, Steve Ballmer, off annoying NBA players somewhere.

Still, though, let's think for a second about what could have been. Microsoft used to have a stranglehold on the entire software industry and much of the enterprise in general. Now, Amazon and Google arguably hold the power in the corporate space. What if Microsoft had stopped focusing on its Vista buggy whip -- which didn't even turn out to be a good buggy whip -- and moved much earlier toward mobile computing and developing a cloud platform? The truth is that the Surface is a good product and Azure is an excellent platform. Even Windows Mobile wasn't bad -- it was just stillborn and beset with bizarre marketing decisions.

Microsoft could have been more powerful than perhaps any other company since Standard Oil...but it isn't. And although the future looks very bright in Redmond, one of the big reasons Microsoft isn't quite what it used to be is an operating system that died this week, but which could still haunt Microsoft for years to come.

Posted by Lee Pender on April 11, 20170 comments

Steve Ballmer is the biggest loser in America ... among tech multi-billionaires. (That's a pretty important caveat, but still.) At Microsoft, he managed -- metaphorically, of course -- to turn the 1960s Celtics into something closer to the Celtics of the 1990s, or maybe the Lakers of the 1980s into the 2014 Lakers. Whatever. Microsoft under Ballmer went from hero to, well, not zero, but certainly something less than hero.

He got violently out-Steved by his late counterpart at Apple. Among former Microsoft luminaries, Bill Gates is currently saving the world, and Paul Allen, more than 30 years gone from Redmond, is still savoring a Super Bowl triumph with his Seattle Seahawks -- and no doubt loving the fact that he left Microsoft at just the right time, before any of the really hard work had to be done. For Allen, it was all music projects and sports-franchise ownership, while everybody else who stayed behind was fighting through antitrust suits and the eventual and humiliating existence of the Zune.

Finances aside, Ballmer was kind of Microsoft's first high-profile loser. Oh, sure, other Microsoft executives got shuffled or booted or whatever, but Ballmer was the first Microsoft household name associated with something other than staggering success and fabulous wealth -- which is funny, of course, because he was successful by many (OK, some) measures and is certainly fabulously wealthy. But popular culture and history (and snarky bloggers) can be harsh judges, as can Photoshop and YouTube clips.

Now, though, Steve Ballmer, like Parker Lewis (look it up on IMDB), can't lose. He is, as of this writing on Friday, May 30, 2014, buying the L.A. Clippers for way too much money, probably. But the money's not important. He has it. Does Steve Ballmer even like basketball? We have no idea. But that doesn't matter, either. It doesn't even matter that the Clippers, aside from a few recent seasons, have never been any good. In fact, that's better for Ballmer. Oh, and the guy Ballmer's buying the team from, Donald Sterling, is literally the most hated man in America, a guy who told his mistress that he didn't want black people coming to his basketball games ... or something like that. (Of course, because Sterling bought the Clippers for a pack of Juicy Fruit and some Little River Band records back in 1981 and now stands to clear a cool couple of bil, he probably doesn't care much about his public image.)

Everything's coming up Ballmer! Steve Ballmer might have taken one of the most dominant forces in the history of the American economy and turned it into an also-ran in its own industry, but he can't screw up this time. Or, more appropriately, he can, and nobody will care. What's the very worst that could happen? The Clippers could become irrelevant losers, the way they have been for most of the past few decades? High-profile players could defect to other teams? Happens all the time in sports. The fans could abandon the team for the sexy counterpart across town? The Clippers never had that many fans. (Or they had L.A. fans, whose loyalty blows in and out like the Santa Ana winds, anyway.) Well done, Steve. Seriously. This is no Zune. This is no Vista. This is no Surface. This is no Windows Phone. This ... this is a winner. Or, at least, it's not a loser.

One thing, though: We'd like to see Ballmer move the team back to Seattle, just so that he and Paul Allen can own sports franchises in the same city at the same time. And one more thing: Steve, or anybody else out there who's still reading, I've got a semi-pro soccer team you could invest in. We're looking for way less than $2 billion, although we'd consider any offer. This is totally inappropriate for this space, of course, but I'm not kidding.

Although I rarely get to write these newsletter entries anymore, I'd like to hear from you, the readers, on this one -- or on anything, really (including that soccer investment). E-mail me your thoughts and PayPal information to [email protected].

Posted by Lee Pender on May 30, 20140 comments

If Microsoft makes an announcement and nobody is there to hear it, does it still make a noise? Once again, as it did with the news about Steve Ballmer's impending, um, retirement, Microsoft dropped a bomb this week at a time when most Americans were off doing something else.

OK, we realize that Microsoft announced its impending acquisition of Nokia's devices and services divisions in Finland, where Nokia is headquartered, and that the world does not actually end where American beaches plunge into the sea. Still, most of the tech press, pretty much all of Wall Street and probably most folks who work for Microsoft were asleep or otherwise occupied when the company revealed its latest blockbuster move overnight Eastern Daylight Time time on Tuesday, just on the other side of the Labor Day holiday here in the United States.

(But not our intrepid Jeff Schwartz, who, like your editor, was up goofing around online late at night and stumbled upon the news, and who, unlike your editor, actually filed a very good story about the deal just an hour or so after news broke. Your editor chose instead to take to the dreaded Twitter and try to make funny comments, which you can review and mock via @leepender on that horrid site.)

In any case, Microsoft's $7 billion buyout of most of the company one of its former execs was running has made, predictably, plenty of noise. The deal has put Stephen Elop, Nokia CEO, clearly at the top of the list to be next chief executive of Microsoft, although we think it's safe to say that Nokia's performance during Elop's tenure has been less than stellar. (Then again, the company was sliding into irrelevancy when he got there, not unlike the company that's buying most of Nokia now.) It has also drawn some praise, some ambivalence, a lot of criticism and possibly even a fairly important departure from the Finnish firm.

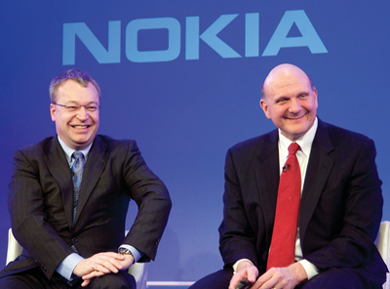

Nokia CEO Stephen Elop (left) with Microsoft CEO Steve Ballmer.

Nokia CEO Stephen Elop (left) with Microsoft CEO Steve Ballmer.

From our seat, however, it has mainly led to Microsoft spinning, as always, that this is great news for the channel, specifically for the Windows Phone hardware partners that surely must be wondering now where (or whether) they fit into Microsoft's plans. This sunny channel forecast, of course, is what we always hear from Microsoft, no matter how bad the news actually is for the channel. And we're thinking this acquisition is probably bad news.

First, there's the obvious. Are we supposed to pretend that Microsoft won't go down the road Apple has so expertly paved, basically developing and selling its own hardware and software and leaving the channel behind? If not, why spend $7 billion on a maker of handset devices? Stephen Elop isn't worth that much by himself, surely. This is a clear and obvious play aimed at making Microsoft a serious competitor in the handset space using Apple's model rather than what Google is still mostly doing with Android (although the Motorola Mobility buy clearly moved Google in a more Apple-like direction), which doesn't make that much money for Google, anyway, at least not directly.

Then, there's Microsoft's recent track record with flailing, desperate moves and alienating the channel. Way back in 2008, as Microsoft realized hosted applications were actually going to stick as a model, the company finally began talking about hosting its own applications. The obvious implication was that it would then be competing with its own hosting partners. That year, Steve Ballmer told a crowd at the Worldwide Partner Conference (the partner conference!) that Microsoft would basically take down its partner-competitors if it had to.

Then there was Surface, Microsoft's embarrassing tablet debacle. Back before it became a famous failure, Microsoft figured it could sell the device on its own and through a few big retailers, essentially cutting the channel out altogether. Then, as Surface sank, Microsoft slowly began letting a few select partners have a go at selling and packaging services with it. (And we do mean slowly, as most partners still wouldn't have the privilege of selling Surface even if they wanted to -- or if anybody was actually buying it.)

Now, Microsoft is nudging the channel aside again with this Nokia deal. However, there is good news for partners, even Microsoft's hardware partners. It might not be obvious, but it's there. First, let's get this out of the way: Most readers here are probably involved in selling and servicing enterprise software of some sort from Microsoft, meaning the likes of SharePoint, Windows Server, SQL Server, System Center and the like. These are huge moneymakers for partners and Microsoft both (and really what the company should be focusing on instead of chasing consumer pipe dreams), and we can't imagine a scenario in which Microsoft would want to hurt its channel for those products in any way. Just the opposite, in fact: Microsoft seems as supportive as ever of these products and the partners that deal with them. So, that's good.

But for partners in the line of fire, there's other good news. Mostly, it has to do with Microsoft's (and probably Nokia's) poor execution. None of these desperate, flailing, way-too-late attempts by Microsoft to catch some leader in a consumer market ever seems to work. Bing isn't exactly a household name. Microsoft bought aQuantive years ago in an effort to become an advertising agency and then ended up writing off that little $6 billion foray. The Zune was a non-starter, to say the least. The Kin phone will go down as one of the great gaffes in tech history. The Surface is a disaster. Even the Windows Vista and arguably Windows 8 operating systems, the one thing Microsoft is really supposed to know how to produce, have proven to be flops. And now Microsoft is trying to revive its drooping Windows Phone franchise buy buying a manufacturer that's been mostly irrelevant and ineffective for the better part of half a decade. We'll see how that goes.

What we're saying to those few Windows Phone hardware partners not named Nokia is that as it is slowly doing with Surface, Microsoft will probably come crawling back to you at some point. Given Microsoft's failures at doing pretty much anything outside the enterprise or Windows/Office spaces, it seems highly unlikely that Microsoft will be able to successfully integrate Nokia and its 30,000-plus employees (yes, for the time being, anyway, Microsoft is about to get much, much bigger) into a smooth-running machine that will threaten Apple and Google. The more interesting race to watch might be to see which phone brand collapses completely first, BlackBerry or Windows Phone.

For a company that still makes most of its money from -- and has built most of business on -- the channel, Microsoft sure seems anxious to cut partners out of its newer ventures. While we don't think that should be a major concern for Microsoft's bread-and-butter enterprise partners, it's certainly a trend that should disturb a lot of players in the Microsoft channel and push them to watch their backs and have contingency plans in case the mother ship turns it guns on them. Then again, when it comes to anything outside its traditional comfort zone, Microsoft usually misses it targets (by a lot), anyway.

Related:

Posted by Lee Pender on September 04, 20130 comments

Steve Ballmer was getting around to it. He was always getting around to it. That's the way Ballmer's Microsoft has worked for years: slowly, almost casually, and with no apparent sense of urgency. So, yeah, Steve Ballmer was going to retire...eventually. But then, according to lots of sources in stories from excellent journalists, Ballmer got retired by Microsoft's suddenly impatient board.

As we all know now, Ballmer said Friday that he'd step down as Microsoft CEO sometime in the next 12 months. Using the classic, old tactic of dumping "bad" news on a Friday (in August, no less), when supposedly nobody is paying attention, Microsoft released Ballmer's announcement only to find out that it wasn't bad news at all. The company's stock price went up -- kind of by a lot, by Microsoft's low standards. The press and pundits took a non-cursory interest in the company for the first time in quite a while. What a surprise, huh, this positive reaction to bad news?

The positive reaction shouldn't have been a surprise at all. Microsoft might have been better off announcing Ballmer's contretemps five minutes before its next earnings release, given the glee that the news has brought in various corners of the industry. The story now goes that Ballmer was thinking of retiring, oh, you know, maybe in five or six years, but Microsoft's board of directors (including Bill Gates, apparently -- ouch) thought it might be time for Ballmer to just go ahead and fade into Bolivian, in the parlance of Mike Tyson.

After all, Ballmer had never really set a firm retirement date, even as he fiddled while Redmond burned around him. (Incidentally, Roman Emperor Nero, the obvious reference in that last sentence, couldn't fiddle, but he could play an early version of the organ. Just so you know.) Was Ballmer going to step down in three years? Or five? Or eight? Or 17? Honestly, nothing would have surprised us. If Ballmer's tenure at Microsoft has been marked by anything, it has been his, let's say, deliberate nature and his propensity to make predictions (or promises?) and then just sort of forget about them (or fail to execute on them).

Remember when Microsoft bought online advertising firm aQuantive for multiple billions of dollars (six, if memory serves) because Microsoft, according to Ballmer (as we remember it, anyway), was going to derive 25 percent of its revenues from Web advertising at some point in the future? That point has not yet arrived, and given what appears to be Microsoft's near-total abandonment of the whole ad-agency plan, despite aQuantive being the company's biggest acquisition ever at the time, it never will.

How about when Bing was going to rule search and be a huge area of focus for Microsoft? Or when Microsoft was going to stick with the Zune until it defeated the iPod? Or when something called the Kin, the name of which was seemingly inspired by the Beverly Hillbillies, was going to revolutionize cell phones? How about when Jerry Seinfeld was going to march in from the '90s and make Microsoft relevant again? We don't have to Google -- sorry, Bing!...no, actually, Google -- any of that stuff to know that not only did Microsoft not reach any of those goals, it gave up on most of them fairly rapidly. Ballmer has talked a good game as CEO but has rarely followed up on his words.

And that's why the Microsoft board (apparently) finally put its collective foot down. Ballmer's Microsoft just kind of does things when it gets around to it, like a college freshman not vacuuming his dorm-room floor until he can't actually see it anymore. (Yes, we remember.) Just look at the Surface tablet, which was some untold number of years in the making and is now about as relevant as a rerun of "Friends" (terrible show, by the way; always was). Or the terrible and famously despised Windows Vista, which took its sweet time to arrive despite the fact that Microsoft actually seemed to try to rush it out the door. Or Windows Phone, which waddled into the market like a substitute soccer player coming on in injury time with the game already decided. Or Windows 8. We haven't even touched Windows 8. Has anybody?

A day late and a dollar short would be an extremely kind way to describe Ballmer's Microsoft, given that many of the company's most important products have been more like years late and (seemingly, although we don't know for sure) way over budget during his tenure. So, the August Friday revelation that Ballmer will soon no longer be jumping around at company events like a sweaty monkey seems to have been Microsoft's board's way of finally calling time on him. And they had to do it. After the strategic hiccups, the product failures and the embarrassing fall of the company from dominant to near doormat, even the staunchest Ballmer supporters -- and there must have been some for him to have lasted this long -- couldn't take it anymore.

Left to his own devices, Steve Ballmer might have tried to hang in as Microsoft CEO for another decade. Sure, he was thinking about retirement, just as he was this close to making Microsoft relevant again. He was going to do both -- really, he was. Eventually, the way he and his company have done almost everything during his tenure. Eventually, slowly, clumsily...and, frankly, probably poorly. Soon, though, somebody else will inherit the former high-speed train Ballmer managed to slow to a crawl. For Steve, time's about to be up. Soon. Finally.

Related:

Posted by Lee Pender on August 27, 20130 comments

At some point soon, and maybe it will already have happened by the time you read this, the movie Jobs will be in theaters. Ashton Kutcher, probably best known for sort of acting in "That '70s Show," hosting a not-unfunny prank show called "Punk'd" on MTV and horsing around on Twitter (ugh), has borne the awesome responsibility of playing the iGod himself, the late Steve Jobs. You know this, of course. But stick with me here, please.

I'm sure ol' Ashton is just fine in that role, no matter how much criticism he's bound to get from Apple sycophants and snooty, ivory-tower film mavens alike. (Seriously, who's more annoying than an old-school, print-publication "film" reviewer? More annoying than the people who never call them movies, only "films"? These people are at a Ph.D.-in-English-Lit level of annoying, and other than crabby blogger, there is no level higher than that.) Seriously, though, I'm sure Ashton does OK. But it doesn't matter. It's only a movie. And it's not the movie, anyway.

Anything with the names "Jobs" or "Apple" attached to it is bound to gather the faithful, the skeptical, the curious and the awestruck. That's a lot of people, ultimately. The iEra vaulted the departed genius into the highest stratosphere of positive public opinion (way up there, in the Frank Sinatra or John Wayne range -- wow, I really need some cultural references from this century), and rightly so. Who doesn't love the iPod, the iPhone, the iPad and all the device-alikes they've spawned over the last decade or so? Did Steve Jobs not change our lives? Of course, he did. So, he's more than worthy of a biopic. It's just that the best one, maybe the only one necessary, has already been made.

Back in the '90s, impossibly long ago, I was working as a reporter at PCWeek (remember?), pretending to have some idea of what 40,000 CEOs of ".com" startups were talking about when they came to meet with me. ("Um, so, it's a turnkey, end-to-end, robust, plug-and-play, Internet-based e-commerce supply chain business process management platform solution for the Central American radish-growing industry? Oh, it will be when you actually launch the product...in three years. No, believe it or not, that's the fourth one of those I've seen this week. Yeah, big market potential, magic quadrant, integrates with SAP, lots of customer references you can't mention...sure, thanks, got it.")

Anyway, a fellow reporter, Margaret Kane, was a bit of a Hollywood buff and managed to convince some cable network (one of the Turner operations, I believe) that she was a movie reviewer for that well-known scion of popular culture, PCWeek. In doing so, she scored us a pre-release version of a movie that would air a few months down the road. Thus did those of us in PCWeek's Medford, Mass., newsroom become among the first people in the world to view Pirates of Silicon Valley, which was, and is (nearly 500 words into this) the definitive Steve Jobs movie.

Oh, let me respond to your skepticism. Yes, it's a movie about Jobs and Bill Gates and how they battled in the '70s and '80s. So, it's not just about Jobs. Yes, it stars Noah Wyle and Anthony Michael Hall, two guys who would fuse their heads together and live as conjoined twins to have even half the career Ashton Kutcher has had. And it was made for TV. Basic cable TV. In the '90s. Fair enough. But you know what? Wyle and AMH (is he famous enough that we can do that?) were good! And the movie was good! And apparently available to watch on YouTube for $2, but here's a trailer:

More importantly, in case you haven't heard this before, listen to what Steve Wozniak, who obviously knew Jobs as well as anybody, said about Pirates: "The entire movie was truthful. Every incident in the movie actually occurred. Every incident in the movie had the meaning that was portrayed in the movie." OK, there were some problems with the timeline, Woz tells us, but read (or listen to) that again. Everything in the movie actually occurred. It's real.

Now, let's see what the imminently likeable Woz has to say about Jobs, the new film. Here's a sampler: "I saw Jobs tonight. I thought the acting throughout was good. I was attentive and entertained but not greatly enough to recommend the movie. One friend who is in the movie said he didn't want to watch fiction so he wasn't interested in seeing it...I was turned off by the Jobs script...I felt bad for many people I know well who were portrayed wrongly in their interactions with Jobs and the company."

Now, we know that Woz was or is working on a different Apple movie. The linked article from Gizmodo mentions that. He mentions it. But Woz has -- and it would be hard to find anybody who would disagree -- a sterling reputation as a good, honest man. (Is he really so worried about money that he would bash a "competing" movie? Aside from the fact that he didn't actually bash it.) I believe what he says. And he says Pirates is real and Jobs isn't, not really.

Here's the other problem some folks might have with Pirates. Given that it was made in the late-'90s, it ends with Apple at its nadir, with Microsoft making both the most famous and forgotten investment in business history with the bailout of Apple. (Remember, Apple would very likely not exist without Bill Gates. Intentions and reasons aside, that's just true.) What about the iEra, then? What about the genius Jobs, the creator, the evangelist, the master marketer, the guy with the turtlenecks and the salt-and-pepper beard?

We know him. (And, oddly enough, the new Jobs movie apparently ends with that iEra rather than fully including it.) We know the man who beat back cancer long enough to change the world. We know the iCon. We know the 21st-century Jobs. But Steve Jobs was, as anybody would be, much more than what he was in his final years. He was a sum of his life's experiences, just like the rest of us. And the beauty of Pirates is that it actually captures Jobs while he was rising and as he fell. It captures the Jobs we didn't know back then. Nobody knew in 1999 what Jobs would become, what Apple would become. There's no reverence in Pirates. There's no over-the-top meanness, either, forced into the movie to make Jobs seem more human, or maybe just more mean.

There's just a pretty darn good portrayal -- not 100 percent accurate because no movie is, but still pretty good -- of a man before he became an iCon, before he was a true household name, before every person in America immediately recognized his company's logo. There's a portrait of Jobs we'll never see again because the final years of his life have defined him in the popular imagination -- and not necessarily unfairly, but he was so much more than that. That's what Pirates gives us. And it's real.

I have a 2-year-old and a 1-month-old, so I won't be seeing Jobs in the theater. I'll probably catch it on Netflix in a year or something. In the meantime, though, I think I might go ahead and spend that $2 and watch Pirates of Silicon Valley again on YouTube. It's the only Steve Jobs movie I need.

Posted by Lee Pender on August 21, 20130 comments

The printed word made it all the way from one Gutenberg to another -- Johannes to Steve, although Steve picked up an extra "t" somewhere along the way -- before finally giving way to the inevitability of pixels, screens and bookmarks not made of plastic and given away for free at the local bookstore. (On a side note, the local bookstore isn't around anymore, either. But we digress.)

Kindle, Nook, iPad, HP Touchpad (hey, we are out there!) -- the age of the e-reader is not only here but has been here for a while. So it's about time Microsoft jumped into it. Late, but not fashionably, to the trendy party as usual, Microsoft took a big stake in the e-reader game this week by pumping a few hundred million dollars into Barnes & Noble's Nook device and the subsidiary-type thingy that B&N will create to produce it.

For its money, Microsoft gets a final nod to patent humility from B&N, a share in e-book revenues and somebody to actually create a reader for Microsoft mobile devices to compete with Amazon's Kindle device and app. Everything considered, given Microsoft's mounds of cash and Barnes & Noble's need for, well, cash, this actually sounds like a pretty good deal for both parties. What it does not sound like is a grand entry for Microsoft into the tablet game.

Nothing we've seen has made this out yet to be a tablet play, but reasonable questions are starting to arise about whether the Nook will eventually run Windows 8 (or, more specifically, the horribly named Windows RT) rather than the Android operating system it runs now. And it very well might. For Microsoft, that would be a nice swipe at Google, although fleecing Android device dealers with patent agreements will likely prove to be a lot more profitable.

What puzzles us is that most reports seem to place Microsoft's investment -- it's not a buyout of anything -- as a move to compete with the iPad. We don't get this at all. Competing with Amazon and the Kindle? Sure. Making some money by helping bail out a struggling company that happens to have a great product? Absolutely. Gaining a little bit of a foothold in the mobile-device space by possibly replacing Android on the Nook? Yeah, that would be a nice benefit.

But competing with the iPad? No, that's not what's happening here. First of all, the Nook, nice little machine that it is, is not an iPad, or even an HP Touchpad (still out there!). Like the Kindle Fire, it's primarily a device for consumption and not really one for creation. It's great for reading, watching videos (although we can't remember which one, the Fire or the Nook, actually supports the Netflix app) and basically staying entertained in a handheld form.

It's not meant to do everything an iPad, or even an Android tablet or Touchpad (yes!) will do. Those are devices designed to darn near replace laptops, allowing for much more creation and productivity than something like the Nook can offer. The Nook competes with the iPad only on the fringes of an almost entirely different market. (It might be overkill to have both a Nook and an iPad, but it's not unthinkable. A single consumer having, say, a Samsung Android tablet and an iPad, though, is fairly unlikely.) So, Microsoft's investment won't help Windows' standing as the bottom-of-mind OS for mobile devices, particularly tablets.

Now, will Microsoft move in further and try to turn the Nook into a full-fledged Windows tablet? Maybe...but we kind of doubt it. The Nook is great for what it is, a consumption machine. As for full-on tablets, Microsoft will have to pursue that market in some other way -- a way that will likely cost more than a few hundred million dollars. And as a competitor, the iPad might just turn out to be a little stiffer than the Kindle. If only the Gut(t)enbergs had known what they were getting us into.

See Also:

Posted by Lee Pender on April 30, 20121 comments

Connoisseurs of great television advertising will remember the days when Smith Barney made money the old fashioned way -- they eahhhned it. And so it goes at Microsoft, which, despite being behind in every new-fangled market from tablets to smartphones (actually, pretty much just those two), continues to make money the old fashioned way -- with Windows. And, um, Office.

Last week's Microsoft earnings report was something of a throwback to the '90s, or maybe even the '80s. Entertainment stuff was weak. Nobody's buying Windows Phone. But the old stalwarts in Redmond -- Windows and Office, plus Dynamics (yes, really) and some servers and whatnot -- drove Microsoft to beat analysts' earnings expectations. OK, so Microsoft is no Apple when it comes to blockbuster numbers. So what?

Tablets -- iPads, let's face it -- have already cut into PC sales. Consumers are buying iPhones and Android devices (the latter of which actually put money in Microsoft's pocket at a pretty good clip) and maybe hanging on longer to their laptops or desktops. We're in a post-PC era, et cetera, et cetera. Except for one thing: We're not.

Just about everybody who starts a desk job still gets a laptop or PC running Windows and Office. Some get iPhones, maybe even iPads, but pretty much everybody gets Windows and Office. That's still a lot of people, jokes about the job market aside. Consumers who don't want to spend a mint on a (fantastic, we'll admit) Mac and don't want to have to goof around with Linux like some basement dweller who hasn't seen the sun in years buy PCs. And when the buy PCs, they buy Windows. And usually Office.

We should pause here to point out, too, that the business stuff -- the various server operating systems, Dynamics, SharePoint and so forth -- are raking in plenty of cash in Redmond, as well. As we've said here many times in the past, those are the areas Microsoft needs to continue to either dominate or capture apace. They're not cool, and they're not trendy -- which is why they're such good, steady sources of income.

They're boring, bland, partner-enriching bedrocks of business technology, and we're guessing that most partners care a lot more about them than they do about Windows Phone or any sort of Microsoft tablet. Pitching and defense. Run the football. Solid goaltending. Pick your sports metaphor -- you get the idea. Well done, Microsoft, for continuing to get that right while screwing up so many other things.

We seem to read a lot of speculation about how much longer Windows will be a moneymaker for Microsoft, or how long it will be before Google or somebody else starts taking chunks out of Office. Well, we figure that as long as those new employees sit down to Windows machines and those consumers buy laptops and PCs from companies not named Apple, Windows and Office will keep making money. Does anybody really see, in the near future -- say, in the next five years, minimum -- the standard office PC or the consumer laptop really going away, just ceasing to exist? Nah, we don't, either. And that's why Microsoft isn't in any sort of danger, either, even if very little that comes out of Redmond is likely to be cool.

See Also:

Posted by Lee Pender on April 23, 20121 comments

We at RCPU don't make a habit of telling Microsoft what to do. We usually focus on what we think Microsoft is doing wrong or could be doing better. That's what bloggers do. We magnify problems without offering any solutions. We're like politicians in that sense.

Once in a while, though -- and this might actually be the first time -- an idea comes along that's so good, so smart and so seemingly simple that we just have to jump on the bandwagon and say, "Do it, Microsoft! Give Bing to Facebook in exchange for Facebook shares and some search revenue." Oh, it's not our idea, of course. Barron's explains:

"The idea, floated by a CNBC commentator last week, goes like this: Microsoft would turn Bing over to Facebook. Microsoft could receive Facebook shares, currently worth two times Bing revenues, roughly $4 billion, which [Nomura Securities analyst Rick] Sherlund posits as a 4% stake. Microsoft currently owns a 1.6% stake in Facebook, a company that is expected to be valued at as much as $100 billion after its initial public offering later this year. Of course, Facebook might want to wait until after the IPO to see what its shares are actually worth.

"The transaction would still allow Microsoft to achieve the two primary objectives behind its current ownership of Bing: making money off its Internet traffic and preventing Google from monopolizing search advertising."

So, that's an out for Microsoft from the Bing business, which never made a lot of sense in the first place, and a pretty well built-out search engine for Facebook, which the social network really seems to need. And the best part is that Microsoft could own a larger share of a huge-growth company and still make money off of a search engine -- without even having to mess with Bing anymore! Oh, and it's bad for Google!

Maybe we're just simpletons here (spare the comments, please, peanut gallery), but this Bing-Facebook thing seems so pure and so right that it almost has to happen. Of course, that pretty much guarantees that it won't happen, as Microsoft doesn't seem to do all that much that makes sense anymore. Ah, that's better. Taking random pot shots at Microsoft is so much more fun than supporting a constructive solution to a big problem. And we're back to blogging again.

What's your take on a Microsoft-Facebook Bing swap? Leave a comment below or send it to [email protected].

Posted by Lee Pender on April 17, 20126 comments

Hmm, let's see here, press releases, news items, Microsoft and Ariba are collaborating on...wait. Hold on. Microsoft and who?

Honestly, on the list of companies we honestly had no idea still existed, Ariba was near the top of the list. But some semi-vague deal with Microsoft has confirmed Ariba's non-death.

What's next? Finding out that Commerce One is still alive? Nah, that's what we thought. At least something in the tech world makes sense right now.

Posted by Lee Pender on April 16, 20120 comments

"A billion here, a billion there, and pretty soon you're talking real money."

-- Something Sen. Everett Dirksen probably never actually said, but still a good quote.

Microsoft and AOL this week cut a deal that makes both parties look like titans of the lost 1990s compared to Facebook, which just keeps charging ahead into the 21st century.

The software giant bought a billion dollars worth of patents (more than 800 of them) from the provider of Internet service to senior citizens, giving AOL a much-needed (but one-time) financial shot in the arm and providing Microsoft's lawyers with fresh new ammunition for the company's patent-lawsuit weapons. The deal seems like a win-win, to use horrible jargon, but it's about as exciting as a "never-ending talk show" (which, terrifyingly, could actually emerge from the deal).

Meanwhile, Facebook, all youth and vigor, is buying something called Instagram for about $1 billion. Instagram must be new and hip because your editor has barely heard of it and has certainly never used it. That's a good sign that it's excellent acquisition fodder for Facebook. If your editor is actually using an application or Web site on a semi-regular basis, it's pretty certain that app is embarrassingly passé and is about to fade into oblivion (after all, we at RCPU actually own an HP Touchpad). Instagram passes the RCPU "what?" test and therefore should be a wise spend for the Facebook folks.

Although they're not related, these deals do reflect where Microsoft and Facebook are as companies. Microsoft's billion is basically going to lawyers, who will likely be able to make the company a ton of money by crushing competitors large and small in East Texas courtrooms (where patent lawsuits always seem to happen). It's also a defensive buy, covering Microsoft's considerable backside in case of legal attack from some patent troll. That's great, but it's not exactly something that's going to spur innovation or give partners a talking point for prospective clients.

Facebook, meanwhile, is off buying something it can weave into its services -- probably in some way that will end up enraging users about a lack of privacy, but still. The new paradigm for everything, social media, is swallowing up new categories of users and expanding its profile while Microsoft, a traditional software company, is digging in for legal battles and bailing out struggling, has-been tech titans. This is dining at the Ritz and embarking on a night of clubbing compared to scarfing down the 4:30 p.m. "dinner" special at the Golden Corral (we just kind of figure there is one) and going home to watch something on TV with "CSI" in the title. But, hey, that's the way it goes getting older ... right?

See Also:

Posted by Lee Pender on April 09, 20129 comments

Does the sliver of the smartphone market that owns Windows Phone-based devices know something we don't? Maybe, as it appears as though Windows Phone is driving a high rate of satisfaction among users -- so high that it tied with the iPhone in a recent survey of customer satisfaction. That's all great news for Microsoft, we suppose, but your editor loved his Intellivision as a kid (George Plimpton did the ads!), but that still didn't stop it from being crushed by Atari. Microsoft's market share for Windows Phone is still less than 10 percent -- but at least it's a happy less than 10 percent.

Posted by Lee Pender on April 02, 201212 comments

Wyse Technology started as a producer of convection ovens in the 1930s before converting itself into an aircraft manufacturer during World War II. OK, not really, but the provider of thin clients does go back to 1981, when Wang was still a major name in computing and Microsoft wasn't. It has been around a while.

But no more, at least not as an independent entity. Dell announced this week that it is snapping up Wyse but didn't mention a price. What also doesn't get mentioned all that much these days is thin client computing, what with all the hype about Software as a Service and the cloud.

You know thin client computing. The OS for client machines runs on a server rather than on the machine itself. That makes the clients pretty much dumb boxes if they're not hooked up to a network. It's not totally client-server, but it's certainly not the cloud, either. It has been around for a long time.

And it's popular. Wyse itself claims more than 200 million users (individuals, not companies), according to the Wired article linked above. Although it was never a great generator of hype, the thin client model has provided cost-effective computing for companies for years, without the risks of outsourcing that the cloud presents. In fact, it sounds a lot like what folks now call the "private cloud," a phrase that still seems counterintuitive.

It's a bit surprising to us here at RCPU that Wyse sat alone at the acquisition dance for as long as it did. It's been one of the largest providers -- probably the largest -- of thin client computing for years now. The company has experienced some twists and turns in its history, but it settled well into a niche and dominated it.

Dell's acquisition is a pragmatic move, one that should bring in revenue immediately rather than merely offering the potential for a gold mine down the road. It also takes Wyse out of the hands of Dell's competitors, not that any of them seemed eager to grab it. Wyse is a great channel company, which Dell seems to want very much to be now after years of turning its back on the idea of a partner model. It couldn't hurt Dell to have a new set of resellers to cozy up to, and it couldn't hurt Wyse resellers to have the Dell name behind them from now on.

Little buys like this in established categories of the market don't get much hype, but they'll have a greater impact for most partners than yet another acquisition of a cloud startup will. We've waited all the way until the end of the post to say this, and we're regretting it already, but we do find Dell's purchase to be a Wyse move. Sorry. That was a hanging curve ball, and we just had to swing.

What's your take on thin client computing? Are you making money off of it? Sound off in the comments below or at [email protected].

See Also:

Posted by Lee Pender on April 02, 20120 comments