Channel Watch

The 4 Cloud Numbers Microsoft Wants Partners To Know

According to IDC, partners that bet their businesses on Microsoft's cloud are making out like bandits. Scott digs into some of the specifics.

- By Scott Bekker

- March 16, 2016

Microsoft regularly hires market research firm IDC to survey and interview partners about their business models. Over the last few years, these joint projects emphasized cloud.

The two companies released another such report in mid-March called "The Booming Cloud Opportunity" (available here as a PDF), which is the first in a series.

The report has a few significant metrics in it that you can expect to see on a regular basis from Microsoft over the next few months, especially in keynotes and slide presentations at the Microsoft Worldwide Partner Conference (WPC) in July. The metrics are based on surveys of 750 partners in eight countries, and other content of the report comes from detailed interviews with 25 partners with solid credentials, like Christopher Hertz of New Signature, Mark Seeley of Intellinet and Geeman Yip of BitTitan.

Let's dig into the four headline claims, and examine what they mean:

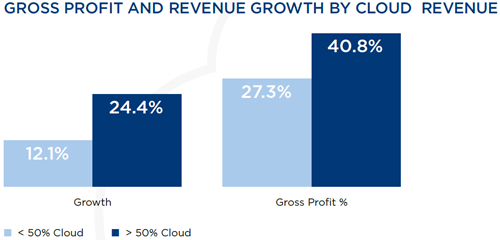

1. Cloud Partners Have 2x the Growth of Less-Cloudy Partners.

For this report, IDC defines cloud partners as companies that get more than 50 percent of their revenues from the cloud. Of the 750 Microsoft partners they surveyed, about a fifth of them hit that mark. That top tier of cloud partners reported overall company revenue growth of 24 percent on average, while the rest saw growth of 12 percent.

2. Cloud Partners Have 1.5x the Gross Profit of Less-Cloudy Partners.

Again looking at the group of partners getting more than half of their revenues from the cloud, this group also saw higher profitability. The figure for the cloud partner group is 41 percent gross profit, while the rest had 27 percent.

Source: IDC

Source: IDC

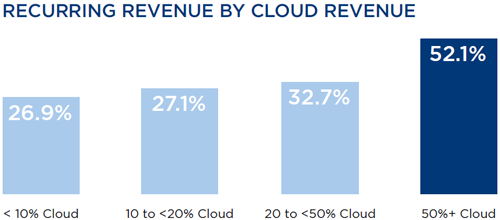

3. Cloud Partners Have 1.8x the Recurring Revenue of Other Partners.

Using the same categorizations, the cloud partners reported that 52 percent of their overall revenues, not just cloud revenues, came from recurring revenue sources. That compares to about 29 percent of revenues coming from recurring sources for the rest of the partners in the survey.

Source: IDC

Source: IDC

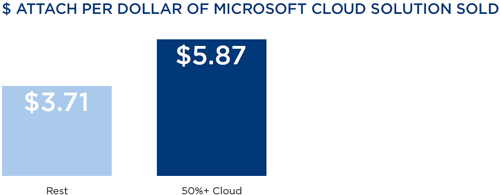

4. Cloud Partners Sell $5.87 of Their Own Offerings for Every $1 of Microsoft Cloud Solutions.

The delta between cloud partners and the rest is pretty large by this measure, as well. The rest of the surveyed partners sold $3.71 of their own offerings for every $1 of Microsoft cloud solutions. Importantly on this one, only a little over 400 partners answered.

Source: IDC

Source: IDC

In all these cases, the IDC report provides a key caveat: "Surveys don't always reveal causation." There's a lot going on inside all of these partner businesses that could account for the differences other than how much Microsoft cloud services the companies sell. Nonetheless, the picture these numbers paint is pretty rosy.

These data points also float against the current of popular channel opinion on cloud -- that selling cloud services is a recipe for lower margins and lower profitability. What do you make of these numbers? Let me know at [email protected].

More Columns by Scott Bekker:

About the Author

Scott Bekker is editor in chief of Redmond Channel Partner magazine.