News

Microsoft, AWS and Google Scrap over Cloud Costs

Barely two weeks into the new year, the top three players in the public cloud arena have already started another tussle over their ever-declining cloud costs.

Amazon Web Services (AWS) fired the first volley last week, when it announced the latest round of price cuts to its Elastic Compute Cloud (EC2) service. The cuts represent the 51st price reduction for AWS, according to a blog post by spokesperson Jeff Barr.

The affected EC2 instances are:

- C4 and M4 running Linux: The On-Demand, Reserved and Dedicated host prices of these instances are now 5 percent lower in all AWS regions except for South America.

- R3 running Linux: The On-Demand, Reserved and Dedicated host prices of these instances are also 5 percent lower in all AWS regions. In addition, On-Demand and Reserved R3 instances running Linux in the AWS GovCloud cost 5 percent less.

"Smaller reductions apply to the same instance types that run Windows, SLES, and RHEL in the regions mentioned," according to Barr.

Days later, Google responded to the AWS price cuts with a statement claiming that its competing Google Cloud Platform (GCP) is still the "price/performance leader" among public cloud computing providers.

"We're anywhere from 15-41 percent less expensive than AWS for compute resources, after their reduction," Google said, providing the following chart to back up its claim:

"We use automatic Sustained Usage Discounts and our new Custom Machine Types to ensure that we're presenting exact spec-to-spec comparisons here, something AWS can't match," Google said, adding, "While price cuts sound appealing on the surface, when you unpack the specifics of Amazon's pricing model, it can be an unpleasant surprise. We often hear from customers who are locked into contracts and aren't eligible for the new rates, or are stuck with instances that no longer fit their needs."

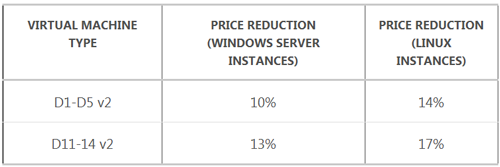

On Thursday, Microsoft parried with price reductions of its own. The price cuts, which will take effect early next month, lower the cost of running Microsoft's Azure Dv2 virtual machines on Linux and Windows Server by as much as 17 percent.

As an example, Microsoft provided the following table to show the reductions for its U.S. East 2 (Virginia) region:

Microsoft noted in its announcement that "Azure Dv2 instances -- unlike AWS EC2 instances -- have load balancing and auto-scaling built-in at no additional charge. This means you get even more value from Azure."

While AWS is still the market leader in the public cloud space, Microsoft's Azure offering is considered to be its closest viable competitor in terms of geographic scope, customer base and cost. To that final point, Microsoft has made no secret of its practice of matching each AWS price cut with its own reductions. Thursday's price cuts reflect Microsoft's "longstanding commitment" to match AWS on commodity cloud pricing, the company said.

Microsoft trumpeted other advantages of using Azure over AWS. "For customers with Enterprise Agreements, you not only get price reductions like these, but also your price points are even lower -- in many cases well below available AWS pricing -- re-enforcing our commitment to be the number one enterprise cloud," the company said, adding, "Unlike AWS, Azure virtual machine usage is billed on per-minute rate so you only pay for the compute that you use. With AWS you pay for an hour even if you only use a few minutes."

AWS, Microsoft and Google have employed retaliatory pricing strategies against each other for years, resulting in a race to the bottom as they try to undercut each other. However, this latest scuffle comes just as a new report indicates that after a years-long free-fall, cloud computing prices are now starting to stabilize.

According to the report, released this week by Tariff Consultancy (TCL), average entry-level cloud computing prices declined by about 66 percent over the two-year period ending in November 2015. However, "the cost of the public cloud appears to have reached a price point which is now relatively stable," TCL said. "For example, both AWS and Microsoft are offering a similar entry level Compute Instance, with other cloud providers following with similar pricing."

With cost being less of an issue, cloud providers find themselves competing on the quality of their services, according to TCL.

"The emphasis by the cloud computing provider is now increasingly on service innovation, not price," TLC said. "The global cloud platform providers (including AWS, Microsoft and Google) now offer a wide range of Compute Instances suitable for intensive computing, memory, content and fast I/O applications. Cloud providers are introducing analytical services available for cloud computing applications and are now offering cloud for the emerging Internet of Things (IoT)."

About the Authors

Gladys Rama (@GladysRama3) is the editorial director of Converge360.

David Ramel is an editor and writer for Converge360.