News

Microsoft's Q1 Buoyed by Cloud Growth, Windows 10 Licensing

Microsoft exceeded analysts' expectations Thursday night, when it released its financial reporting for the first quarter of its 2016 fiscal year.

The company reported $0.67 per share in earnings, far more than the consensus estimates of $0.59 per share.

Although GAAP earnings were only $0.57 per share, deferred revenues from Windows 10 licensing of more than $1.2 billion brings that figure up to the $0.67 per share figure that investors are cheering on Friday, bidding up shares more than 10 percent in morning trading.

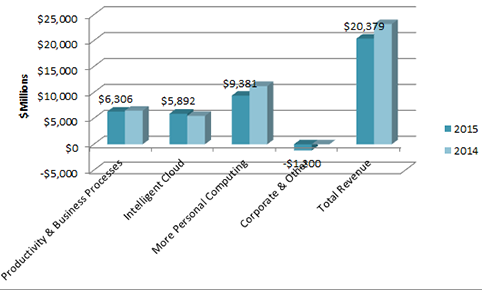

Profits increased 2 percent year-over-year, despite a 12 percent drop in overall revenues, which totaled $20.4 billion. Though total revenues were below expectations, those were outweighed in the market's reaction by other factors, such as the growth of the company's cloud business by 8 percent to $5.9 billion. Other results for the quarter included operating income of $5.8 billion and net income of $4.6 billion.

New Reporting Segments

The Q1 2016 results were reported for the first time in Microsoft's new format. The company had announced earlier this month that it planned to consolidate its six business segments into three segments. Here's a breakdown of those new segments:

- Productivity and Business Processes: Includes Office commercial and consumer products and services; Dynamics products and services; and Office 365 services such as Exchange, SharePoint and Skype.

- Intelligent Cloud: Consists of server products such as Windows Server, SQL Server and System Center; services; and "Enterprise Services."

- More Personal Computing: Covers Windows, devices (Surface and phone), gaming (Xbox) and search.

The More Personal Computing segment showed the greatest year-over-year decrease of 17%. Productivity and Business Processes was down 3%. Intelligent Cloud grew 8% (see chart below).

Microsoft's Q1 2016 revenues. Source: Microsoft Investor relations page.

Microsoft's Q1 2016 revenues. Source: Microsoft Investor relations page.

Microsoft broke out some business-segment details. The More Personal Computing segment had a 6% Windows OEM revenue decrease, along with a whopping 54% Phone constant currency revenue decline. Bing search grew 29% in constant currency. Xbox Live grew 28% to reach 39 million total subscribers.

The Productivity and Business Processes segment had a 70% Office 365 revenue growth in constant currency. Consumer Office 365 use increased to 18.2 million subscribers, but Microsoft did not break out the business numbers. Dynamics revenue was up 12% in constant currency.

The Intelligent Cloud segment had a combined server-plus-cloud-services revenue growth of 13% in constant currency. Only this combined percentage was provided. However, Kevin Turner, Microsoft's chief operating officer, indicated in Microsoft's announcement that Microsoft had a "70 percent year-over-year growth in our commercial cloud run rate." A run rate is a projection for the year, based on a single quarter's result. Microsoft also reported "doubled" Azure revenue year over year for this segment, although it didn't provide an exact figure. The company now has 20,000 Enterprise Mobility customers, presumably referring to its Enterprise Mobility Suite licensing.

[Editor's Note: This story has been updated to reflect market reaction to Microsoft's results.]

About the Authors

Kurt Mackie is senior news producer for 1105 Media's Converge360 group.

Jeffrey Schwartz is editor of Redmond magazine and also covers cloud computing for Virtualization Review's Cloud Report. In addition, he writes the Channeling the Cloud column for Redmond Channel Partner. Follow him on Twitter @JeffreySchwartz.