News

Microsoft, IBM Make Gains Against Amazon in IaaS

- By Kurt Mackie

- July 29, 2014

Though Amazon Web Services (AWS) still leads the cloud infrastructure services space, it faces increasing competition from Microsoft and IBM, according to research by Synergy Research Group and Gartner Inc.

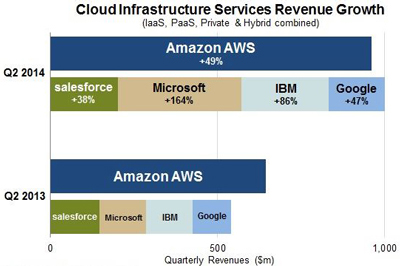

Amazon's second-quarter earnings results, filed late last week, show that while AWS is the market leader in Infrastructure as a Service (IaaS), its 49 percent growth rate is outpaced by both Microsoft's (164 percent) and IBM's (86 percent), according to Synergy.

Cloud services growth, Q2 2014 vs. Q2 2013. (Source: Synergy Research Group.)

Cloud services growth, Q2 2014 vs. Q2 2013. (Source: Synergy Research Group.)

Synergy found that Microsoft and IBM had IaaS market gains "over the last four quarters" even while the performances of AWS and Google stayed flat. AWS lost its claim to be bigger in the IaaS market compared to its next four rivals, explained John Dinsdale, Synergy's chief analyst and research director.

"While it [AWS] remains a formidable leader of the market, Microsoft is making some huge strides in IaaS and PaaS while IBM now has clear leadership in the private and hybrid infrastructure services segment," Dinsdale said, in a released statement.

Synergy estimated the total IaaS, Platform as a Service (PaaS) and private/hybrid cloud services revenue to exceed $13 billion annually.

Meanwhile, Lydia Leong, a research vice president at Gartner, offered thoughtful analysis about the nature of AWS' apparent slip in the IaaS market. She suggested that the competition is being shaped by the service providers that have the most in-depth software capabilities, as well as the most "sticky" ecosystems.

Commoditization, in which service providers drop prices to compete with rival service providers, isn't really where the market is located, according to Leong. IaaS may get commoditized but the real market comes from selling premium services, she contended. However, traditional IT shops deploying premises-based servers may get compelled to adopt cloud services because of that commoditization.

"The cheaper it is to do it in the cloud, the more difficult it is to make a business case to do an on-premises solution, especially a private cloud," Leong wrote, explaining that costs for maintaining a private cloud typically may stay static for three to five years, whereas IaaS prices may decrease by 30 percent each year. There also may be an inequality between cloud-based and premises-based infrastructure capabilities.

"It's tough for internal IT to compete, especially when the major IT vendors aren't delivering software that allows IT to create equivalent capabilities at the speed of an AWS, Microsoft, or Google," Leong wrote.

Microsoft's IaaS growth has been propelled, in part, by the discounts it has offered to Azure users. But Microsoft also has been effective in its marketing, according to Leong. Some organizations will choose AWS over Azure as a result of this marketing push, but she contended that Microsoft would make inroads over time. Gartner recently published a report showing Microsoft in the IaaS "leadership" quadrant with AWS.

In contrast, Google hasn't performed as well in its cloud marketing, according to Leong. However, Google, which lowered its IaaS and PaaS prices in March, is still a contender because it can set the market price, she added.

In general, competition among the top cloud services providers will move the market faster, but that acceleration means tougher times for the smaller cloud services competitors, according to Leong. She contended that AWS will continue to lead the market for years, but it won't have the control it once had.

About the Author

Kurt Mackie is senior news producer for 1105 Media's Converge360 group.