In-Depth

RCP Reader Survey: Cautiously Optimistic

In our annual RCP reader survey, the channel community is slightly upbeat about the changes coming in the Microsoft Partner Network, but unsure about what lies ahead.

- By Scott Bekker

- March 01, 2010

This is a pivotal year for Microsoft partners. In addition to being clutch for many businesses after the epic difficulties of 2009, this is the year that Microsoft is overhauling nearly every aspect of its partner program. While the transition from the Microsoft Partner Program (MSPP) to the Microsoft Partner Network (MPN) began in 2009, many of the structural changes take effect this year.

In our annual RCP reader survey, we asked partners how they feel about the state of their partnerships with Microsoft, how they're feeling about the transition to the MPN and how they're feeling about business. We heard back from about 500 partners in December.

Consistent with prior years, partners say they're relatively happy with Microsoft's partner program. This year, they're also cautiously optimistic about IT spending and business prospects. On the question of the MPN, however, many are saying that they're going to wait and see. Partners tell us they're not clear on the details, not clear that the changes will help and not sure how they'll fit into the new categories of the MPN.

A reader who works in the Texas office of a global systems integrator sums it up best: "Overall, Microsoft is doing a good job. They just need more communication on future plans."

MPN Changes

A Registered Member and ISV in the South clearly feels it's time for some changes to the MSPP. "With the last round of changes in the partner program, Microsoft made it much more about 'how much money are you giving Microsoft' and less about working with Microsoft products to create unique and innovative solutions," he explains.

When we asked how satisfied partners are with the changes made in creating the MPN, though, the largest group, 32 percent, say they aren't sure. Those who do have an opinion, however, are OK with the changes. Some 30 percent are somewhat satisfied, 23 percent are satisfied and 5 percent are very satisfied.

One of the main goals of the MPN is to help partners differentiate their skills, services and offerings from the 300,000 to 400,000 other members of the MPN and hundreds of thousands more solution providers of all stripes worldwide. We asked whether the new partner program levels -- Advanced, Standard, Communities/QuickStarts and Subscriber -- and Competencies would do a better job than the old Competencies and program levels of Gold Certified Partner, Certified Partner and Registered Member. Readers' thoughts? A solid "maybe." The biggest group, 31 percent, says "it won't make much difference." About 34 percent say it would help, 11 percent say it wouldn't help and 23 percent aren't yet sure.

Even though the Gold Certified Partner level is going away when partners re-enroll in the MPN in late 2010, the level remains popular. When asked if Microsoft should keep the Gold Certified Partner level, 35 percent say yes and 26 percent say no (39 percent aren't sure). The answer suggests that readers seem resigned to the change. Apparently many have changed their opinions over the past year. When we asked the question last year, before Microsoft announced plans to sunset the Gold Certified Partner level, 67 percent said Microsoft should keep Gold Certified Partner and only 8 percent said Microsoft should eliminate it.

An overwhelming majority are still uncertain as to what membership level they'll apply for under the new MPN in the fall. Nearly 60 percent are unsure. Other than the undecided, the biggest contingent is partners who'll apply for Advanced status (17 percent).

The confusion is contributing to one consultant in the Northeast taking a look at downgrading his membership. "I'm a Microsoft partner, yet I've heard nothing about these new partner levels. I'm being pressured to continue my Gold Certified partnership despite the fact that it's being phased out," he explains. "Perhaps I'll just wait and see what happens and go back to being a Registered Member with the Action Pack for a while."

Microsoft officials seem to agree with readers that the number of partners is probably about right, according to public statements issued by the company in recent months. More than 60 percent of respondents are comfortable with the number of partners in the MPN. More readers (31 percent) think there are too many partners than those who think there were too few (8 percent). "The number of partners must be thinned out and only active partners allowed to stay in," says a Registered Member from the South.

A consultant based in the Northeast agrees that the effort to thin the ranks -- at least of partners calling themselves Gold Certified -- might reduce the noise level. "I think many partners who claim 'goldness' have no real formal training in some of the products they purportedly say they know well, particularly in the unified communications area," he says.

[Click on image for larger view.] |

Meanwhile, concerns that Microsoft's Customer Satisfaction (CSAT) data collection efforts might be damaging aren't supported by the survey. Asked how helpful they expect the CSAT effort to be to their business, 19 percent say very helpful, 34 percent say somewhat helpful, 45 percent say neutral, 2 percent say somewhat damaging and only 1 percent say very damaging.

That's not to say partners don't see room for improvement in the process. As one Midwestern custom development firm and Gold Certified Partner puts it: "The CSAT would be better if partners could see the average responses to each question. This would allow us to work on specific areas that need it the most."

Satisfaction

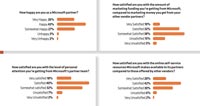

While a lot is changing in the MPN, not a lot has changed when it comes to partners' overall satisfaction with the partnering relationship. We asked, "How happy are you as a Microsoft partner?" The answers were almost identical to last year: 26 percent very happy, 43 percent happy, 27 percent somewhat happy, 3 percent unhappy and 2 percent very unhappy.

Also, partners are fairly satisfied with the amount of personal attention they're getting from Microsoft, with 18 percent reporting being very satisfied, 40 percent satisfied, 32 percent somewhat satisfied, 7 percent unsatisfied and 2 percent very unsatisfied.

And satisfaction with personal attention isn't simply a matter of whether a partner is Gold Certified or a Registered Member. Squarely in the "very satisfied" camp is a Registered Member and systems integrator in the Southwest: "We appreciate how the Registered Member program has helped us get our feet wet as a Microsoft partner and a smaller company. We closed some nice deals last year due to our [Telephone Partner Account Manager] and from having more insight into different ways to sell and promote Microsoft solutions."

Meanwhile, a Gold Certified Partner and systems integrator in the Midwest says, "We're active with our partnership, but we receive very little attention from our local Microsoft reps."

[Click on image for larger view.] |

When it comes to money, things are positive, but less so than with personal attention. When we asked how satisfied partners are with the amount of marketing funding they get from Microsoft compared to the amounts they get from other vendor partners, 10 percent are very satisfied. A solid 32 percent are satisfied, and 38 percent are somewhat satisfied. On the unsatisfied side, 15 percent -- a high unsatisfied figure for this survey -- are unsatisfied and 5 percent report being very unsatisfied. "It seems the more changes Microsoft makes, the less ad funding is available," a consultant and Registered Member from the Midwest responds.

Most respondents believe they're doing fairly well finding their way around the online self-service resources that Microsoft makes available on its portal, with 20 percent very satisfied and 42 percent satisfied with Microsoft compared to other vendors in that regard. But that leaves a fairly large contingent that's still having trouble navigating the resources.

Business Expectations

Predictably, the partner community reports a tough year in the channel for business results. Readers reporting double-digit growth matched those reporting double-digit declines: 12 percent. Single-digit growth outpaced single-digit declines by 22 percent to 15 percent, but the most common result, 35 percent, is flat revenues in 2009. Hopes are high, but not too high, for 2010. Most readers expect revenue growth, with 28 percent predicting double-digit growth and 46 percent expecting single-digit growth. A fairly large group, 20 percent, expect flat revenues, while 4 percent expect a single-digit decline in revenues and 2 percent expect a double-digit decline.

Readers have a lot of ideas for ways that Microsoft can help with revenues. One Certified Partner solution provider in the South reminds Microsoft what makes partners tick: "Microsoft should remember that margins on their products keep the partners, who are Microsoft's sales force, in business."

A lack of good training materials on Microsoft's newer technology might constrain growth, worries one Microsoft Certified Partner for Learning Solutions. "The new courseware is still weak from both the instructors' view and the customers' evaluations. New technology is hard for companies to embrace when it's so difficult to train and implement," the Gold Certified Partner explains.

A Registered Member with a consulting practice in the West says that one long-standing complaint is still relevant. "They need to simplify licensing and reduce the number of Windows operating system offerings. Microsoft makes things too complicated."

And a Certified Partner systems builder in the Upper Midwest has a competitive concern: "One of the larger benefits Microsoft offers is a homogenous software base for products. Google growth in search and applications as well as its forthcoming Chrome OS operating system is making an impact. It's really important for Microsoft to increase its presence in the search and communications arenas," he says. "Bing is a very good restart. It's long overdue and it's a start. It needs to be better than Google."

Software plus Services

One of the most challenging areas of intersection, opportunity and conflict between Microsoft and its partners is Software plus Services (S+S), Microsoft's hybrid spin on the Software as a Service (SaaS) business model. Microsoft has rolled out several S+S releases over the last few years that partners can sell and collect margins on, including the Microsoft Business Productivity Online Suite, Dynamics CRM Online and Microsoft Exchange Online.

Last year and this year we asked how many are selling Microsoft S+S offerings, and the number has gone up a bit. Last year, 16 percent said they were selling Microsoft S+S offerings. This year, 24 percent report selling S+S -- about a 50 percent increase in uptake.

We also asked how quickly SaaS and cloud computing will change the structure of the channel. One Certified Partner and systems integrator in the Northeast is unequivocal: "Cloud computing is where IT is heading; 2010 will be the year of the cloud." He's joined by about 18 percent, who think the real impact will come in 2010. The largest group believes that the biggest impact will come in 2011 (26 percent), while 16 percent see it coming in 2012 and 10 percent look at the impact as a 2013 or later event. In the "it's already happened" camp are 8 percent. On the other end of the scale, 22 percent answer: "It's overblown, the channel model won't change that much."