Bloomberg: Taxes on Microsoft's Overseas Profits Could Pay for DoJ

How much would Microsoft's overseas profits add up to if the company paid U.S. taxes on them the way Uncle Sam prefers? A lot, according to an infographic in the March 9-15 issue of Bloomberg Businessweek.

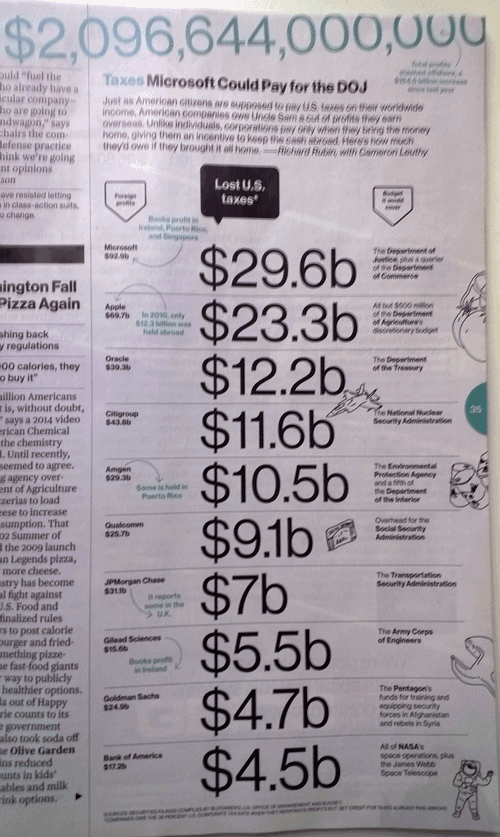

In the graphic (see below or page 35 of the print issue, which just landed in the snow outside my house), Bloomberg compiled securities filings and U.S. Office of Management and Budget information and assumed the 35 percent tax rate that companies owe when they repatriate profits after getting credit for taxes paid abroad.

[Click on image for larger view.]

[Click on image for larger view.]

Bloomberg says Microsoft booked $92.9 billion in profits in Ireland, Puerto Rico and Singapore. The magazine declares that amounts to $29.6 billion in lost U.S. taxes. According to the graphic, that's enough to cover the entire budget of the Department of Justice and a quarter of the Department of Commerce.

Microsoft tops the Bloomberg Businessweek list, but two other tech giants are close behind. Apple has $69.7 billion stashed and would owe $23.3 billion if it brought it all home -- enough to pay for all but $500 million of the Department of Agriculture's discretionary budget. Oracle has $39.3 billion stashed overseas -- equal to about $12.2 billion in taxes, enough to cover the Department of the Treasury.

In all, corporations are parking more than $2 trillion in profits offshore, the magazine said. For perspective, the proposed U.S. budget for 2015 is about $3.9 trillion. That's one year of U.S. federal government spending, and the offshore corporate accounts have been amassed over many years.

It's a nice touch by the magazine to subtly note that Microsoft's tax avoidance choices are equal to defunding the department that gave them so much trouble in the 1990s.

Posted by Scott Bekker on March 06, 2015